Build a Real Estate Crowdfunding Platform with Ascendix

We’ve got 2 decades of expertise in real estate and SaaS development. Trust your project to Ascendix professionals.

This year, the global crowdfunding market reached a valuation of 1.41 billion U.S. dollars, with a projected growth trajectory that is set to more than double by 2030.

Amidst the evolving financial landscape, investors are increasingly drawn to crowdfunding platforms, captivated by the numerous advantages they offer, namely, lower fees, higher diversification, and better risk-adjusted returns. And if you’ve already been thinking about how to build a crowdfunding platform – we got you! Please continue with our guide in the article below.

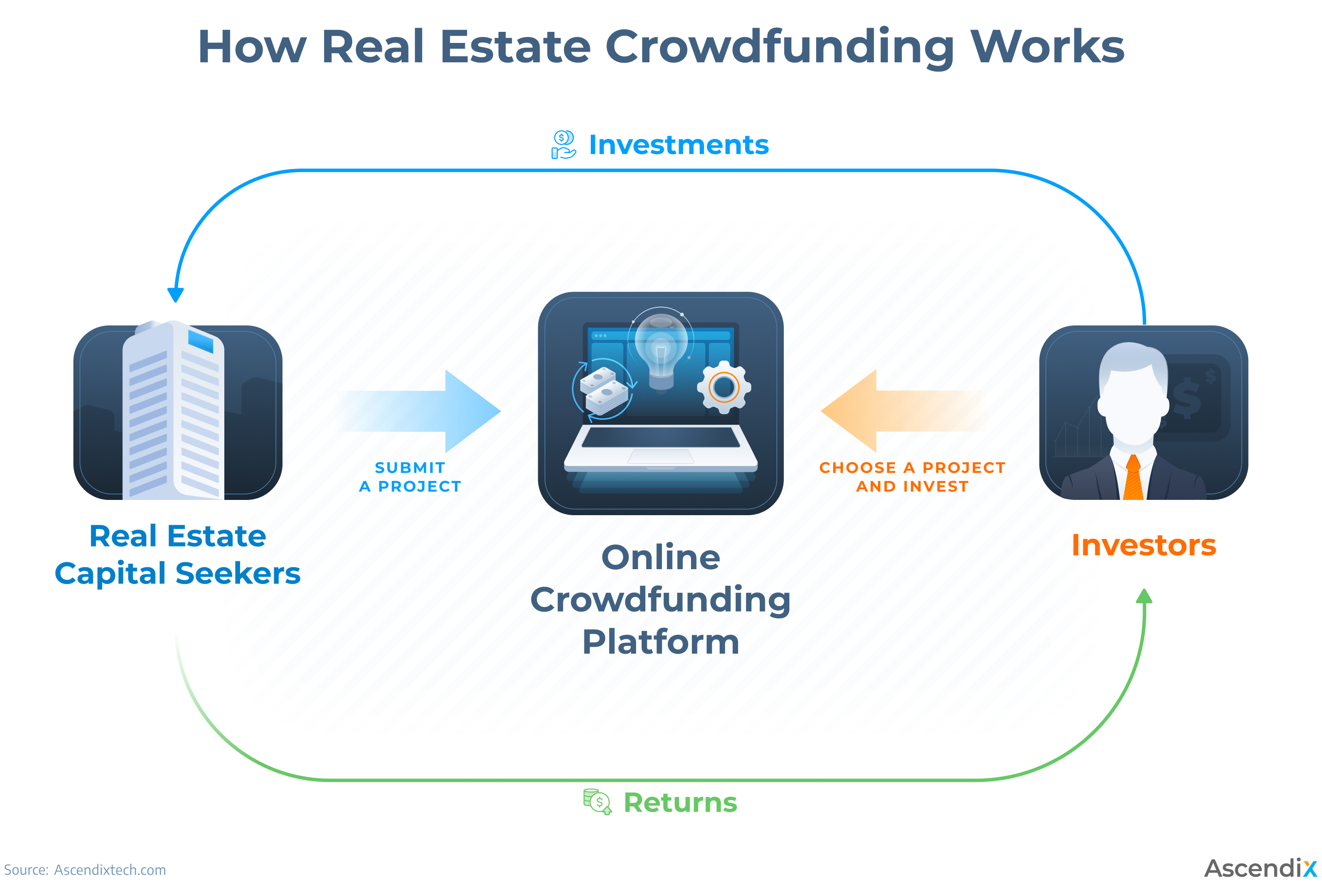

Real estate crowdfunding is an approach used by real estate companies to raise funds required for project development and completion from a large pool of small investors, whether funding companies or individuals.

Unlike traditional funding, which relies on a few large investors, crowdfunding aims to attract as many small investors as possible to complete the project.

Depending on the crowdfunding type, real estate investors can get monetary rewards such as project ownership stakes and regular interest payments.

A crowdfunding platform is an online platform that allows real estate businesses to raise funds for their projects from a vast number of funding companies and individuals. In their majority, crowdfunding platforms operate as real estate marketplaces.

In 2021, the global crowdfunding market was valued at $10.8 billion, and it is anticipated to skyrocket to around $250 billion by 2030 (with an impressive CAGR of approximately 45% between 2022 and 2030).

How Real Estate Crowdfunding Works

Why are real estate crowdfunding platforms a trend to stay?

To create a crowdfunding platform, you must start with choosing its type because the type you choose for your platform will highly influence its whole functionality and the target audience it’ll attract.

To further define your niche, you also need to decide what kind of property you’ll be focusing on:

