The present-day world is full of on-going situations that influence our social and business life. For example, COVID-19 has showed a large impact on most entrepreneurial spheres and many companies ceased to exist.

In these instances, insurance policies help minimize the potential healthcare and financial risks by insuring enterprises, their employees, and corporate assets for big sums that help to survive in the market.

For this reason, the market demand for insurance management software has greatly increased over the last years.

What’s more, many startups and entrepreneurs even get motivated by the successful insurance software companies’ results and want to build their own custom insurance software.

However, many of them don’t know where to start so that they succeed and become profitable.

So, we have prepared a detailed guide on custom insurance software development covering the following aspects:

- What are insurtech and its key types

- Insurance agency software market stats

- Core functionality of insurtech solutions

- Key steps of building SaaS insurance software solutions.

Enjoy your reading and let’s start with the definition.

What is InsurTech and Its Key Types

InsurTech is a relatively new term (same as PropTech) that means the integration of insurance business needs and technologies designed to meet them and revolutionize the insurance industry.

Simply put, insurtech is about developing software used by insurance companies that need automating daily workflow, reducing costs, increasing customer satisfaction, and boosting overall efficiency.

There are dozens of different software types created to serve specific insurance business needs and now let’s check what software do insurance companies use.

The Most Common Insurance Software Types | Ascendix Tech

Insurance document management software

This type of solution is designed to help insurance companies effectively search, store, filter, organize, and access crucial documentation.

For example, policyholder agreements, customer proofs, policy applications, and contracts are among the most widespread documents that brokers use daily while working with insured clients.

Insurance automation software

This type of software product helps insurance companies automate their daily workflow and streamline core business operations within sales, marketing, lead management, human resources, customer support departments, and many others.

Insurance automation software is as important for the industry as possible as insurance companies have hundreds of multicomponent touchpoints daily which require high insurance automation software to improve the process efficiency and boost team performance.

Insurance policy management software

One of the most important operations for insurance businesses is creating, processing, adapting, and managing policies for clients.

Insurtech startups provide policy management software with embedded Artificial Intelligence algorithms that allow companies to decrease insuring risks and perform reinsurance operations efficiently through automating facultative arrangements and reinsurance treaties.

Insurance underwriting and rating software

Underwriting is among the most crucial processes for insurance companies as it calculates the risks of insuring clients’ assets like properties, vehicles, personal health, and other life aspects.

For this reason, insurance underwriting and rating software help automate and bring transparency to the underwriting process that releases time for employees to focus on major tasks.

Namely, insurers just need to create rules and prepare policies to help the software automatically execute the needed operations that bring down potential human errors and allow to avoid tons of manual operations.

Insurance claims management software

This type of digital solution empowers insurance companies to streamline claims management processes, achieve automated claims records generation, get lots of opportunities for payment management, achieve fraudulent claims verification, and obtain policy administration.

So, insurance claims software allows companies to automatically process large volumes of accurate data securely, detect fraudulent claims, and capture first notices of loss to reduce costs in the long run.

CRM software for insurance agencies

Like with any other business niche, the insurance industry is also about lead generation and management, communication with customers, marketing strategy adjusting, and other activities.

However, insurance companies differ from many other market-specific organizations by the amount of sensitive data that should be stored, organized, processed, and transferred within the greatest possible safety.

This way, CRM software for insurance agencies provides the latest security protocols and high flexibility which allows brokers to interact with clients in safe collaboration and deal rooms sharing sensitive documents, signing policies, and making digital payments.

Insurance quoting software

Quoting insurance agency software is crucial for saving lots of time during the negotiations with leads and clients that want to get or renew insurance policies.

Simply put, this type of software allows companies to generate personalized and pre-made negotiation scenarios which help both parties.

Insurers can avoid handling hundreds of face-to-face meetings or calls to inform prospects about policy details and provide payout approximations.

Instead, quoting software for insurance brokers fully automates these processes and needs just to be once adjusted and integrated with an app or website form.

