Maximize Your Investment with Real Estate Tech Audit

Let a real estate tech expert with 16+ years of industry experience audit your proptech startup.

Since time immemorial, investing in innovation with potential has been a pursuit, and proptech is no exception to the trend, with VC funding being a crucial driver. But with venture capital funding plummeting by 38% from $32.0 billion in 2021 to $19.8 billion in 2022, proptech VC firms conduct capital allocation slower and with more diligence.

What are proptech VC funding trends now and who are the top players? Let’s find out.

In the first half of 2022, investments in equity and debt surpassed the $8 billion mark after the proptech world entered AI euphoria. And with 70% of all deals focusing on AI startups and 64% of businesses planning to invest in AI for increased productivity, no wonder proptech VCs are expecting returns on their investments higher than ever.

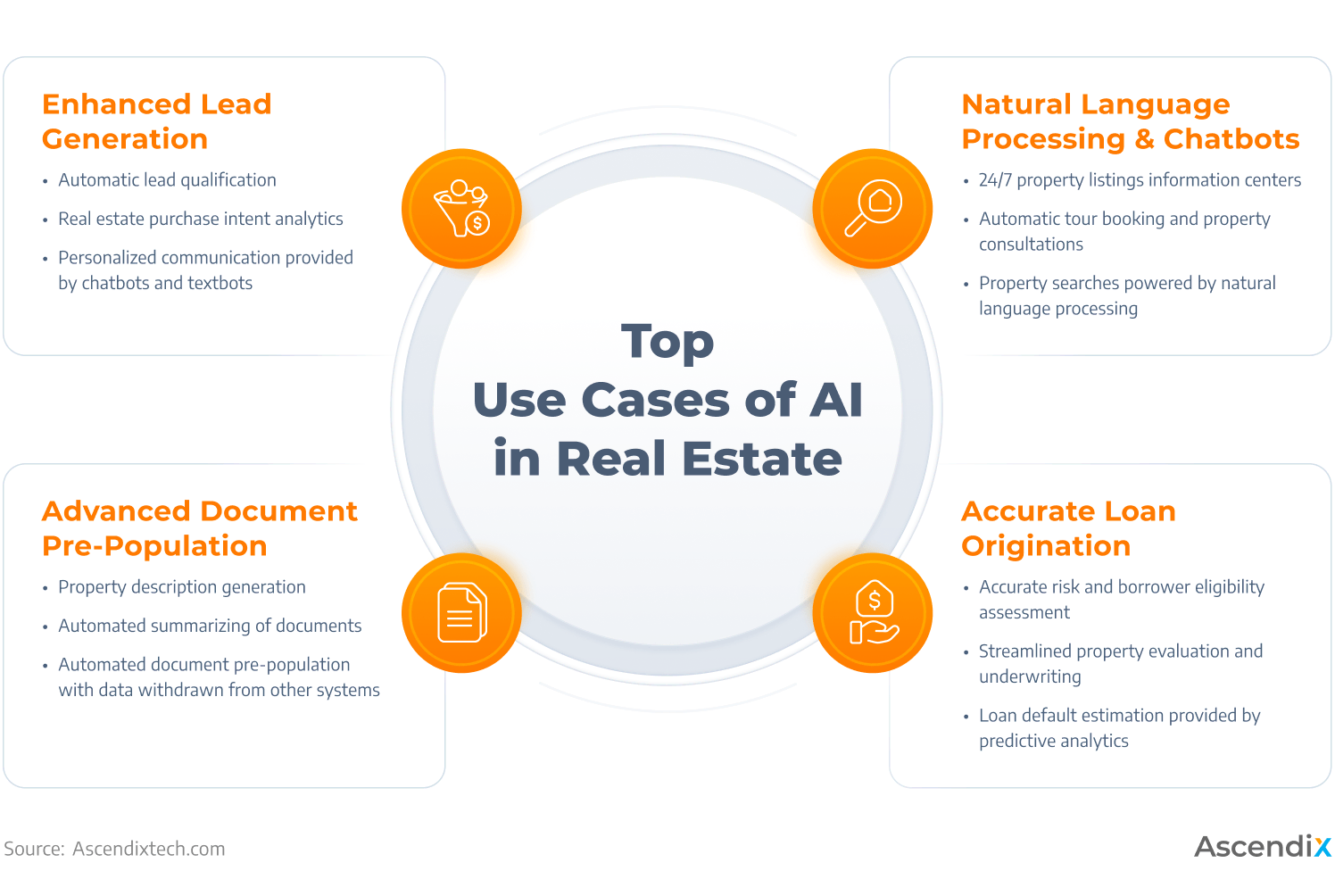

Top Use Cases of AI in Real Estate

Why? Because according to predictions, AI will contribute 21% net increase to the United States GDP by 2030. With generational AI in real estate (an umbrella term for chatbots, virtual assistants, image generation tools, natural language processing, and optical character recognition), companies will be able to fully automate their workflows, adding speed, accuracy, and data efficiency.

A great example is EliseAI, a conversational AI tool that has already gained the attention of the top proptech VC funds like JLL Spark, MetaProp, and Navitas Capital, raising a total amount of $67 million.

With mortgage rates being close to 7%, getting approval of credit applications, especially for vulnerable demographics such as first-time buyers or the elderly, is a no-win contest. Startups will draw inspiration from the crisis and try to make the home-buying experience affordable for everyone with out-of-the-box investment models.

