“ Progress has been made on inflation, but it's happening at too slow of a pace to satisfy. ”

Amidst the soaring interest rates and swollen costs of living, everybody’s eyes are set on emerging trends in real estate 2025, or where the world’s most asset-heavy industry worth $379.7 trillion (2024) is heading.

2025 Emerging trends in real estate:

- Home Prices Growth

- Rise in Technology Budgets

- PropTech’s Focus on Customer Management

- Renting Overtaking Homebuying

- Workspace Eco-Friendly Conversion

- Strengthening Workplace Policies

- The Sun Belt’s Area Popularity

- Post-pandemic Housing Preference

To provide a clear, unbiased real estate forecast 2025, we have asked multiple thought leaders to share their perspectives on the emerging real estate trends in 2025, technology- and business-wise.

Our emerging trends in real estate 2025 report represents the outlook of a wide range of industry experts, including investors, fund managers, advisers, and consultants and reflects their consensus opinion on the following questions:

- What are the emerging trends in real estate 2025, as well as technology insights?

- What are some of the up-and-coming real estate markets 2025?

- Will home prices drop in 2024? And more.

Real Estate Today

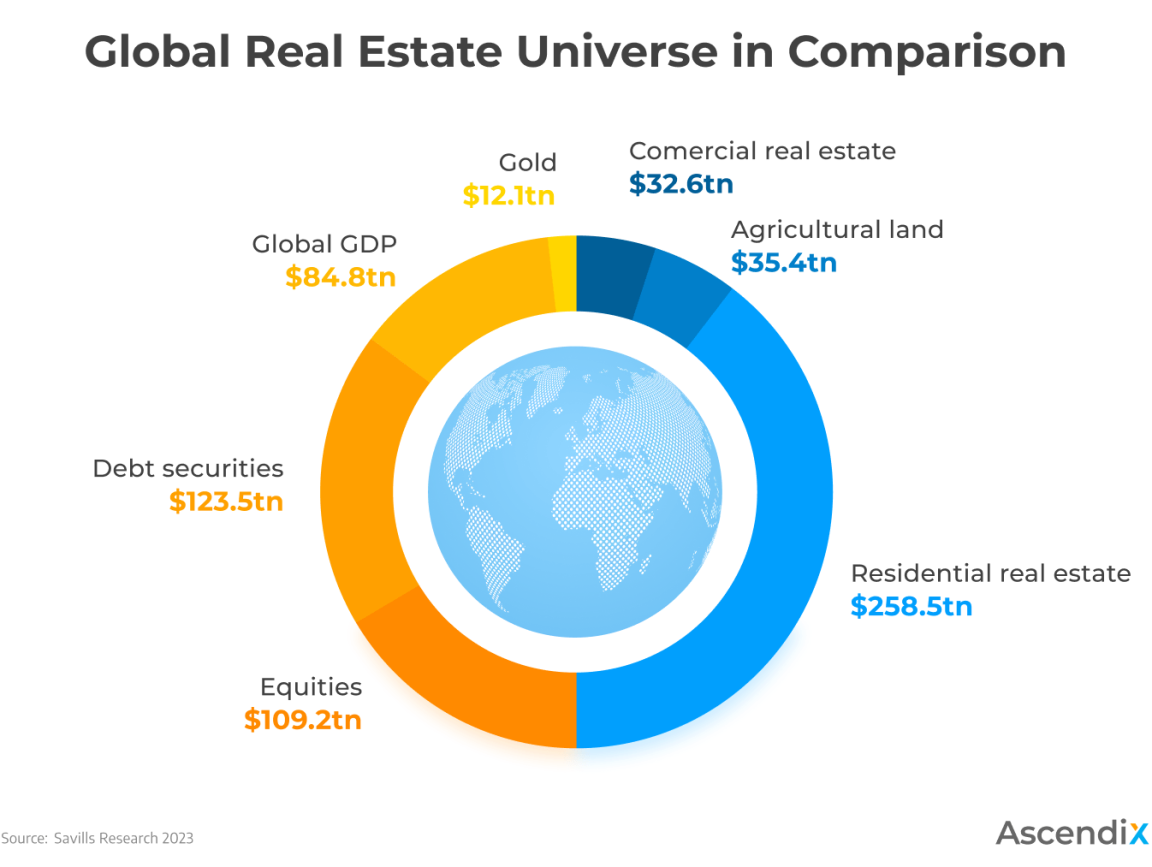

With almost USD $379.7 trillion in global assets, real estate is the biggest industry the world has ever seen. Just to compare, the value of all gold ever mined stands at $14.5 trillion – just 3.5% the value of global property assets.

Apart from gold, real estate is more valuable than all global equities and debt securities combined, and almost four times that of global GDP.

Real Estate Trends 2025 | Real Estate Global Value in comparison

A Warning Concern That Looms Over Real Estate

Since 2019, the real estate market has faced challenges from inflation, COVID-19, the cost-of-living crisis, and rising interest rates. A few years ago, industry managed these difficulties relatively well, thanks in part to proptech advancements that supported everyone involved. However, in 2024, the situation appears more concerning. The combination of continued high interest rates and persistent inflation has strained affordability for both buyers and renters. In this article we’ll break down the latest concerns.