In turn, prospects and clients can save much time and avoid dozens of multicomponent procedures to get approximate payout details according to their insurance type. People now can use automated insurance quoting software and get personalized feedback in a quick and remote way.

Need Technology Help?

As a technology advisor, we partner with small firms and global enterprises helping them bring automation to their operational processes.

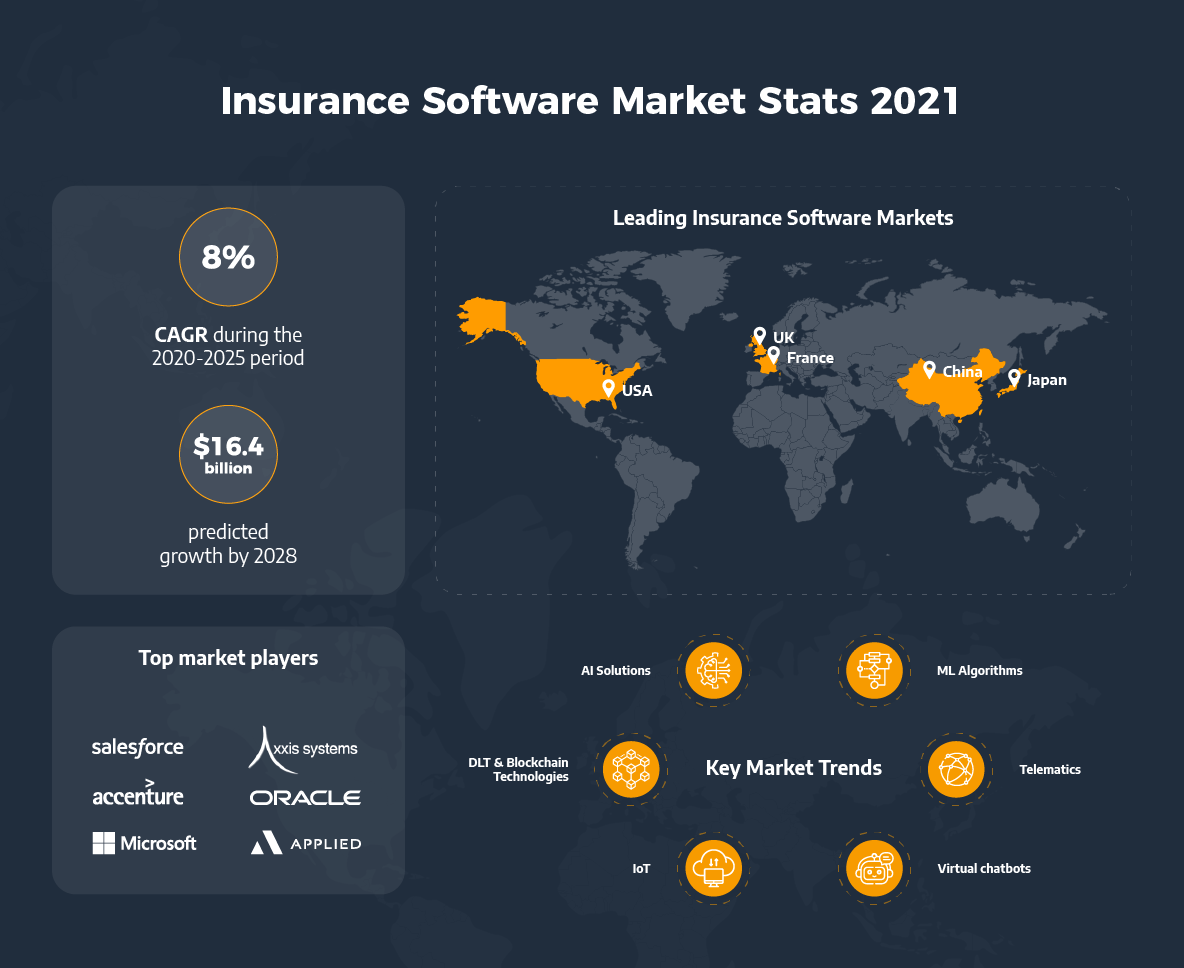

SaaS Insurance Software Market Stats

Now we want to share some highlights and market statistics to emphasize the cloud-based insurance agency software market growth that stimulates many startups and companies to invest in building innovative technology solutions that revolutionize the industry.

