Need Technology Help?

As a technology advisor, we partner with small firms and global enterprises helping them bring automation to their operational processes.

When you use contactless payment platforms like PayPal, Samsung Pay, Apple Pay, Google Wallet, or pay by credit card, you’re using FinTech.

And when you go online to find the best mortgage rates to buy a house or to refinance the one you’re living in, that’s the FinTech industry.

FinTech has drastically changed multiple sectors like payments, electronic commerce, banking, social commerce, and wealth management within the last decade, making them attractive for investors.

Organizations worldwide are contributing to the growth of fintech software development. As a result, this industry is considered to be the hottest trend in 2021 to succeed.

FinTech software development is everywhere, so why not talk about it more deeply and clarify what makes the FinTech sector so promising and successful?

In this article, we’ll highlight:

Let’s get started!

FinTech is an umbrella term used to describe various software created for financial transactions facilitation. It covers apps helping banks connect to customers, apps enhancing users’ investment skills, apps providing instant money transactions, etc.

Being an industry that combines financial services and technology, Fintech has transformed the way businesses operate. In a short time, this sector changed its business scenario and modified its approaches to customer service.

According to the Global Fintech Market Research Report by Market Data Forecast, the global financial technology market is expected to reach approximately $324 billion by 2026, growing at a compound annual rate of about 23.41% over the forecast period 2021-2026.

The global FinTech market is segregated into North America, Europe, South America, Asia-Pacific, Middle East, and Africa.

The North American region has been the leading contributor since 2019 and is expected to keep its dominance in the forthcoming years due to the high adoption and development of major technologies involved in the fintech sector.

The European region keeps second place in the adoption of fintech solutions. The United Kingdom is one of the most fintech-friendly countries.

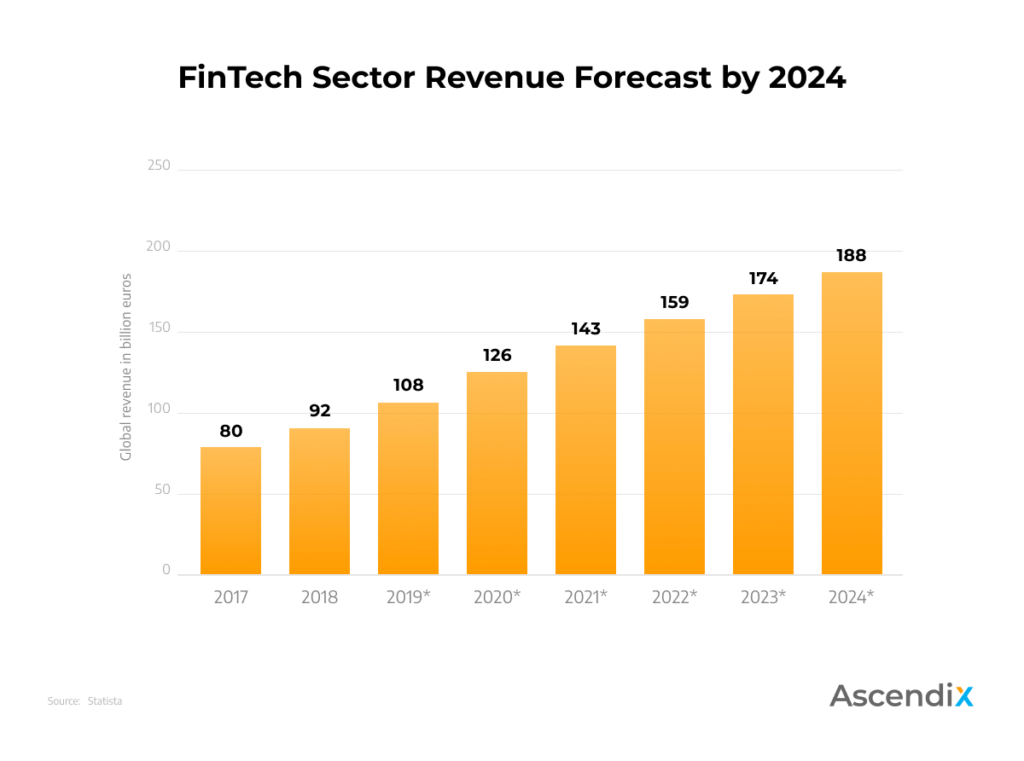

As Statista states, according to the forecast presented in the graph, the revenue of the FinTech sector was expected to grow at an average rate of nearly 12 percent in the following years and reach a value of 188 billion euros by 2024.

