Build Custom Real Estate Software with AscendixTech

Hire AscendixTech and we’ll execute your vision and create a thriving real estate software product or bootstrap your existing solution.

AI property valuation refers to the application of artificial intelligence, such as machine learning and automated valuation models (AVMs), to determine the property value. AI analyzes vast sets of data including features of the property, like its location, condition, and number of rooms, and estimates property’s worth.

Property valuation AI capabilities include predicting property price for sale, lease, or evaluating the house price for rent and other investment. In our article, we delve into the details of machine learning algorithms used for developing AI appraisal app from scratch, as well as present a complete and comprehensive guide on how to create and train the machine learning model for your own AI valuation tool.

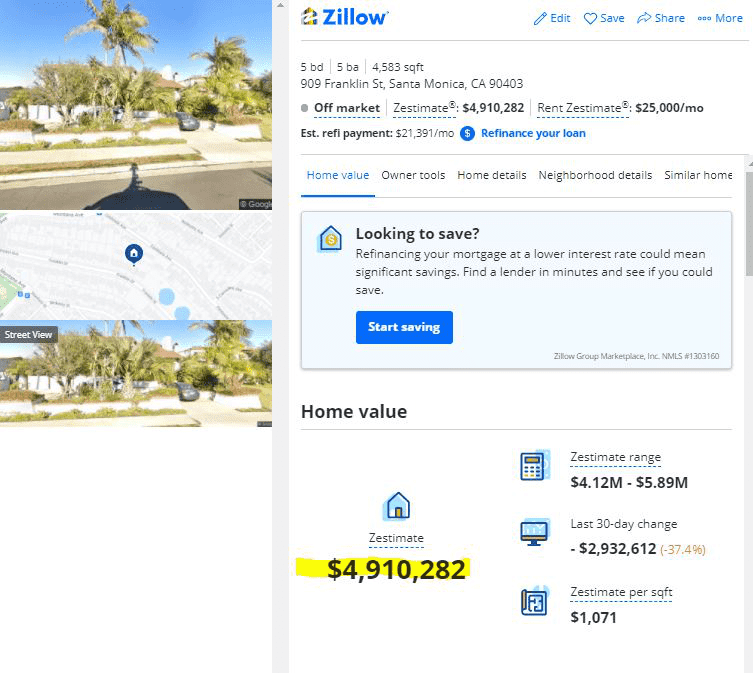

Zestimate, Zillow’s AI Real Estate Valuation Software | Source: Zillow

Talking about AI in real estate valuation, consider the likes of Zillow’s Zestimate or Airbnb’s property valuation tool. Both are property marketplaces and both aim to inform landlords about potential sale or rental values while providing the same insights to buyers or tenants. Here’s the usual workflow of such an AI valuation tool:

The process of AI real estate valuation seems quite simple and straightforward, but behind it, a great deal of work has been conducted to train the AI model with machine learning for real estate and teach it to provide accurate and relevant results. The algorithm can be applied for both rent and property valuation sales assessment, which makes AI a suitable and optimal choice for both marketplace owners and real estate agents and brokers. The dataset and features used for training would still be different, though.