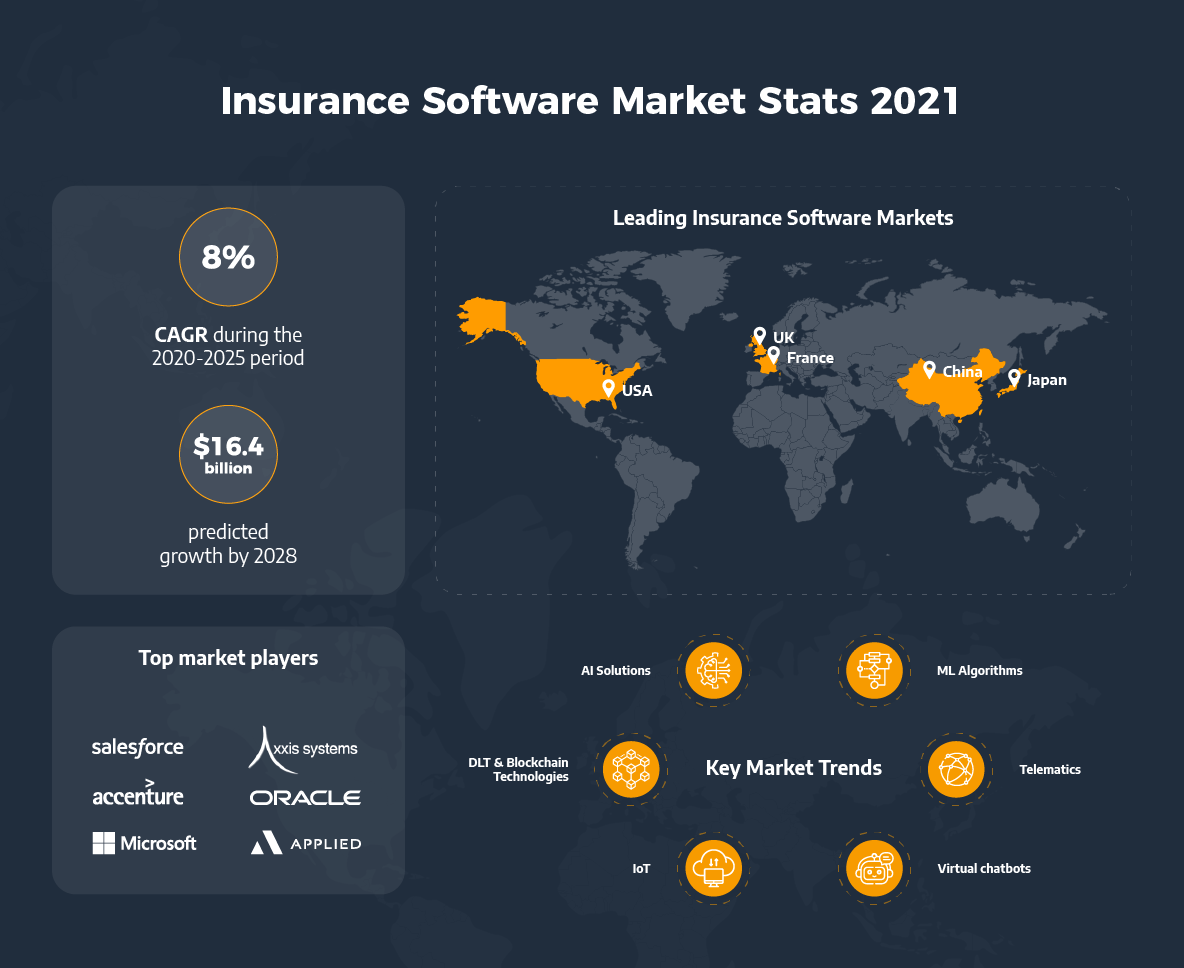

What is the global market growth rate?

