Need Technology Help?

As a technology advisor, we partner with small firms and global enterprises helping them bring automation to their operational processes.

Insurance software companies are making waves nationally, with prospective insurtech startups and seasoned top insurtech companies leading the trend.

Insurtech company count is estimated to be between 1,500 and 3,500, according to Crunchbase.

Who are these tech-minded insurance professionals? And how do they disrupt the insurance industry with their tech-driven solutions? These and many other questions will be answered in this post.

Keep reading to find out about:

Let’s get down to business.

It’s time to uncover the top 10 insurance software companies, including insurtech startups and seasoned insurance software development companies that have made the headlines over past years and shaken up the insurance industry.

While assembling our list of the best insurtech companies & startups, we paid attention to the next criteria:

So, let’s discover the seasoned players first!

Annual revenue: $19M

Number of employees: 101-250 employees

Subsector: Commercial Insurance

Founded: 1996

Headquarters: the US, Poland, Luxembourg, and Portugal

Ascendix is one of the top insurance tech companies and probably the most experienced software developer in the global insurtech space.

Serving the needs of a variety of insurtech startups, brokers, and insurance firms for top-notch software, Ascendix has been the 1st choice among insurance professionals for more than 25 years, putting the world’s best insurance software development companies aside.

Here is what Ascendix has to offer:

Ascendix has proven experience as one of the top insurtech companies, trusted by hundreds of

loyal clients, such as JLL, Stiles, Calson, Hanna CRE, and others.

Have an insurtech startup in mind or need to optimize your current insurance platform? Leave it to Ascendix – one of the top insurance software companies in the insurance coverage space. Hire the Ascendix tech team to get a ball-park estimate of your project.

Annual revenue: $55.7M

Number of employees: 251-500 employees

Total Funding: $201.7M

Subsector: Commercial motor insurance

Founded: 2016

Headquarters: London, United Kingdom

Founded in 2016, Zego has already made its way into the list of the top insurtech companies UK, disrupting the traditional models of getting commercial motor insurance.

One of the best-ranked insurance software product companies, Zego provides simple and flexible solutions for both individual drivers and entire fleets of vehicles through its customer-friendly website and mobile apps.

Here are the key features of the Zego app:

