Want to Build Custom Proptech Software?

We are tech experts with 16+ years of experience in the real estate industry. We can execute your vision and give expert advice on your project.

WeWork, once a leading provider of coworking and flexible office workspaces, filed for Chapter 11 bankruptcy on Monday, 6th of November, in the federal court of New Jersey. The company reported debt of $18.65 billion, while having $15.06 billion of assets at that time (Source).

The bankruptcy is filed only for US and Canada, though, it is unlikely that the company will continue its operations further, as the failure has already had negative consequences for all office SpaaS industry, casting shadow even on such giant WeWork alternatives like IWG (Regus) and Knottel.

Founded in 2010, WeWork is known for its innovative and flexible solutions of short-term office leases. Functioning as a Space as a Service business model, the company provided shared office spaces, meeting rooms, and collaborative environments on a subscription basis to individuals and companies. Focusing on sense of community, the company also offered amenities like networking events, shared resources, and a collaborative work environment.

WeWork’s business model was leasing long-term spaces, conducting renovations, and subleasing on a short-term basis, which was thriving in a decade of low-interest rates. By 2014, the company achieved a valuation surpassing $1 billion, earning the “unicorn” status. In 2019 WeWork had its peak valuation of $47 billion (Source).

However, the strategy, so innovative at the beginning, started to fail since the COVID-19 outbreak and a plummeting demand for office spaces and co-workings.

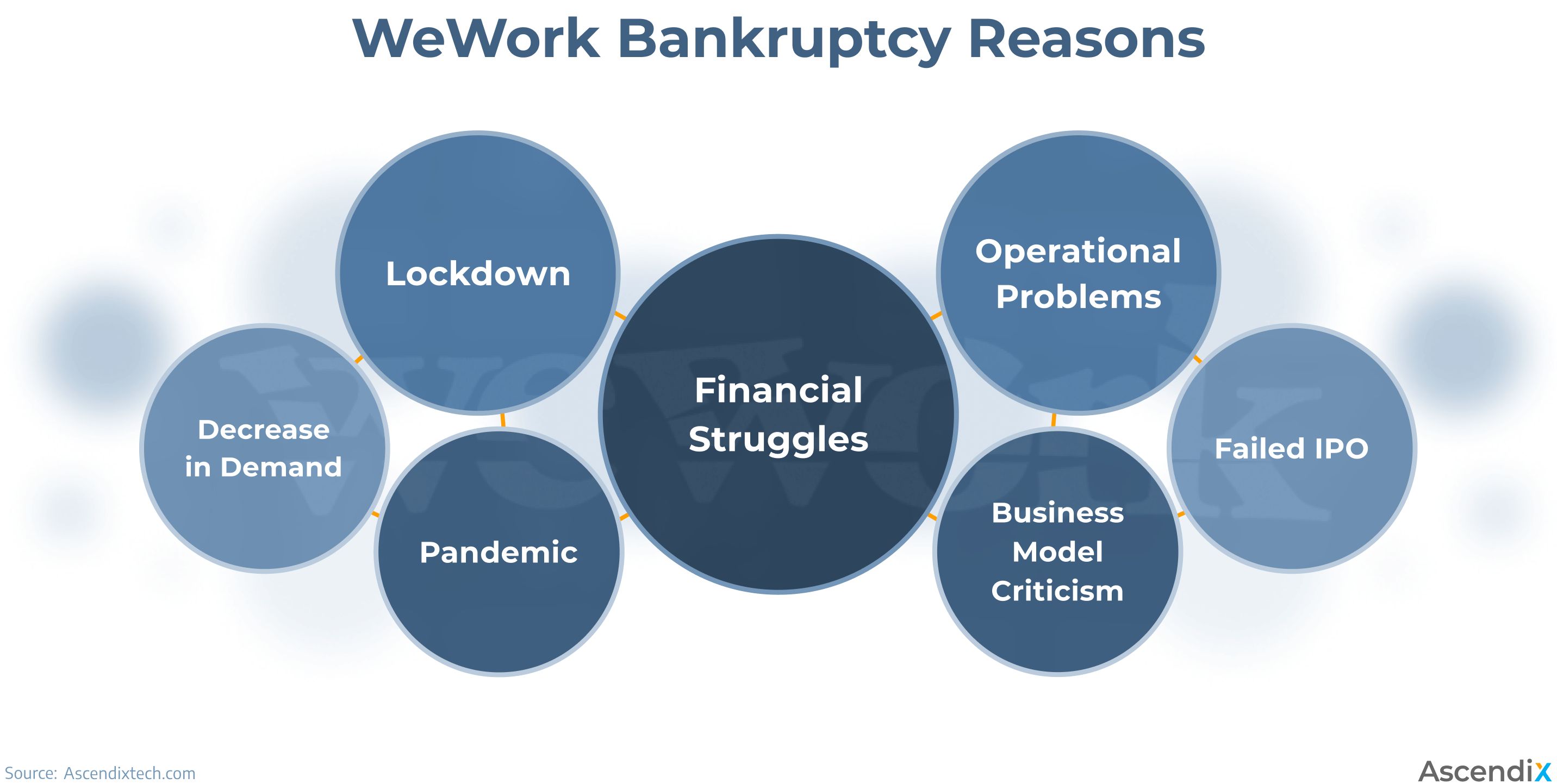

Among various factors which slowly but surely led the company into the abyss of bankruptcy the most significant ones were

Major signs of impending bankruptcy appeared in August 2023, when the company released a statement, it had ‘substantial doubt’ it would be able to stay in business and continue its operations (Source).