According to Technavio Insurance Software Market Overview Report, the market size is predicted to grow by $7.3 billion with a CAGR of 8% during the 2021-2025 period.

What is the global P&C insurance market volume?

The world property and casualty insurance market size was calculated at the level of over $9 billion in 2020 and is predicted to hit the point of $16.4 bln in 2028 with a CAGR of 7.5% during the 2020-2028 period according to Verified Market Research.

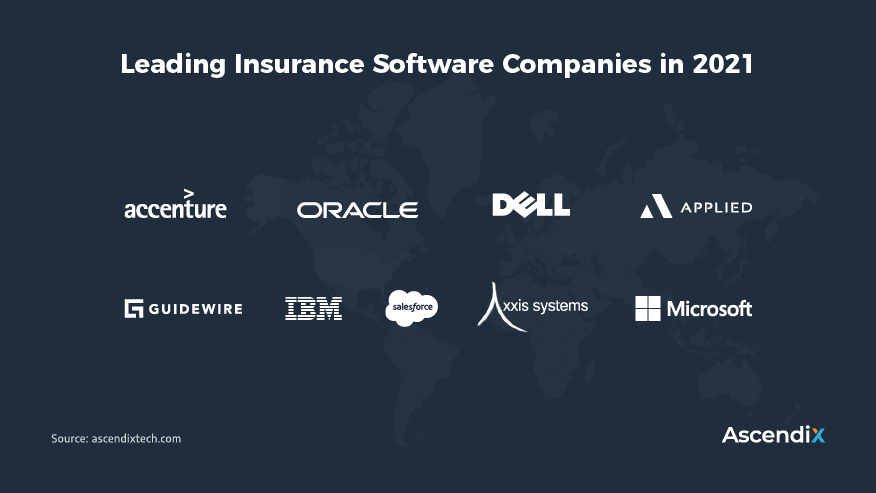

What insurance companies compete for market leadership in 2021?

Among the best insurance agency software market players, we should mention such enterprises as

- Accenture

- Applied Systems

- Axxis Systems

- Dell Technologies

- Guidewire Software

- International Business Machines

- Microsoft

- Oracle

- Salesforce.

Leading Insurance Software Companies in 2021 | Ascendix Tech

What are the insurance agency software market trends in 2021?

The modern world of insurance software solutions is full of different technologies, but insurtech startups still provide high-tech solutions that help the industry grow, automate, and simplify the life of brokers and clients even more.

In 2021, the key SaaS insurance software market trends include:

- Artificial Intelligence-based solutions for high automation and prediction accuracy

- Distributed ledger technology (DLT) and Blockchain for payment transparency and security

- Machine Learning algorithms for revolutionized claims processing opportunities

- Internet of Things (IoT) for secure and stead-and-small data sharing

- Telematics technologies to boost progressive auto insurance

- Virtual chatbots that increase s=customer satisfaction and save time.

Dominating Trends of Insurance Software Market 2021 | Ascendix Tech

What are the core insurance software markets?

Technavio report states that the US (North America specifically), Japan, UK, China, and France are among the most rapidly growing insurance software markets.

Insurance Software Market Stats 2021 | Ascendix Tech

Benefits of Insurance Software Solutions

Now we want to share the core advantages you can get by implementing or using cloud-based insurance agency software for your business.

#1 Reduce operational costs

The best insurance software allows your company to decrease the level and frequency of human errors, agreement durations, and document losses.

This way, you can greatly save on operational costs and streamline most business processes by helping your employees avoid tons of manual operations thus boosting productivity and decreasing the human mistake factor.

#2 Improve your compliance management

Custom insurance business software helps your company adjust an in-built compliance protocol thus making your business to be immune from constantly changing regulations.

Improved compliance management allows you to avoid manual changing of directives and costly mistake fixing.