For instance, Virgil, a French startup that already raised $15M last year, provides potential buyers with a financial assistance of up to €100,000. The model is simple: in return for a 10% investment of the property’s cost, Virgil acquires a 15% ownership stake in the property, with payment received upon the apartment’s resale (no later than a decade after acquisition).

Why have we put GreenTech/ClimateTech and ConTech side by side? Most GreenTech solutions are designed for the construction industry, since the latter is responsible for 39% of carbon emissions globally. And amidst the legislation related to the climate crisis like the Sustainable Finance Disclosure Regulation (SFDR) and the Corporate Sustainability Reporting Directive (CSRD), companies build their models with ESG regulations in mind.

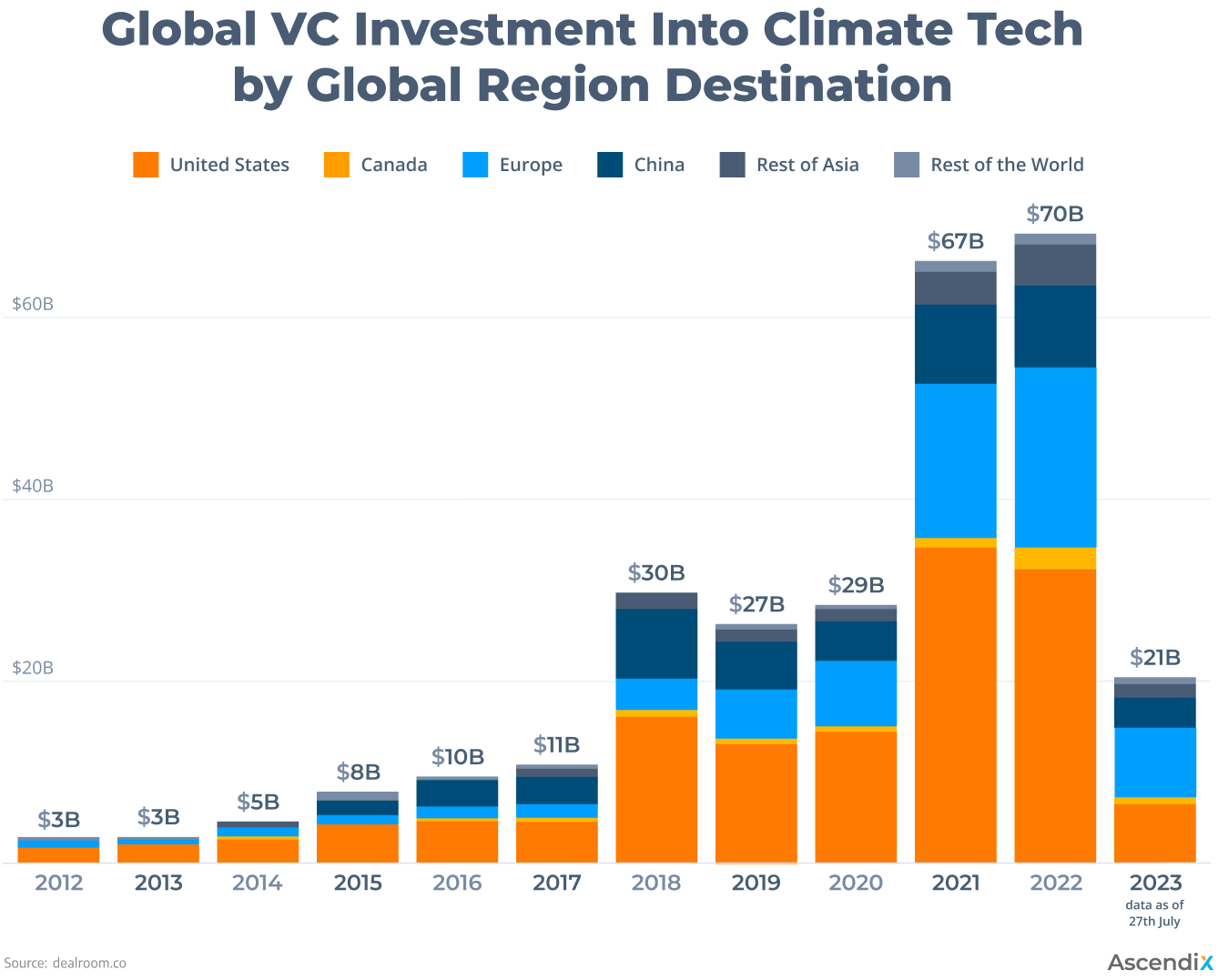

Global VC investment into climate tech by global region destination

Because decarbonization practices and safe energy in construction are a trend that won’t vanish soon, proptech VC funds will keep investing in startups (to be precise, 64% of the funds) that put sustainability at the heart of their practices. No wonder most investors will allocate their resources to Green Construction, be it the development of digital solutions for ESG measurement or sustainable construction services.

And despite the 50% slowdown in ClimateTech VC funding in 2023 ($21B globally compared to $70B in 2022 and $67B in 2021), it is still expected that proptech VC funding will surpass the numbers in 2020 and previous years.