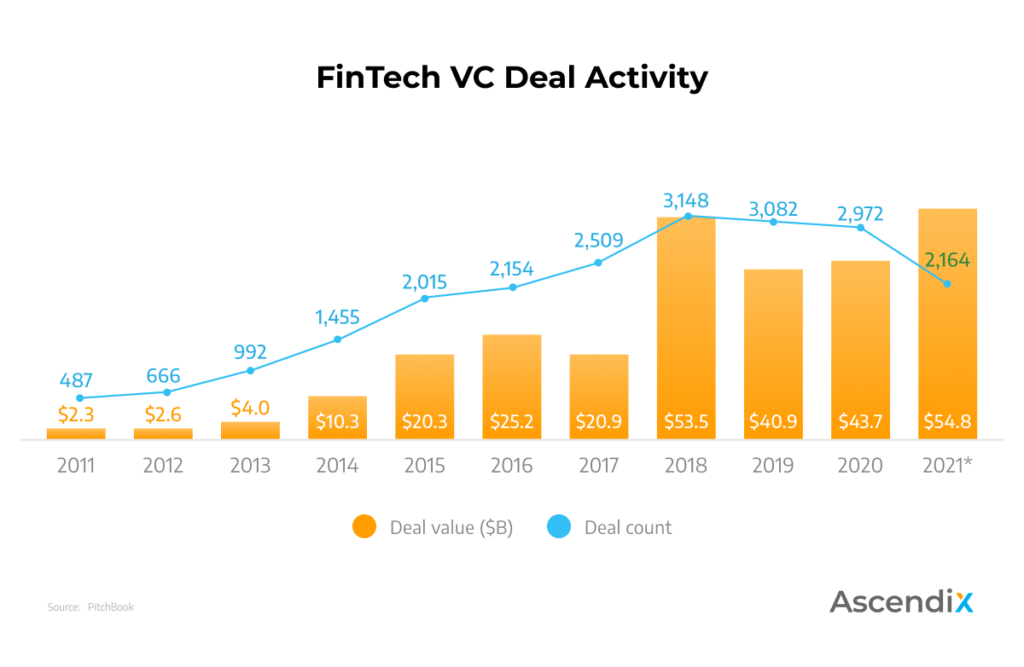

As we know, the amount and timing of investment in FinTech is an important indicator of industry viability, if not maturity. Analyzing the investment and deal activity data by sector reveals interesting dynamics.

According to Emerging Tech Research by PitchBook, in Q2 of 2021, fintech companies globally raised $30.9 billion in VC across 1,801 deals. And all the deals were proceeding at a frenetic pace. PitchBook assumes that venture-capital firms have sold $70bn in stakes in fintech startups so far.

Digging deeper into the financial technology sector, let’s analyze the current trends in FinTech that influence the approaches to software development.

Digging deeper into the financial technology sector, let’s analyze the current trends in FinTech that influence the approaches to software development.

Trend #1. Implement AI and Machine Learning

Autonomous Research suggests that AI will help the financial and banking industries reduce costs by 22% by 2023. How? Everything is simple.

AI and machine-learning-powered platforms prevent companies from fraudulent activities towards accounts access. Moreover, both technologies help analyze large blocks of data to solve problems and make informed decisions.

Trend #2. Biometrics in FinTech apps

Fingerprint verification and facial recognition make special sense in utilizing biometric data for online payments.

As Counterpoint predicted in its whitepaper, around 1 billion smartphones will have some form of face unlock in 2021 and the following years. First used to unlock the phone, fingerprint verification and facial recognition have been adopted to log in to mobile apps and perform mobile NFC payments in-store.

Biometrics is difficult to forge and provides people with ultimate control over their finances and personal information. Moreover, it has high accuracy and the cheapest cost compared to other approaches.

Trend #3. Apply Blockchain

Blockchain is all about transparency and data privacy. It is based on a distributed database where each can add a new record but not change older data blocks. It helps build trustful relationships between users and service providers.

Trend #4. Cybersecurity is a must

According to the 2019 Seventh Annual Community Banking Research and Policy Conference Survey, 70% of bankers consider security the most pressing concern for future profitability.