What’s more, this software will empower your company to make sure that every process is moving at the correct pace within your funnel.

#3 Enhance customer service

As we mentioned earlier, insurance quoting software transforms communication with prospects and clients into an automated and time-saving process where the latter get pre-built quotes for their questions and requests.

This helps avoid extra time spending for both parties thus boosting customer service and increasing the loyalty of clients.

Besides, insurance CRM software offers unlimited opportunity management features that mean your clients can ensure service requests are as convenient as they need.

Having a transparent understanding of customer behavior, CRM software for insurance companies will automatically send upsell and cross-sell signals to your sales reps and brokers thus increasing lead-to-deal conversion rate and revenue generation.

#4 Leverage predictive analytics and reporting tools

In-depth data analysis is a key to evaluating your teams’ performance and making data-driven decisions to increase the efficiency of your insurance company operations.

For these reasons, lots of insurance software companies use Artificial Intelligence algorithms and Machine Learning neural networks to provide predictive smart insurance analytics software tools.

They analyze tons of information that goes through your business operations daily and build high-probability analytics for both internal and external usage.

What’s more, predictive insurance agency software allows you to automatically generate insightful charts and graphs that visualize raw numbers and can transform them into visually-appealing reports for further analysis.

#5 Increase data accuracy

Insurance is foremost about ensuring high accuracy of collected, processed, and provided data as it may result in sufficient financial losses and a high churn rate.

This means using cloud-based insurance agency software with high-quality tools that authenticate data accuracy is must-have for your business.

The most widespread business operations that require data accuracy authentication are system audits, address converters, payment verification systems, and policy data generation.

Moreover, insurance fraud software can help you automatically find fraud claims and accelerate the investigation processes through AI algorithms RPA (Robotic Process Automation) technologies.

5 Benefits of Insurance Software Solutions | Ascendix Tech

Main Features of Insurance Agency Software

As we mentioned above, there are lots of insurance business software types that include their specific functionality depending on business operations they make more efficient.

For this reason, we want to share the most widespread features that most top insurance software products provide in 2021.

#1 Policy Lifecycle Automation

Working with policies is among the most important attributes in a daily workflow for insurance brokers. To help agents automate their daily workflow and avoid dozens of routine tasks, insurance industry software solutions provide policy management tools as the must-have feature.

This functionality allows companies to automate policy creation, maintenance, and underwriting along with termination processes.

This way, policy management software helps boost your company’s revenue by providing both insurance and non-insurance upsell, and cross-sell offers.

Second, your sales reps and customer service can personalize communication with customers by creating pre-built custom quotes, client-specific discounts, tailor-made policy documentation, and revolutionizing the overall communication process.

Third, policy lifecycle automation allows your company to generate and offer dynamic policies to customers by enabling clients to choose payment intervals and due dates as preferred.

#2 Insurance Claims Management

Creating, processing, and sending claims is also one of the daily used operations for every insurance business.

For this reason, insurance claims management automation is a must-have feature as it releases much time spent on hundreds of low-level tasks and helps greatly reduce labor costs thus boosting teams’ productivity.

Apart from high automation, this functionality offers high-quality encryption protocols that enable your company to get, process, and share sensitive data as securely as possible.

What’s more, insurance claims management functionality is about boosting customer satisfaction as you can offer transparent self-service to clients which helps them to avoid hours of chatting, calling, or attending offline meetings to meet their needs.

Your insurance business also gets lots of opportunities to prevent fraud by monitoring the payout lists in real-time and granting diverse authorization levels within any claim amount.

Ultimately, both your agency, partners, and clients get vast flexibility opportunities as each party can fill out claims personally without extra interactions.

#3 Powerful Finance Infrastructure Tools

It’s of utmost importance to monitor the financial picture of business operations and analyze accounting results in real-time and insurance companies are no exception.

Besides, this functionality provides lots of capabilities to automate invoicing, payments, fees, and reconciliation. This helps saving much time and avoid operational challenges.

