Want to Use AI in Your Mortgage Document Workflows?

See how Ascendix can help you automate mortgage operations with the help of AI.

Mortgage lenders and brokers deal with huge numbers of documents daily. The paperwork includes bank statements, tax forms, background check reports, and many more documents that must be considered carefully before the mortgage approval. The risk of error is tremendous, and so is the volume of data. How can it be solved?

This is where AI mortgage document processing technology steps in, offering a cutting-edge solution for mortgage automation of the extensive document analysis required in every loan phase. By automating document management and summarization, AI and ML tools streamline the workflow, improve efficiency, and enhance accuracy.

In this article, we describe how AI mortgage document processing works, discuss the ways of mortgage automation implementation and share mortgage process automation solutions that will be helpful for both lenders and brokers.

AI mortgage document processing refers to the use of artificial intelligence to automate and streamline the handling of mortgage-related documents within the loan processing workflow.

AI mortgage document management can handle tasks like document classification, data extraction, verification, validation, analysis, data entry into the CRM or a database, document compliance check, etc.

In AI mortgage document processing, the backbone of efficiency lies in mortgage OCR (Optical Character Recognition) technology. OCR is responsible for the key tasks in mortgage document automation – recognizing the data from the document. This plays a pivotal role in enhancing the accuracy and speed of AI mortgage processing.

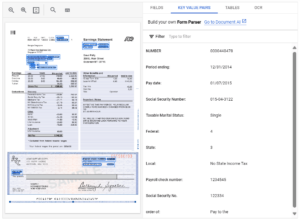

With the help of mortgage OCR, AI algorithms recognize and interpret mortgage documents, extracting relevant information (such as borrower details, property information, financial data) from text documents, scans, images, and other data formats.

Except for recognizing and extracting the data, AI mortgage document processing tools can validate the accuracy of the extracted data, and facilitate decision-making processes for mortgage underwriting, loan approval, data verification, and compliance checks.

Moreover, some AI mortgage document processing tools also offer the possibility to automate data entry into the existing company’s CRM. By utilizing AI in mortgage lending, financial institutions can significantly reduce manual efforts, improve data accuracy, enhance operational efficiency, and accelerate the overall loan processing timeline.

AI mortgage document processing tools can handle a variety of documents, required for getting a loan, or providing finances to borrower and checking their credibility. The most common documents include:

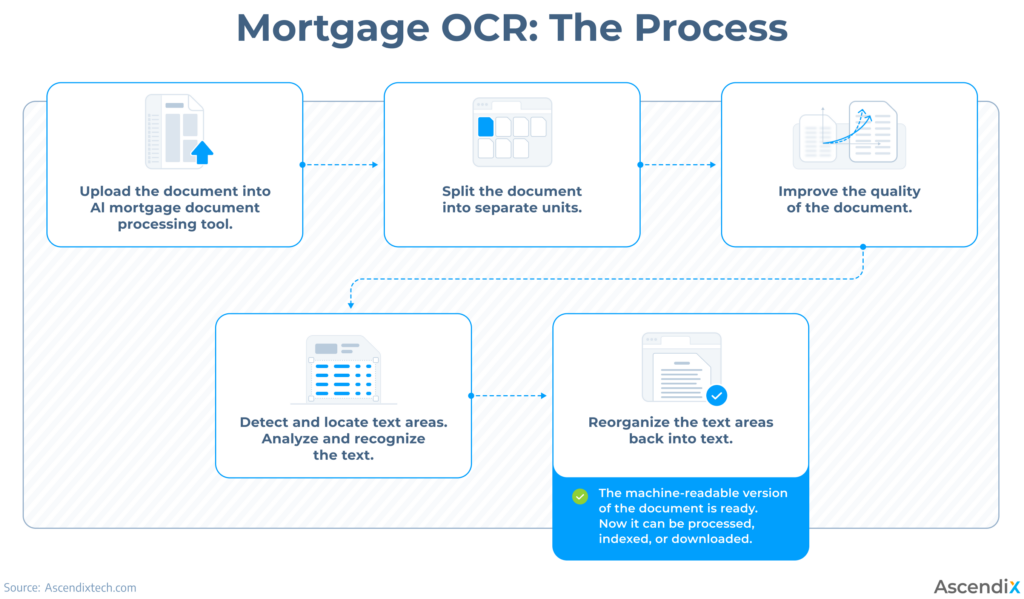

AI mortgage document processing involves several stages – from document upload to processing the result and fine-tuning the data. Let’s discover the process in detail.

First of all, the mortgage documents must be uploaded to the mortgage document automation tool. The documentation may also be retrieved from various sources like Loan Origination Systems (LOS), emails, FTP servers, company databases, Dropbox folders, cloud storage solutions, or any other integrated systems for storing data.

