“ Right now, it’s all about figuring out what is smoke and mirrors or vaporware, versus what is an actual product. ”

Given an eye-watering US$4 billion in total proptech investment raised by proptech ai startups in 2022, which is double the 2021 venture capital, we can say for sure: yes, proptech VCs are very much positive about the new unfolding trend. Notably, out of all proptech VC deals as of today, 70% are AI startups, reports JLL.

However, investors are getting pickier in their investing decisions amidst the broader proptech VC environment, which has slowed down, and the dangerously alluring “gold rush” mentality around AI. Here are the key takeaways on how the proptech VC activity unfolds around generative ai proptech:

- Proptech VC investment in AI startups is going to grow at least several more years going forward, but not in the quantity but quality of startups.

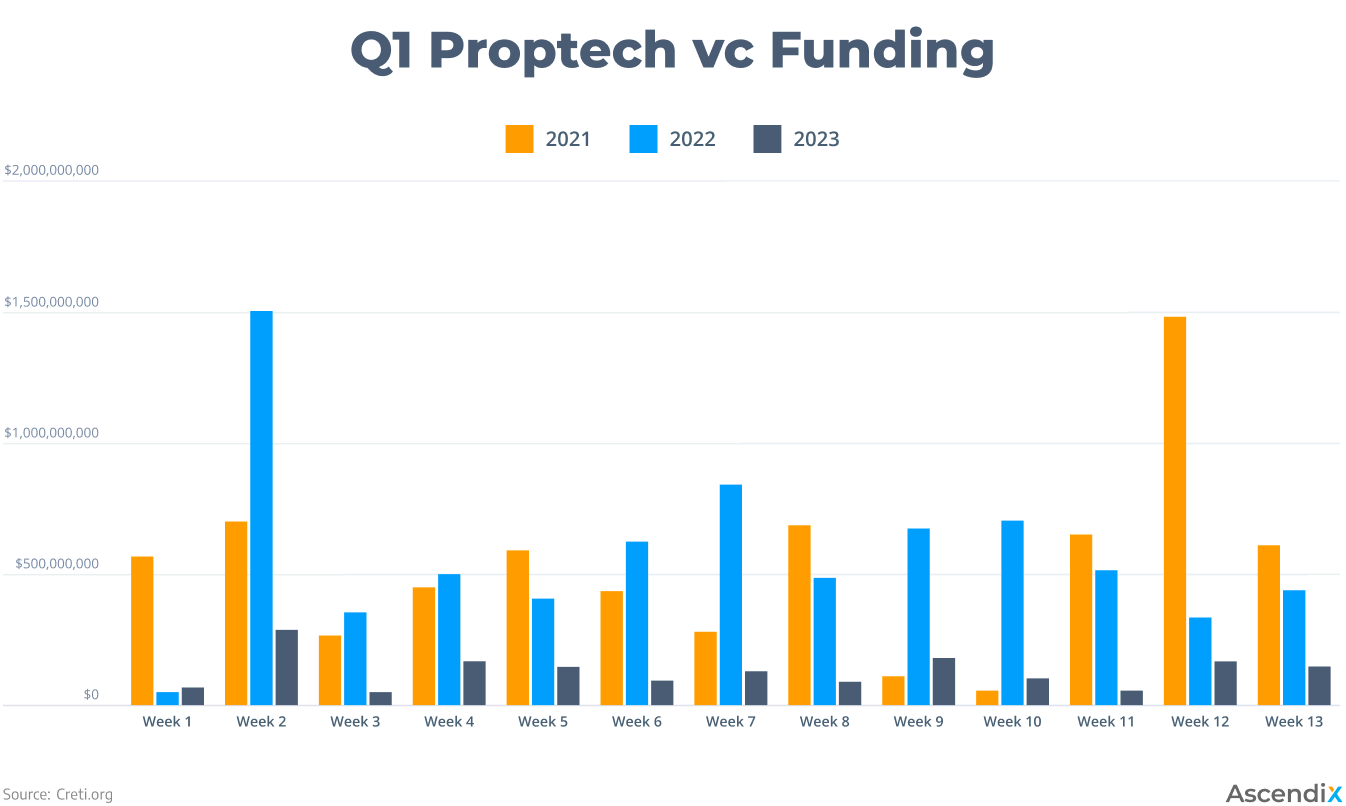

- General VC funding is sinking, Q1 2023 proptech investment activity slowed, with $1.69 billion invested compared to $7.44 billion and $6.97 billion in Q1 2022 and Q1 2021, respectively, amid market uncertainties.