Second, advanced finance tools enable your agency to provide customers with flexible payment methods gateways, selecting the preferred payout frequency, and modify payment gateways whenever they want.

Third, these tools are crucial to scale your insurance business and expand into lots of new markets meeting local regulations. This becomes possible as powerful finance functionality allows you to add multiple currencies and languages thus meeting regulatory requirements.

#4 Insurance CRM Software Functionality

According to LIMRA’s 2020 Insurance Barometer Study, over 50% of Americans (approximately 160 mln people) had different types of life insurance in 2020 and this number only tends to grow.

This statistics means that insurance companies should effectively interact with leads and customers to stay competitive and avoid financial losses in the future.

For this reason, CRM software for insurance companies is a must-have feature for every market-specific agency.

First, customer relationship management systems provide your company with a centralized cloud platform to keep track of all prospects and customers you have. Brokers can monitor all historical actions taken by customers with an opportunity to analyze them in a timeline format.

Second, sales reps and agents can set up omnichannel communication with claimants and customers. This way, you improve customer lifetime value, leverage powerful audience segmentation, boost operational efficiency, and increase sales.

Third, insurance CRM software functionality provides advanced search and filtering tools that accelerate the search experience empowering brokers to find, modify, and analyze records easily.

#5 Insurance Reporting Software Tools

Successful insurance companies pay careful attention and invest sufficient funds into advanced reporting software to generate data-driven insights, predict customers’ behavior, and get ahead of market rivals.

This makes insurance reporting software tools one of the must-have features that all top insurance companies should have.

This functionality helps agencies and brokers store all important business-related information in one place, access and review it in real-time, and automate report generation processes.

What’s more, reporting tools allow your company to track numbers that matter by adjusting and filtering reporting dashboards that help monitor preferred business KPIs in real-time.

This way, insurance reporting software makes it possible to define what policy quotes, market segments, and sales channels drive the best business results.

Ultimately, this feature helps you to keep internal teams accountable by creating visually-appealing insurance standard reports and sharing them within all needed company departments.

5 Common Insurance Software Features | Ascendix Tech

Build Custom Software with Ascendix

We help companies automate their workflow by developing bespoke software solutions. Leverage our experience in real estate, legal, financial, and transportation industries.

Custom Insurance Software Development

#1 Set up your business goals

Before building any type of insurance management software, you should come up with the key business operations and processes you want to enhance, accelerate, and automate.

The matter is that the key role of custom insurance agency software is meeting your specific tech- and non-tech needs tailored to a definite workflow and an exact business model you operate in.

Moreover, we recommend coming up with the needed business results you want to achieve with custom insurance software development.

Depending on your operational model, they may greatly differ but most commonly include operational costs reduction, revenue growth, market share increase, and many others.

This way, first create a list of aspects and workflow activities you want to improve and try to describe the way they should work specifically for your business model.

This basic understanding will help you prepare some kind of technical specification and project requirements to share with a technical partner and in-house developers, freelance development teams, or insurance software development companies.

A detailed development plan is about saving your time, funds, and building the exact tailor-made insurance agency software you actually need.

#2 Pick the right insurance software type

The next step towards custom insurance software development is selecting a specific solution type.

This is crucial due to the fact that each cloud-based insurance agency software is designed to solve different and exact business and technical demands your company has.

For example, if you want to improve lead management and communication with customers to boost the number of claimants and reclaimants, you should choose insurance CRM software as its key mission is to help improve customer relationship management.

As we mentioned the most common types of insurance software with their descriptions earlier, let’s now just recall what software do insurance companies use:

- Insurance document management software

- Insurance policy management software

- Insurance underwriting and rating software

- Insurance claims management software

- CRM software for insurance agencies

- Insurance quoting software

- Insurance automation software.

In 2021, lots of insurance companies build custom technology solutions that combine multiple features from several cloud-based insurance agency software types.

This is a great time- and cost-effective option if you are clear with the detailed functionality you want to implement for your insurance business.