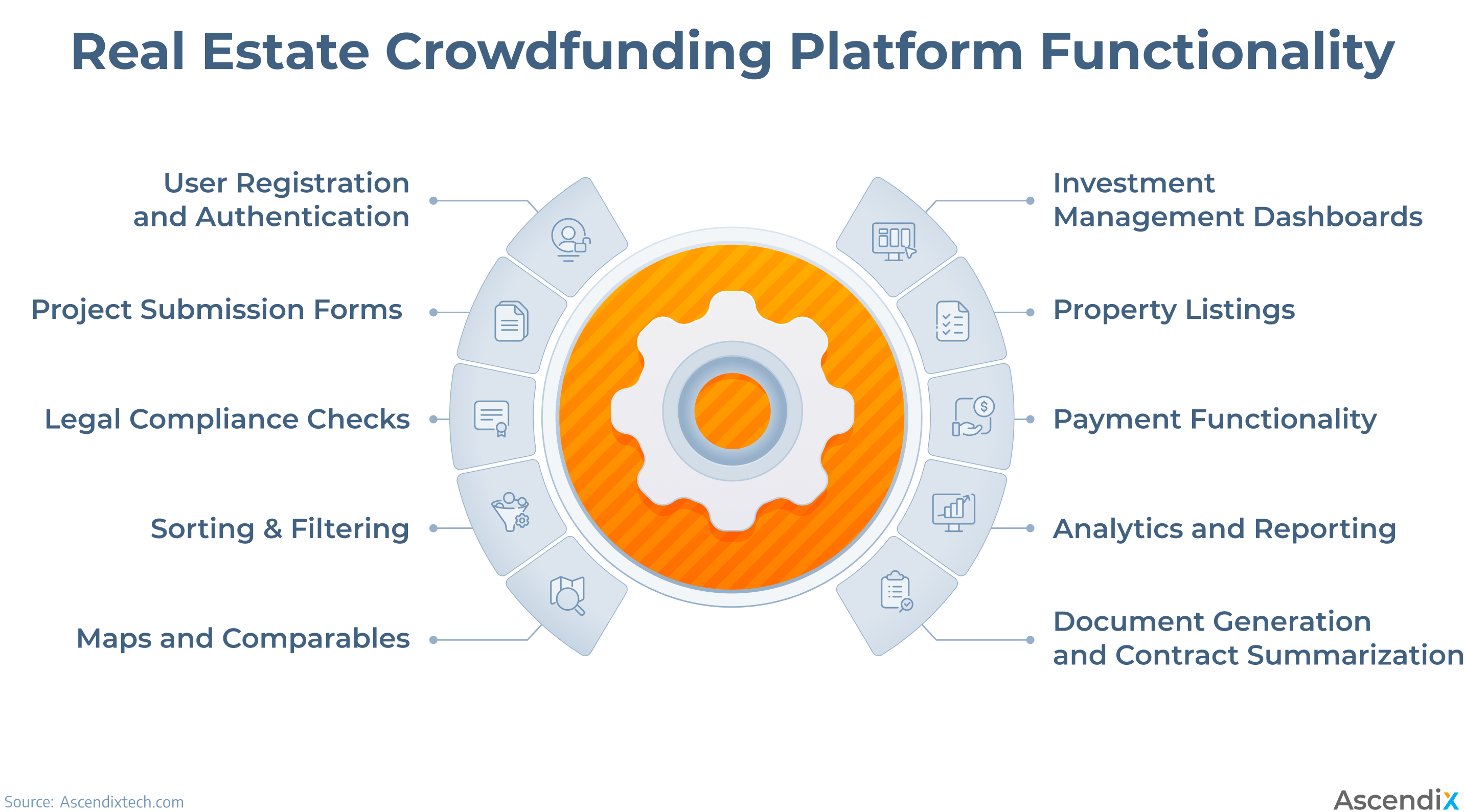

Real Estate Crowdfunding Platform Functionality

Both registration and authentication processes are far more complicated in crowdfunding platforms compared to traditional real estate marketplaces and listing portals.

The registration process should be as thorough as you want it to be, but it surely must include vital details like personal identification data and financial credentials.

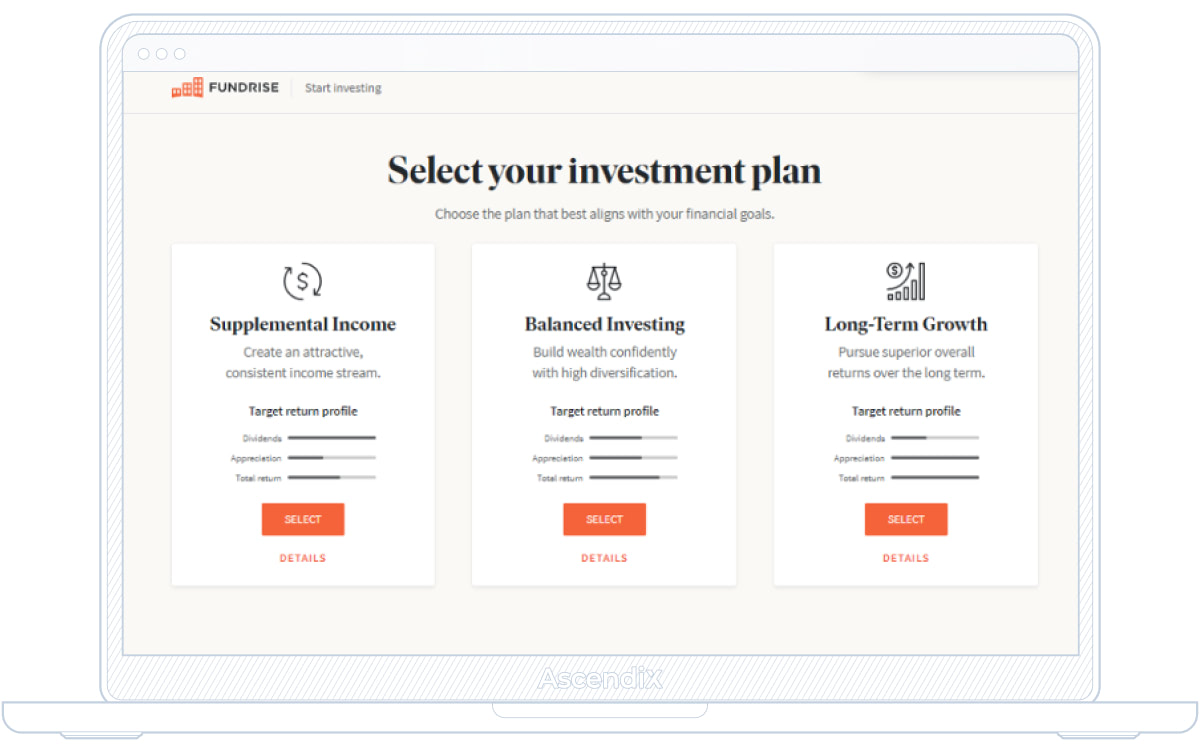

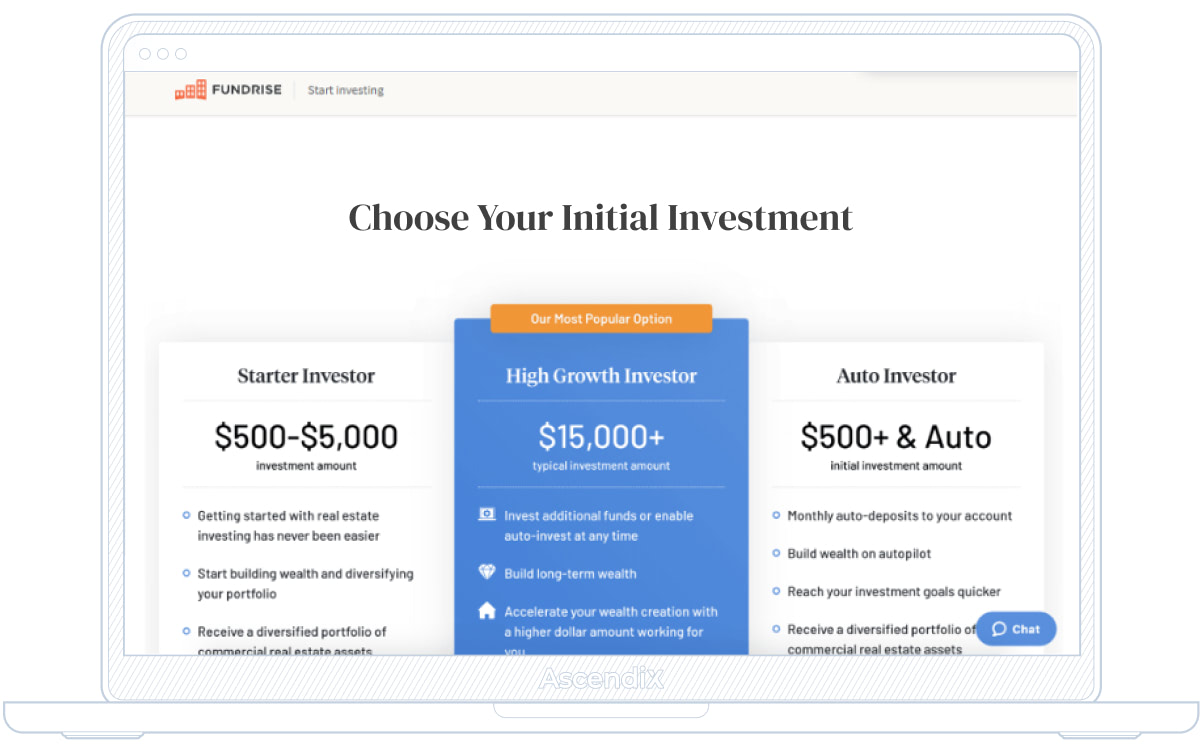

Users should be able to provide you with details like risk tolerance and investment preferences as a part of an introductory questionnaire or by choosing the investment plan based on their competence (just like Fundraise did, for instance):

Fundrise’s Choose Your Plan Interface

Users should be able to create accounts (commonly, details like first and last name, email, and password creation are required) in order to access the platform, browse the projects, apply for them, and manage their portfolio.

Some platforms might ask users to confirm their country of citizenship as well (especially if we’re talking about global crowdfunding platforms).

If the target audience of your platform is both investment companies and individuals, then the platform should include two types of accounts which users should choose from, individual account or company account.