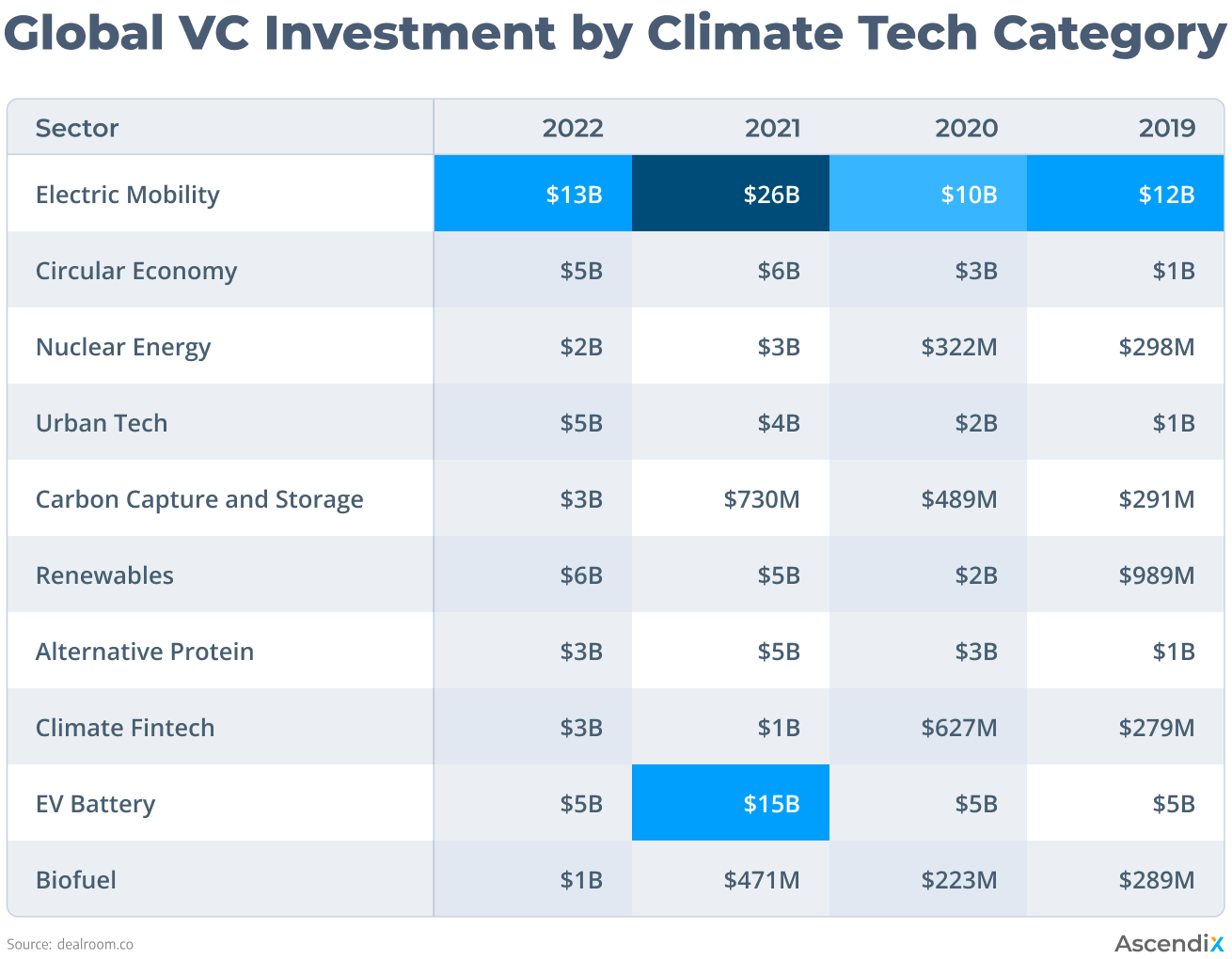

Meanwhile, the top ClimateTech segments companies will still invest in are carbon capture and storage solutions, renewables, and UrbanTech.

Global VC investment by climate tech category

With housing shortages and high rental fees skyrocketing, homebuying gets postponed, giving a rise to new trends like co-living platforms and fractional homeownership.

The fractional ownership market is projected to expand at an 8.3% CAGR from 2021 to 2028, as indicated by Research and Markets. Knight Frank’s report highlights that the market, valued at $5.39 billion in 2020, is anticipated to reach $8.92 billion by 2025.

Notably, startups like Pacaso are already revolutionizing the single-family homeownership sector, monetizing underutilized assets and alleviating the financial burden. Pacaso’s clients can own a portion of their second home and use a fair scheduling system for booking it. In less than 3 years, the company has drawn the attention of 25 investors and raised $1.5B.

As for the co-living and rental platforms, proptech VC investors will be interested in startups like Allihoops ($800K in funding, 6 investors) that focus on sustainable city development by designing affordable co-living spaces.