- Pioneering generative ai proptech startups backed by VC are likely to endanger existing proptech companies with no AI component.

- JLL Spark, Metaprop, Navitas Capital, and other Proptech VC funds all took steps to invest in AI-powered proptech, EliseAI and Infogrid being notable examples.

Proptech AI Flourishes Amidst Sinking Proptech VC Deals

AI in proptech has a promising future. JLL’s research reveals that global funding for AI-powered proptech surged to $4 billion in 2022, almost doubling 2021’s figure. In fact, proptech AI startups account for 70% of all proptech VC activity. These firms span the developmental spectrum, with around 20% in early stages, 25% in early-stage VC rounds, and 15% in late-stage VC rounds (source).

70% of All Proptech VC Activity is Devoted to Proptech AI

Prominent examples of proptech VCs fueling AI in real estate include:

- JLL Spark and their latest investment in EliseAI, enhancing facility management through AI and IoT, as part of their Series C on June 6, 2023.

- MetaProp and one of their latest ventures in OnSiteIQ from Feb 2, 2023 – an AI-powered construction intelligence platform for real estate developers, equity partners, and lenders. Along with JLL Spark, they invested in EliseAI, too.

- Navitas Capital and their recent investments in Openspace – an AI-powered reality capture and analytics tool for builders (Mar 2, 2022), Oda – a generative AI tool for property photo editing (Dec 7, 2021), and before-mentioned EliseAI.

- Fortified Ventures who are one of the lead investors for Plunk – AI-driven analytics and real-time insights platform for residential real estate.

Check more VCs focusing on proptech in our List of Top Proptech VCs.

In the Meantime, Proptech VC Deals Experience a Slump

While these real estate AI advancements paint an optimistic future, a contrasting narrative emerges when observing the wider proptech investment landscape. Q1 2023 witnessed a significant downturn in investment activity compared to the preceding year. First-quarter investments in the sector amounted to $1.69 billion, a sharp decline from the $7.44 billion and $6.97 billion recorded in Q1 2022 and Q1 2021, respectively (source).