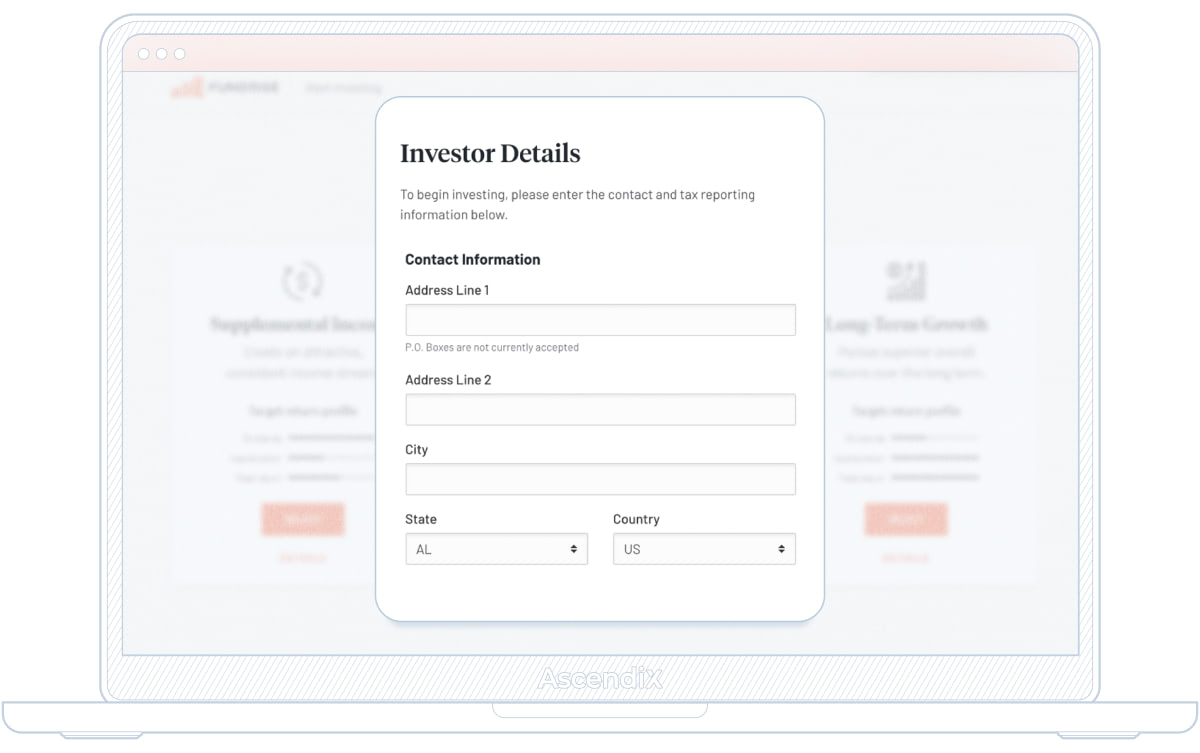

The next step is providing the data like address, city, state, and zip code as well as tax information. Commonly, the interface might be as simple as this one:

DiversyFund’s Investor Details Interface

Further, users should be able to choose the amount of investment (you can also include an ‘auto-invest’ option as a part of the investment plan here, allowing users to schedule recurring investments with different frequency).

DiversyFund’s Investment Plan Interface

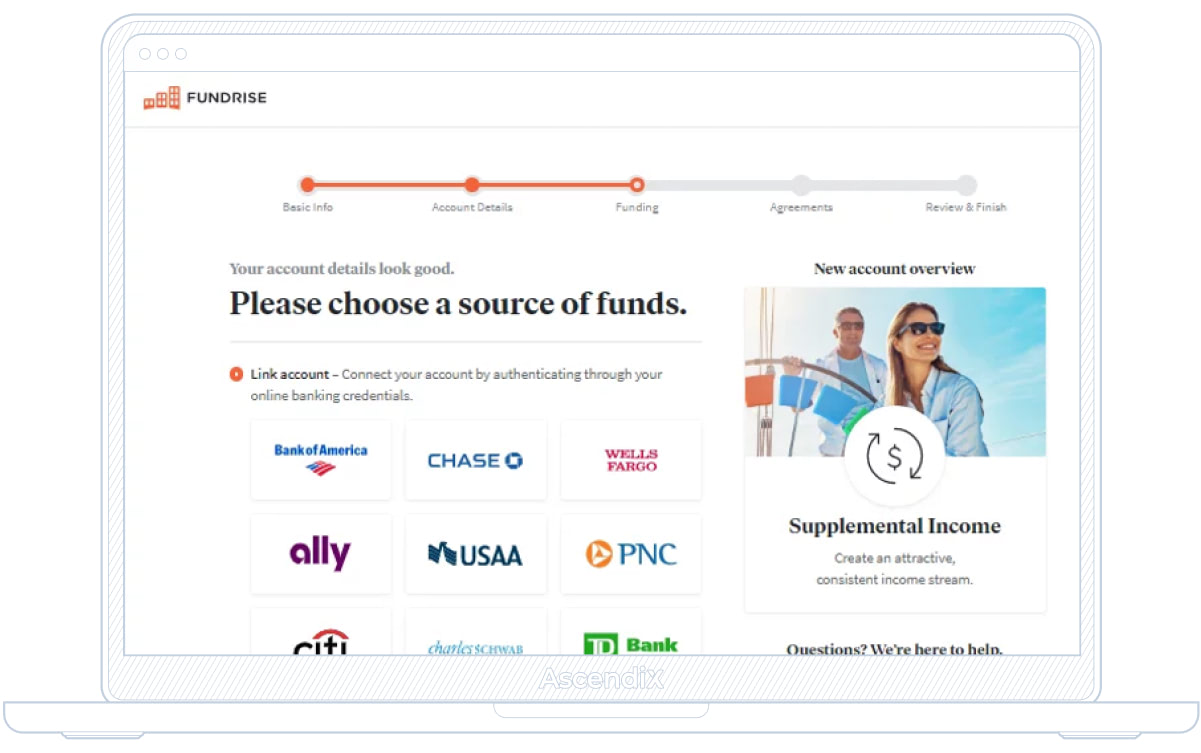

Other than that, your users should be able to link their account to the source of funds by authenticating through their online banking credentials or entering manually their banking account data:

Fundrise’s Choose the Source Interface

In the end, users are often asked to agree to terms and conditions (though this step might be included in the beginning), review the details, and finish the registration.