#3 Choose the development approach

Before starting the custom insurance software development process, you should pick the right development option that meets your specific needs and budget expectations.

Let’s now review the most common models you should consider when building cloud-based insurance agency software.

#1 Hire insurance software development companies

Finding a technology provider with solid experience in building insurance agency software is surely a great option for your business.

First, a custom insurance software development company with relevant expertise has a deep understanding and background of completed projects that help them build your digital solution time- and cost-efficiently.

Second, experienced software companies can both help you transform project requirements into reliable insurance agency software and provide alternative technology solutions designed specifically to meet business needs first.

Third, you get access to a large talent pool and completely avoid onboarding/offboarding activities that are fully held by a custom insurance software development company.

Fourth, you can choose the most suitable engagement model that meets your budget expectations and the internal team’s preferences.

At Ascendix Tech, we have outsourced custom software development to Ukraine, and it allows us to offer lots of flexible engagement models within onshore or offshore models.

For example, we can offer our dedicated teams in case you want to closely collaborate with our software developers as an integral part of your team, manage their work, and adjust requirements on the go.

In turn, you can fully delegate the development process to us so that we autonomously build cloud0basedinsurance agency software and provide you with a final product.

Below you can see the key contract options we offer for collaboration.

Ascendix Tech Contract Options

#2 Find a technical partner/CTO

This person is a highly experienced professional with relevant solid insurance industry experience (optional) who is keen on building result-oriented insurance agency software having strong skills in technologies.

We recommend considering this option when you have enough time to visit offline conferences or special digital platforms for business networking.

Alternatively, you may have lots of contacts that can give you a few pointers on great CTOs they have worked with successfully.

The key benefits of finding a technical partner are:

- Avoidance of talent pool seeking, onboarding/offboarding, training, and management activities

- An ability to build a strong in-house development team with dedicated technical specialists

- A possibility to focus on major business development activities like strategic planning, fund-raising, etc.

- The creation of a predictable development budget that meets your expectations, resources, and an insurance management software product release plan.

It’s worth noting that finding an experienced industry-specific technical partner is a costly affair but may become extremely cost-effective in the long run.

#3 Hire freelance development teams

This development option seems to be the cheapest one, but it also depends on the level of experience, expertise, and other factors that will impact the final development costs.

Such platforms as Upwork, Fiverr, Freelancer.com, PeoplePerHour, and TopTal are among the most popular websites where you can find freelance developers for your custom insurance software development project.

Considering the benefits, hiring freelancers allows you to access reasonable rates, relatively fast product delivery, a wide talent pool, etc.

However, you may bump into communication issues, lack of transparency, source code ownership nuances, and low quality of the delivered insurance agency software product.

#4 Build insurance software solutions yourself

In case you have strong technical and technology skills, you can start building the best insurance software yourself.

The most important advantage of this development option is that nobody knows what and how should be implemented to meet your specific business needs as you do.

Most likely, you will need to find and hire additional specialists once the MVP version is built as scaling and maintaining the insurance management software product is extremely time-consuming.

For this reason, you can assemble a small team of dedicated professionals who have the same product development vision in the future.

Bottom Line

Custom insurance software development is a complex and thorny process that requires lots of time and funds.

However, the chances are high that you will get the best insurance software tailored to your specific business needs with lots of flexibility and scalability opportunities.

At Ascendix Tech, we have solid expertise in building insurance broker software solutions and will be glad to help develop yours. If you’re looking for a reliable custom insurance software development company to help transform your project idea into a problem-solving digital solution, feel free to check our case studies and contact us to discuss your project.

Daniil Torkut , Content Marketer

Daniil specializes in content marketing and has a deep knowledge of promoting the company's products and services through high-quality content. On the Ascendix blog, Daniil shares his tricks and tips on custom software development, provides technology trends and insights, and helps you get valuable content to make your business even more successful and profitable.

(25 votes, average: 4.80 out of 5)

(25 votes, average: 4.80 out of 5)

Great Blog. Thanks for Sharing.