Looking to Build a Proptech SaaS Solution?

Hire Ascendix. We’ve been at the forefront of SaaS Proptech for 16 years.

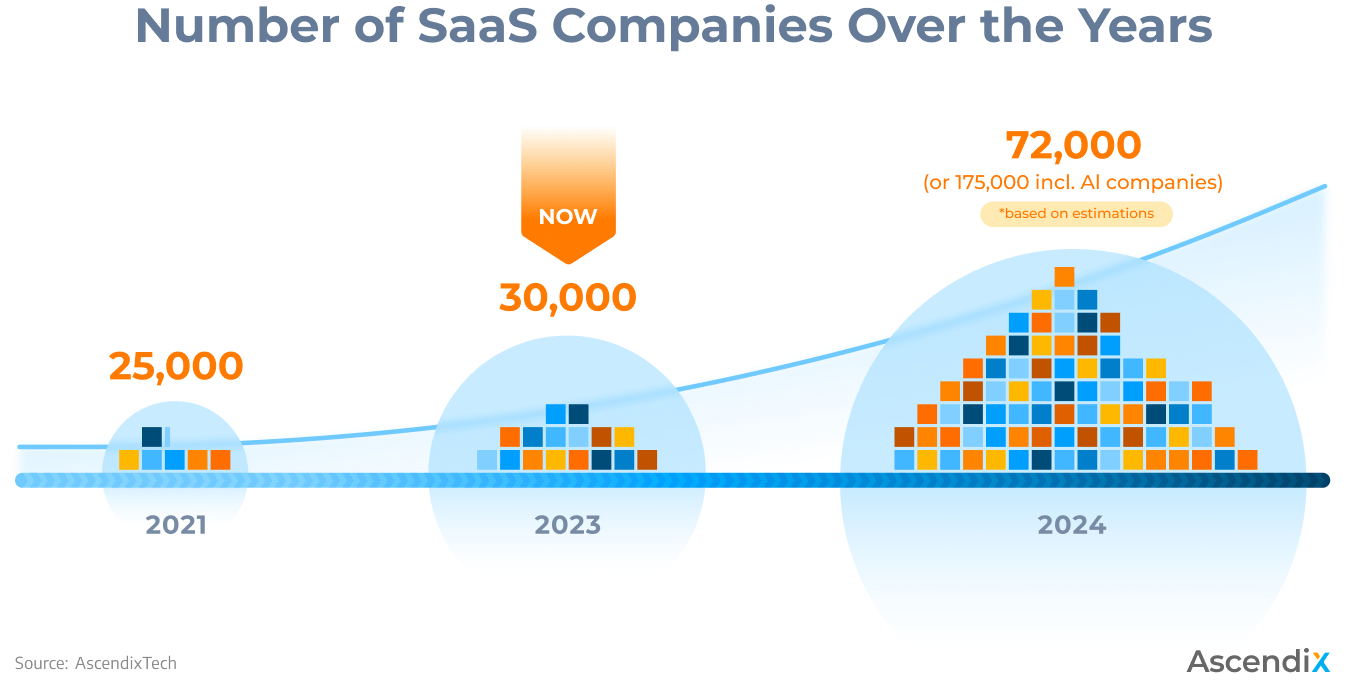

In 2023, the world of SaaS is rapidly expanding. There are currently over 30,000 SaaS companies serving millions of customers.

The market size of SaaS is projected to reach $700 billion by 2030, with a CAGR of 18.3% from 2022 to 2030. The United States holds the largest share of the global SaaS market, accounting for over 70% of the market size. At the forefront of this booming industry is the world’s largest SaaS company, Salesforce, which generated over $21 billion in revenue in 2021.

Below, we will provide an overview of the key statistics on SaaS, including SaaS market size, growth rate, number of Saas companies by region, and the top SaaS companies among them.

Table of Contents:

The number of SaaS companies in the world in 2023 is about 30,000, according to a Statista report on SaaS organizations by country (Source).

By the end of 2023, there will be anywhere from 30,000 to 72,000 SaaS companies in operation. However, this estimate doesn’t account for companies specializing in artificial intelligence, which could increase the number to 175,000.