Cybersecurity aims to prevent organizations from data breaches that may cost millions of dollars.

Trend #5. Access to Big Data

The amount of data gathered from millions of devices daily is estimated in quintillions. To get the results from the raw data, fintech companies use Big Data. It helps to get insightful information about customers’ behavior and create effective marketing strategies and development opportunities.

As a technology advisor, we partner with small firms and global enterprises helping them bring automation to their operational processes.

Thanks to the advanced opportunities of fintech development services, companies can analyze user behavior and provide personalized solutions using applications.

Therefore, this passage will describe the must-have functionality every company should get through fintech software development.

Account Verification and Management

Account verification and management are some of the basic functional features—people like easy-to-use apps, especially when it comes to managing personal bank accounts.

Chatbots and Online Assistants

This functionality allows banks and financial organizations to reduce the time for solving various challenges: from standard user requests to providing individual solutions to each client. The 2017 Juniper Research Report suggests that chatbots will help companies save over $8 billion annually by 2022.

An AI-powered automated online bank assistant can handle many incoming customer requests. By receiving user data from mobile devices, the mobile banking application uses machine learning to provide the necessary information or redirect the user to the right source.

Card Management System

This technology is one of the top fintech banking trends. It enables both credit and debit card management systems and makes the entire process safer and more secure. Also, a card management system enhances users not to go through a lengthy authentication process, for example, in case of loss or card theft.

Data Analytics

Suppose a user wants to track the history of financial transactions, seek business insights or analyze the income level for a particular period in a few clicks. In that case, data analytics functionality is an integral part of all FinTech products.

Security

The 2019 Report by Aite Group indicates that 97% of financial services lack proper code protection, while 90% of apps leave essential data in other apps. In other words, the authentication process should be secure in addition to being intuitive.

Push Notifications and Updates

Each step users take in the transaction process should be followed by updates and notifications. People need to stay active and informed.

UI/UX For Seamless Navigation

There is no need to explain the importance of UI/UX app design. As stated in the article by Think With Google, 52% of users said they’re less likely to engage with a company that doesn’t use responsive mobile design.

Seamless navigation is vital for FinTech products. If people can’t navigate through the app intuitively, they stop using it, decreasing user engagement.

We listed the basic features of FinTech software development. Below, there is a table of essential features for different fintech application types.

| Features for Different FinTech Application Types | ||

|---|---|---|

| Banking App | Money Lending App | Native Investment App |

| Sign Up Screen | User Registration Screen | Profile Registration |

| Sign In Screen | Login Screen | Login/Social Media Integration |

| Card details | Complete Profile Screen | Profile Details |

| Transaction History | Credit Products | Bank Details |

| Checkout | Loans Page | Payment Option |

| Cashback | Account Summary | Education Option (add/save investment videos) |

| Money Installment | Customer Support | Search Filters/Sorting |

| Saving Management | Push Notifications | Cart |

| Deposit Machines | Instalment Calculator | Monitoring Withdraw |

| Bank Branch Details | ||

| Account Settings | ||

| Support | ||

| Push Notifications | ||

We recommend following this proven methodology to combine your unique offerings and basic features into your product.

Step 1: Conduct Research

In such a multi-faceted industry as FinTech, the research phase should be your top priority. So, before you start a fintech application development, you need to analyze:

However, calculating expenses and time planning won’t be precise without a team.

Step 2: Hire a Team and Define a Tech Stack

Find professionals that can build a successful fintech product. Ideally, your developers should have experience with fintech apps, an appropriate tech stack, and communication tools.

How can you find a team that has the necessary skills and expertise? There are several approaches you can take.

First of all, you can assemble an on-demand team. In this case, the specialists of a particular company manage your project.

Secondly, you can hire a dedicated team. This option provides you with the management of engaged professionals. There are also options to hire an offshore team or a blended team (if a company has offices in several countries).

You may hire a CTO, freelancer, or a fintech software development company that can recommend the best practices for your fintech project ideas.

Each option has specific terms. However, whatever team you hire for fintech application development, you’ll most likely need business analysts, UX/UI designers, front-end and back-end developers, testers, and project managers.

Ultimately, when you hire a team for your project, one of the primary questions you need to discuss is a tech stack.

The finance industry is about adapting to changing customer needs. Your technology stack should reflect these ideas and allow flexibility during development. But what is the best programming language for fintech development?