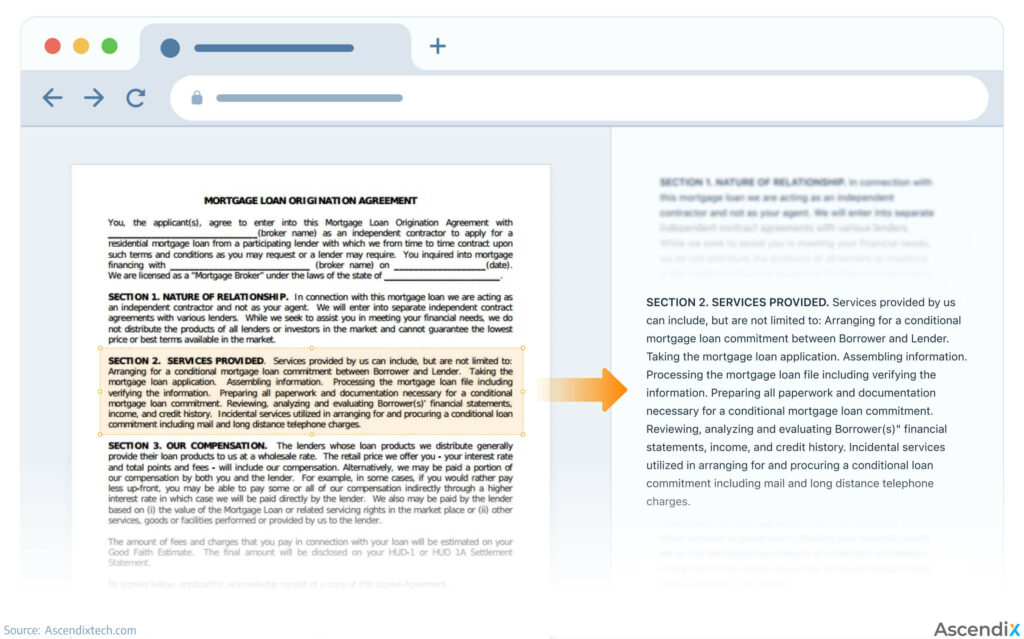

Mortgage OCR works by using AI algorithms to analyze images of text and convert them into machine-readable text. The OCR text recognition happens after the documents are already in the system, and it also includes several stages.

The final output of the mortgage OCR processing is a structured text that is easily managed, so can be further processed, indexed, searched, or analyzed.

While AI mortgage document automation tools are quite reliable due to the advanced mortgage OCR technology, AI still may make errors in extracting data, especially from complex or poorly formatted documents.

To ensure accuracy, AI-extracted fields that are questionable or unclear are reviewed by humans for accuracy. For this purpose, AI mortgage document processing tools offer Human-In-The-Loop (HITL) interfaces, where mortgage professionals can access the extracted data, review it against the original document, and correct any inaccuracies.

This approach of combining fully automated mortgage document management with human oversight significantly helps to improve the accuracy and reliability of the data extraction results.

As the process of mortgage OCR data extraction is finished, the data may be downloaded or integrated back into systems like LOS, compliance software, or analytics platforms, for further management, analysis, and usage.

AI mortgage document processing may include an additional step of automated data entry for companies that use CRM systems. After the data has been extracted, reviewed, and approved, AI can integrate it into chosen CRM systems, business databases, or other applications. AI data entry frameworks can be integrated into the existing software for streamlined data input or can be added as a new solution for mortgage businesses. This will lead to streamlined, efficient, and optimized processes in the company.

See how Ascendix can help you automate mortgage operations with the help of AI.

Hire Ascendix and we’ll create a tailored AI mortgage tool to bootstrap your processes.

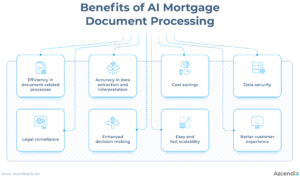

Custom AI mortgage document processing tool is tailored to business needs and ensures high efficiency in those very processes that may have problems and highly need automation. Implementing a custom AI mortgage document automation solution offers a lot of significant benefits.

Ascendix stands out as a pioneer in AI software development for real estate-related industries. With our unique expertise and knowledge, we excel in merging cutting-edge technology with real estate expertise.

Our hands-on experience in custom AI software development includes building frameworks for AI property search, AI lease abstraction, AI property valuation, AI data entry, AI recommendations engine, and AI chatbots.

Why Choose Ascendix for Mortgage Document Management Automation?

How Ascendix Can Assist with AI Mortgage Document Processing:

Contact Ascendix and automate your mortgage document management with tailored AI automation tools. Schedule a free consultation today to explore the possibilities of mortgage automation with us.

Contact Ascendix and we’ll develop AI mortgage software that would ideally match your business needs.

AI in mortgage lending is used to streamline processes in document processing, including data extraction data analysis, risk assessment and optimal loan terms calculation. AI chatbots and virtual assistants improve customer service by answering queries, providing information, and guiding borrowers through the application process. AI in mortgage lending significantly accelerates workflows, improves accuracy, and enhances the customer experience.

OCR (Optical Character Recognition) in mortgage is a technology for converting scanned mortgage documents into machine-readable text. It automates textual information extraction from documents like loan applications, income statements, and tax returns. Mortgage OCR plays a crucial role in digitizing and processing large volumes of documents, improving efficiency, accuracy, and speed in document processing workflows.

Mortgage brokers can highly benefit from AI document processing, data analysis, and customer interaction. AI technology streamlines the mortgage application process by automating document verification, data extraction from documents, data entry, data analysis, credit scoring, and risk assessment. AI algorithms can also identify and analyze market trends, assess borrower risk profiles and optimize loan portfolios, enhancing decision-making for mortgage brokers.

Yana is a proptech enthusiast and a technology fan. In her articles, she explores the world of real estate software, including proptech news, useful resources, and real estate technology insights, assisting everyone involved in the industry to modernize and optimize their business.

Get our fresh posts and news about Ascendix Tech right to your inbox.