Real Estate Trends 2024

Fads and trends are traditional components of any industry. Proptech is no exception. To stay ahead of the real estate industry trends, take a look at these key points:

1. Home Prices Growth

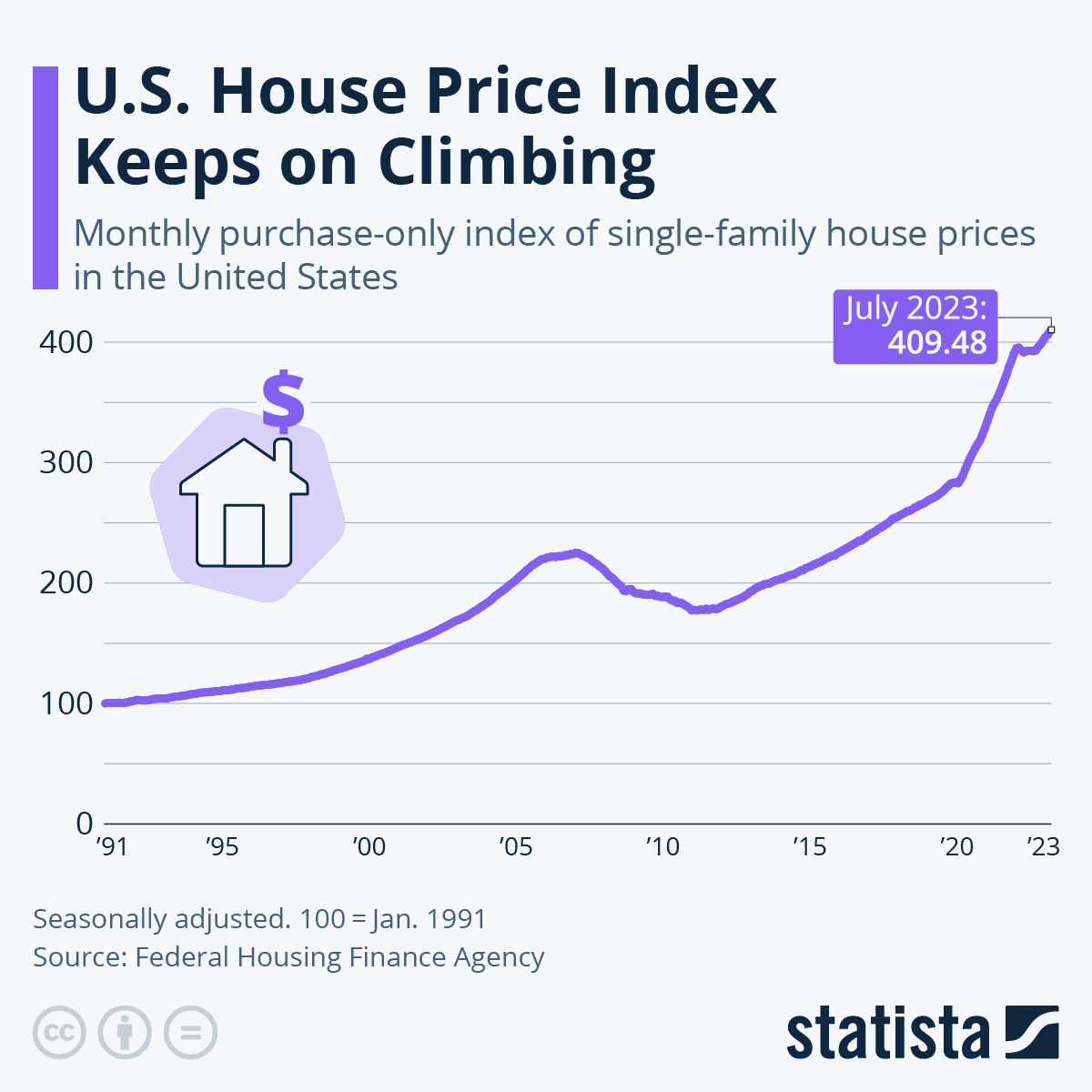

According to CoreLogic’s latest analysis, home prices across the nation increased by 5.3% between March 2023 and March 2024. Additionally, it was predicted that this rate of price growth will slow down as we move into the spring real estate season.

The impacts of this slowdown are tangible in different sectors:

- Mortgage originations have stopped (resulting in significant layoffs of mortgage brokers)

- Home builders are trying to figure out how to move inventory

- Apartment developers have walked away from development projects that they were pursuing

- Bankers and equity providers have decided to move onto the sideline for the rest of the year to see how much further the FED wants to raise rates and what effects those additional increases will have on the markets.

These gloomy real estate trends are going to persist throughout the whole of 2024 and beyond.

Will home prices drop in 2024?

The answer to the question is no. Most experts agree that home prices are unlikely to fall in 2024. Here’s a summary of where some leading industry analysts expect home prices to be by the end of the year:

| Forecast | Expected home price (2024) |

|---|---|

| Fannie Mae | +4.8% |

| National Association of Realtors | +2.0% |

| Mortgage Bankers Association | +4.3% |

For a more current market update, Realtor.com reported in May 2024 that national home prices had increased by 0.3% from 2023, bringing the median sale price to $442,500. Similarly, the National Association of Realtors (NAR) data from April indicated a larger year-over-year rise of 5.7%, with the median home sale price reaching $407,600.

In 2025, the housing market is expected to see moderate growth, driven by various economic and demographic factors. While there are potential risks, the overall outlook suggests stability rather than a significant downturn:

- Home Price Growth: Home prices are anticipated to increase by 1% to 2% above the current inflation rate. This growth is supported by rising real incomes, lower mortgage rates, and improved affordability.