In the beginning of November, a huge discussion on WeWork bankruptcy and the possible results of it were started in multiple real estate sources. The main suggestions were WeWork bankruptcy filing for Chapter 7 (liquidation of the company) or Chapter 11 (postponing the debt payment and restructuring the company). Eventually WeWork chose the second option, which meant the chance to continue operations after conducting major changes.

WeWork had to compromise its relations with creditors who expect the debts to be paid. Therefore, the company made the Restructuring Support Agreement (RSA) with its credit holders who represent about 92% of its secured notes. The forthcoming changes which were agreed upon with the creditors involve significant cuts to the WeWork portfolio of office spaces. The company management seems optimistic about the company’s future, and in the statement made on 6th of November claims the global offices of the company will not be affected.

WeWork bankruptcy in the USA and Canada is claimed to not affect the company’s global operations and franchisees worldwide, as they not involved in these legal processes.

The WeWork business model presupposed leasing offices worldwide for long-term and leasing them out for short-term, usually after renovation and refurbishment. The company offered a plethora of office spaces and co-workings in more than 700 locations in 39 countries around the world.

As Covid-19 pandemics affected the landlords, WeWork suffered the massive shift towards remote work and the decline in the demand for office spaces (Source).

WeWork and New York City

Once, the company held the position of the largest leaseholder in New York City, meaning that WeWork’s bankruptcy would be very painful for many landlords.

WeWork occupied approximately 6.4 million square feet spread across 70 offices in Manhattan, with Boston Properties, Rudin Management, RXR Realty, and Tishman Speyer being the biggest company landlords. Now there is substantial doubt whether the company would be able to pay back the rent (Source).

As WeWork filed for Chapter 11 bankruptcy, meaning the company would try to restructure and continue functioning with the chance to postpone the payments on back rent and debt, the landlords are likely to get the payback when company rises again.

Moreover, even if the creditors pushed the company into liquidation, it would not cover the debt, as the WeWork liabilities currently significantly exceed the existing assets. Therefore, the situation is highly unappealing to New York and worldwide WeWork landlords, leaving them in an undefined situation about their finances.

WeWork Bankruptcy Consequences for Global Real Estate

WeWork’s financial challenges created a ripple effect within the whole co-working industry, causing significant concerns among investors and customers. The WeWork bankruptcy filing and negative publicity led to increased skepticism of co-working providers in general. WeWork competitors like IWG (Regus) and Knotel were especially impacted, with IWG facing a decline in its share price due to its alleged association with WeWork’s difficulties.

Despite the strong financial performance of IWG, the whole industry now struggles to demonstrate the sustainability of the co-working model amid ongoing uncertainties about WeWork’s future. Tenants are actively seeking WeWork alternatives, while WeWork competitors are suffering increased market volatility and coworkings’ shares plunge.

However, despite WeWork bankruptcy, the number of WeWork alternatives – companies which have provided office spaces for decades – still continue to thrive. It is very likely that WeWork’s reliance on debt was the major setback in its operations, worsened by the pandemic. Now, as the world goes back to normal, companies like WeWork may try to carve the niche for themselves in the modern office space market.

The rise of WeWork alternatives may happen soon, mostly fueled by the company’s leaving the market temporarily. So, we decided to overview the major players in this industry in our list of WeWork competitors, their core offerings, locations, and pricing.

We are tech experts with 16+ years of experience in the real estate industry. We can execute your vision and give expert advice on your project.

Having roots in traditional real estate, The Office Group stands as one of Europe’s longest-standing providers of office spaces. Operating in the UK and Germany, this WeWork alternative has workspaces with a slightly more corporate atmosphere.

TOG primary offering remains serviced offices, complemented by the recent introduction of Membership option, which made the company similar to other WeWork competitors.

These memberships include options for a dedicated desk or hot desking across their workspace network, as well as access to co-workings, and a variety of services such as high-tech office equipment, support, and access to communal areas.

Knotel specializes in providing headquarters for big enterprises, as well as on-demand meeting and conference room spaces. The unique feature of this WeWork alternative is that it is a B2B business focusing on big companies. Knotel also allows clients to reserve rooms on short notice and provides on-site support and management for its tenants.

Acting as an intermediary, Knotel leases spaces from office landlords and then transforms them with renovation, furnishings, specialized wiring, and customized interior design. Additionally, this WeWork competitor provides on-site managers for companies that require such a service.

We’ve got 2 decades of expertise in proptech development. Trust your project to AscendixTech professionals.