Number of SaaS Companies Over the Years

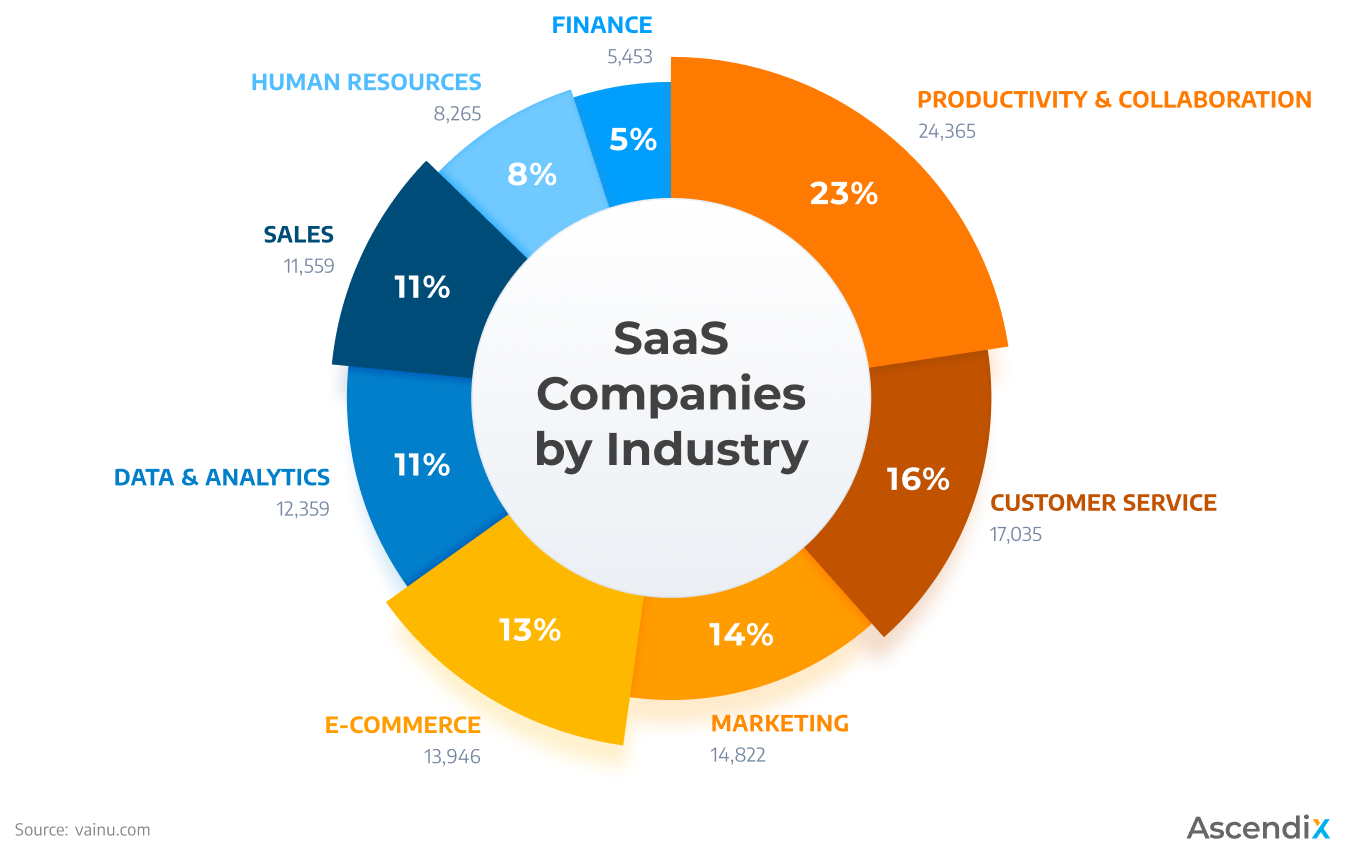

These SaaS companies operate in various segments, with over 24,000 Productivity Tools and Collaboration Applications alone.

Additionally, there are about 17,000 companies like Salesforce in the Customer Service Solutions segment, 15,000 in Marketing Software, nearly 14,000 in E-commerce, and 12,000 in Data & Analytics. Sales come in at 11,500 companies (these estimations include AI companies).