- Purchasing Trends: More buyers are expected to pool resources with friends and family members to purchase homes. This trend includes intergenerational households and families formed from friendships, aiming to avoid the uncertainties of renting.

- Interest Rates Growth: Interest rates are expected to moderate by 2025, making mortgages more affordable and supporting housing demand.

2. Markets with limited housing supply will hold up throughout the crisis

Automate Your Daily Workflows in Real Estate

For 2 decades we’ve been developing bespoke software that automates workflow in real estate companies.

“ High supply is great news for renters and a hurdle for investors,” said RealPage chief economist Jay Parsons. “Renters suddenly have far more options than they’ve had in recent years, and that’s putting downward pressure on rent growth. ”

In 2023, U.S. apartment construction reached its highest level in 36 years, with nearly 440,000 units completed. An additional 671,000 units are scheduled to be completed in 2024, marking a significant increase (source).

This surge in construction comes amid a changing leasing landscape. Initially started during a period of high occupancy rates and rent growth, many of these projects faced a different market upon completion.

Rental markets saw a decrease due to substantial new supply. Meanwhile, nearly one-third of metro areas, mostly in the Midwest and Northeast, experienced rent growth of 3% or more in 2023, driven by limited new supply.

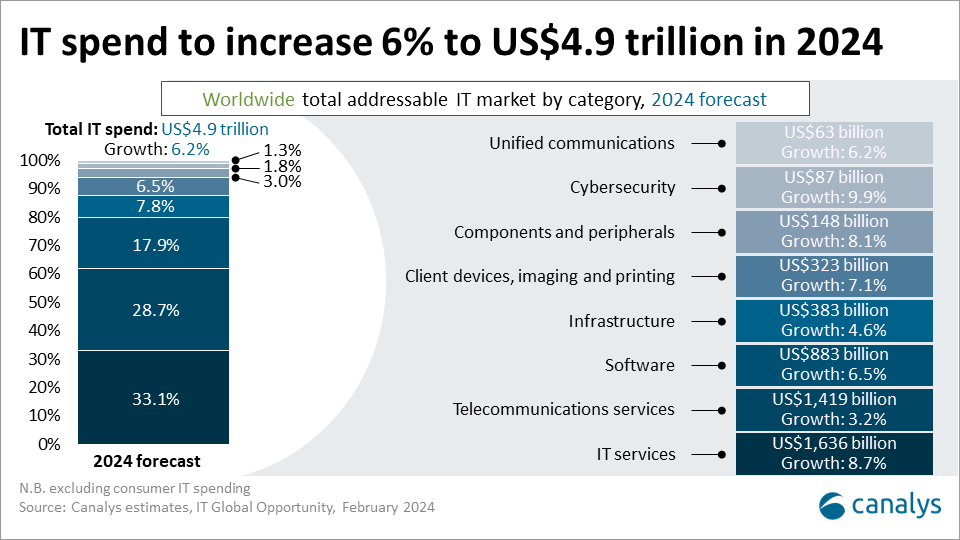

3. Technology budgets to raise in the near-term

Economic challenges are nothing new for 2024. Despite that, one of the emerging real estate trends is technology investments. Canalys’ February IT Opportunity update forecasts a 6.2% growth in global IT spending, reaching $4.94 trillion. This growth persists despite risks and instability. In fact, businesses are determined to use technology and IT services to improve their operations, build resilience, and increase productivity. Partner-delivered IT will make up 73% of this spending, showing how important it is in the tech world.