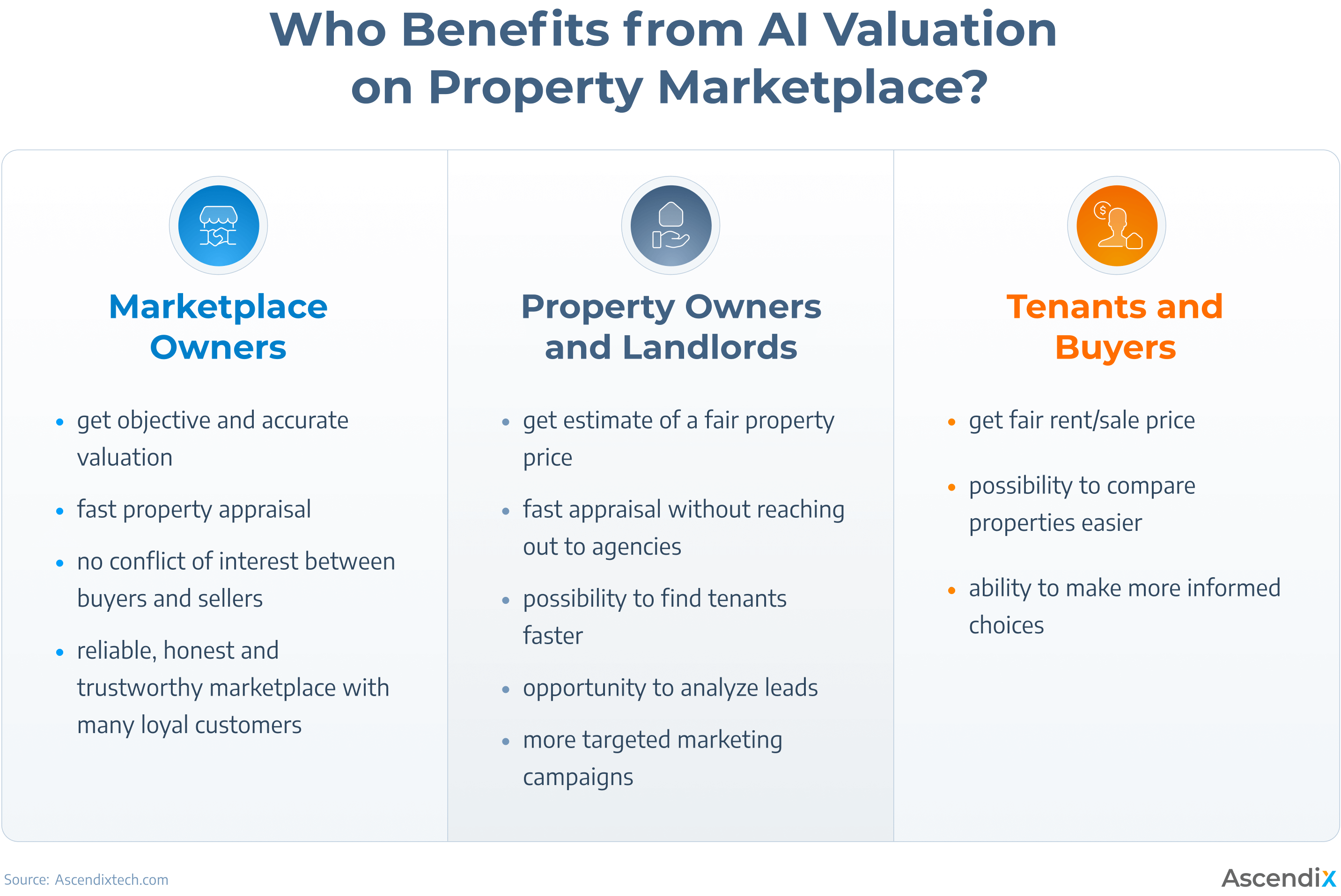

AI property valuation offers multiple benefits for all parties involved in property leasing, buying, selling, or renting.

Advantages of Real Estate Valuation Software

Developing and integrating a custom AI property valuation model into your marketplace may seem quite a difficult task. However, there are multiple benefits to doing it with machine learning real estate technology rather than buying a ready-made tool or integrating an already existing model into the marketplace.