Convene provides premium meeting and event spaces, coupled with workplace solutions. The company stands out among other WeWork alternatives due to its focus on high-end hospitality-driven services, elevating the co-working and office experience.

Unlike similar WeWork competitors, Convene offers full catering at the events and a wide range of extra services, from on-site management to full culinary catering, treating office experience like a hotel, where guests’ experience is the highest priority.

This concentration on hospitality and curated experiences makes Convene a unique WeWork alternative. Best suited for professionals looking for upscale workspaces and event venues, Convene combines productivity with a touch of luxury.

Industrious specializes in flexible workplace solutions, offering a variety of dedicated and shared office spaces. What sets Industrious apart from WeWork alternatives is its worldwide presence and a wide range of options for individuals, small and medium teams, and big enterprises, which makes the company one of major WeWork competitors.

Along with offices, meeting spaces, and conference rooms Industrious also provides shared amenities and services as needed. If you are seeking for WeWork vs Industrios comparison, the latter one stands out as an attractive option for professionals seeking a balance between flexibility and a more refined work environment.

The core offering of International Workplace Group (IWG), commonly known as Regus, is flexible office spaces, meeting rooms, and virtual office solutions globally. With its extensive global presence and diverse range of office formats, Regus may be the biggest company among WeWork competitors on the worldwide scale.

While there are many Regus competitors, none of them has such global coverage yet, which makes IWG the best WeWork alternative for big multinational enterprises. Best suited for businesses requiring an extensive global network, Regus provides an option that combines flexibility with a widespread international footprint.

Originating as a conventional office provider, Spaces has recently incorporated flexible coworking alternatives into its services. However, this option is constrained to Spaces-owned workspaces and is available primarily in larger cities worldwide.

Additionally, Spaces organizes regular events, predominantly sports-related, in its workspaces, which makes it a unique WeWork alternative. Spaces appeals to individuals seeking creative workspaces that foster a sense of community and collaboration.

Check out the overview of the proptech consulting and software development projects we delivered to our clients.

LiquidSpace specializes in on-demand flexible office solutions, similarly to many companies like WeWork. Workspaces are available via a single platform, where the network offers users a variety of suitable options.

LiquidSpace works as an intermediary, simplifying the communication of landlord and business owner, facilitating the processes in commercial real estate.

The company follows the AirBnB for businesses model, matching the office owners with potential tenants and providing flexibility for both parties. Such a WeWork alternative is an excellent option for those who prioritize choice and flexibility in their workspace.

HubbleHQ, one of major Knotel and WeWork competitors, used to provide traditional office spaces. However, after pandemic the company shifted toward coworking concept significantly. While HubbleHQ still offers office rent on a monthly basis, the main offering is now flexible shared workspaces for hourly or daily rental.

Just like other Regus competitors, HubbleHQ boasts a wide global presence, albeit concentrated in larger cities worldwide. Access to Hubble workspaces is facilitated through the Hubble Pass, and the pricing depends on the needs of every person.

Impact Hub focuses on providing co-working spaces that foster social impact and community engagement. The company is committed to supporting socially responsible and mission-driven businesses. Similar to companies like WeWork, Impact Hub offers flexible office spaces and networking opportunities.

The company helps professionals seeking WeWork alternatives to get a co-working environment aligned with social and environmental values, making it a competitor in the socially conscious co-working sector.

Upflex provides a global network of flexible workspaces, allowing users to access various offices on a pay-as-you-go basis. Upflex works for businesses of all sizes, offering access to a worldwide network of workspaces, making it a decent WeWork competitor.

The company also provides the all-in-one platform for flexible and convenient spaces booking, helping remote and hybrid employees easily manage their time with this WeWork alternative.

Amids WeWork bankruptcy, multiple WeWork alternatives come to light, offering similar services and products: flexible office spaces, meeting and conference rooms, amenities like high-speed internet connection and catering, virtual offices, and others. Though WeWork competitors will struggle for a while because of this industry giant going bankrupt with suspicion and doubts following it, finally the companies will continue to make profit and the popularity will increase.

Definitely not. WeWork’s bankruptcy doesn’t mean doom for the coworking industry as a whole. Despite WeWork’s challenges, other long-standing and stable coworking providers like Regus, Spaces, Hubble HQ, and Industrious continue to thrive. The demand for flexible workspaces remains strong, driven by factors such as cost-effectiveness and scalability. The industry is diverse, and the ability of operators to adapt to changing circumstances will shape its future, most probably after experiencing some transformations.

WeWork’s main competitors are Regus (IWG), Upflex, Liquidspace, Spaces, Industrious, Convene, Knotel, The Office Group, and Hubble HQ, each offering unique approaches to shared office solutions in the flexible workspace landscape.

Yana is a proptech enthusiast and a technology fan. In her articles, she explores the world of real estate software, including proptech news, useful resources, and real estate technology insights, assisting everyone involved in the industry to modernize and optimize their business.

Get our fresh posts and news about Ascendix Tech right to your inbox.