IT Spendings to Increase in 2024

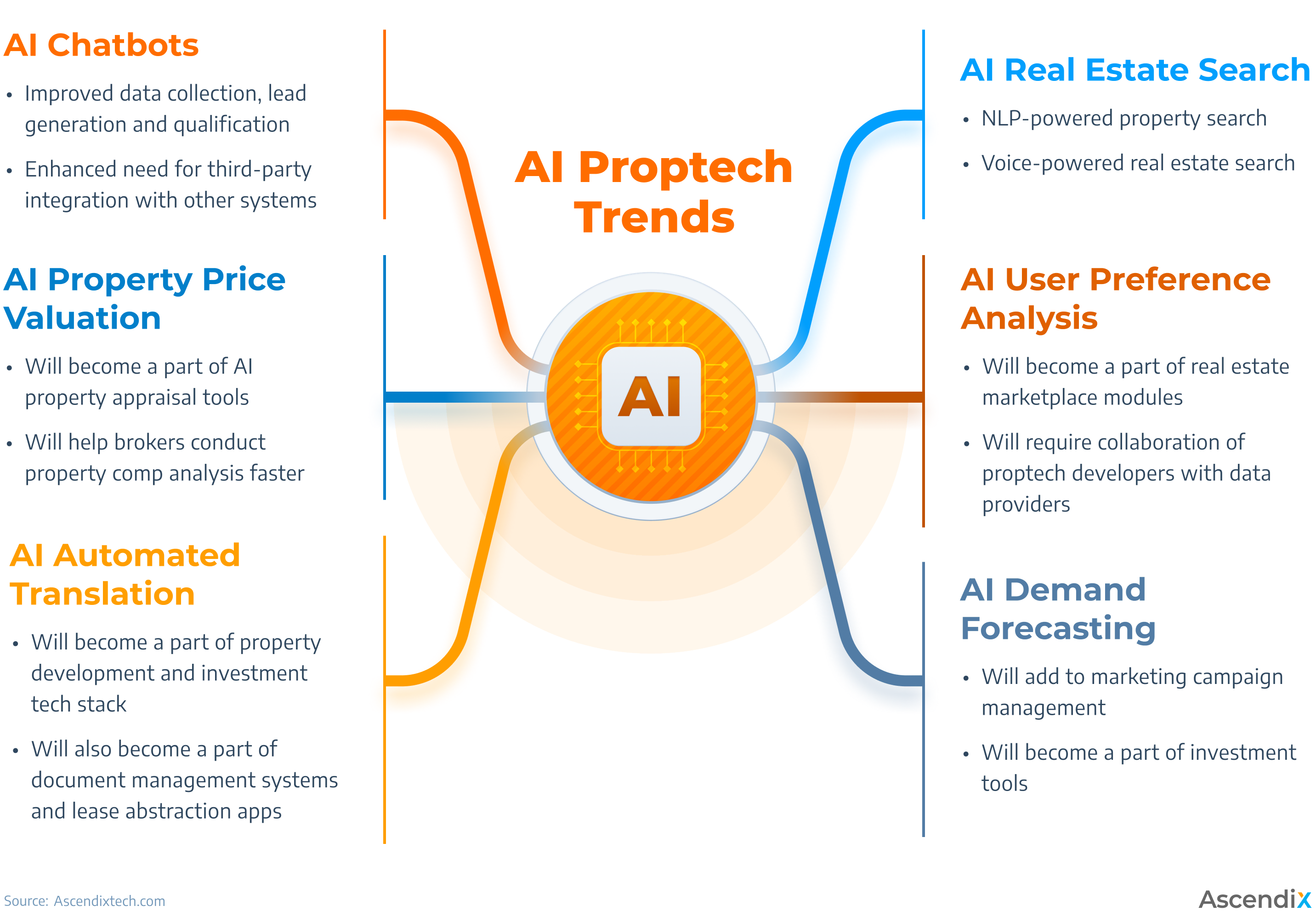

4. AI adoption in real estate

While some cut their technology budgets, thus inevitably sacrificing operational performance, others will move ahead of the pack by embracing one of the major emerging trends in real estate for 2024 – AI adoption.

According to recent reports, real estate firms of all sizes are focusing on embracing AI-powered solutions. Of the main interest are the following innovations such as AI property valuation and AI lease abstraction, internal data management, property management, and reporting.

AI PropTech Trends

5. Rentals will overtake homebuying, creating new opportunities for proptechs and investors

“ As real estate transactions are slowing down following the soaring rise of interest rates, less people can afford to buy a new home. This is why I think that the focus is going to be on renting instead of homebuying and selling. In the new reality, it is going to be tough for some companies to survive, but it definitely is going to be a huge opportunity for new ones. ”

As mortgage rates keep growing almost universally, more and more people turn to long-term rentals as opposite to homebuying. This real estate trend 2024 has been manifested in the Zillow real estate forecast 2024 and by our respondents from Plug and Play – a global platform matching investors, startups, and corporations.

Elena Ruiz, a global investor and innovation expert representing the above-mentioned firm, says that this emerging trend spurs a lot of opportunities for numerous proptech startups redefining how people search for rentals (e.g., a Canada-based startup Properly), build credit for rent, pay for their home, etc.

Elena also points out that in the light of this emerging real estate trend 2024 toward rentals many smaller proptech companies initially focused on mortgages and homebuying will have to recalibrate their business model – or they will simply not survive this storm.

This real estate trend 2024, however, will not hit long-established iBuyers and home listing platforms like Zoopla, Rightmove, and Opendoor, as they have enough resources to withstand the change of paradigm.

Build Real Estate Software that Automates Your Workflow

Hire Ascendix. We’ve been at the forefront of Property Technology for 16+ years.