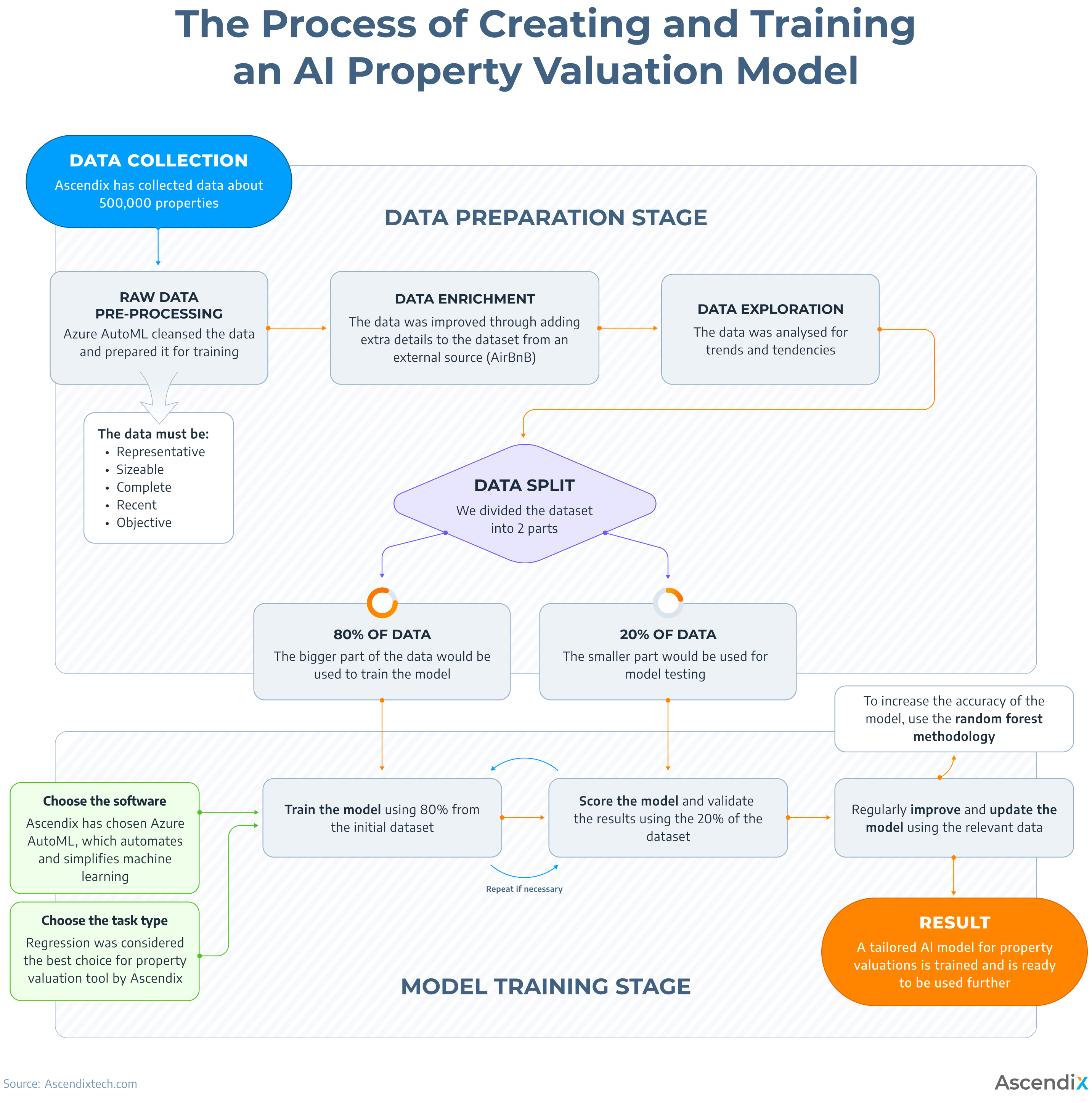

The process of machine learning real estate valuation software development can be divided into two major stages: the data preparation stage and the model training stage. During the first stage, the real estate valuation data set is collected, prepared, analyzed, enriched, and processed for the training. During the second stage, the training itself happens, and the model is then thoroughly tested to ensure that the results match the expectations and that the tasks are completed properly. The whole process of AI real estate valuation is depicted in detail below.

The Process of Creating and Training an AI Property Valuation Model

The journey begins with gathering raw real estate data. The raw real estate valuation data set may include information about property location, condition, age, and any other important features. The more data – the better, as the results of the training would be more accurate.

Ascendix used 500,000 properties to train the model, but everything depends on the business needs the real estate appraisal technology is meant to solve and the size of the available dataset. Before the data is fed to the model and training is started, the raw data must be processed and prepared for training. Therefore, data cleansing is performed at this stage, and the properties with many missing values are deleted. It can be performed automatically by the ML automation platform. For instance, Azure AI automatically does this for you after uploading the data.

For the machine learning real estate valuation model to work correctly, the training dataset must be representative, sizable, complete, recent, and free from biases to ensure model accuracy and generalizability.

Representative: the data must be representative of the actual real-world scenario where the model will be applied, i.e. for real estate valuation app would require information about certain property features and prices, and not the historical records of stock market changes.

Sizeable: the data must have enough volume for the model to learn from it and be able to generalize and make conclusions.

Complete: the data must be cleansed from missing values and empty features, as missing data can lead to biased or incorrect results because the model might make incorrect assumptions about the missing values.

Recent: the data must be as new and relevant as possible to ensure that the results of the valuation are correct and up-to-date.

Objective: the model must be unbiased and free from prejudice to exclude the risk of human factors interfering with the results.