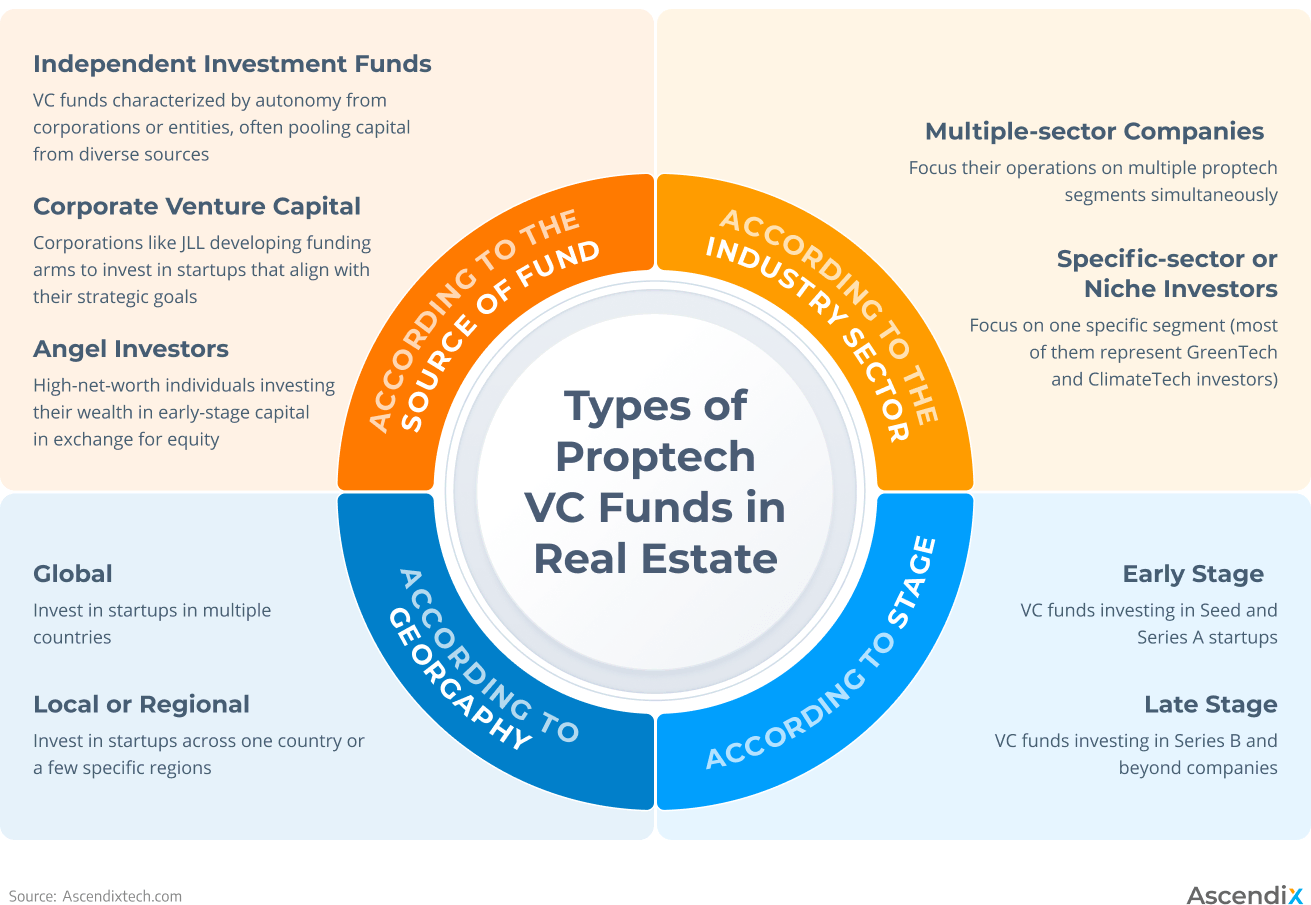

Given the dynamic nature of VC market, the total number of proptech VC investors is constantly changing. According to the latest data, there were 1809 proptech investors globally.

Depending on the stage, proptech VC funds are:

By georgaphy:

By sector:

By source of fund:

Location: New York, US

Founded: 2015

Investment Focus: AI, GreenTech/ClimateTech

Website: https://www.metaprop.vc/about

MetaProp has conducted 152 investments in total with 24 lead & 36 diversity investments and 17 exits. Their latest investment happened on July, 2023 – the company invested $4.5M in Pest Share.

This proptech VC firm focuses on early-stage startups and offers one of the largest proptech portfolios in real estate with the most significant investments as follows:

Our wrap-up: MetaProp promotes diversity in the company’s community and is clearly in touch with the market trends. The company has invested in AI solutions and Greentech and has generally made a higher-than-average number of investments. A perfect match for AI and Greentech/ClimateTech startups.

Location: Rockville, US

Founded: 2011

Investment Focus: Proptech, ClimateTech, Fintech

Website: https://cambercreek.com/

Another proptech VC funding titan with 64 investments (17 lead investments, 6 diversity investments, and 14 exits). The company has recently invested $16.3M in Bowery Valuation, a provider of tech solutions for CRE appraisers.

Among the proptech investor’s top clients are:

Our wrap-up: We haven’t found much data on the investor online, but from the details gathered, we can say that Camber Creek is a good match for companies representing all proptech sectors and fintech.

Location: San Francisco, US

Founded: 2017

Investment Focus: ConTech, Fintech, Smart Buildings Technology

Website: https://spark.jllt.com/

JLL Spark is a corporate venture capital arm of JLL that has conducted 60 investments with only 1 exit (SkylineAI). The company’s last investment happened in June 2023 when EliseAI raised $35M.

According to the statistics on the company’s site, JLL Spark has invested around $380M in 45 early-stage proptech startups. The company’s focus area lies in ConTech, ESG, Fintech, Future-of-Work technologies, and Smart Buildings.

Our wrap-up: JLL Spark is one of the largest investors in real estate. The company heavily allocates resources to AI startups and has an impressive portfolio diversity with global operations conducted in APAC, EMEA, and America, making it a perfect match for AI proptech startups from any corner of the world.

Location: Los Angeles, US

Founded: 2016

Investment Focus: Proptech

Website: https://fifthwall.com/

One of the top proptech investors, Fifth Wall has completed 153 investments (25 diversity investments) with 12 exits. The latest investment carried out by Fifth Wall was when Terbase Energy raised $25M in July 2023.

Backed by more than 100 partners, this impact venture capital firm assists companies addressing real-world challenges like climate change or aging infrastructure.