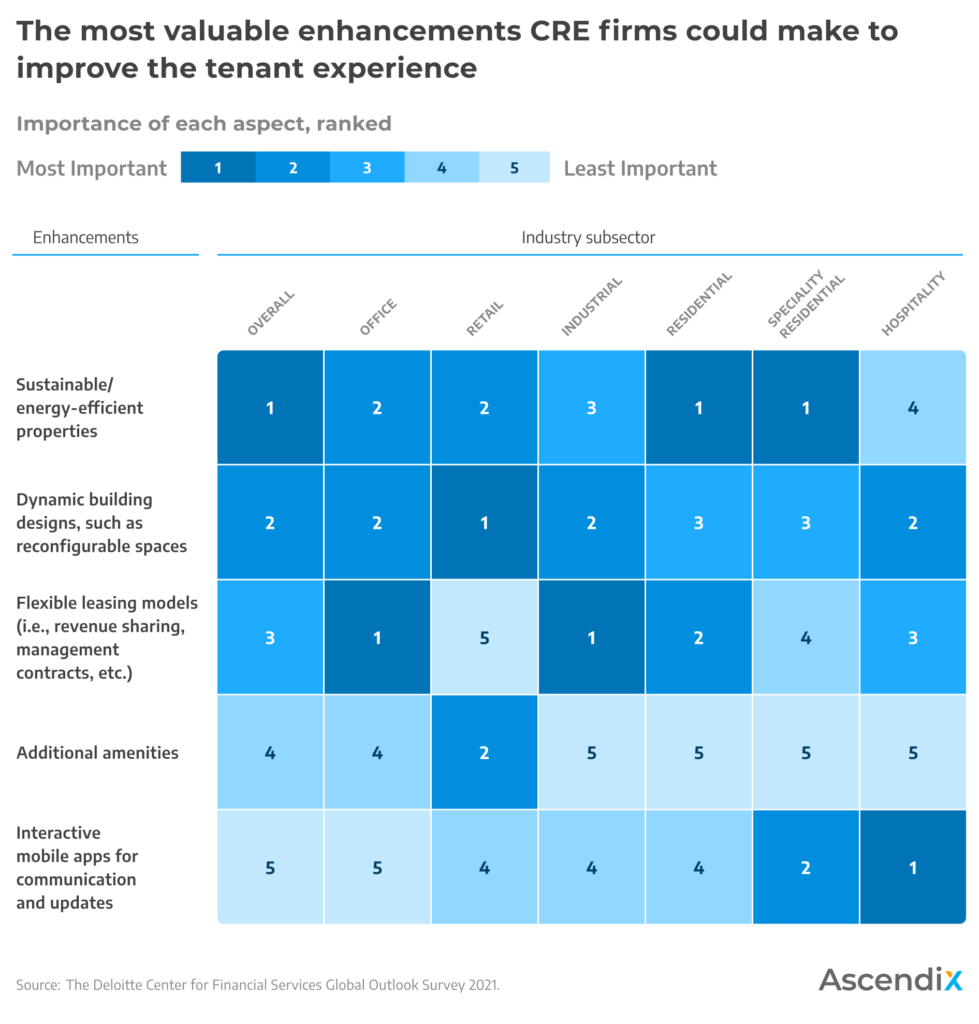

6. The focus will shift from the property itself to the “tenant experience” it can give

“ No longer will the focus be so much on the building, but on how the building impacts the productivity of people working or living in it. By building I mean the physical space itself and people working behind to bring it to market, i.e., real estate brokers, property managers, contactors, etc. ”

This real estate trend 2024 is what Forbes calls “tenant experience,” which is the sum of every aspect that impacts property occupants during their time in a building (source). These can include services and amenities, maintenance and cleanliness, and of course, quality communication with a real estate service provider.

As tenant expectations evolve, however, ensuring decent tenant experience becomes almost impossible without an industry-wide shift in mindset in how firms engage with tenants, end-users, investors, and developers. Deloitte refers to the new business model as Real-Estate-as-a-Service, which implies not only physical space but digital services combining data, technology, and strategic changes.

Real estate leaders and investors can unlock additional value from the REaaS model by implementing the following real estate technology trends:

- Customer Relationship Management technology

- Green / sustainable technologies

- Dynamic / reconfigurable designs

- Flexible leasing models

- Additional amenities

- Interactive mobile apps for communication and updates.

Real Estate Trends 2024 for Impeccable Tenant Experience

7. Smart City technologies are on top of the real estate agenda in 2024

“ Smart Cities, or Urban Tech, is an umbrella term for energy, IoT, construction, mobility, GreenTech, and ClimateTech solutions. Within green and climate technology space, the investment is flowing more toward heavy industries, mostly to assess and reduce the production of emissions. In the residential space, these solutions are focused on the optimization of energy consumption in homes, especially given the soaring gas and electricity prices across Europe. ”

Smart City technology, i.e., modular construction, ClimateTech, GreenTech (Artificial Intelligence, Internet of Things, and Big Data) will largely define what will the housing market look like in 2024, according to Elena Ruiz from Plug and Play.

In her real estate forecast 2024, she envisions that over 50% of all proptech investment will be routed into startups that embrace new “green” ways of developing, constructing, and utilizing the property.

As this area of real estate has been seriously underinvested for decades despite the fact that real estate as a whole is actually responsible for around 30% of all emissions, there is a lot of low-hanging opportunities for both proptech innovators and investors.

The most lucrative possibilities for proptechs, given the skyrocketing gas and electricity prices in Europe, arise from the need to reduce energy consumption (e.g., London-based Carno.io addressing the heating issues by providing an easy tool for heat loss calculations and design), transition to solar panels (Pine Gate Renewables), etc.

8. Real estate tokenization to democratize fractional ownership

Need Technology Partner with Experience in Real Estate?

We speak real estate. We’ve been developing software products for real estate for 2 decades. Speak to Ascendix consultant.

“ Fractional ownership and fractional investment is already being pretty massive because it is democratizing the real estate space. Everybody is going to be able to invest in real estate if they have a hundred dollars in their pockets. And this is going to push big players towards rethinking the way of doing things. ”

There isn’t and will not be a single real estate owner anymore, says Elena Ruiz. Blockchain is helping to democratize and spread the ownership of a single property between multiple stakeholders through the conversion of real estate assets into tokens, like Bahnhofstrasse building in Zurich and Britain’s Greenwich Peninsula project.

And despite the recent volatility on the cryptocurrency market, the real estate trend 2024 toward tokenization seems to be gaining momentum with Miami having announced its plan to accept crypto tokens for preconstruction deposits for its Cipriani Residencies project and Jamestown accepting crypto as rent payment for a range of their development across the US with a plan to expand to Europe (source).

9. Property management technology takes the spotlight

“ Early in proptech we saw a lot of fintech businesses around the home purchase transaction. However, with rising rates, I think we can realistically expect to see a retraction there. Instead, look for innovation in and around property management for all real estate asset classes to better manage the supply chain of real estate. ”

Property management has experienced steady growth over the last decades as a field with promising opportunities for modern businesses. While 2009 shows that the property management revenue was around $60 billion, 2022 boasts $99 billion in the US.