Data enrichment refers to the process of improving the data quality in machine learning real estate processes aimed at enhancing the performance of models trained with this data. Data enrichment helps balance available data, adding extra features to improve the quality of the model’s training process and results. By introducing variations in the data, enrichment can help prevent models from overfitting to the training set. This way, the results become more relevant and accurate.

In the case of AI real estate valuation software, data enrichment can include adding demographic data, economic indicators, or urban development plans, providing a more holistic view of the valuation model. Moreover, if the company does not have enough available data for conducting AI appraisals model training, the dataset can be enriched with the help of another platform’s database, for instance, Airbnb or Zillow.

This phase involves analyzing the data to identify trends, patterns, and anomalies using statistical methods and visualizations. Understanding the relationships between various factors influencing property values is crucial for forming hypotheses and guiding model development.

Data analysis could include identifying the range and distribution of values, understanding the type of data, and checking for gaps and inconsistencies, which could have occurred due to errors in data collection, or they could represent rare but important events.

Data exploration and analysis help to understand how different factors are related to each other. For instance, in machine learning real estate software training, we might want to understand how factors like location, size, age, and condition of the property influence its value. Understanding these relationships is crucial for training the model and improving the overall accuracy of predictions later.

To ensure that the model is trained and validated properly, it is important to split the real estate valuation data set into separate parts for training and testing. The typical ratio of the split is 80/20, but this can vary depending on the circumstances and purpose. The main principle is to have a large enough training set to allow the model to learn effectively, while also having a substantial test set to validate the model’s performance by using unseen data. This way, machine learning real estate technology is accurate and can provide the best valuation results.

The training set, which comprises 80% of the data in our case, is used to train the model. Using it, the artificial intelligence real estate appraisal technology learns to make predictions by adjusting its parameters based on the input features and the target variable in the training set.

The test set – the remaining 20% of the data – is used to evaluate the model’s performance. This set is not used during the AI real estate valuation model training phase and due to this, it provides a measure of how well the model can generalize new unseen data.

Data splitting is an essential step in machine learning, as it helps to conclude whether the results are valid or not by comparing the results model shows after the training to the actual data.

Hire AscendixTech and we’ll execute your vision and create a thriving real estate software product or bootstrap your existing solution.

As the data is collected, cleansed, enriched, and prepared, it’s time to start developing the machine learning model itself. To do so, it is necessary to choose the software which would handle the task. As the technologies used for machine learning real estate valuation become more widespread, the choice range extends, as there are multiple tools and platforms where the model training can be performed. Some examples are:

Except for finding the software most suitable for your needs, it is important to understand what type of machine learning tasks you are going to perform. There is a wide variety of them, so in order to stay concise, let’s discuss the ones available in Azure AutoML, which was used by Ascendix to create our AI real estate valuation software.

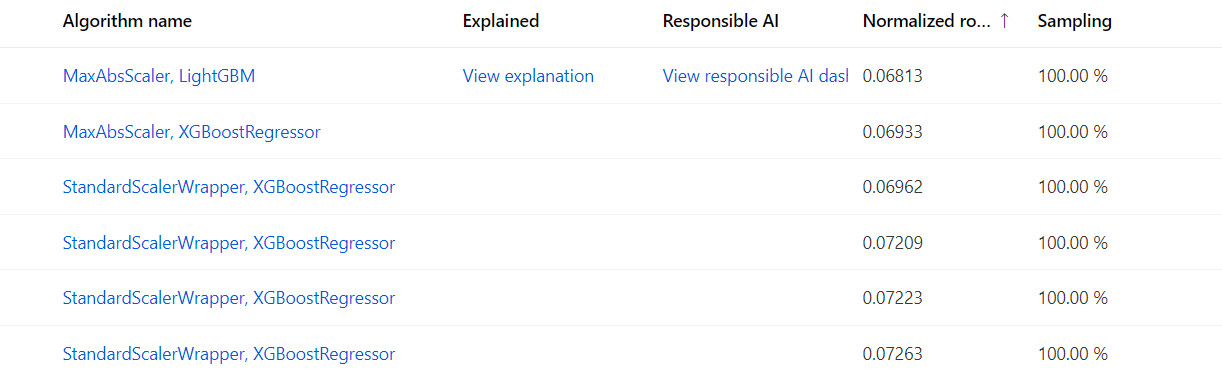

As everything is prepared, the chosen real estate valuation data set is inserted into the machine learning platform, relevant machine-learning tasks are chosen, and the training begins. The process is performed with AI trainers which teach the linear regression untrained model to recognize and analyze the interdependencies between data. During training, Azure Machine Learning creates a number of pipelines in parallel that try different algorithms and parameters.