In the portfolio of this proptech VC fund, you’ll find the real estate trailblazers like:

Our wrap-up: A mature investor with the greatest portfolio of the top real estate players in the list. Fifth Wall has built an incredible reputation in the investment world and has earned the trust of the largest number of investors in the group. So, yes, if you’re a climate tech / green tech startup – consider FifthWall.

Location: New York, US

Founded: 2015

Investment Focus: Proptech, Fintech, Web & SaaS

Website: https://www.reshape.co/

Based in NYC, Reshape is a boutique early-stage investment firm. Since 2015, the proptech VC firm has invested in 200+ proptech, retail, e-commerce, and healthcare startups.

Reshape invests in multiple sectors (Proptech, Fintech, FoodTech, Healthcare, Retail & E-Commerce, Web & SaaS). As for the proptech market, Reshape can boast 14 investments with the most notable being as follows:

Our wrap-up: Though the company is still young, it has already proven its ability to stay in the market; a perfect fit for proptech startups with activities that overlap with other industries.

Location: San Francisco and Hong Cong

Founded: 2015

Investment Focus: Multi-sector Investments

Website: https://www.clickventures.vc/

Most of the company’s proteges represent Asian and Northern American businesses. Headquartered in Singapore and New York, Click Ventures has completed 48 investments, among which are 9 diversity investments (KitSplit). As for the exits, the company’s portfolio currently includes 11, the most notable being Spotify, Kabam, and DocuSign.

As for the CRE-related technologies, the range of Clink Ventures’ investments includes:

One of the latest Click Ventures’ investments is Oddup, a digital platform offering real-time insights and data on startups and cryptocurrency markets to investors and venture capitalists. In 2021, Click Ventures invested $12.8M as a part Series C.

What is our opinion on Clink Ventures? Sure, the number of startups is huge, but there are not many CRE startups despite the latter being said to be among the company’s primary focuses. But the good part is that the investor is not a startup itself and has more experience compared to startup venture funds like Sunriver Ventures.

Location: Dallas, US

Founded: 2021

Investment Focus: Proptech, HealthTech

Website: https://sunrivervc.com/

Founded in 2021 and headquartered in Texas, Sunriver Ventures is an investment firm specializing in supporting early and mid-stage technology companies. The proptech investor takes pride in helping startups not only with structured debt and equity capital but with hands-on operational assistance.

Currently, the company has made 7 investments with the top focus on fintech development (clients like Groundbreaker, Deposify, and MX Build). Lately, Financial Holdings Financial Services has raised an undisclosed amount as a part Series A.

Eariler in 2022, Sunriver Ventures invested in:

What is our wrap-up? Though this proptech VC firm is still young, it has already proved its intention to invest in real estate with the number of companies like Occuspace, Theo Build, and others. A good match for tech startups focusing on commercial real estate.

Location: New York, US

Founded: 2022

Investment Focus: Climate Tech, Industry & Infrastructure Tech, and Social Impact Tech

Website: https://www.altalurra.com/

As the company claims, its activities are primarily focused on impact-driven tech investing in the US and Europe, encompassing Climate Tech, Industry & Infrastructure Tech, and Social Impact Tech.

With its determination to support businesses adhering to ESG regulations and promoting diversity, Altalurra Ventures not only measures the company’s impact but also develops an investment strategy that aligns financial success with positive social and environmental outcomes.

Currently, there is only one investment in Altalurra’s portfolio. In September 2022, Altalurra invested $4.5M in impak Finance as a part of Series A rounds. impak Finance shares Altalurra’s values by being an impact intelligence platform that helps companies ensure their operations meet the EU Sustainable Finance Disclosure Regulation.

What is our wrap-up? Though Altalurra is a fresh enterprise, it has already shown its commitment to follow its values and help businesses adopt sustainability practices. Startups focused in GreenTech and ClimateTech development (generally any company with a potential to address pressing climate crisis challenges) can garner Altalurra’s attention.

Location: Gothenburg, Sweden

Founded: 2021

Investment Focus: SaaS solutions, Data & AI, IoT-driven Smarter Homes, GreenTech

Website: https://www.proptechfarm.com/

Bridging the Nordics with Southeast Asia, PropTech Farm has focused its investment activities on SaaS solutions, Data & AI, IoT-driven Smarter Homes, Sustainable Energy Tech, and Transaction-related technologies in the proptech sector.

With in-depth expertise in real estate, tech and finance, PropTech Farm prioritizes sustainability-oriented businesses. The company’s investment portfolio is distributed as follows: smart cities development – 32%, transactions – 22%, SaaS – 17%, Design – 8%, SPaaS – 15%, Greentech – 6%.

In 2 years, PropTech Farm has already invested in 11 proptech projects with 1 exit (Pixery Media).

Among the company’s clients are:

From the list above, the latest PropTech Farm’s investments are XNomad (raised $3.2M in Seed series from PropTech Farm and Luminar Ventures) and Vinden Storage (raised $2.8M in the unknown series from PropTech Farm and 2 other investors).

Our final thoughts: Though the company is a young investor, we believe that proptech startups representing geographically the Nordics and Southeast Asia can benefit from the cooperation with this investor.

Location: Berlin, Germany

Founded: 2018

Investment Focus: Proptech, Contech, and Urbantech

Website: https://pt1.vc/

Proptech1 Ventures is a European team of real estate professionals, digital entrepreneurs and venture capital experts that like Altalurra has narrowed its investments to socially and ecologically impact-driven businesses.

Unlike most of other venture funds in this list, Proptech1 Ventures openly cooperates with other investors, offering co-investing opportunities in the Proptech, Contech, and Urbantech community.