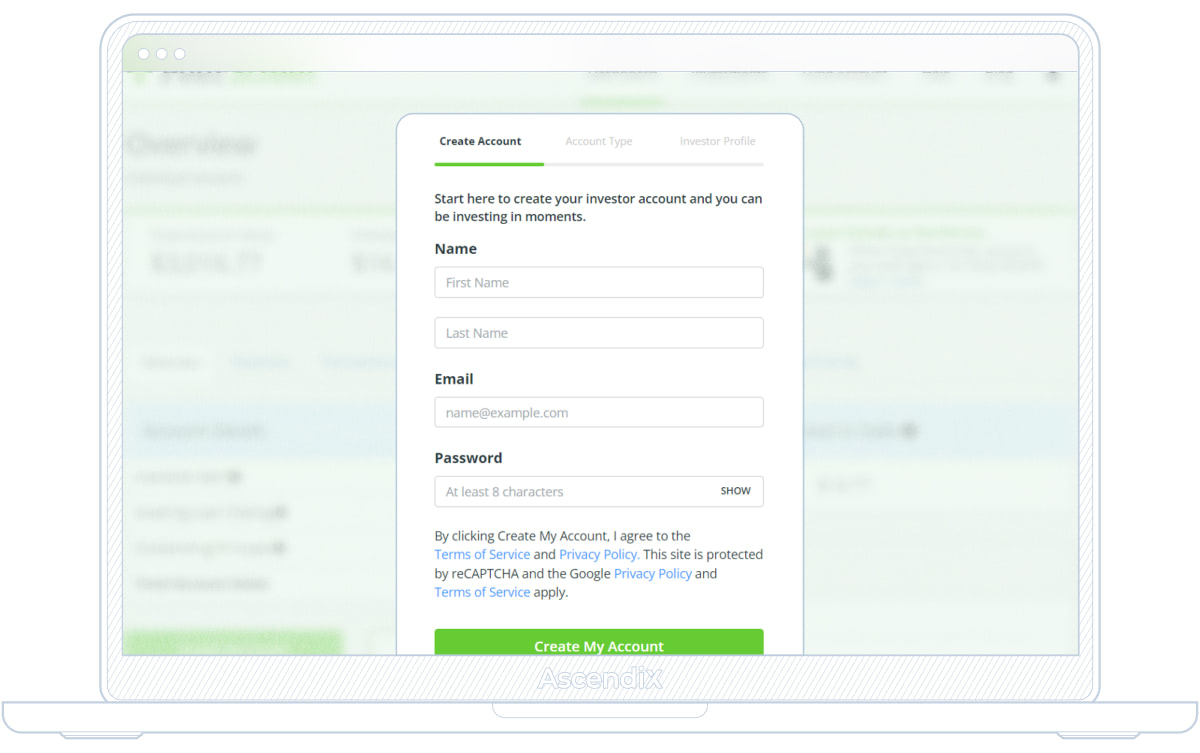

If you want to keep the registration process less stressful for users, you can omit a few steps (again, if the nature of your crowdfunding platform allows it) and leave it as simple as PeerStreet did, for example:

PeerStreet’s Registration Interface

As you can see from the screen above, the registration process includes only three steps: creating an account (only name, email, and password are required), choosing the account type and filling in the Investor Profile.

Other than that, you can allow users to register and later authorize via Facebook, Google, or LinkedIn, making the whole process even less complicated.

Meanwhile, the authentication process often includes the platform sending security codes to users each time they log into their account with a password.

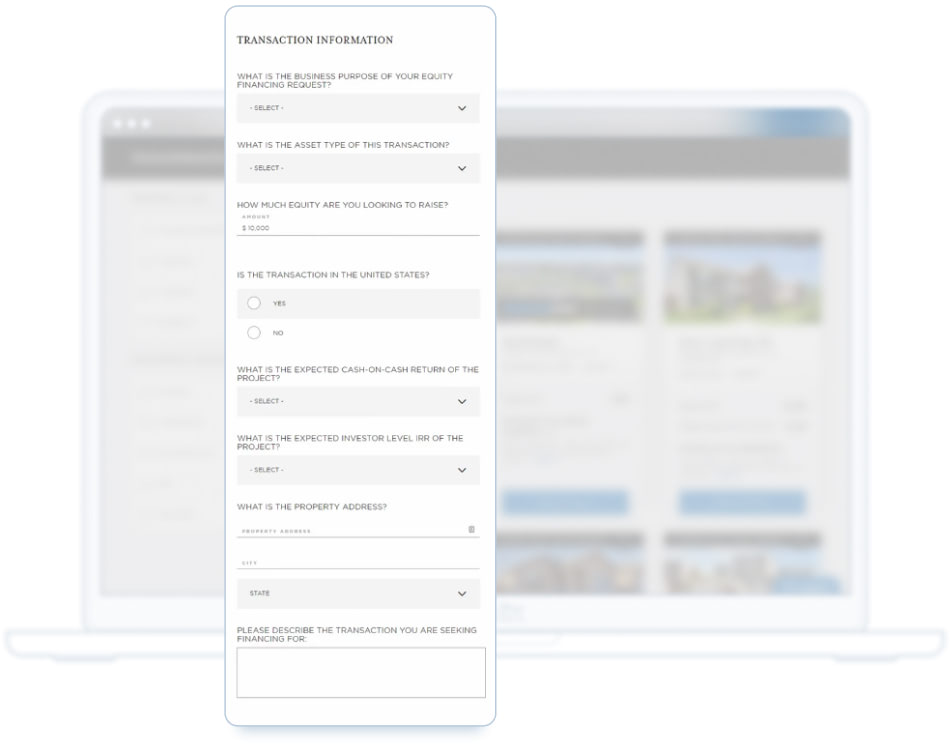

Your crowdfunding platform should have project submission forms for project owners who want to display their project and attract the right investor.

Often, project submission forms might come as a part of the registration process.

What should a project submission form include?

Company’s data like its focus, background, and financial data;

Project information, such as the asset type, property data (location, due dilligence documents, etc.), the amount of the equity required, the investor type the company is looking for to finance the project, the expected cash-on-cash return, etc.

As an example, this is how the project submission form looks like on RealtyMogul:

RealtyMogul’s Project Submission Form

As a creator of a crowdfunding platform, you’re fully responsible for the credibility of the projects displayed. To ensure that investors get an access to projects that align with industry requirements and the legal side, your crowdfunding platform should include the following features:

Secure document upload and storage. Users should be able to securely upload and store vital project documentation like financial statements, property reports, and legal documents;

Robust communication. Both project owners and investors should be able to securely and efficiently exchange documents;

Third-party verification integration. Your crowdfunding platform should integrate with third-party verification services so users can perform background, financial, and credential verification checks;

Risk assessment functionality. You can introduce risk assessment tools as a part of your platform or include them in premium services so investors can ‘predict’ the project success considering factors such as market fluctuations, economic downturns, and property-specific risks.

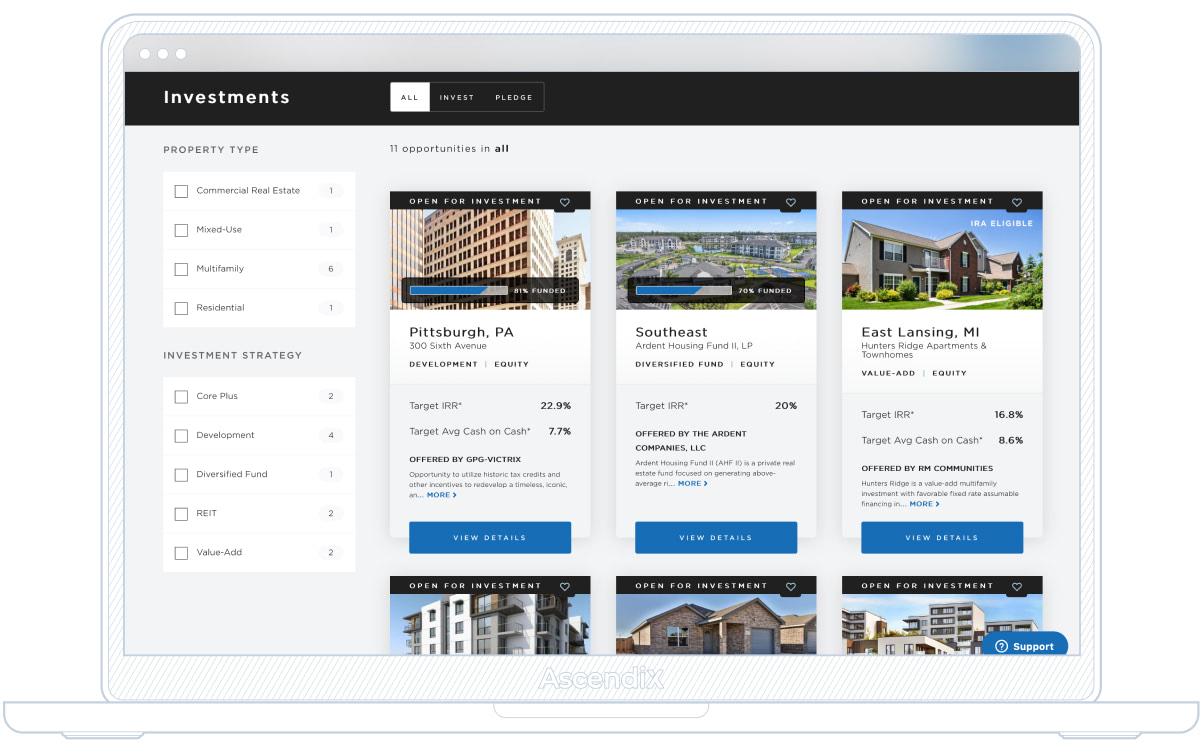

Users should be able to search for projects based on location, property type, investment preferences, projected returns, and risk profile.