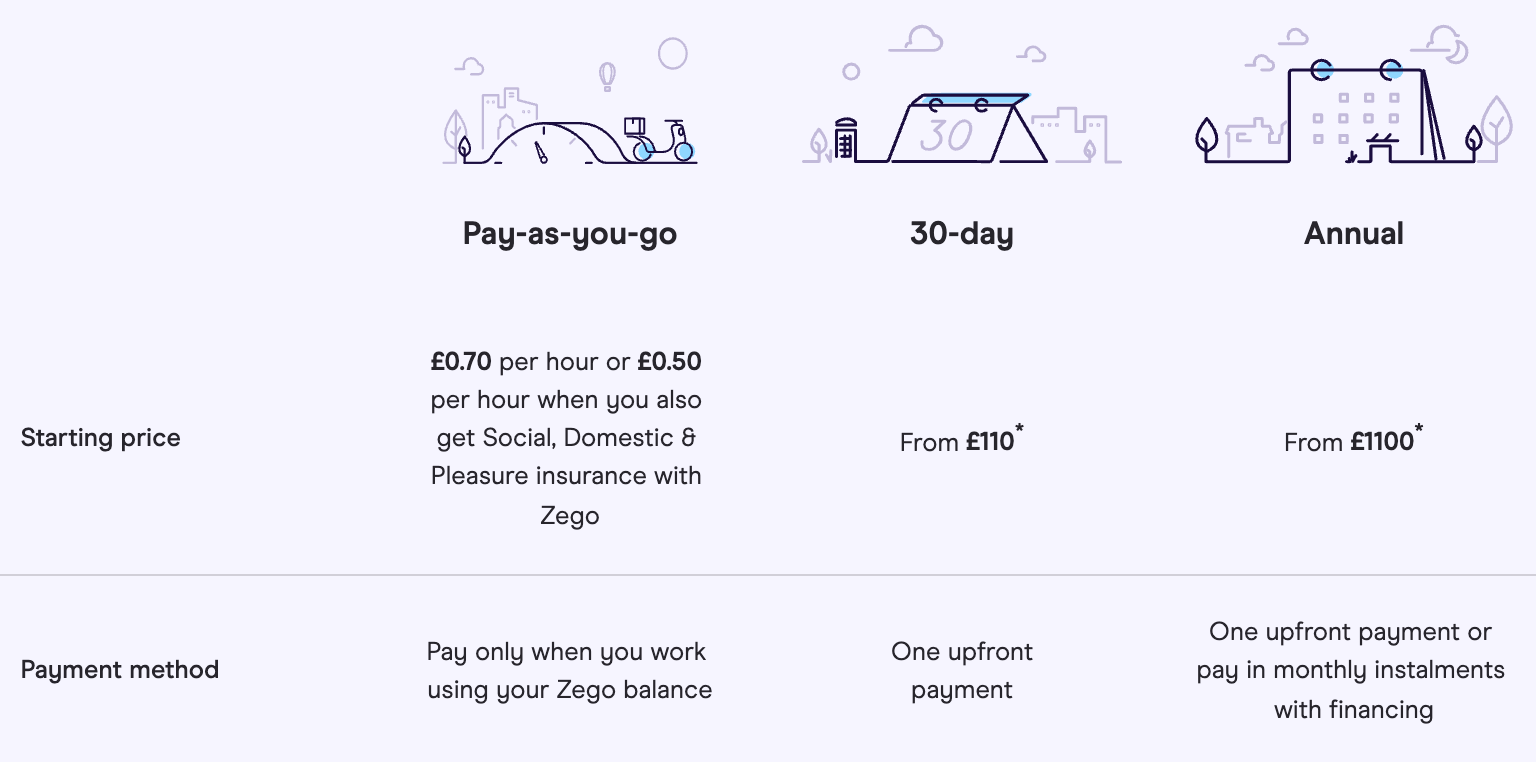

Prices vary according to a plan users choose, spanning from £0.80 per hour per pay-as-you-go to £1,100+ per year for the car insurance plan.

Zego pricing

Zego is not only one of the top insurtech companies UK but also a global insurance provider trusted by a bunch of companies in the ride-hailing space, such as Uber, Ola, and Bolt, and in the delivery space, such as Uber Eats, Just Eat, and Deliveroo.

More than that, Zego has made headlines as the 1st of the top insurtech companies 2019 UK that obtained a license to provide coverage for e-scooters for the government UK trials.

Annual revenue: $20.2M

Number of employees: 251-500 employees

Subsector: Commercial Insurance, Personal Insurance

Founded: 2002

Headquarters: Camberley, Surrey, United Kingdom

A part of the Acturis Group, ICE InsureTech is a seasoned player among the world’s best insurance software companies that was the first to bring automation & efficiency to the insurance market back in 2002.

ICE InsureTech operates as a provider of core software systems to Insurers, MGAs, TPAs, and InsurTech start-ups, including:

ICE Insurtech – one of the top insurance software product companies – has successfully delivered tailor-made solutions for MasterCard, Polaris, Global Payments, and other giants.

As a technology advisor, we partner with small firms and global enterprises helping them bring automation to their operational processes.

Annual revenue: $23.7M

Number of employees: 101-250 employees

Total Funding: $50.5M

Subsector: Small business insurance

Founded: 2016

Headquarters: Columbus, Ohio, the US

Bold Penguin entered the scene as one of the top insurtech companies aiming to simplify the buying process of insurance policies for small businesses.

Often named one of the key B2B insurance software companies, Bold Penguin operates a convenient exchange platform to match, quote, and bind policies from a range of insurance providers. Here are the key highlights of their product:

Gold River Insurance, Insurica, Fusco Orsini, Satanoff, and others are among the top insurance agencies partnering with Bold Penguin – one of the top insurance tech companies on the market.

Annual revenue: $121.6M

Number of employees: 1001-5000 employees

Total Funding: $200.6M

Subsector: Life/Health Insurance

Founded: 2010

Headquarters: London, England, United Kingdom

BIMA is one of the leading health insurance software companies and providers of mobile-delivered insurance and life & health services targeting developing economies.

As one of the most innovative top insurtech companies 2018, according to the DIA Top 100 Report, BIMA provides affordable coverage for those who cannot access these vital products through traditional channels. The key features of the BIMA solutions include:

One of the world’s leading insurance startups, BIMA is now active in 10 countries, including Bangladesh, Cambodia, Indonesia, Malaysia, Pakistan, Philippines, and others.

Annual revenue: $22.9M

Number of employees: 101-250 employees

Total Funding: $116.2M

Subsector: Private motor insurance

Founded: 2017

Headquarters: London, United Kingdom

Another Londoner on our list of the best insurance tech companies, Marshmallow was founded in 2016 by tech-driven twin brothers Oliver and Alexander Kent-Braham and their engineer friend David Goaté.

Marshmallow is one of the most promising insurtech startups providing private motor insurance plans at affordable rates to lessen the insurance troubles foreign-born drivers often face.

A licensed insurance carrier and one of the top insurance software companies, Marshmallow has a user-friendly app with the following features:

Marshmallow strives for diversity, so 20% of the company’s labor force are from BAME backgrounds, and 50% are female, according to Sifted.