After the algorithms were tried and the trainers finished the job, the model must be scored and validated. The trained model is used to make predictions on a new set of data, which was unseen by the model. In our case, it is the 20% test dataset, which was preserved after the initial data split. Using the metrics for scoring the models like MAE, RMSE, and R², the model training results are compared to the actual and real-life data, which ensures accuracy and reliability.

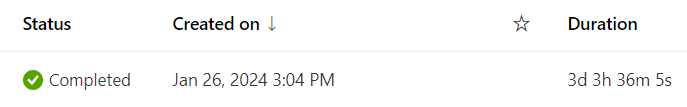

It is not uncommon, though, for the trained model to provide irrelevant results, or the training experiment to fail. In our case, a trainer failed 45% of jobs, which means the training process requires either more time or a more powerful environment to finish the job.

AI Valuation Software Model Trainers in Azure AutoML

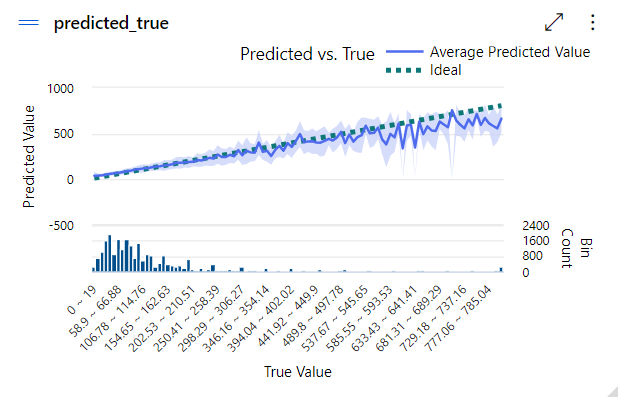

When the experiment is successful, the results shown by the trained model (average predicted value) will be as close as possible to the Ideal value. In the case of the artificial intelligence real estate appraisal app by Ascendix, the results of the most successful experiment looked like the following diagram:

The AI Valuation Model Results Compared to the Ideal Performance

To keep a model up-to-date, it’s important to regularly update it with new market data and make adjustments and improvements with the help of A/B testing. If the model isn’t working well, changes are made. This could involve choosing a different trainer, using different features, or even selecting a different model or dataset. After the required updates and changes are made and the model is working better, it’s then ready to be used with a new dataset. This process helps the model stay useful and adjust to changes in the market and data trends, which is required for high-quality machine learning real estate valuation.