For instance, RealtyMogul allows its users to search projects based on property type (mixed-use, multifamily, residential), investment strategy, and status like ‘Open for Investment,’ ‘Open for Pledging,’ ‘Waitlist,’ etc.

RealtyMogul’s Interface

Meanwhile, project owners should be able to look for investors based on criteria like investment type, investment focus, geographical preferences, etc. And if you want to improve the matchmaking process, you can implement AI real estate technologies (for instance, natural language processing) that will recognize words used for the search as actionable filters and provide users with accurate results.

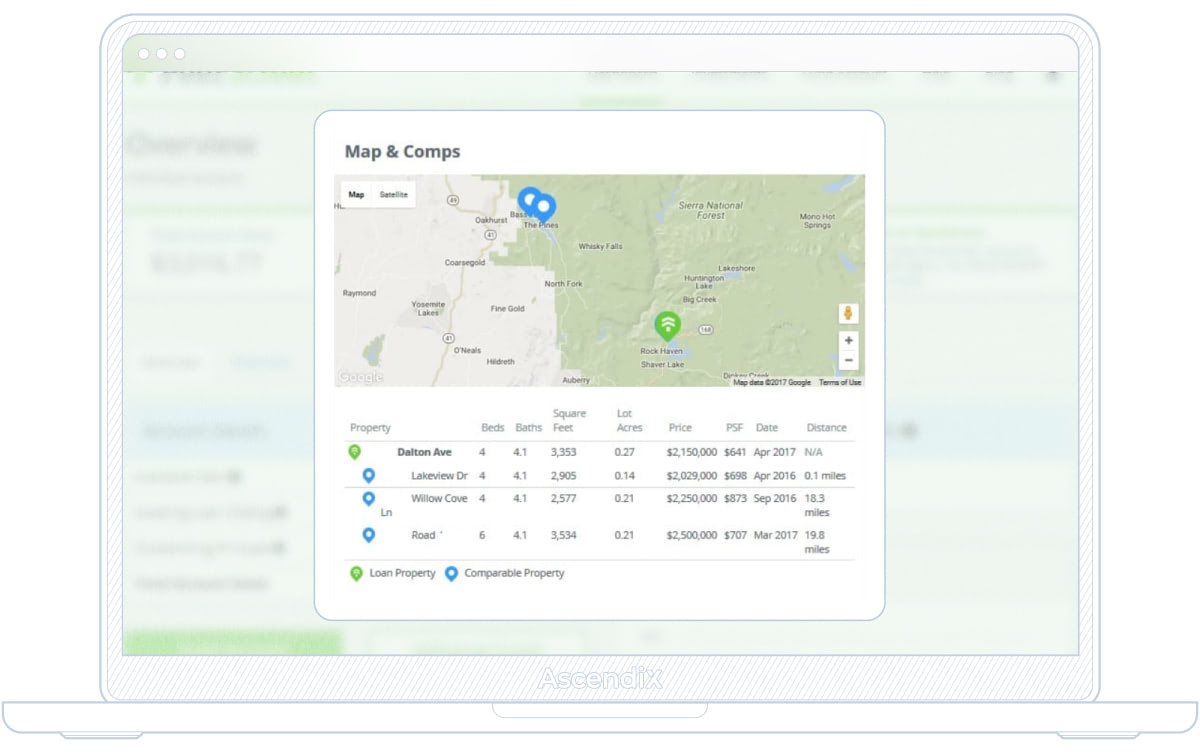

In our research we’ve found that a few crowdfunding platforms offer map search despite the latter being extremely helpful when it comes to geographic targeting.

With map search, users can target projects that align with their interests and gain valuable market insights by analyzing the distribution of investor interest on the map.

This is how the map & comps functionality looks on PeerStreet website. With comparative analysis, users can analyze comparable projects in the area and juxtapose them with the property they want to invest in.

PeerStreet’s Map & Comps Functionality

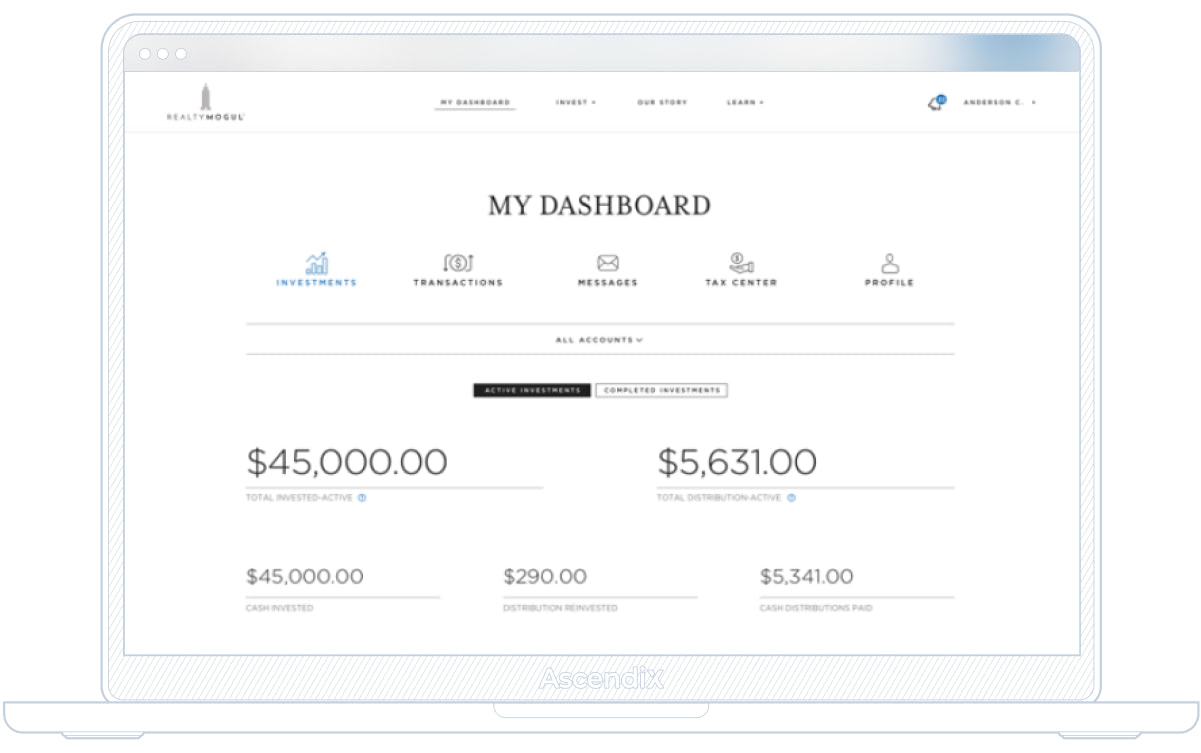

The investment management dashboard is an irreplaceable element in your crowdfunding platform’s functionality. This is where users can check their investments, track portfolio performance, and get real-time updates on their investments, including current holdings, transaction history, and earnings.

