Build a Payment App Easily

Outsource money transfer app development to us and we’ll help create P2P payment apps with your business needs and end-users’ demands in mind.

A payment or money transfer app is software that allows users to make electronic transactions from one card/account to another.

The global digital remittance market was valued at $17.88B in 2021 and is expected to reach $42.46B by 2028 (BusinessWire).

Just to illustrate, PayPal’s annual revenue was $25.3B in 2021, a 20.72% increase from 2020. And the company is expected to get over $32B revenue in 2022 according to Statista.

These facts stimulated us to tell you how to build payment apps that rock and:

A p2p payment system is a web/mobile application for making electronic transactions from one bank account to another. Such platforms utilize payment gateways that handle money transferring operations in a fast and secure way. PayPal, CashApp, and Venmo are among the most popular peer to peer payment software.

It is a PayPal-like payment system that has its own money transfer payment gateway to facilitate transactions. This type offers full-featured wallet functionality to help end-users store, send, and withdraw funds.

PayPal and Venmo make the list of the top standalone platforms covering >200 countries and 300 mln of users that transfer money daily.

It means a peer to peer payment system developed by a banking institution to simplify the way users can make transactions.

Zelle is the most popular bank-centric P2P payment app designed by the top US financial institutions including Bank of America, Trust, Capital One, JPMorgan Chase, and others.

Facebook Pay, Snapcash, and Square Cash are examples of top social media-centric platforms. They mean that end-users can transfer funds directly from the social media app connecting their bank account or debit/credit card.

This type of peer to peer payment system includes Apple Pay and Google Pay as the top examples. Mobile OS-focused systems refer to payment service providers integrated right into your iOS or Android smartphone.

Such P2P payment gateways help users transfer funds quickly and easily decrease the cyber threat risks on the operating system’s level.

It’s a heart of your P2P payment system as it enables end-users to store, transfer, request, withdraw and top up the funds.

Integrating VISA and Mastercard payment tokenization services is a must as these two providers cover most countries and banking institutions. These services also provide out-of-the-box functionality for your app users thus saving your funds on peer to peer app development.