With North America and Europe leading the global property market, the industry will keep growing despite the political turmoil and economic fluctuations. And with real estate transactions dropping in the second half of 2022 and early 2024 due to soaring interest rates, real estate professionals need to better manage the real estate supply chain.

In the end, there will be more tasks to solve and more property to manage, especially in the rental property space. Learn how to simplify rental property management with technology.

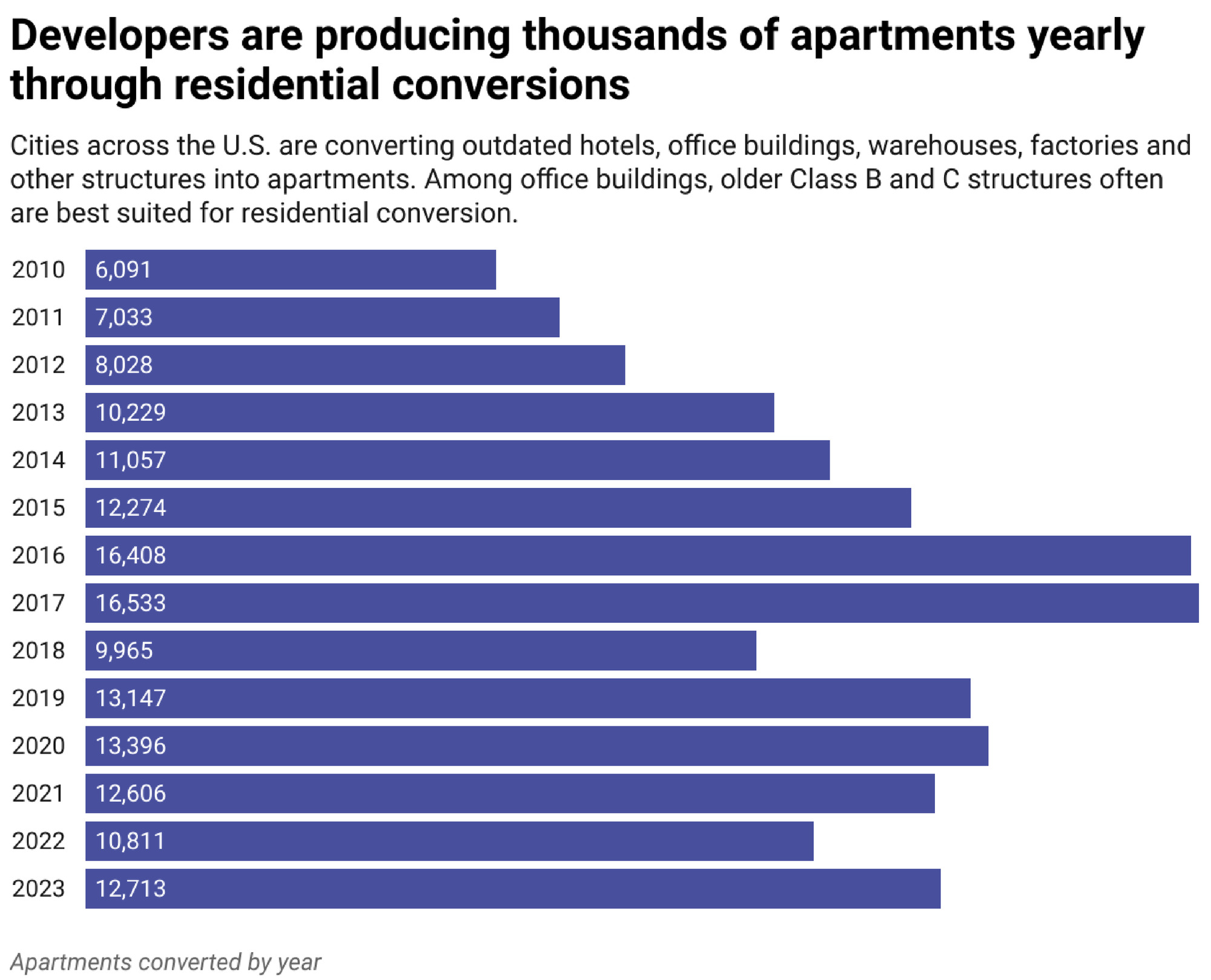

10. Vacant workspace to be converted into residential housing

“ At some point in the next three years, the office market will reach a tipping point … the result will be a relative avalanche of conversions of various kinds... Offices will start to compete directly with housing — by turning into apartments. This will be a marginal issue in most markets, but in some cases, it might have a real impact on the housing supply. ”

The COVID-19 pandemic showed American businesses that employees can work productively from home or a favorite coffee shop. Post-COVID-19, employers are struggling to find the right balance of in-office and remote work.

This shift is affecting commercial spaces. Office vacancy rates shot up post-COVID-19 and remain near 20% nationwide, the highest rate since 1979 (source). Tenants are downsizing or relocating, putting pressure on existing development loans and leading to defaults or creative refinancing in a market already challenged by higher interest rates.

Office tenants with more resources prefer newer and larger buildings with more amenities, known as Class A or “trophy” buildings. Older Class B and C buildings, which often have fewer amenities or less-desirable locations, are struggling to fill space.

High vacancy rates are forcing developers to get creative. With reduced demand for older buildings and housing shortages in many cities, some downtown buildings are being converted to residential use. These projects often include affordable housing, supported by tax incentives.