SaaS Companies by Industry

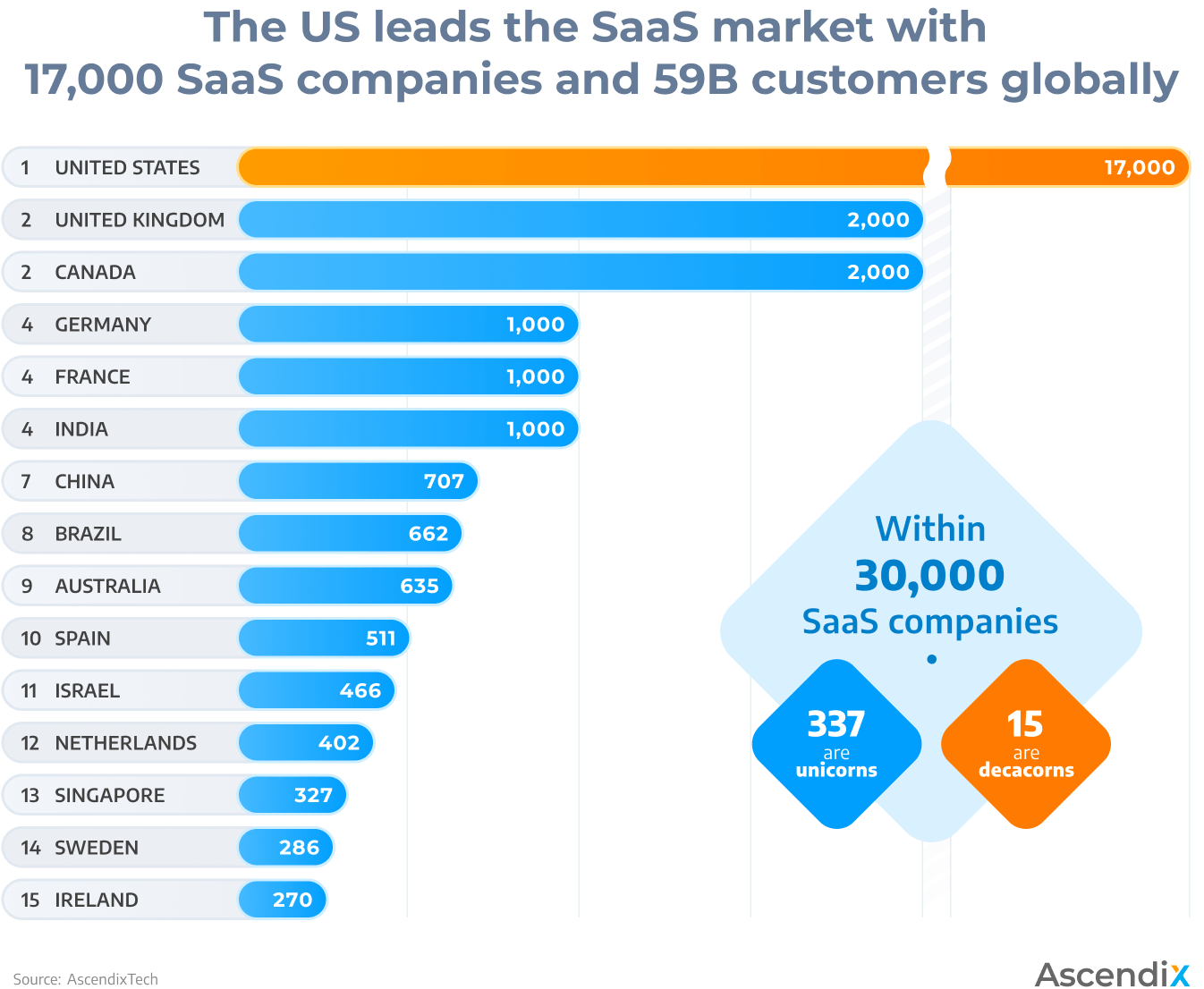

According to Statista, the leading country by number of SaaS companies is the United States with a staggering 17,000 SaaS companies and 59 billion customers globally, followed by the United Kingdom and Canada with approximately 2,000 SaaS companies each, while Germany, France, and India round off the top six with 1,000 SaaS companies each.

These firms include established companies such as Dropbox and Adobe Creative Cloud, as well as small startups.

Number of SaaS Companies by Country

In fact, the US has over 8 times more SaaS companies than any other country. In the USA, Silicon Valley is the hub for top enterprise SaaS companies and products (Google Workplace, HubSpot, Jira, Slack, Atlassian, GitHub, Figma, Salesforce, Xero, Zoom), with two-thirds of the top 100 located there.

The top five SaaS companies in the USA (Microsoft, Salesforce, SAP, Oracle, Google) are located in California, Washington, New York, Massachusetts, and Utah.

Europe as a whole has a rapidly growing number of SaaS companies, with countries such as the UK, Germany, and France leading the way. Following the US is the United Kingdom, with 2,000 companies and 3 billion customers.

The UK’s SaaS market was valued at €7.5 billion in 2020, and it is expected to double by 2025.

Canada, Germany, and France are three countries that follow closely behind with relatively high numbers of SaaS companies’ revenues and customer rates.

It is predicted that by 2025, Germany will experience the most significant growth among all SaaS companies, increasing to €16.3 billion.

India stands out on the Asian continent, with 983 companies and two billion customers. Brazil is also highly prioritizing SaaS as a startup model, with 41.12% of SaaS companies being Brazilian startups just two years ago.