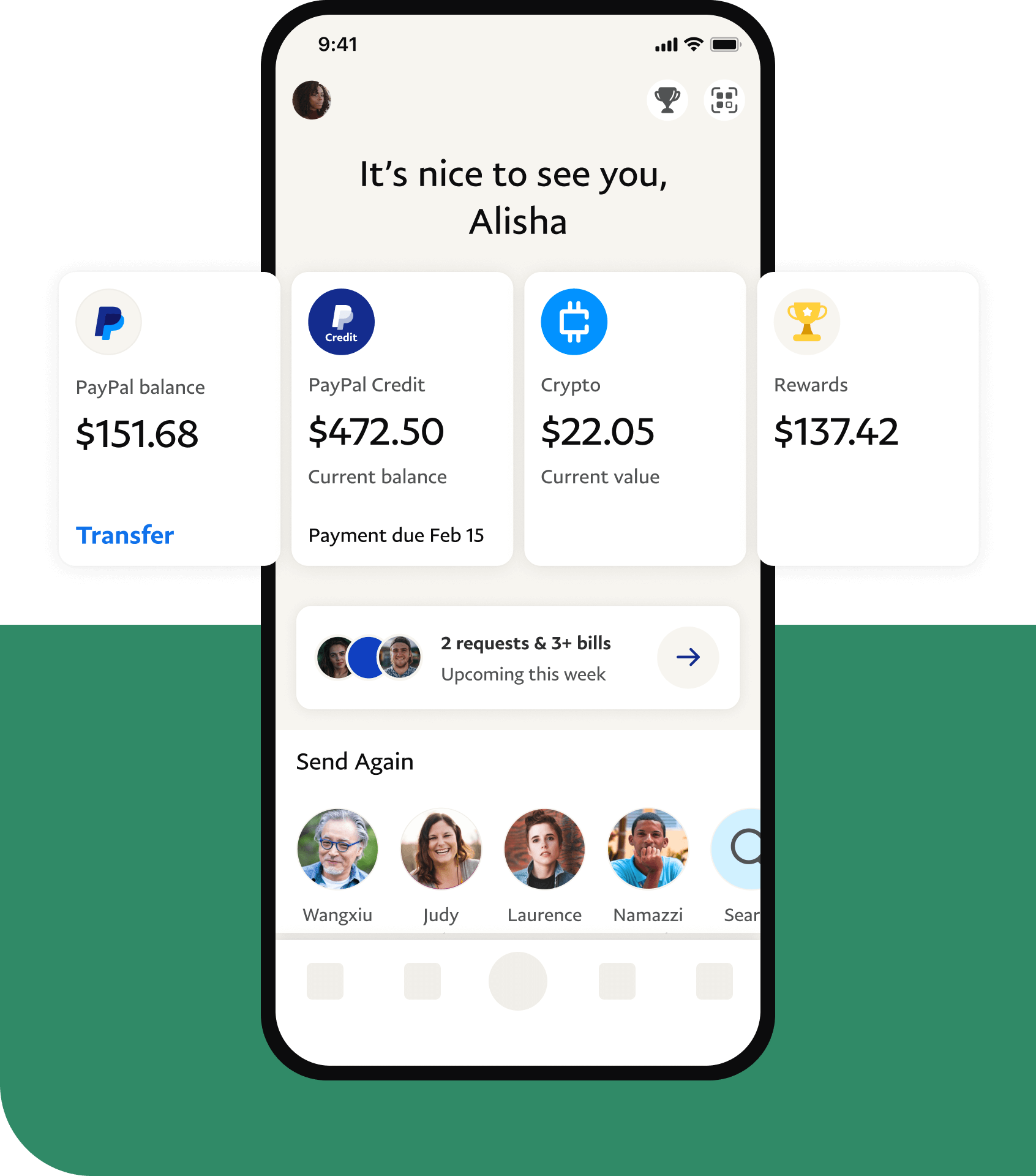

Here is a great example of a peer to peer payment app digital wallet by PaypPal.

Digital wallet by PayPal

Payment app users perform two key operations – sending and requesting funds from other users. This fact makes it a must-have for your app to implement a robust payment gateway to handle transactions in a secure and lightning-fast way.

Most organizations and folks tend to request a transaction invoice or bill to make sure the sender has performed the money transferring operation. So, you should implement and offer users an easy-to-use bill/invoice generating feature supporting the most popular formats like PDF, email-centric, and in-app.

Also, implement a convenient way to share the generated bills and invoices with the recipient with single click ease.

Your P2P payment app won’t become valuable and in-demand without an automated currency conversion functionality. Paying for goods and services abroad, making cross-border payments, transferring money to other currency-based cards, and many other activities become possible for users with automated currency conversion.

Technically, you should integrate your peer to peer payment app with exchange rate APIs that will help you handle automatic conversions at the time of each transaction.

According to KMPG, 72% of enterprises witnessed different types of cyberattacks in 2018. They included phishing, DDoS, exploits of vulnerability, and spam activities that damaged the stability of over 100,000 end-users.

These statistics mean you should pay careful attention to the security of your payment gateway app. Here come one-time passwords (OTP) and unique IDs that users need to enter with the defined frequency. One of the most secure and non-distractive methods is to request an OTP for each login and transaction session.

In terms of unique IDs work similarly, but you can ask end-users to save and store their identifier once while creating their account. It means that hackers have no chance to get a unique ID from the client-side.