Vacant workspace is converted into residential housing

Proptech Software Development Portfolio by Ascendix

Check out the overview of the proptech consulting and software development projects we delivered to our clients.

Real Estate Investment Trends 2024

It’s high time to look at what the third quarter of 2024 brings into real estate investment trends. So far, we have:

- Up-and-coming markets in the southeastern states (USA)

- Increased use of AI investment tools

- Growing real estate in Asia and the Pacific

- Digital house hunting

- Smart construction trends

Without further ado, let’s dive in:

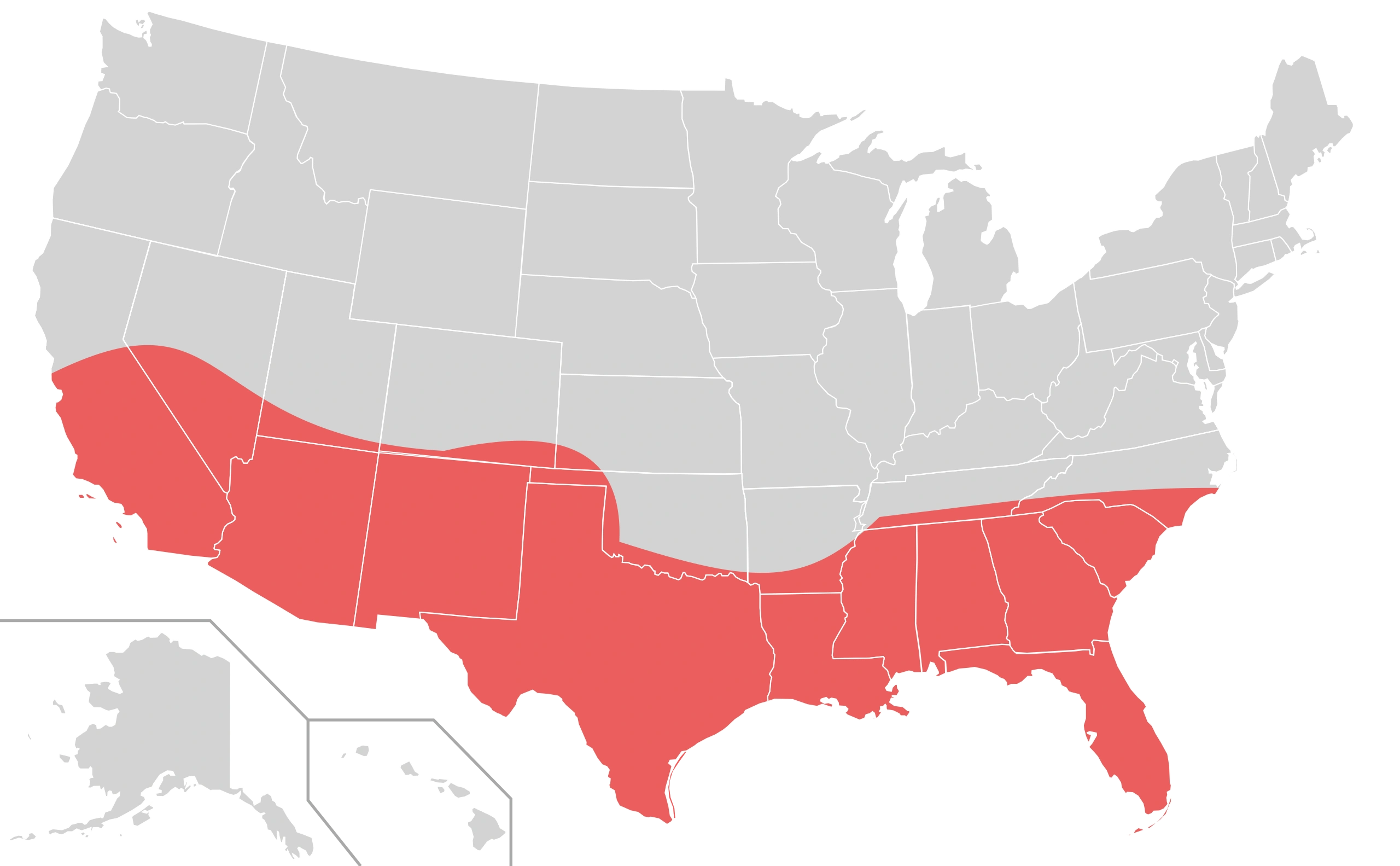

The Sun Belt area is a new hot spot for buy-to-let investors

The investors are here for the new wave on the American dream. The urban city-dwellers are leaving big cities in favor of the southeastern — Sun Belt — states.

The Sun Belt region is becoming more popular, with its population expected to grow from 50% to 55% by 2040. This area is attractive because it has lower taxes, more affordable housing, and more space than cities like New York. For investors, this means there’s growing demand for all types of real estate. Cities like Dallas and Tampa are now top spots for real estate investment. Despite rising home prices, the lower living costs and better quality of life continue to draw people in, making it a great place for long-term investments.

The Sun Belt area

House hunting turned digital

House hunting has gone digital. The pandemic sped up the use of virtual tools like 3D tours, drone videos, and virtual staging.

Websites like Zillow let buyers browse listings, talk to agents, and explore mortgage options online. Searches for “virtual staging” have increased to 13,000 per month in 2024, up from 8,000 in 2020. For investors, more online interest means more potential buyers and faster sales, making the market more attractive for investment.