Proptech VC Funding | Q1 2023

Broader VC Landscape and Influencing Factors

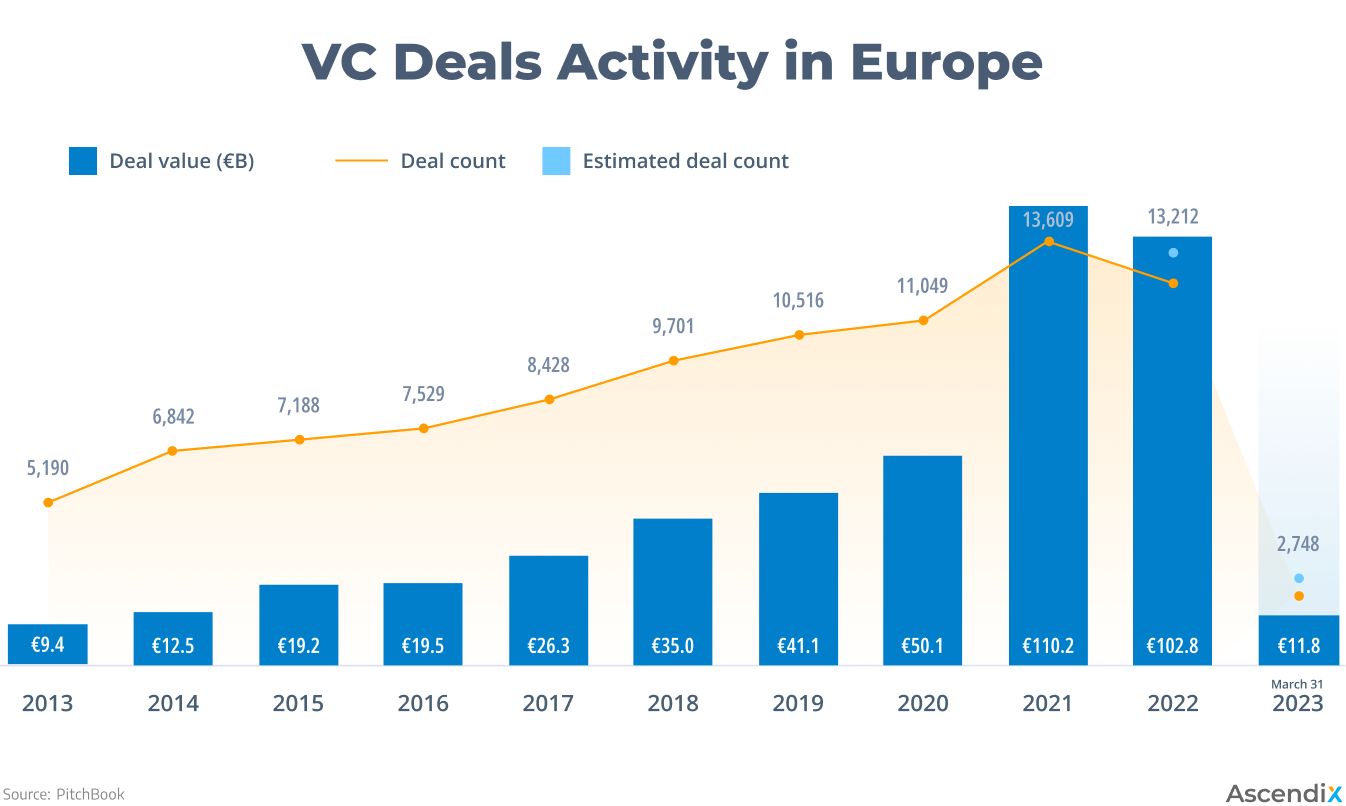

The slump in proptech investment aligns with a broader trend in VC dealmaking. In Europe, for instance, Q1 2023 saw a downturn of around 32.1% in deal value and 19.2% in deal count compared to the previous quarter (source).

VC Deals Activity in Europe Over the Years

Pitchbook highlights several factors contributing to this global VC dealmaking downturn, including:

- The collapse of US banks that played an important role in startup funding (SVB, Signature Bank, Silvergate) and Credit Suisse’s acquisition.

- Rising inflation, particularly in the UK, which is home to more than 800 proptechs (2nd place after the US)

- Energy sector resurgence attracted investments, especially in clean energy, driven by climate goals and eco-friendly advancements.

Implications for Proptech AI Investment

The decline in dollar volume in the overall VC and proptech VC does affect the number & scale of deals for proptech AI – we are witnessing fewer proptech AI investments than we would have in 2022 or 2021, for example, considering that the proptech VC deal volume was 3-4 times bigger. However, it is worth mentioning again that 70% of all existing proptech VC deals are around real estate AI startups, which cannot but bring us onto positive thoughts. Let’s see if proptech VC investors themselves share the same perspective.

Quality Over Quantity: What Proptech VCs Say About AI

The general mood among proptech VCs is that there isn’t yet an explosion in AI-related funding, but that it’s becoming a hot commodity. A hot commodity that has already gained US$4 billion in total proptech investment, as mentioned earlier, and that is likely to double the investment in the second half of 2023, according to Dan Wenhold, a partner at real estate-focused venture capital firm Fifth Wall (source).

At the same time, proptech investors are being careful, similar to how they approached trends like blockchain and tokenization startups in the past.

“We are not getting overly excited about AI, much in the same way that we didn’t get overly excited about blockchain and tokenization startups,” said Jeffrey Berman, a principal at real estate VC firm Camber Creek. “The rush to throw money at any startup that says ‘we’re using generative AI technology’, we arch an eyebrow.”

Dustin Gray, CEO and co-founder of Milestones.AI – an Austin-based startup building a home management system – isn’t very enthusiastic about the current state of proptech AI either.

“It’s going to take us 10 years to get to the place where we’re really smart” – he says, ruling at the need for further advancements to artificial intelligence before it starts to bring really significant value to proptech. Just a note, his proptech startup, Milestones.AI, has amassed 200,000 users and raised $15.4 million in venture capital.

Dan Teran, the Managing Partner at New York-based venture firm Gutter Capital, shares the same perspective on the hyped trend, saying that AI in the current state of development is prone to mistakes.

“Without the right dataset, novel AI chatbots can often deliver incorrect answers that can damage the reputation of startups”.

He also mentioned a very good point: “Adding AI to a startup pitch is like adding 50 percent to the price tag.” Indeed, we are seeing a kind of gold rush mentality around AI in proptech and other areas. It does seem that every other company and startup is implementing or considering adding an AI component to their offering. Remember the statistics we already mentioned before – 7 of every 10 proptech startups are AI focused.

This means that proptech VC investors have to get wiser in their choices.