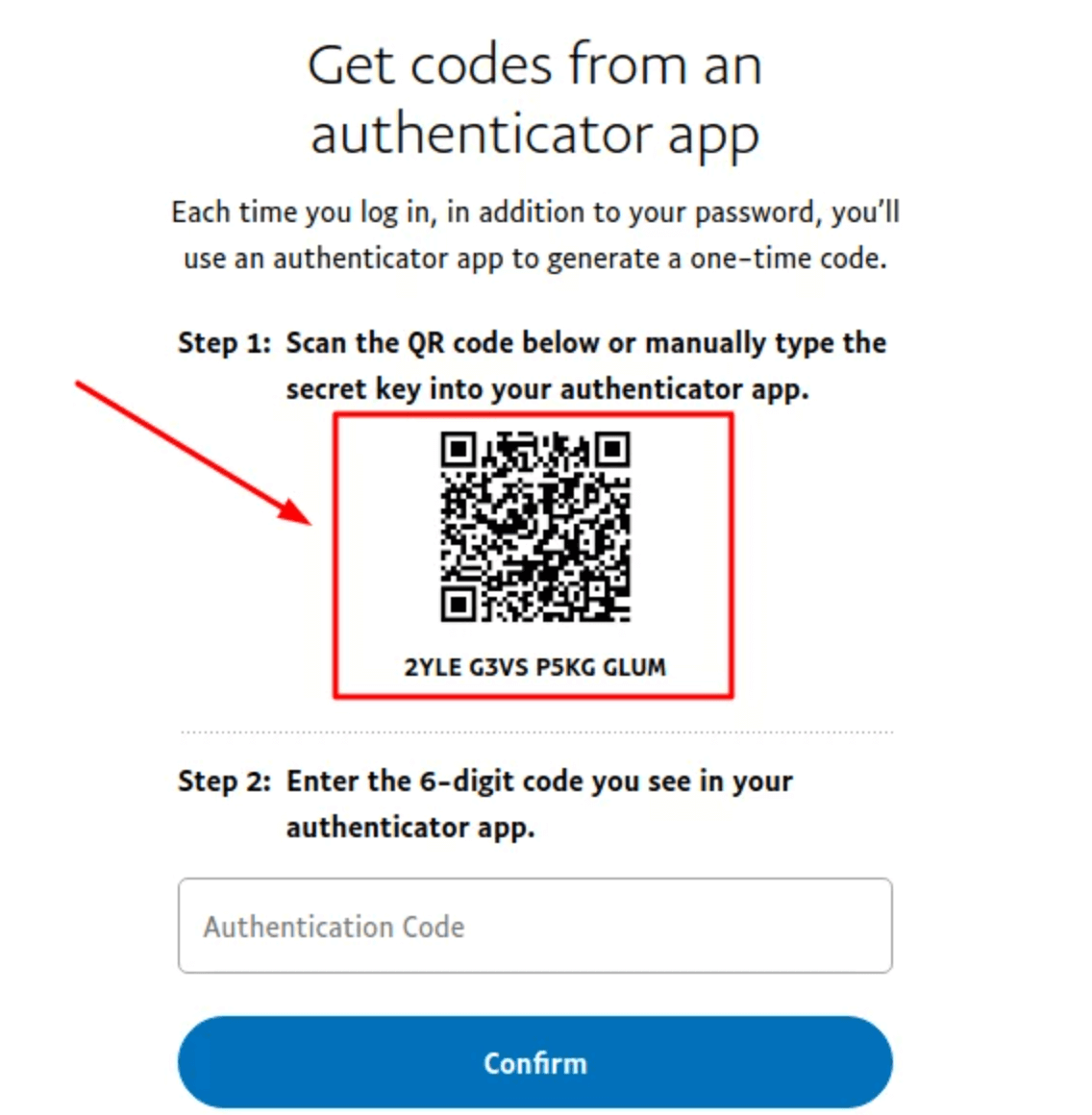

Here is an example of OTP and two-factor authentication functionality by PayPal.

OTP and 2FA by PayPal

Many users need to transfer funds to bank accounts, not only cards. Providing card-account transactions allows you to stay competitive as this functionality is a must. So, don’t leave your end-users without bank account transfers and meet the needs of any scale.

History of transactions helps end-users reconcile their inflows and outflows and keep track of their account’s balance. Try to allow users access as much information as possible.

If you want to stand out from the competition, provide users with deep filters like custom date range, smart sorting, etc. Also, enable customers to generate and download statements convert transaction history into PDFs, and share it via multiple apps and messengers.