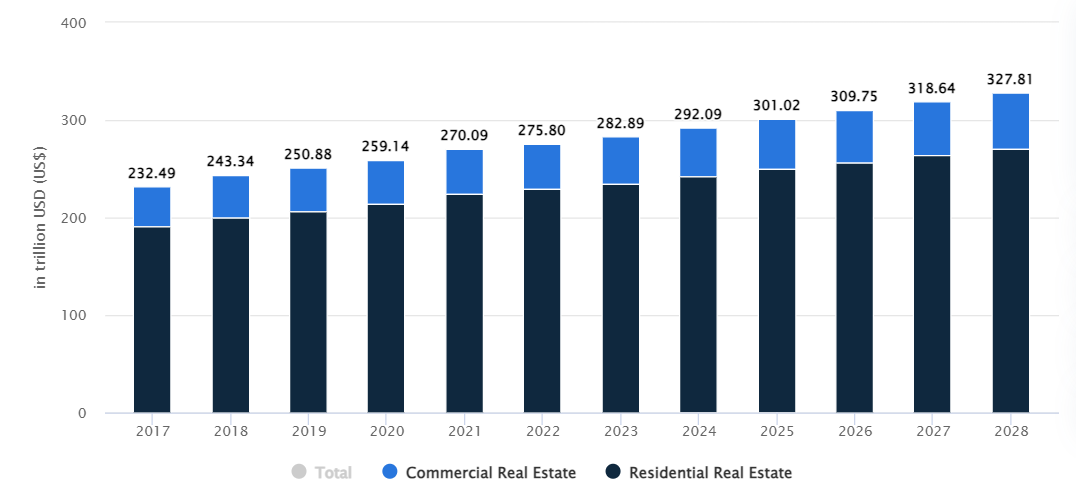

Growing real estate opportunities in Asia

The real estate market in Asia is booming, with projections showing a value of $+292.10 trillion in 2024. Residential real estate is leading this grow.

Real estate opportunities in Asia 2024

This rapid expansion offers investors significant opportunities:

- Residential real estate: Strong employment and economic development are the main drive. Substantial growth is projected in cities like Manila (5.9%), Sydney (5%), and Mumbai (5.5%).

- Domestic investment surge: Since domestic activities have been dominant in the Asia-Pacific area, the multi-family real estate is forecasted to exceed the previous record set in 2020.

- New opportunities in China: The living sectors market in the Chinese mainland has great growth potential. With a huge population of 1.4 billion, investors see an opportunity to develop affordable housing solutions.

Post-pandemic housing preference

The result of remote work has set an ever-growing trend — working-from-home-friendly properties. The key features include single-family homes with dedicated spaces for home offices, high-speed internet connectivity, and proximity to essential amenities.

The impact of smart cities on construction industry operations

Projected to reach $203 billion by 2024 and potentially exceeding $676 billion by 2028, global spending on smart cities is revolutionizing construction practices.

Companies are increasingly incorporating IoT (Internet of Things) technologies into building materials, a trend already familiar to 60% of US building managers.

This integration involves embedding sensors and connectivity features directly into materials like concrete, glass, and insulation. It enables real-time monitoring of structural integrity, energy usage, and environmental conditions. By collecting and analyzing data, construction companies:

- Optimize building performance

- Reduce maintenance costs

- Enhance occupant comfort and safety

What Real Estate Technology Trends Are Going to Be on the Rise?

Amidst a tough economic situation, there is a notable increase in technological investment. For instance, recent advanced solutions that gain popularity include AI for document processing, AI property valuation, and cutting-edge property search solutions. These advancements reflect a growing demand for automation solutions like CRM systems, property management platforms, and data management tools, alongside emerging technologies such as tokenization and GreenTech.

Why Ascendix for Real Estate Innovation

Ascendix has been at the forefront of delivering cutting-edge real estate technology solutions for nearly two decades.

Our client roster includes industry leaders such as JLL, and Savills, with operations spanning five global offices. We offer tailored solutions that meet the unique needs of each client, whether assessing AI readiness, implementing system integrations and upgrades, or developing custom CRM solutions, including Salesforce-based platforms.

Our expertise extends from building solutions from the ground up to utilizing advanced frameworks like AI for document abstraction and AI-driven property search.

Tell us more about your project and we’ll make sure to provide you with the knowledge and resources to make innovation happen for you and your business.

FAQ

What Real Estate Technology Trends Are Going to Be on the Rise in 2024?

A few emerging trends in real estate, 2024 will gain prominence. AI and automation will be increasingly used for property management. Big data and analytics will provide deeper insights into market trends and customer preferences. Sustainability technology will also be adopted more widely to track and reduce the carbon footprint of properties.

What Up-and-Coming Real Estate Markets Will Be There in 2024?

The future of real estate is expected to bring positive changes in 2024. Austin, Texas, will continue its growth due to expanding tech and business sectors. Nashville, Tennessee, is to attract more residents with its strong job market and population growth. The Southeast will remain appealing to businesses and young professionals. Additionally, the Sun Belt area will become more popular for its affordability and job opportunities.

Share:

Alina is a proptech technology expert and a storyteller at Ascendix, investigating the real estate market and sharing her insights and tips with up-and-coming proptech startups, established real estate agencies, and industry stakeholders. She talks about real estate technology, business automation, and industry news.

(21 votes, average: 4.80 out of 5)

(21 votes, average: 4.80 out of 5)