“Right now, it’s all about figuring out what is smoke and mirrors or vaporware, versus what is an actual product.” – rightfully said Fifth Wall’s Wenhold. But for the broader proptech market, it isn’t bad at all. With cautious proptech VC not throwing their money at every proptech startup claiming they are disruptive AI, the funding will flow to innovative and disruptive products really worth global attention. This cautious approach might lead to fewer deals, but the ones that do happen could have a bigger impact on the industry.

Leading Real Estate Market Incumbents Join the AI Competition

Among the top real estate firms already investing in AI are Zillow, JLL, Redfin, Zumper, and Opendoor. While there are many more players in this transformative landscape, for brevity’s sake, we’ll focus on a select few.

Zillow, a trailblazer in the real estate sector, is calmly embracing AI’s potential impact on its operations. One of its hallmark features, Zestimate, has been utilizing machine learning since its inception. Furthermore, Zillow introduced an AI-powered search feature in January, with plans to enhance property listings through intuitive natural language interactions and immersive, lifelike 3D tours.

Matt Kreamer, Zillow’s spokesperson, emphasized their strategic advantage, stating, “We’ve had a head start for quite a while and some of our coolest AI stuff has been launched in the last couple of years.”

JLL proudly introduced JLL GPT™, a pioneering large language model tailored specifically for the commercial real estate (CRE) industry. This innovative tool is designed to empower JLL’s global workforce, leveraging the firm’s extensive CRE data along with external sources. By harnessing AI, JLL aims to streamline workflows, delivering intelligent insights that drive revenue generation and cost-saving measures for clients, all within a secure and compliant framework.

Redfin, on the other hand, has rolled out a practical solution to aid prospective homebuyers. The Redfin ChatGPT plugin allows users to describe their dream home and neighborhood in everyday language, instantly generating tailored property listings. For instance, users can inquire about three-bedroom homes with private outdoor spaces near trendy restaurants, receiving a curated list of suitable options. Zumper, a leading marketplace, has similarly integrated ChatGPT to enhance user experience.

However, not all AI initiatives of the leading real estate firms prove successful. Opendoor ventured into the AI realm by highlighting its superior home-valuation algorithm. Unfortunately, this move encountered challenges during a housing downturn, leading to significant losses – nearly $1 billion in the third quarter of 2022.