A win-win strategy for your payment gateway app. First, you can send new updates, releases, promotions, and offers. Second, end-users can get a notification of account’s receipts, debits, credits, and other activities.

Implement the feature of selecting the types of push notifications customers want to get in the settings so that you can avoid annoying them and keep them on board.

Quite often, users need to attach comments and details to their money transfers so don’t leave them without this functionality. Implement the chat feature in your payment gateway app and enable users to message others while making transactions.

In case you have a chat app, a payment gateway will also become a great offering for your end-users to send money right there and then.

Outsource money transfer app development to us and we’ll help create P2P payment apps with your business needs and end-users’ demands in mind.

Start building a payment platform with selecting the type of a payment gateway app you want to implement. As we’ve already discussed, there are 4 key options:

The type you choose will greatly influence the final money transfer app development costs.

Also, you can launch smartly and save expenses by prioritizing the mobile platform you want to build an app for. For example, you can initially develop your payment gateway app for iOS users.

First, this allows you to save funds on building a payment app on Android.

Second, you can get deep insights into the interests and behavior features of a smaller audience.

Next, define the list of must-have MVP features to launch fast and cost-efficiently. They should provide the core value of your peer to peer payment app to end-users.

It means that customers should try your minimum viable product after launch and realize its advantages over competitors. There is no need to implement additional nice-to-have features as the key goal of launching your MVP version is to validate your idea and collect feedback.

What’s more, the list of must-have features will help money transfer app developers understand how to build payment apps you need from a technical point of view.

The more functionality you prepare before money transfer app development, the higher are chances to get the payment gateway app you’re looking for.

The industry of p2p payment apps and fintech is strictly regulated in many countries. Depending on the region you want to launch your app in, you should conduct deep research. It’s crucial to ensure that your peer to peer payment app will be compliant with the current legislation.

Apart from specific regulations, ensure your app complies with all Payment Card Industry Data Security Standard or PCI-DSS requirements. It’s a one and only must-have standard including 12 requirements to handle cardholder data and become a service provider for card payment transactions.

Acquire the PCI-DSS certificate to boost transparency and trust before launching your peer to peer payment app.

The visually-appealing and modern user interface is a must for your product to compete and succeed. There are two reasons.

The interface is the first crucial touch with your end-users.

The more contemporary and killing your design is, the higher chances are you gain users’ hearts. You should make it unique yet intuitive to find the golden mean engaging with customers.

Competitors are on the alert.

There are dozens or hundreds of similar offerings in the market. This means your rivals are also trying to follow the latest design trends and amaze end-users with new interface killer features. Think outside the box and embed a high-quality user interface and experience from scratch.

You can get inspired and train your visual experience by surfing through Pinterest, Dribbble, and Designspiration where other companies and specialists publish their designs.

In terms of the user experience, we recommend building a clickable prototype, mockups, or wireframes that represent the final user’s flow. This will help you get deep insights into the way customers will navigate through your payment gateway app.

Once your design is in process, you can start implementing the selected must-have MVP features. There are several ways to succeed:

Outsource to a money transfer app development company

If you decide to outsource building a payment platform to a company, follow the next simple rules. They will help you choose the most reliable and experienced provider.

If the company is proving its background on a blob, then it should become an indicator of double-checking its specific skills. Consider companies that know how to build payment apps based on their expertise and success stories. This will save much time and funds for your business.

If the provider cannot offer clients’ reviews and testimonials, there are no grounds to believe its words and consider it as an outsourcing company.

If the company doesn’t offer flexible engagement models, there are high chances to bump into scalability issues during the project development process.

In case the provider doesn’t offer a project discovery phase, it should become an indicator of the potentially low quality of works. At Ascendix, we offer to conduct a project discovery session in most cases. This allows us to get a deep understanding of the project for both our team and a client.

Freelance teams of money transfer app developers can become a great option as they are dumping the market rates and may offer high-quality services. But we recommend following the next principles when hiring freelancers.

Don’t choose the minimal rates you find on the platform. They often mean a little background and low quality of works that freelance specialists provide. However, it doesn’t mean you can’t find an experienced team of money transfer app developers at affordable rates.