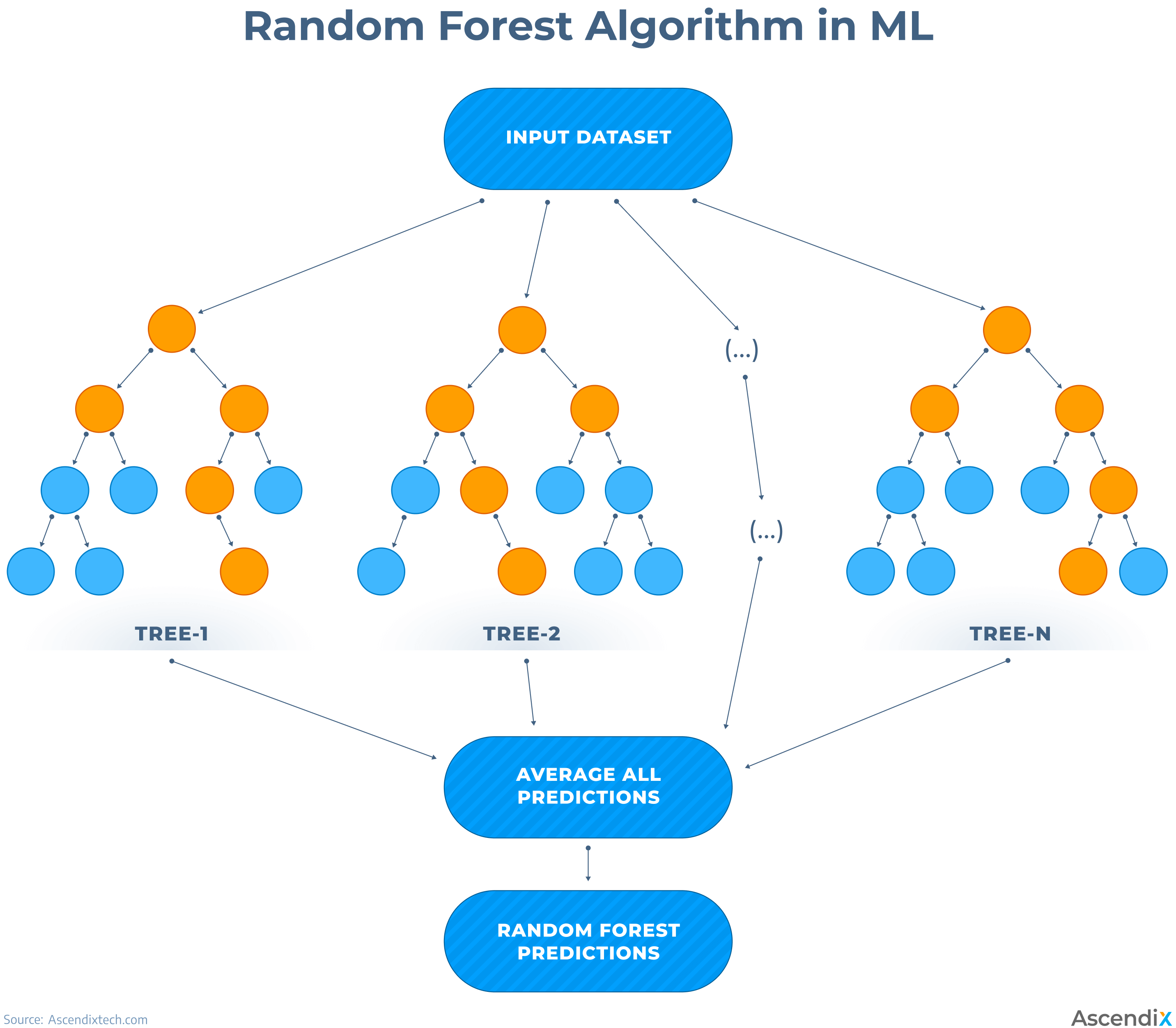

To improve the model prediction accuracy, a method of random forest might be used, which ensures higher objectivity of the prediction, reduces the risk of bias, overfitting, and overall variance, and results in more precise predictions.

Random forest is a machine learning algorithm for regression and classification tasks. The main principle here is utilizing multiple algorithms and decision trees and combining them to get a single solution to the problem.

In machine learning terms, each decision tree is a simple model that makes a prediction based on the data it sees. The Random Forest algorithm creates a bunch of these trees, each one trained on a random set of data. When we need to make a prediction, each tree in the ‘forest’ makes its best guess based on the data it was trained on. Then, the results of all trees are analyzed, and the most common result is considered the best answer.

See how AscendixTech can help you close more deals and improve your prospecting with the help of AI.

Before training any AI real estate valuation software, it is extremely important to fully understand the challenges and assess the risks related to tailored machine learning and custom development of your own AI tool. Training the AI model requires time and investment, so the business must fully understand whether it will break even soon enough, either way, the investment is useless.

Time which was spent on launching a ML trainer

Ascendix is an AI and ML pioneer in the real estate industry, which combines a deep knowledge of modern technology with expertise in proptech and real estate. We have established unique and substantial experience in fostering transformative change in real estate.

Why choose Ascendix as your real estate partner?

How Ascendix can help in your AI real estate valuation:

In our further articles, we are going to share more details about custom training and development of your AI valuation tool. Subscribe to our newsletter and never miss a thing!

Contact AscendixTech and discover how our AI real estate expertise can boost your operations.

To train an AI real estate valuation model using machine learning, start by gathering a diverse dataset of real estate properties with relevant features. Clean and preprocess the data and analyze it to identify the patterns. Choose a suitable machine learning algorithm and train it using a split dataset. Evaluate the model’s performance and fine-tune it for better accuracy. Deploy the model into production systems, integrate it into the existing software, and continuously monitor and update the software for improved performance over time.

Yana is a proptech enthusiast and a technology fan. In her articles, she explores the world of real estate software, including proptech news, useful resources, and real estate technology insights, assisting everyone involved in the industry to modernize and optimize their business.

Get our fresh posts and news about Ascendix Tech right to your inbox.