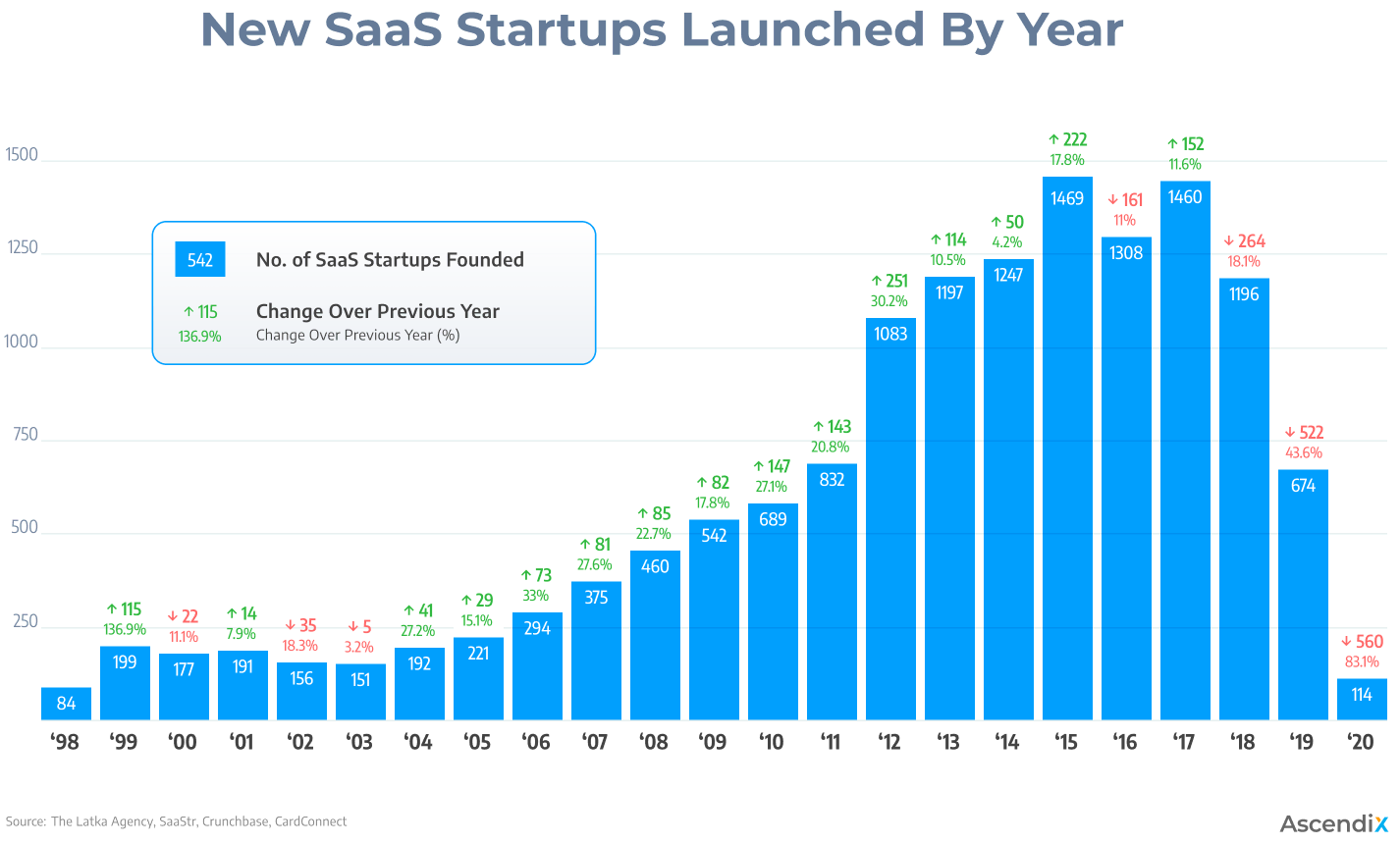

In 2022, over 377 new SaaS companies were created, and this number is expected to increase in 2023 (source 1, 2).

New SaaS Startups Launched By Year

Over time, there has been a general increase in the number of newly launched SaaS companies, except for a slight drop in 2015. This trend reflects the growing popularity of the SaaS business model and the increasing demand for cloud-based software solutions.

In 2018, the number of newly launched SaaS companies reached its peak, with more than 2,000 new companies entering the market that year. This may indicate that the market is becoming more congested and competitive, making it difficult for new companies to establish themselves.

The number of newly launched SaaS companies in 2020 is lower than in previous years due to the COVID-19 pandemic’s impact on the economy and business activity.