RealtyMogul’s Investment Management Dashboard

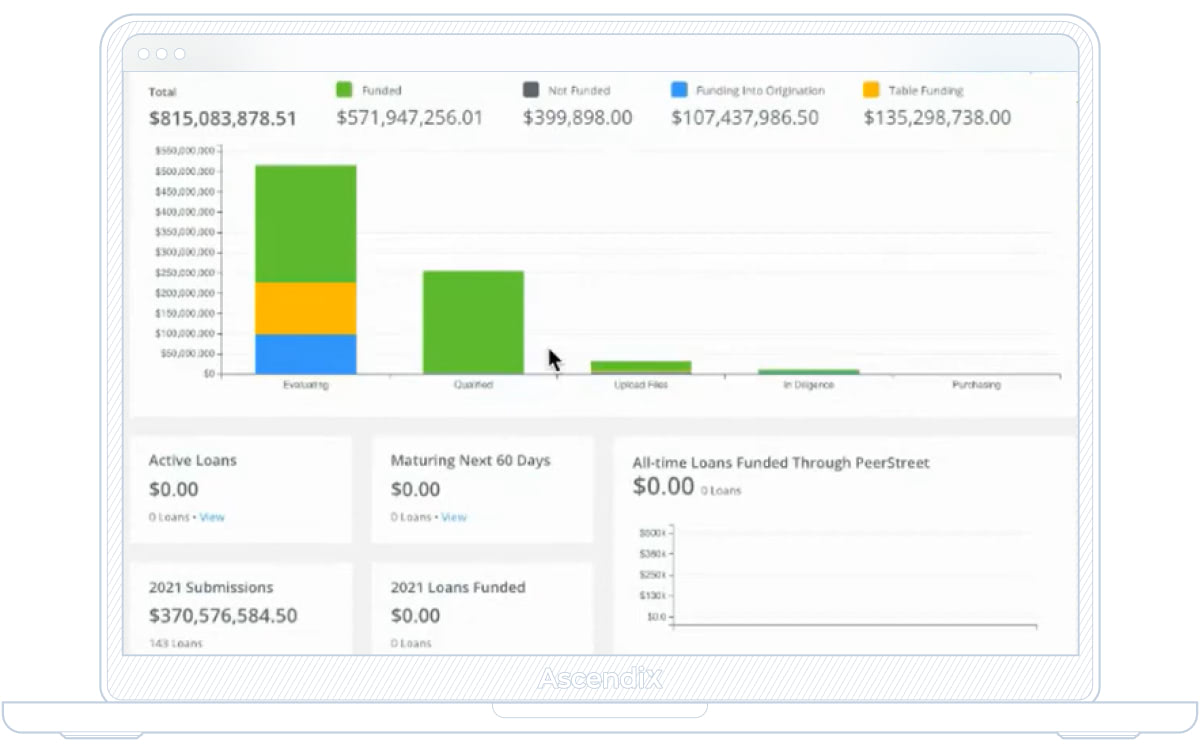

You can keep it simple like RealtyMogul did or more elaborate like PeerStreet’s dashboards with a detailed project pipeline, loan trend reporting, and investor reach (based on project geography).

PeerStreet’s Investment Management Dashboard

Just like with real estate marketplaces, property listings or we’d rather call them ‘project listings’ in this case should be visually appealing to users and contain the essential property data like projected return, location, size, amenities, pricing, and detailed descriptions. And though crowdfunding platforms don’t commonly offer 2D and 3D tour creation features, your users still should be able to upload property data files.

Investors should be able to securely transfer their funds to project owners, hence your platform must provide multiple payment methods and Escrow functionality. For that to happen, you’ll need third-party integration with payment getaways like PayPal.

And if we’re talking about the tokenization of investments, we advise you to build a crowdfunding platform that integrates with cryptocurrency exchange platforms so investors can easily transfer funds from their exchange accounts to the platform to invest in blockchain projects.

We’ve got 2 decades of expertise in real estate and SaaS development. Trust your project to Ascendix professionals.

You can offer analytics and reporting features directly as a part of the investment management dashboard or upgrade them and sell such features as premium services.

Analytics and reporting commonly includes the generation of interactive charts and dashboards or reports for portfolio performance tracking. For instance, RealtyMogul allows its users to conduct performance benchmarking, comparing their portfolio performance against industry benchmarks and other investors.

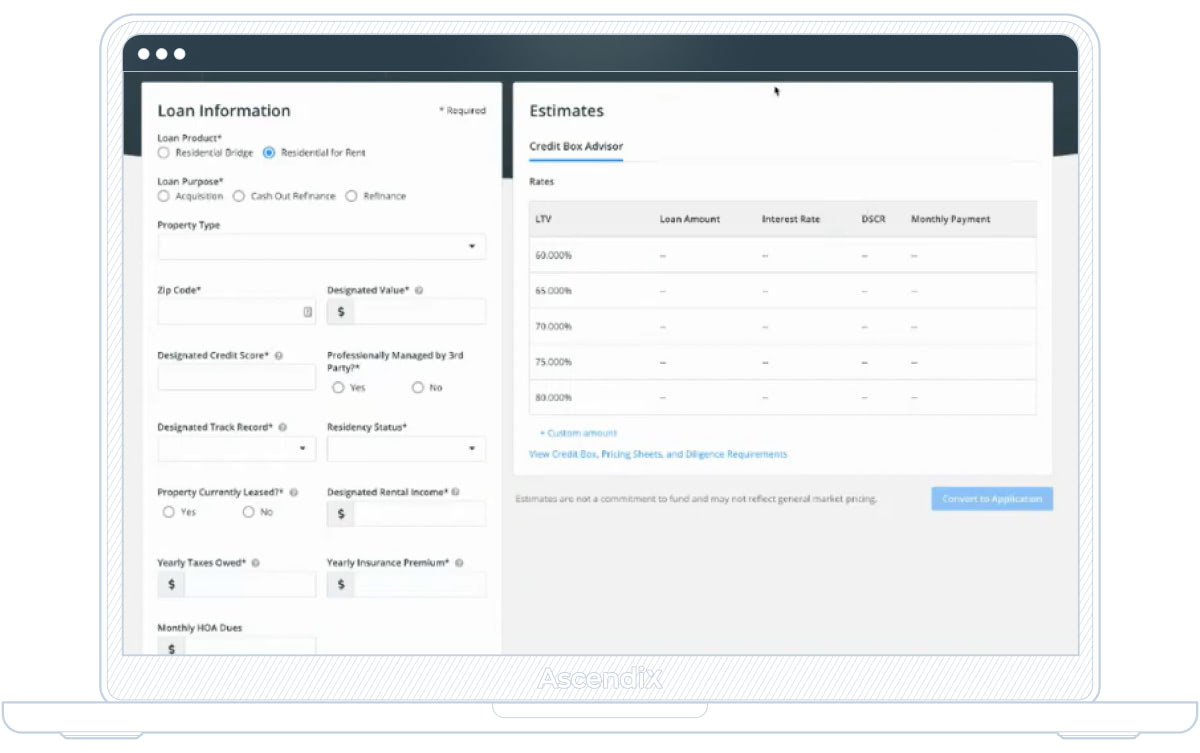

Another great example of crowdfunding platform analytics is Scenario Builder developed by PeerStreet that allows users to explore how different terms such as interest rates and loan-to-value ratios would affect their revenue, hence make informed decisions about their investments.

PeerStreet’s Scenario Builder

Again, not all crowdfunding platforms offer it. However, offering users such functionality will alleviate the pain of underwriting in real estate that can take days and even weeks (in case you’re planning to create a crowdfunding platform for lending loans) and generally help investors close deals faster.

Here, you can go one step further and add contract summarization or abstracting features to build a crowdfunding platform that is an AI-powered product in the end. Such a feature helps investors save valuable time and resources by automatically extracting essential details from lengthy legal documents, condensing pages of complex information into summaries that display the vital data concisely.

Sure, AI-powered abstraction is a relatively new thing in real estate, but why not be a pioneer and revolutionize the industry? We’ve already shared insights on how we’ve built our lease abstraction tool.