Python is one of the most sought-after programming languages for the financial industry. It’s followed by JavaScript and Scala, with C++ and SQL languages close behind.

The cost of development will immediately rise when you decide to build a cross-platform application.

Hire Ascendix experts. Leverage our experience in real estate, legal, financial, and transportation industries.

Step 3: Create the Minimum Viable Product

Test your app before releasing it by creating an MVP product. It helps to check if your potential customers are interested in your fintech app before starting full-scale development.

Brief explanation: MVP (Minimum Viable Product) is a prototype version of your product with barebone functionality. With MVP, you can test your software at the early stages of production and define bugs, unnecessary features, etc. Done right, MVP helps to focus on what your customers want.

Key aspects you need to consider during MVP software development:

Think of APIs and all possible integrations

People expect fintech products to support third-party APIs (Application Programming Interfaces). Most financial services are built around user experience, and customers want your app to work with their favorite SaaS solutions. It’s equally important to make the integration seamless and secure.

Consider Security

Fintech products and services are about collecting financial, personal, and other information about customers. The leakage of such sensitive data can have severe financial and reputational implications for your company.

Consider data protection regulations, policies, and best practices for secure fintech application development to prevent yourself and your customers from it.

Some of the most effective solutions include:

Make User-Friendly App Design

The primary focus of fintech products is user experience, remember? Keep an eye on every feature and interface element that provides value. If you want to maximize revenue, you should consider the needs of all users, including the financial service provider and end customers.

Additionally, you can get more customers by creating interfaces for different user categories. For example, if you’re developing a money lending app, you need to build your app for two parties: a loaner and a loanee. In this case, app design will have some features in common (style, fonts), but the primary features should differentiate.

Step 4: Launch the MVP

One of the keys to successful fintech software development is continuous testing. This step aims to test MVP viability and get feedback from test groups to improve your product before delivery.

Actual feedback from customers can help you smooth out the rough edges in your app. Of course, don’t forget about security measures for private data and legal documentation for testers (sign a Non-Disclosure Agreement to avoid data leakage).

Step 5: Product Upgrade and Support

When you release your product keeping all fintech standards, you’re at the beginning of your way. The FinTech industry is a constantly changing market, so you should be prepared to maintain, support, and upgrade your app throughout its life cycle.

As you can see, fintech software development is a challenging task. However, hiring a team of professionals can streamline the process.

There are two factors affecting fintech cost:

A fintech app development time starts from 1500 hours. And as for the hourly rate of the developers, it varies according to the country of origin. An average hourly rate ranges from $30/hour to $150/hour.

Each product is unique and should be estimated individually, even if apps have similar features. However, the software product discovery phase can help with that. Let’s speak in a few words about it.

The discovery phase of a software project is the first step in a discussion between a software development company and a client. It aims to identify various aspects: from analyzing client’s business ideas to defining time and budget estimation.

Done right, this phase helps you and your software development partner clearly realize when, how, and what both parties will get by documenting all crucial project development aspects: from expectations to exact functionality and estimates.

If you want to get a quality product for a fair price, consider fintech software outsourcing in Eastern Europe. It gives such benefits as:

Fintech software outsourcing in Eastern Europe stimulates more world-class companies from the US, Great Britain, and other countries to invest in this industry.

We help companies automate their workflow by developing bespoke software solutions. Leverage our experience in real estate, legal, financial, and transportation industries.

FinTech software development is no longer a buzzword – it’s a business opportunity. Now, when you know how to develop a fintech app, current trends in FinTech, you can understand whether this field is for you.

FinTech industry growth is followed by the implementation of advanced technologies that require solid tech expertise and background.

With Ascendix, you’ll easily manage all stages of the Product Development Life Cycle, understand policies, requirements, define users’ expectations, and more. Our team of fintech developers, project managers, UI/UX designers know how to build a fintech app around your idea and make it valuable.

If you are looking for a FinTech software development company for your new or existing project, Ascendix Tech is a great choice!

Check our case studies and contact us to get a precise estimate for your project.

Kateryna specializes in creating engaging content about CRM software development for Legal Services and custom software development. In her articles, she provides relevant data, stats, business tricks and makes overviews and guides of new technology trends and CRM updates.

Get our fresh posts and news about Ascendix Tech right to your inbox.