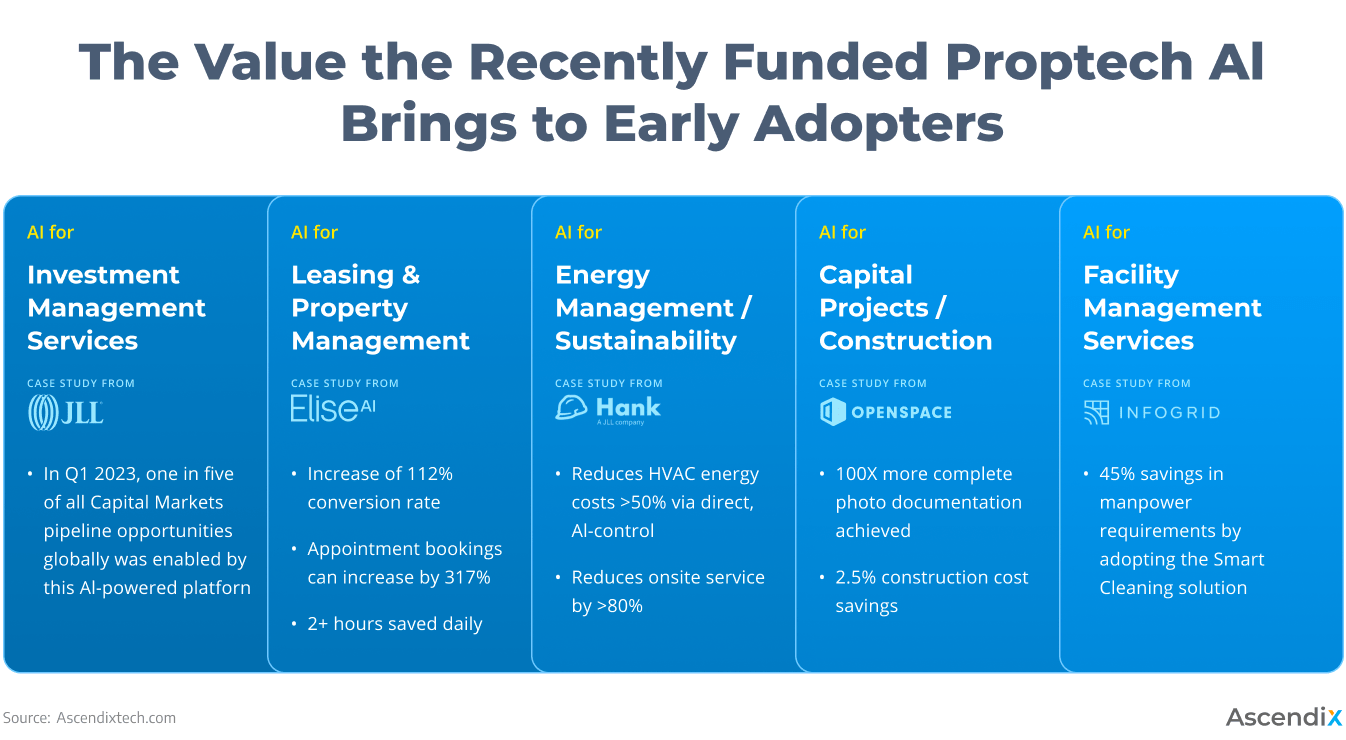

Early adopters of Proptech AI solutions are already seeing returns

Returning to the proptech AI startups that have recently secured funding, their impact is becoming increasingly evident as adopters start to see tangible returns. JLL, in particular, has released a timely report highlighting the value these solutions bring to their early adopters.

A notable example comes from Royal London Asset Management, a prominent UK investment firm, which witnessed remarkable enhancements in HVAC operations and energy efficiency within an 11,600 square-meter commercial office building. By integrating JLL’s AI-powered Hank technologies, the firm achieved an impressive ROI of 708% and substantial energy savings of 59%, concurrently reducing carbon emissions by up to 500 metric tons per year (source).

The Value the Recently Funded Proptech Al Brings to Early Adopters

The triumphs witnessed among the early adopters of proptech AI solutions not only exemplify the transformative power of artificial intelligence within the real estate sector but also serve as compelling beacons guiding the course of proptech VC investment. We are at the forefront of the next phase of the industry’s evolution.

Why Ascendix for Proptech VCs and Startups?

In the dynamic realm of proptech, Ascendix emerges as the ultimate partner for startups seeking investment and guidance in MVP creation or product enhancement, as well as proptech VC funds needing technical assessment for their portfolio startups.

Why Ascendix as your partner?

- Local Real Estate Mastery: Based in Dallas, Texas, our in-depth grasp of the local market enables us to deftly navigate its complexities.

- Proven Industry Prowess: We’ve achieved groundbreaking success, crafting proptech solutions for industry leaders like JLL and Colliers. This solidifies our reputation as a trusted, capable partner.

- Decades of Tech Leadership: Since 1996, we’ve pioneered business tech innovation, continuously adapting to evolving technology landscapes for cutting-edge solutions.

- Global Reach: With offshore offices in Europe, we offer competitive rates while maintaining top-notch service quality. This ensures 24/7 project delivery and support.

Elevate your proptech venture with Ascendix. Contact us now to leverage intelligent proptech solutions for enduring, significant gains.

Need an Outsourcing Partner?

We’re at your service with 20-year expertise. Just fill in the form and we’ll send an estimate.

Are investors positive about the integration of Generative AI in Proptech?

Absolutely. Proptech VCs are displaying a strong positive outlook on Generative AI in Proptech. With a remarkable US$4 billion raised by proptech AI startups in 2022 – twice the venture capital of 2021 – the trend is clear. In fact, AI-focused startups account for 70% of all proptech VC deals, as reported by JLL.

Which proptech VC funds are investing in Generative AI-powered startups?

Leading proptech VC funds, including JLL Spark, MetaProp, and Navitas Capital, have made significant investments in AI-powered proptech startups. Examples include EliseAI and Infogrid. These investments underline the increasing interest and recognition of the potential that AI brings to the real estate industry.

Share:

Alina is a proptech technology expert and a storyteller at Ascendix, investigating the real estate market and sharing her insights and tips with up-and-coming proptech startups, established real estate agencies, and industry stakeholders. She talks about real estate technology, business automation, and industry news.

Subscribe to Ascendix Newsletter

Get our fresh posts and news about Ascendix right to your inbox.

(58 votes, average: 4.90 out of 5)

(58 votes, average: 4.90 out of 5)