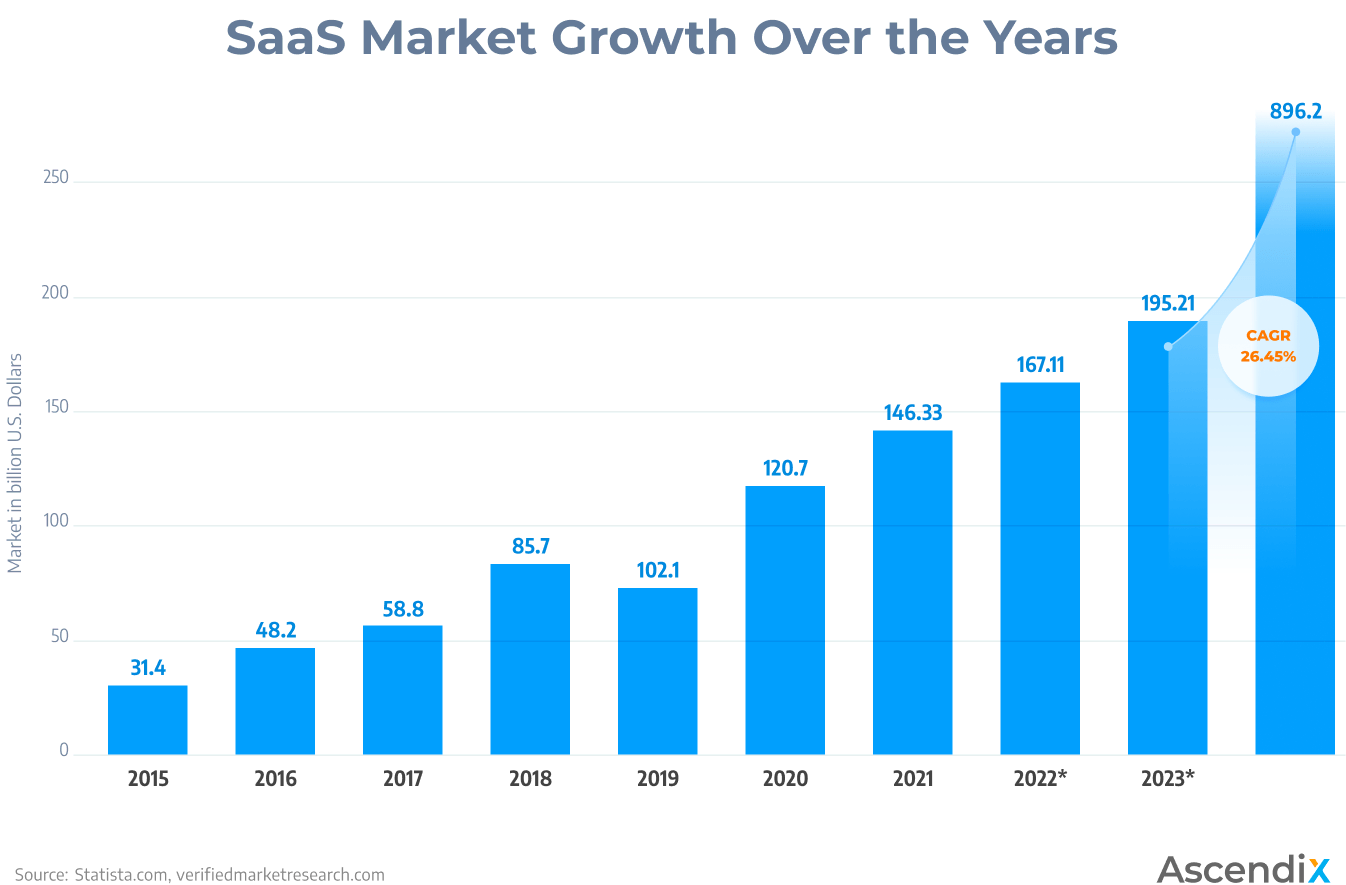

As per the findings in the report published by Verified Market Research, the global SaaS market size had a valuation of USD 151.31 billion in 2022, and it is expected to reach USD 896.2 billion by 2030, growing at a CAGR of 27.45% during the predicted period of 2022-2030 (source).

SaaS Market Growth Over the Years

The report highlights that the SaaS market is experiencing growth due to the surge in demand for cloud-based solutions and the increasing adoption of mobile devices. Furthermore, the market is expanding due to the cost-effectiveness, scalability, and easy deployment offered by SaaS solutions.

According to the report, the Asia Pacific area is forecasted to have the highest growth rate in the near future due to the rise of cloud-based technologies and the increasing number of SMEs in the region. Meanwhile, North America and Europe are expected to retain their lead in terms of market share as they have numerous established SaaS providers.