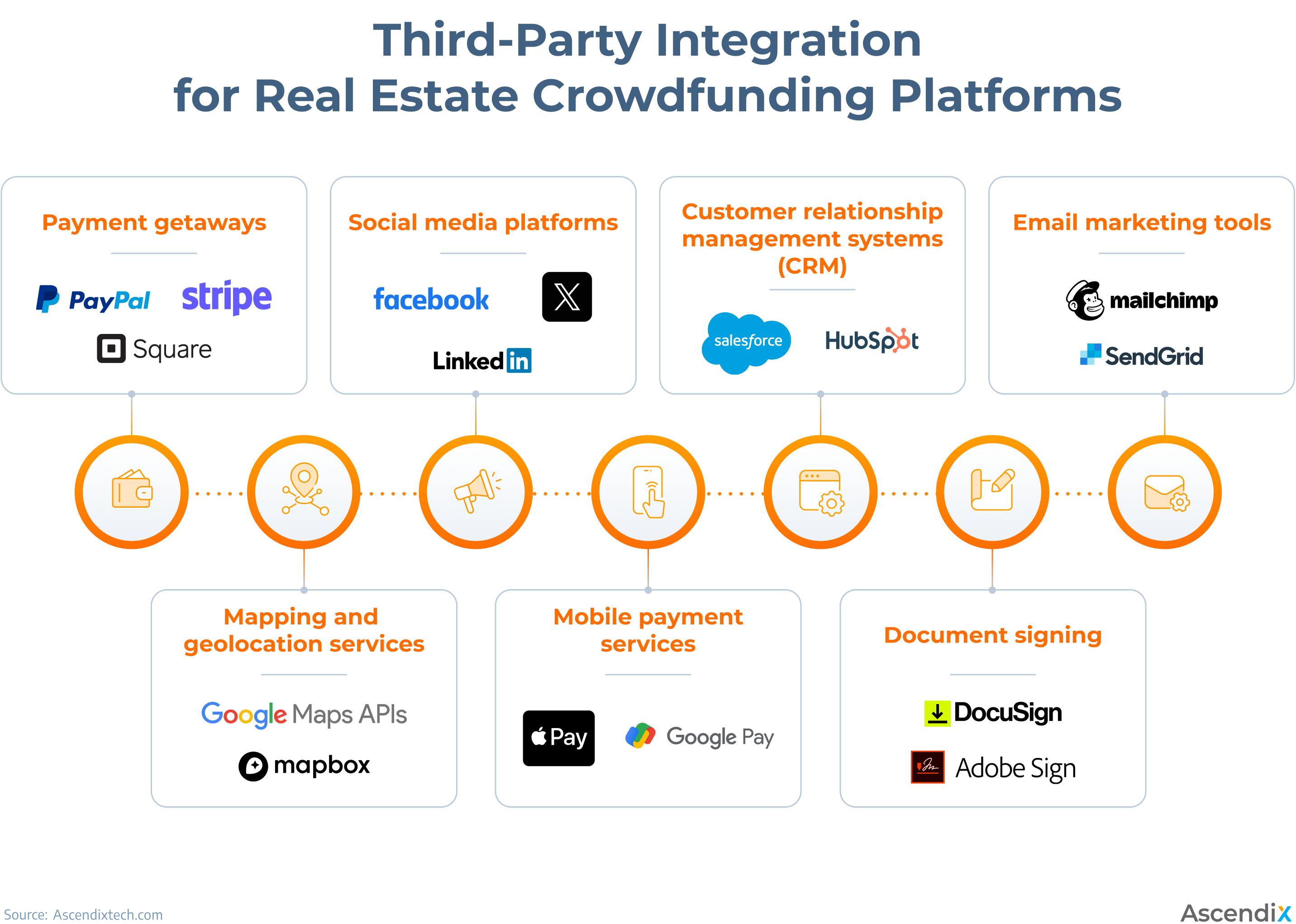

Third-Party Integration for Real Estate Crowdfunding Platforms

How to build a crowdfunding platform that is not only functional but also user-friendly? As you’ve already guessed, for that to happen, the platform must integrate with external services and applications (please note that these are only examples, and the list of the possible solutions doesn’t end here):

Payment getaways – Paypal, Stripe, Square;

Social media platforms – Facebook, Twitter, LinkedIn;

Customer relationship management systems (CRM) – Salesforce, HubSpot CRM;

Email marketing tools – Mailchimp, SendGrid;

Mapping and geolocation services – Google Maps API;

Mobile payment services – Apple Pay, Google Pay;

Document signing – DocuSign, Adobe Sign.

There isn’t a single correct answer or one-size-fits-all model suitable for every crowdfunding platform, since commonly, such businesses apply a combination of a few monetization models.

Many monetization models used in crowdfunding platforms align with those used in real estate marketplaces. Below, we’ll briefly explore these models. For a more in-depth understanding, you can refer to our article here.

Fee-Based Monetization Model

Investors and project owners pay fees based on the number of projects displayed on the platform.

For instance, investors using Fundrise are subject to an annual advisory fee of 0.15% in addition to a yearly management commission of 0.85%, while EquityMultiple charges 0.5%-1.5% on equity investments.

Commission-Based Monetization Model

The platform earns a percentage-based commission on successful fundings, often when the project is successfully closed.

For instance, RealtyMogul earns a percentage of the total funds raised for each investment opportunity (the percentage depends on the project type, size, etc.). Another platform, Crowdestate, charges a success fee, usually set at 20%, applied once the yearly hurdle rate of 8.00% is surpassed.

Users pay regular subscription fees to access premium features, exclusive investment opportunities, or advanced analytics and market insights.

You might not charge a joining fee, but still, you might want to divide your services into categories based on investor experience and goals and charge for them accordingly.

For instance, AcreTrader offers different subscription plans for the users of their Acres analytics platform, including a free account for everyday landowners, premium plans, and enterprise-level options catering to brokers, land professionals, and land finance companies.

Advertisement Monetization Model

Crowdfunding platforms can display targeted advertisements to users, generating revenue from advertisers seeking to reach potential investors and project owners. None of the platforms we’ve researched offers such services openly, but you can obviously create a crowdfunding platform with a featured listings functionality and offer it as a premium ad service.

Add-on Services Monetization Model

Building a crowdfunding platform with this additional model will allow you to offer services like professional consultancy, legal support, or premium investor education resources, for a fee. For instance, Fundrise charges $5000 due diligence/closing fee.

Referral-Fee Monetization Model

Both investors and project owners can enjoy exclusive benefits and discounts whenever they recommend the rental marketplace services to others.

For example, Fundrise’s ‘invitation program’ allows users to earn bonus shares once they invite their friends and the latter become users of the platform themselves. The share bonuses commonly range from $25 to $100 depending on the account value.

When looking for crowdfunding platform developers, focus your search on teams that have specifically based their activities in real estate. You might have heard a million times that proceeding with a generic developer is a good idea, and sure it is, but will a generic development team know about the pains and challenges of what being in a real estate business is? No. That’s why you need a crowdfunding platform developer that has been in real estate long enough to understand the intricacies of being in the industry and growing in the constantly changing digital landscape.

Ascendix has been empowering real estate companies and startups with top-notch solutions for 2+ decades. By choosing Ascendix, you’re not just getting a tech partner that knows how to create a crowdfunding platform, you’re gaining a strategic ally who comprehends the complexities of the real estate sector.

Now moving back to the MVP development. A Minimum Viable Product approach is the version of your proptech solution built with the core features that can successfully meet the needs of early users and provide you with feedback on the tool’s efficiency. With such an approach, developers can build a crowdfunding platform seamlessly, refining the product based on real user experiences and market demands and creating a crowdfunding platform that is an efficient and user-friendly product in the end.

After developers build a crowdfunding platform, quality testing turns into a crucial stage, during which a quality assurance team conducts functional, performance, security, and usability testing to ensure the product’s readiness for launch or deployment.

Further, during the deployment stage, the proptech solution is prepared for its official release to users. The deployment involves implementing strategies for data migration, especially if the proptech solution involves transferring data from legacy systems or previous software versions.

If you hire a generic developer, there is a high chance that deployment will be the last stage in the crowdfunding platform development. But if you’ve hired a proptech development team, your journey doesn’t end with deployment—it’s just the beginning of a long-term partnership. Because a proptech development team understands the unique industry challenges, they’ll offer ongoing post-development support and maintenance services to address any issues, implement updates, and introduce new features as market demands change.

Get an unbiased audit of your current product to identify risks and define growth points.

Year: 2013

Platform Type: Debt crowdfunding

Property Type: Residential, Multifamily

Minimum Investment: $1000

Investor Accreditation: Not required

PeerStreet is a crowdfunding platform that has brought lending to a new level. How does it work? As one of the crowdfunding platforms for predevelopment in real estate, PeerStreet has a goal to revitalize American neighborhoods by matching investors with borrowers.