Better avoid working with foreign freelancers that have communication barriers or a low English level. This will directly influence the final peer to peer payment app quality as the provider should perfectly understand what you need.

One of the core challenges of working with freelance money transfer app developers is the missed deadlines. Take a careful look at the team’s reviews to know what previous entrepreneurs said about working with it.

Finding a technical partner for your online payment project is a great yet time- and cost-consuming initiative. The chances are high to spend lots of time on finding a perfect match which increases the time-to-market period and requires lots of your engagement.

But still, an ideal technical partner and CTO should perfectly know how to build a p2p payment app, create a solid technical team, recruit talents, and roll out your payment gateway app to the market.

Once the app’s design and features are ready, you should deploy the new version to production and launch your app. The key goal here is to validate your project’s idea through the feedback you will get from early users.

Process any comments to collect as much data from users as possible. The gathered information should indicate what features to change, add, or even remove. Then, convert these notes into a detailed technical specification for money transfer app developers to improve and scale on.

You can perform several test launches and MVP releases. This is normal as your core goal is to transform the minimum viable product and know how to build a mobile payment system with full-featured functionality for end-users. It should be ready to handle thousands of users and provide stability on load.

As an entrepreneur, your key goal is to generate profit from launching and offering a peer to peer payment app. Here are 4 main ways to monetize your money transfer app.

One of the core business models is to charge users per feature. This means you provide specific basic functionality for free but offer paid pricing plans. They should include extra features that users are ready to pay as this functionality meets their specific needs.

For example, you can provide users with deep analytics tools and a smart balance moneybox that will automatically round up about 0.1% of each transaction and save it beyond the user’s balance.

This monetization model means you charge a fixed amount per each transaction so that users get net payments. It is a great yet aggressive business model which may distract some users as they’ve already come up with a specific sum to transfer.

What’s more, refund and chargeback scenarios shouldn’t include additional fees as many users perceive it as non-fair activity. But you can implement flexible payment gateway app fees that work great both for your business and customers.

This strategy is similar to the revenue share and app fee models but implies that users pay for high account activity and don’t charge them for each transaction.

This approach works well if you analyze and count the monetary amount over a specific period per user. Then, you can charge customers on a regular basis. The process will become easier if you work with a billing platform that automates per-usage charging for your business.

With over 10 years of experience in money transfer app development, we know how to build payment apps and meet your needs. We always suggest our clients to begin with a project discovery phase to explore your project requirements.

Our solution architects will analyze your needs and suggest the most time- and cost-effective technology solutions. We will define the scope of work and proceed with peer to peer app development based on them.

We follow the latest trends and utilize the most up-to-date tech stack to create money transfer apps in robust, secure, and high-capacity ways. This approach allows you to forget about multiple technical issues for years.

Wondering how to work with our teams? No worries! We offer a wide range of flexible engagement models that will suit your budget and business needs.

Want to fully manage our money transfer app developers and extend your in-house team? That’s a deal as we have a dedicated team model. Otherwise, fully delegate all peer to peer app development activities to us so that we handle building a payment platform from A to Z.

Ultimately, you can blend our talents so that you collaborate with US-based business analysts and project managers while our European technical teams create a money transfer app that rocks.

You can create a payment system by setting up a hosting and acquiring an SSL certificate. Next, you should build a payment form/page and find a service provider which enables you to handle multiple types of transactions. They should include credit, debit, direct debit, and other types of payments.

It depends on the functionality you want to implement, and the final number of hours required to complete your project. Then you should multiply the received number by the proposed developer hourly rate. On average, a money transfer app cost starts from $10.000.

You can build a payment app using 4 key methods:

Get a detailed fintech software development guide in our post to build payment gateway apps that customers will enjoy.

Daniil specializes in content marketing and has a deep knowledge of promoting the company's products and services through high-quality content. On the Ascendix blog, Daniil shares his tricks and tips on custom software development, provides technology trends and insights, and helps you get valuable content to make your business even more successful and profitable.

Get our fresh posts and news about Ascendix Tech right to your inbox.