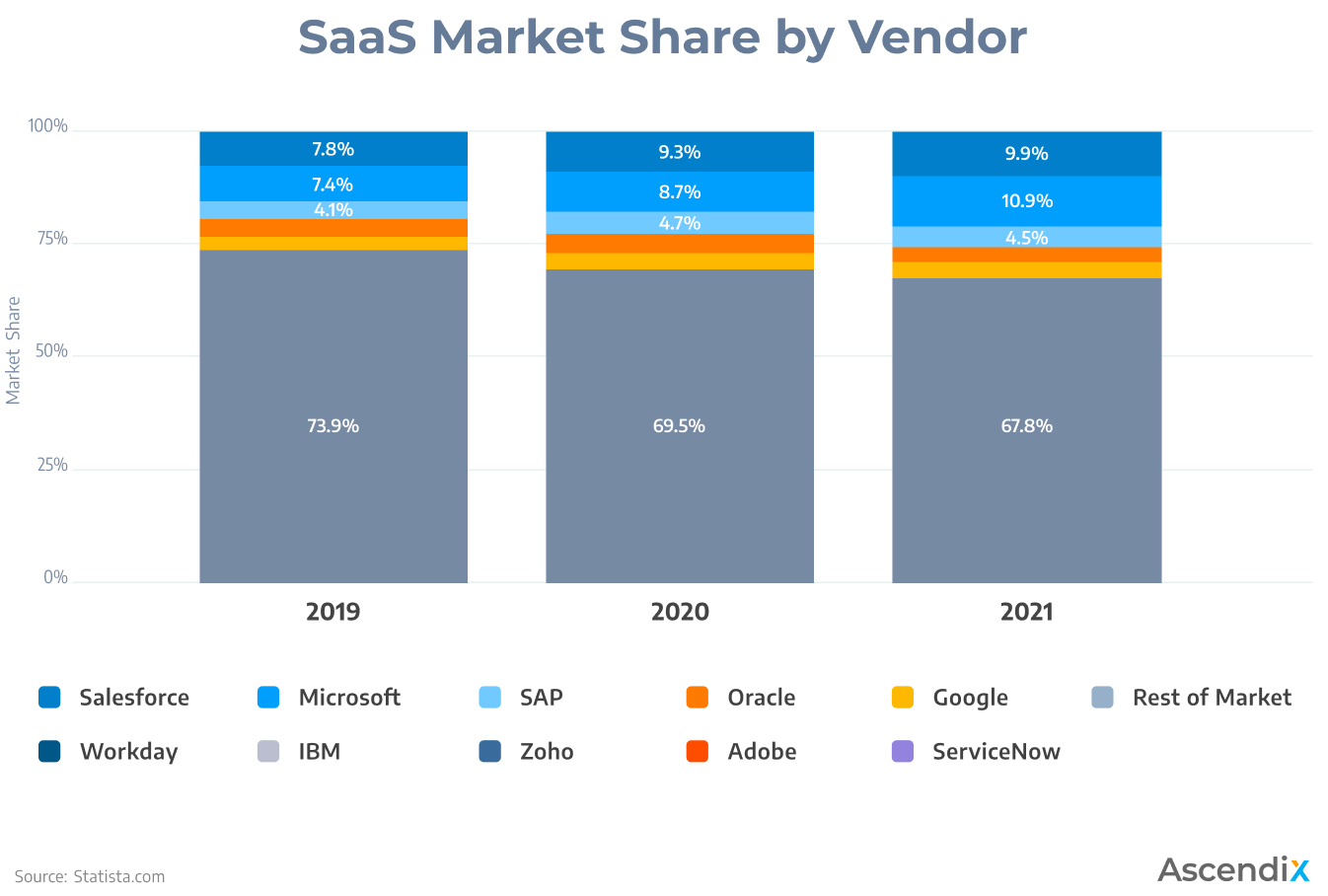

The global market for software as a service (SaaS) was dominated by Microsoft in 2021, accounting for 11% of the market share. Other significant players in the industry are Salesforce, SAP, and Google.

Here is a list of the top SaaS companies with the largest market share:

SaaS Market Share by Vendor

Although no single company has a monopoly in the SaaS market, these five largest SaaS firms collectively hold a market share of approximately 33.3% as of 2021.

Below, the 50 biggest SaaS companies with the largest market share in terms of market capitalization are all listed on U.S. stock exchanges, but not all of them are based in the United States. For instance, Atlassian, one of these companies, has its headquarters in Sydney, Australia.