The company boasts over 1 billion loans funded, 100+ lenders within the network, and 45+ states covered.

Functionality Specifics: Users claim that PeerStreet is a user-friendly platform with a simple registration and authentication process and simple lend-and-borrow process. With Automated Investing feature, PeerStreet automatically identifies and secures your place in investments aligning with your predetermined criteria, including maximum term, loan-to-value ratio (LTV), and minimum yield. Another efficient feature is Scenario Builder that allows users to ‘predict’ the outcome of their investments based on loan-to-value ratio before making an investment decision.

Year: 2018

Platform Type: Land crowdfunding

Minimum Investment: $10000

Investor Accreditation: Required

As one of the land development crowdfunding platforms, AcreTrader has already raised $320M+ in equity. Users can invest in high quality farmland, supporting the farming sector.

The platform is a great place to diversify your portfolio if you’re looking for new investment opportunities but be prepared that the number of projects to invest in is limited due to slow vetting process.

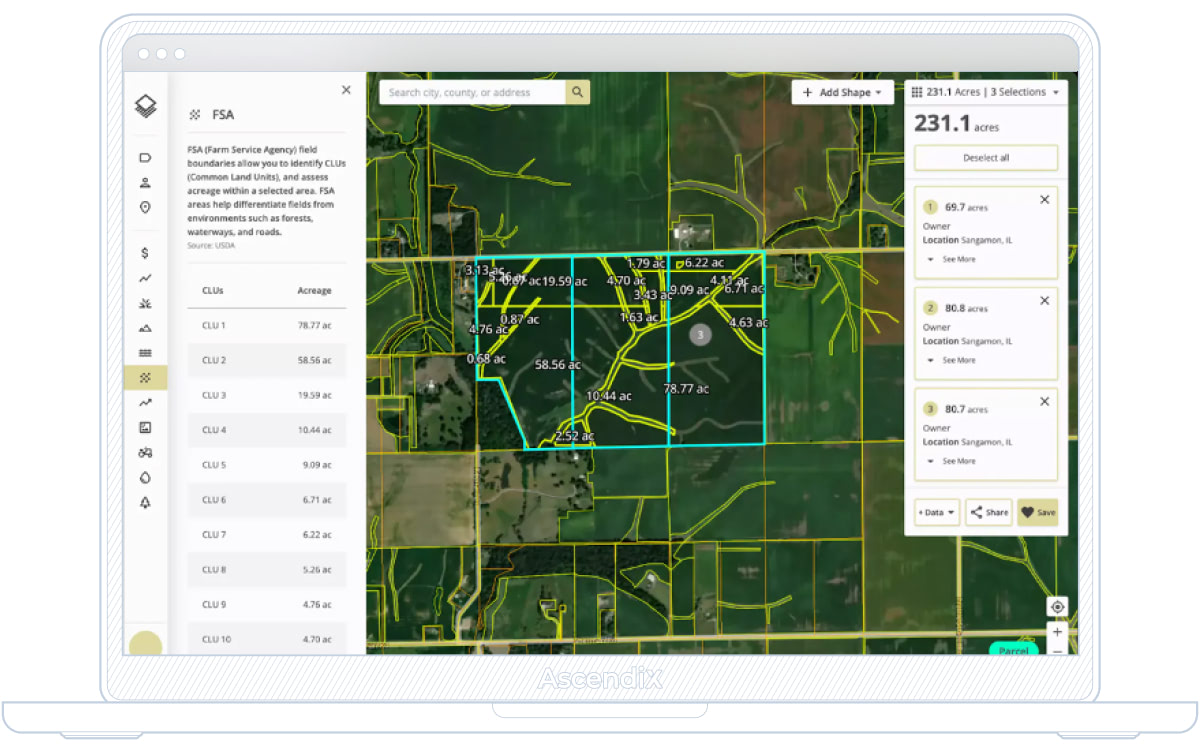

Acres’ Interface

Functionality Specifics: In 2022, AcreTrader has launched Acres, a user-friendly land analysis platform available on both desktop and mobile. This platform grants users access to extensive data such as crop history, vegetation indexes, and public owner records covering 150 million U.S. parcels, along with local insights and comparable sales. Users can generate PDF reports of land data, customize their land maps with drawing tools, notes, etc.

Year: 2010

Platform Type: Equity-based crowdfunding

Property Type: Mixed

Minimum Investment: $10

Investor Accreditation: Not required

The company oversees over $3 billion in equity, representing the interests of more than 387,000 individual investors. On our list, this is the company with the lowest investment minimum and the most diversified investment opportunities, hence the one democratizing the idea of crowdfunding on a national scale.

Functionality Specifics: Though users claim the investment management process to be complicated with Fundrise (as compared to PeerStreet, for instance), they still call the platform’s functionality user-friendly (unlike RealtyMogul’s signing process, the one for Fyndraise takes less than 10 minutes). Users can now access Fundrise Pro, a premium membership service that allows them to build custom investment plans, place direct investments, and access The Wall Street Journal articles curated by Fundrise.

Year: 2013

Platform Type: Equity-based crowdfunding

Property Type: Multifamily, residential

Minimum Investment: $5000

Investor Accreditation: Required

RealtyMogul serves as a real estate crowdfunding platform, linking investors with thoroughly vetted real estate project owners.

RealtyMogul takes charge of the due diligence process, underwriting, and investment execution, simplifying access to commercial real estate investments for investors without the complexities of direct property ownership.

The platform also offers a buyback program – you can get 100% of your funds back if you’ve held your investment for 3 years or more, but you can’t sell if you’ve invested for less than a year

Functionality Specifics: This is the platform with the most complicated registration and authentication process. When joining the platform, users get their own Investor Relations Representative, and by using the online booking calendar, they can actually set up a meeting with them if any questions arise. The deal pipeline has also been improved recently – there, you can sort your projects based on property type, projected revenue, timeline, and also review the revenue generated by past investments.

Year: 2018

Platform Type: Real estate tokenization

Minimum Investment: Not specified

Investor Accreditation: Not required

Fireblocks stands as a premier digital asset security platform, delivering a secure and compliant infrastructure for the storage, transfer, and issuance of digital assets. Trusted by exchanges, custodians, banks, and various institutional investors, Fireblocks is instrumental in safeguarding digital assets against theft, loss, and fraud.

Functionality Specifics: The platform has built an effective real estate tokenization feature required to top operation security. By employing multi-signature wallets, Fireblocks ensures multiple approvals for transactions, while hardware security modules and air-gapped storage fortify against hacking and cyberattacks.

Also, Fireblocks offers robust risk management tools, including transaction monitoring, fraud detection, and real-time alerts, enabling the identification and mitigation of risks.

During our journey of 2+ decades in real estate, we’ve accumulated expertise and knowledge that sets us apart as industry leaders. At Ascendix, we understand the unique challenges faced by real estate professionals, whether it’s optimizing property management processes, harnessing the power of data analytics, or creating intuitive user interfaces.

Why choose Ascendix?

How can we help?

Book a free proptech call today or contact us directly to leverage our proptech expertise and transform your vision into reality.

Real estate crowdfunding is a strategy employed by real estate enterprises to secure funds necessary for project development and completion. This approach involves gathering financial support from a diverse pool of investors, ranging from funding companies to individual backers.

The cost to start a crowdfunding website can vary depending on the size and complexity of the platform, the features and functionality, and the development team’s experience. Commonly, a general estimate ranges between $30,000 and $70,000 for a basic platform with essential features.

Fractional ownership vs crowdfunding in real estate is the core distinction that shapes how individuals invest in property. While fractional ownership is more about fractional second homeownership (often fractional ownership vacation homes), crowdfunding is all about investing in property and growing your investments.

Tania is a fan of technologies and an expert in writing about them. In her content, she shares insights into new trends and proptech solutions in real estate that can help your business thrive while keeping your customers content (pun intended).

Get our fresh posts and news about Ascendix Tech right to your inbox.