Among the company’s co-investors are:

Banks and insurance companies

Real estate players

The company has made 21 proptech investments. Due to an impressively extensive proptech investment portfolio, we’ll only present a few of the recent Proptech1 Ventures’ clients:

Our wrap-up: This proptech investor is a great fit for Proptech, Contech, and Urbantech startups and co-investors like bank, insurance, and real estate companies, all representing the European region.

Location: Los Angeles, US

Founded: 2009

Investment Focus: Proptech, ConTech

Website: https://www.navitascap.com/

Navitas Capital helps proptech startups navigate industries with go-to-market strategies that pave the way for transformative success.

Among the company’s recent investments (23 investments in total) are:

Our wrap-up: The company’s portfolio includes the greatest number of the top proptech startups. A part of Navitas investments is ClimateTech businesses, so if your startup promotes sustainability or represents Green Construction, ask Navitas for help.

Location: Park City, US

Founded: 2017

Investment Focus: Proptech, Fintech, Efficiency-as-a-Service technology

Website: https://www.ret.vc/

RET Ventures are the largest group of multifamily and single-family rental owners and managers ever amassed. Overall, the proptech VC fund boasts 2.5M rentals managed by their strategic investors in 48 states.

The company operates in Canada & US and has already made 34 investments in 6 years according to their portfolio.

RET Ventures´ recent clients include:

Our wrap-up: A company with the most diverse portfolio; if you operate in the US and Canada, your business represents residential real estate or you’re building Greentech, Fintech, and insurance software – RET Ventures might be a suitable partner for you.

Location: Stockholm, Sweden

Founded: 2022

Investment Focus: Proptech, GreenTech/ClimateTech, Fintech

Website: https://agvinvest.se/

Founded only a year ago, the company has already made 6 investments. AGV Invest operates in the Nordic region and is devoted to propelling advancements within proptech by investing in proptech startups promoting sustainability and decarbonization solutions.

Currently, the companies represented in AGV Invest’s portfolio solely represent Sweden and segments like:

Our wrap-up: AGV Invest is a good option for Greentech, Fintech, and Proptech startups with operations based in the Nordic region, specifically Sweden.

Location: Raanana (Israel); Toronto (Canada); Amsterdam (the Netherlands)

Founded: 2010

Investment Focus: GreenTech, AgroTech

Website: http://www.greensoil-investments.com/

This venture capital firm focuses exclusively on GreenTech, operating at the intersection of Real Estate, Food, and Agriculture. The proptech VC fund has been heavily investing in startups with a mission to tackle the climate crisis with digital solutions.

Currently, Greensoil Investments’ operations are channeled through two specialized investment funds: Agro & Food Tech and Building Innovation.

The Proptech portfolio includes 20 items (with 3 exits):

Our wrap-up: This venture capital firm focuses exclusively on Greentech and is a perfect option for startups representing the Israeli region and operating at the intersection of Real Estate, Food, and Agriculture.

Location: Boston, US

Founded: 2022

Investment Focus: Proptech, ConTech, Logistics

Website: https://www.legacycv.com/

Legacy Capital Ventures invests in property development (industrial, warehousing, multifamily, etc.) and companies representing construction & ConTech, proptech, and logistics.

The company’s property development portfolio includes 25 items, representing residential, industrial, and self-storage properties.

Meanwhile, the Private Equity investment portfolio includes 13 investments (6 active).

The examples of active Private Equity investments are:

Our wrap-up: The only company on our list that heavily invests in property development and ConTech (and, interestingly, in cybersecurity). So, if you’re a property developer or a ConTech provider, you can count on the investor’s support.

Location: North Carolina, US

Founded: 2019

Investment Focus: CRE tech, real estate investment

Website: https://www.thirtycapital.com/

The brainchild of Rob Finlay, Thirty Capital R.J. Finlay & Co, TC Realty Advisors, and TC Ventures) is a CRE tech investor with a wide range of investments including real estate sponsors, organizations, and investment funds.

The target audience of tech solutions supported by Thirty Capital are investors, property owners, and CRE property managers.

Thirty Capital’s portfolio includes 21 investments (17 prior and 4 current).

Among the company’s recent proptech investments are:

The prior investments include:

Our wrap-up: If your company represents proptech development, real estate investment, or is a real estate organization of any type, Thirty Capital will definitely help you pave your way to a promising future supported by reliable proptech investors.

Let a real estate tech expert with 16+ years of industry experience audit your proptech startup.

Location: Palo Alto, CA, US

Founded: 2015

Investment Focus: Bio, Gaming, Generative AI, PropTech

Website: https://nfx.com/

With a track record of building 10 companies with over $10B in exits, one of the biggest real estate venture capital firms invests in seed and pre-seed stages.

NFX actively invests in Bio, Gaming, Generative AI, PropTech, Marketplaces, and FinTech + Crypto across the U.S., Israel, Latin America, and Europe.

The list of the companies NFX has invested in includes:

Our wrap-up: NFX stands out as a formidable real estate VC, offering a global perspective. If your startup aligns with the company’s geographical focus, considering NFX as a potential investor is highly recommended.

Location: Silicon Valley, Tokyo and Beijing

Founded: 1996

Investment Focus: Consumer, Enterprise, Healthcare, Fintech

Website: https://www.dcm.com/

DCM, with over $4 billion in AUM, is a seasoned VC real estate player with a 25-year focus on seed, series A, and series B. They’ve proudly partnered with 35 unicorns and counting.