| Rank | Company | Ticker | Market Cap (USD billions) |

|---|---|---|---|

| 1 | Salesforce, Inc. | CRM | 190.1 |

| 2 | Adobe Inc. | ADBE | 171.9 |

| 3 | Intuit Inc. | INTU | 120.5 |

| 4 | ServiceNow, Inc. | NOW | 87.9 |

| 5 | Shopify Inc. | SHOP | 57.4 |

| 6 | Workday, Inc. | WDAY | 49.3 |

| 7 | Snowflake Inc. | SNOW | 43.9 |

| 8 | Autodesk, Inc. | ADSK | 43.0 |

| 9 | Atlassian Corporation | TEAM | 39.1 |

| 10 | Square, Inc. | SQ | 36.5 |

| 11 | CrowdStrike Holdings, Inc. | CRWD | 31.0 |

| 12 | Veeva Systems Inc. | VEEV | 27.3 |

| 13 | Datadog, Inc. | DDOG | 20.9 |

| 14 | Zoom Video Communications, Inc. | ZM | 20.3 |

| 15 | HubSpot, Inc. | HUBS | 19.5 |

| 16 | Samsara Inc. | IOT | 19.2 |

| 17 | Cloudflare, Inc. | NET | 18.7 |

| 18 | Palantir Technologies Inc. | PLTR | 17.0 |

| 19 | Paycom Software, Inc. | PAYC | 16.4 |

| 20 | Zscaler, Inc. | ZS | 16.2 |

| 21 | MongoDB, Inc. | MDB | 15.2 |

| 22 | Splunk Inc. | SPLK | 14.8 |

| 23 | Okta, Inc. | OKTA | 13.3 |

| 24 | Bentley Systems, Incorporated | BSY | 12.0 |

| 25 | Akamai Technologies, Inc. | AKAM | 11.9 |

| 26 | Twilio Inc. | TWLO | 11.5 |

| 27 | DocuSign, Inc. | DOCU | 11.4 |

| 28 | Dynatrace, Inc. | DT | 11.3 |

| 29 | ZoomInfo Technologies Inc. | ZI | 11.3 |

| 30 | Unity Software Inc. | U | 10.8 |

| 31 | Qualtrics International Inc. | XM | 10.7 |

| 32 | Ceridian HCM Holding Inc. | CDAY | 10.6 |

| 33 | Paylocity Holding Corporation | PCTY | 10.2 |

| 34 | UiPath Inc. | PATH | 8.8 |

| 35 | F5, Inc. | FFIV | 8.5 |

| 36 | Procore Technologies, Inc. | PCOR | 8.3 |

| 37 | Dropbox, Inc. | DBX | 7.6 |

| 38 | BILL Holdings, Inc. | BILL | 7.4 |

| 39 | The Descartes Systems Group Inc. | DSGX | 6.6 |

| 40 | Guidewire Software, Inc. | GWRE | 6.3 |

| 41 | Smartsheet Inc. | SMAR | 6.2 |

| 42 | Coupa Software Incorporated | COUP | 6.1 |

| 43 | Confluent, Inc. | CFLT | 6.1 |

| 44 | monday.com Ltd. | MNDY | 5.9 |

| 45 | Wix.com Ltd. | WIX | 5.6 |

| 46 | HashiCorp, Inc. | HCP | 5.3 |

| 47 | Elastic N.V. | ESTC | 5.3 |

| 48 | SPS Commerce, Inc. | SPSC | 5.3 |

| 49 | Workiva Inc. | WK | 5.2 |

| 50 | GitLab Inc. | GTLB | 5.1 |

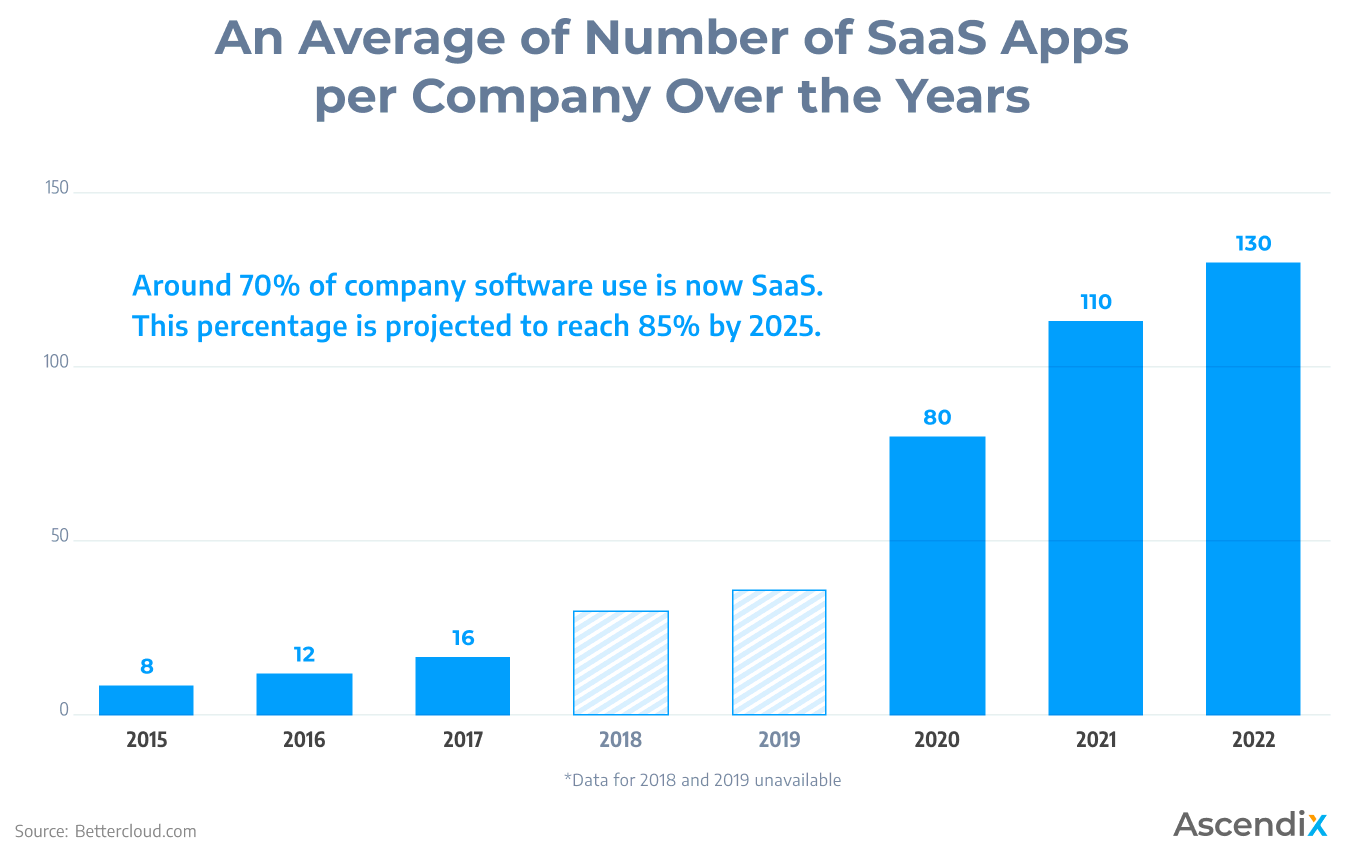

Around 70% of company software use is presently attributed to SaaS. According to predictions, the usage of SaaS software by organizations will reach 85% by 2025. Nevertheless, the expansion of SaaS app adoption has decelerated due to optimization endeavors. Although the number of SaaS apps grew by 18% from the prior year, 40% of IT experts disclosed that they consolidated repetitive SaaS apps, leading to an elevated turnover rate.

It is common to find that organizations use multiple SaaS apps for project management, such as Asana, Monday, and Trello, among thousands of options available. This year, IT professionals have consolidated redundant SaaS apps, resulting in a slower growth rate.

According to BetterCloud, the average number of SaaS applications per company has increased from 110 in 2023 to 130., with a 5x increase over a period of 3 years and a total of 10x since 2015. However, the number of SaaS apps used by organizations varies based on their size (source).

An Average Number of SaaS Apps per Company Over the Years

Companies with fewer than 50 employees use only 16 SaaS applications on average, while companies with 50 to 99 employees use an average of 24 SaaS applications, a 50% increase.