Annual revenue: $46M

Number of employees: 201-500 employees

Total Funding: $110M

Subsector: Commercial insurance brokerage

Founded: 2017

Headquarters: San Francisco, California, the US

Newfront is a modern insurance brokerage firm and one of the brightest insurance startups providing commercial coverage across a range of industries, including manufacturing, hospitality, agriculture, and more.

Here is what one of the US-based top insurtech companies offers:

One of the Top 50 Fintech companies for 2021, according to Forbes, Newfront serves more than 5,000 businesses spanning across industries, including Uber, Segment, Zenefits, Optimizely, and hundreds of others.

We help companies automate their workflow by developing bespoke software solutions. Leverage our experience in real estate, legal, financial, and transportation industries.

Annual revenue: $18M

Number of employees: 11-50 employees

Total Funding: $7.4M

Subsector: Motor & home insurance

Founded: 2017

Headquarters: Madrid, Spain

Bdeo is an Artificial Intelligence company and one of the fast-paced insurtech startups based in Spain, Mexico, France, UK, and Germany.

Bdeo is not only one of the insurance startups but also a key player in the software development arena, successfully competing with other prominent insurance software product companies. The Bdeo app has the following key features:

Bdeo was awarded as the most disruptive startup and one of the top insurtech companies 2019 in the South Summit 2019 in Madrid, according to the Global Insurtech 100 Report.

Some of the clients that put trust In Bdeo – a prospective fresher among European insurance startups – include Zurich, Fidelidade, Chubb, BBVA, and others.

Annual revenue: $18M

Number of employees: 1-10 employees

Total Funding: $4M

Subsector: Life/Health Insurance, On-Demand/Travel Insurance

Founded: 2018

Headquarters: Vancouver, British Columbia, Canada

Goose is a consumer-facing insurtech challenger and one of the top insurtech companies 2018 operating an innovative platform called the Goose Insurance Super App. Being one of the leading insurance startups on the market, Goose strives to solve 2 problems:

That’s why Goose – one of the brightest startup insurance companies – employs the following features & technologies in its products:

Annual revenue: $15.8M

Number of employees: 51-100 employees

Total Funding: $7.1M

Subsector: Life/Health Insurance, On-Demand/Travel Insurance

Founded: 2017

Headquarters: Gurgaon, Haryana, India

Toffee Insurance is among the key insurance startups specializing in microinsurance and product development. As one of the top insurance software companies, Toffee serves individual customers through its competitive products. Here is what the firm offers:

The key audience: digitally active youth with less than $300 of monthly income.

Standing in a row with the world’s best insurtech companies, Toffee Insurance partners with a number of key players in the market, including Hero Cycles, Rynox, True Balance, and others.

The tech-savvy insurance landscape is getting more and more competitive, so the fresh insurance startups need to be innovative, disruptive, and opportunity-driven.

To make your insurtech insurtech startups stand out from competitors, you need to find reliable insurance software development companies to build your solution from scratch or support your tech initiatives.

When it comes to insurtech development, Ascendix is at your service. Here is what we offer:

Ascendix will be glad to offer you its full-cycle software & product development services to meet your needs and visions. Contact us to get an estimate of your upcoming project.

Why Is It Viable to Build InsurTech Startups

In the light of the recent Covid-19 pandemic outbreak and economic troubles it brought to almost every industry, it might seem that starting a new business is a bad idea – especially in such a tightly regulated, complex sector as insurance.

If you think so too, you might find yourself left at the tail end of the global insurance market disruption led by insurance tech companies.

To keep up with the market, consider the following reasons why it is worth building your own insurtech startups in 2022:

Hire Ascendix experts. Leverage our experience in real estate, legal, financial, and transportation industries.

Regardless of who you are, where you live, and what business you run, protecting your health, home, vehicle, assets, and loved ones has always been a key concern.

With this in mind, insurance software companies leverage innovative technologies to bring a better user experience at a more affordable price, overcoming the barriers of traditional insurance models.

Do you want to be among the early market disruptors and innovators? Don’t hesitate to reach out to Ascendix – one of the key insurance software development companies, and we’ll provide you with a detailed estimate and help you develop your own insurtech solutions that your clients will love.

Most of the insurance software companies are located in the United States (46% of global insurtech funding), followed by the UK (8%) and China (5%), according to Statista.

The total count of insurtech companies worldwide is estimated to be from 1,500 to 3,500, according to Crunchbase.

The Top Insurtech Companies UK are Zego (£146.5M), BIMA (£91.7M), Bought by Many (£105.9M), Tractable (£43.5M), as found in this research.

Alina is a proptech technology expert and a storyteller at Ascendix, investigating the real estate market and sharing her insights and tips with up-and-coming proptech startups, established real estate agencies, and industry stakeholders. She talks about real estate technology, business automation, and industry news.

Get our fresh posts and news about Ascendix Tech right to your inbox.