Operating hands-on, they invest in a select few companies annually, becoming true partners to founders in areas such as go-to-market, product, financial planning, and recruiting.

With a global, diverse, and multicultural team across the US and Asia, DCM provides founders with access to the best ideas, talent, and opportunities worldwide.

The list of the company’s portfolio includes:

Our wrap-up: While DCM is a multi-sector investor, consider it as a potential partner if your startup specializes in fintech or intersects with consumer and enterprise sectors.

Location: Los Angeles, California, USA

Founded: 2009

Investment Focus: Consumer, Healthcare, Enterprise

Website: https://svangel.com/

SVA invests long-term in founders, ensuring that they become agents of positive change in both business and the world.

The company proactively advocates for initiatives such as racial justice, healthcare accessibility, and the reduction of income inequality and gun violence.

In SV Angel’s list of projects, you’ll find notable companies like Pinterest, Postmates, Uber, DoorDash, SpaceX, and OpenSea.

The list of the company’s portfolio also includes:

Our wrap-up: As one of the global real estate venture funds, SVA heavily invests in early-stage startups with ideas that demonstrate potential for transformative impact, innovation, and sustainable growth.

Location: San Carlos, California, US

Founded: 2017

Investment Focus: Multi-Sector Investor

Website: https://www.hustlefund.vc/

Hustle Fund distinguishes itself from other real estate venture capital firms by offering investors the opportunity to learn the art of angel investing and invest as little as $1k in top-performing early-stage startups.

Drawing from the expertise of the Hustle Fund team, which has reviewed over 40k investment opportunities, Angel Squad offers resources to make investors smarter regardless of experience level.

Their diverse Squad Members include executives from major tech companies, startup founders, and individuals from various backgrounds such as art curators, chefs, pilots, lawyers, doctors, allergists, real estate investors, quant traders, and more.

The company’s portfolio includes:

Our wrap-up: Hustle Fund is an ideal destination for both early-seed startups and aspiring investors seeking to learn the art of investing and achieve their goals.

Location: Menlo Park, California, US

Founded: 2009

Investment Focus: AI, Consumer, Crypto, Enterprise, Fintech

Website: https://a16z.com/

Andreessen Horowitz (a16z) is a real estate venture capital fund with $35B in assets under management, supporting visionary entrepreneurs across various technology sectors, including AI, bio + healthcare, consumer, crypto, enterprise, fintech, and games.

Founded on respect for the entrepreneurial journey, a16z is led by general partners with diverse backgrounds, many having been successful founders or operators in the tech space.

The list of the companies a16z has invested in includes:

Our wrap-up: a16z is unquestionably a significant player in real estate VC, boasting one of the most diverse portfolios on the list. Considering the company’s high focus on AI, it stands as a strategic choice for those navigating the intersection of real estate and artificial intelligence.

Location: Miami, Florida, US

Founded: 2020

Investment Focus: Multi-Sector Investment

Website: https://pareto20.com/

Pareto Holdings, an early-stage investment vehicle and venture studio created by Edward Lando, specializes in building and investing in early-stage companies.

With over 800 investments globally across various industries, they are frequently the first to back exceptional entrepreneurs. Executing multiple investments monthly and building companies annually with a skilled team of operators, they bring strategic support to foster growth.

In the company’s portfolio, you’ll find the following projects:

Our wrap-up: While relatively young in the real estate VC landscape, Pareto has already made over 800 investments, establishing a reputation as a reliable investor. We recommend considering Pareto Holdings, especially if your proptech solution intersects with fintech.

Location: Palo Alto, CA, US

Founded: 2015

Investment Focus: AI, IoT, Cloud Computing, Big Data, Fintech

Website: https://nfx.com/

Since 2017, UpHonest Capital has supported 466 companies, with 28 becoming unicorns and 76 valued over $100 million.

The UpHonest ecosystem engages in media and PR, reporting on over 1500 innovative projects and building a community of young professionals exploring entrepreneurship and investment.

UpHonest Scouts, launched in July 2020, has recruited nearly 200 scouts from top tech companies.

Beta Fellowship, since October 2021, is a software-driven community with 4000+ registered users, partnering with 60+ organizations globally.

Their comprehensive ecosystem includes venture capital, entrepreneur community, innovation events, media coverage, and entrepreneurship education.

Among the projects that have ended on the company’s list, including top proptech companies, are:

Our wrap-up: UpHoonest Capital is partially a real estate venture capital firm with a heavy focus on AI and IoT, so if your proptech ideas overlap with these sectors, UpHonest Capital stands out as an ideal consideration for potential investment.

Location: Silicon Valley, CA, US

Founded: 2015

Investment Focus: Marketplaces and Network-Effect Companies

Website: https://www.turtlevc.co/

Turtle Ventures focuses on investing in winners within massive markets plagued by inefficiencies. They recognize that the most successful tech companies revolutionize existing markets, bringing efficiency, lower prices, and enhanced customer convenience.

In the company’s portfolio you’ll find the following top proptech companies:

Our wrap-up: With the extensive number of proptech companies on the list, Turtle Ventures showcases a commitment to propelling revolutionary proptech endeavors. Therefore, if you’re seeking a reliable and forward-thinking real estate VC, especially if your company is a real estate marketplace, Turtle Ventures stands out as a compelling choice with a proven track record in the industry.

Location: London, England, United Kingdom

Founded: 2008

Investment Focus: Multi-Sector Investor

Website: http://claytonventures.com/about-us.php

As independent investors and boutique finance advisors, Clayton Ventures boasts a global track record since their establishment in 2008.

Specializing in various sectors, they collaborate with a range of clients, from cutting-edge startups to global corporates.

With offices in Dubai and Hong Kong, Clayton Ventures provides invaluable support for complex cross-border deals, combining local presence with a global perspective.

The company’s portfolio includes the following projects:

Our wrap-up: If you’re looking for a seasoned real estate venture fund with a global focus, Clayton Ventures stands out as a reputable choice.

Location: San Francisco, California, US

Founded: 2000

Investment Focus: Multi-Sector Investor

Website: https://www.industryventures.com/

Industry Ventures, a pioneering venture capital firm with over two decades of experience, manages over $7 billion in institutional capital. They support founders, general partners, and institutions throughout the private tech ecosystem, investing directly into companies and venture capital partnerships through various strategies.

Among the company’s projects, you’ll find:

Our wrap-up: If you are seeking a real estate venture capital firm with a diverse portfolio and a wealth of experience, Industry Ventures proves to be a compelling choice in the dynamic landscape of technology investment.

Location: Munich, Bayern, Germany

Founded: 2015

Investment Focus: Proptech, Fintech, Logistics

Website: https://www.picuscap.com/

Picus Capital is an early-stage technology investment firm empowering entrepreneurs to reimagine the way we live and work.

With a long-term investment philosophy, they have made 170+ investments across 20+ countries, leveraging their 9 offices and a dedicated team of 50 members.

Picus Capital collaborates closely with daring technology companies, aiming to be the closest partner in shaping tomorrow by addressing key strategic decisions and operational challenges.

The company’s list of investment projects includes the following:

Our wrap-up: Notable projects in Picus Capital’s portfolio, including top proptech companies such as Casavo, limehome, and Nested, vividly illustrate the firm’s significant presence and influence in the proptech sector. If you are in search of a strategic partner for proptech ventures, Picus Capital stands out as a reputable and visionary VC real estate firm, ready to support your transformative ideas.

Location: Chicago, Illinois, US

Founded: 2009

Investment Focus: Big Data, Digital Media, Fintech

Website: https://www.scv.vc/

Second Century Ventures (SCV) adopts a highly collaborative approach to venture capital, backed by the National Association of REALTORS®. They provide capital investments along with market expertise through strategic partnerships, a diverse team, and access to a global community.

Their growth accelerator, REACH, supports earlier stage companies in real estate and adjacent industries.

The list of the company’s investment projects includes:

Our wrap-up: Second Century Ventures is a perfect match if you’re looking for a real estate venture fund with a global outreach and a profound history of proptech investment.

Location: Los Angeles, California, US

Founded: 2021

Investment Focus: Proptech, Future-of-Work Technologies

Website: https://www.75andsunny.vc/about

75 & Sunny Ventures is dedicated to investing in companies offering bold solutions to everyday problems.

Founded by Spencer Rascoff, the co-founder and sole General Partner, they invested in 39 companies in 2020, with a strong focus on Los Angeles.

In 2021, they are set to invest in over 25 startups and launch two new companies through 75 & Sunny Labs.

The team offers leadership coaching, marketing advice, brand amplification, product strategy, recruiting, and access to a broad network of partners.

Among the company’s projects, you’ll find:

Our wrap-up: With Spencer’s involvement in over 55 venture capital funds, this real estate venture fund is a key player in informal deal-sourcing at the earlier stage. So, if you’re looking for a reliable partner in proptech investment, you should definitely consider 75 & Sunny as a strategic investment partner.

Location: San Francisco, California, US

Founded: 2009

Investment Focus: Multi-Sector Investor

Website: https://freestyle.vc/

Freestyle, as high conviction, low-volume investors, backs 10-12 companies annually, emphasizing close collaboration with founders. They lead Seed rounds with a $1.5M — $3M check, making streamlined and transparent decisions.

Freestyle offers transparent advice, a portfolio platform, community, and an established network of market leaders.

Among the projects in the investor’s portfolio, you’ll find:

Our wrap-up: The combination of a focused investment approach, transparent decision-making, and a robust support system positions Freestyle as an ideal VC real estate investor for proptech ventures looking to thrive and innovate.

We’re not a venture capital firm ourselves, but working with real estate companies for 2 decades taught us the value of top-notch MVPs that capture investor interest fast as well as the value of thorough tech audits if you’re an investor looking for the next big startup opportunity but not having enough tech expertise to assess the code.

Why Ascendix?

How can we help you?

Are you a startup looking for third-party investment? We can build an MVP to effectively communicate the essence of your concept to potential investors. We can test and audit your product or build a new one from scratch if you’ve got a groundbreaking idea and need tech assistance to turn it into reality;

Are you an investor looking for the next real estate disruptor? Ascendians can offer a leg up on the investment ladder with VC consulting that encompasses proptech startup assessments (MVP assessment and tech audits) and creating a roadmap for future scale-ups.

Contact us or book a free call to leverage our expertise and ensure your next investment is worth every cent.

There are 1809 proptech VC funds in 66 countries that have helped 2045 proptech companies raise $12.05B in 2021-2022.

The top proptech investors globally are JLL Star, Fifth Wall, RET Ventures, and Navitas Capital.

The biggest proptech VC firms in Europe are Proptech1 Ventures, PropTech Farm, and AGV Invest.

Tania is a fan of technologies and an expert in writing about them. In her content, she shares insights into new trends and proptech solutions in real estate that can help your business thrive while keeping your customers content (pun intended).

Get our fresh posts and news about Ascendix right to your inbox.