Organizations with 100 to 499 employees use almost double the number of SaaS applications compared to those with 50 to 99 employees (47 vs 24), and larger organizations with over 1,000 employees use an average of 177 SaaS applications.

The report also shows that collaboration and communication tools are the most commonly used SaaS applications, followed by human resources management and project management software. Additionally, it indicates that larger organizations tend to use more SaaS applications compared to smaller ones.

This disparity in perception vs. reality highlights the need for businesses to analyze their software usage carefully.

Gartner’s report predicts that the worldwide expenditure of public SaaS companies by end-users will increase to nearly $600 billion in 2023 from $332.3 billion in 2021, which includes various cloud services, not just SaaS (source).

The amount spent by companies on SaaS depends on different factors such as company size, industry, and specific software needs. BetterCloud’s report reveals that, on average, an organization spends 30% of its IT budget on SaaS applications, but this percentage can vary depending on the SaaS companies by size and industry.

The expense of SaaS varies and is determined by various factors, including the number of users, the level of functionality required, and the duration of the subscription period. Some SaaS software charges per user, while others may have a fixed monthly or yearly cost. The amount spent on SaaS by a company will ultimately be determined by its unique requirements and the SaaS applications it selects to use.

The SaaS market has by country been growing rapidly in recent years, with the United States taking the lead as the largest market, accounting for 59% of the global market share as of Q3 2021, according to a report by Synergy Research Group. However, Europe and Asia-Pacific follow closely behind with 20% and 14% shares, respectively (source).

Despite this dominance, emerging markets such as Latin America and the Middle East are expected to see significant growth in the SaaS market. The SaaS market in Latin America will grow at a CAGR of 22.6% from 2021 to 2026. Similarly, the Middle East and Africa are also projected to experience growth in the SaaS market (source).

With these projections in mind, it is important for businesses to consider expanding into these regions if they haven’t already. By doing so, they can tap into new markets and demographics and stay ahead of their competitors.

The software as a service (SaaS) industry has seen a significant increase in the number of unicorns in recent times, with numerous companies attaining this prestigious status.

According to recent industry reports, there are currently over 100 b2b SaaS companies that have achieved unicorn status, meaning they have a valuation of $1 billion or more, and this number is expected to continue growing as more businesses adopt SaaS solutions.

The B2B SaaS industry is currently experiencing an unprecedented surge in unicorns, with over 100 companies worldwide having achieved this status as of 2021, according to CB Insights (source).

The industry comprises several noteworthy companies, and below are some quick details about a few of them.

| Company | Location | Employees | Valuation |

|---|---|---|---|

| Zoom | San Jose, California | Over 3,500 | $35 billion |

| Slack | San Francisco, California | Over 2,800 | $15 billion |

| DocuSign | San Francisco, California | Over 3,000 | $6 billion |

| PagerDuty | San Francisco, California | Over 800 | $2 billion |

| Datadog | New York City, New York | Over 2,000 | $15 billion |

| HubSpot | Cambridge, Massachusetts | Over 3,000 | $5 billion |

| CrowdStrike | Sunnyvale, California | Over 2,500 | $7 billion |

| Okta | San Francisco, California | Over 1,500 | $14 billion |

| AppFolio | Santa Barbara, California | Over 1,200 | $3 billion |

| Twilio | San Francisco, California | Over 3,000 | $40 billion |

| Stripe | San Francisco, California | Over 2,800 | $95 billion |

| UiPath | New York City, New York | Over 2,500 | $10 billion |

| Robinhood | Menlo Park, California | Over 1,000 | $11.2 billion |

These companies have revolutionized traditional industries and transformed business practices. As more businesses embrace SaaS solutions, the number of SaaS unicorns is expected to increase in the future.

Hire Ascendix. We’ve been at the forefront of SaaS Proptech for 16 years.

The SaaS industry has a promising future as the transition to cloud technology is ongoing, providing opportunities for new SaaS startups to disrupt the market. Whether you’re already in the SaaS industry or planning to enter it, this is a good time.

The success of a SaaS business largely depends on its Sales & Marketing activities, especially when revenue reaches several million. Therefore, it’s recommended to allocate most of your resources towards S&M and outsource Research & Development to a reliable partner such as Ascendix.

Our SaaS product development solutions can assist you in achieving the:

If you’re still uncertain, you can click on the “Contact us” button and review our case studies to gain further insight. Together, we can elevate your SaaS business to new heights.

A B2B SaaS refers to companies that provide cloud-based software to other businesses for their project management, customer relationship management, human resources management, accounting and finance, and marketing automation.

The top 10 SaaS companies by revenue are Microsoft (10.9%), Salesforce (9.9%), SAP (4.5%), Oracle (3.6%), Google (3.4%), Adobe, Workday, Zoho, ServiceNow, and IBM.

SaaS Sales and Marketing spend stands at 27% of annual recurring revenue, going up to 40% for Wix and 50% for Smartsheet.

Alina is a proptech technology expert and a storyteller at Ascendix, investigating the real estate market and sharing her insights and tips with up-and-coming proptech startups, established real estate agencies, and industry stakeholders. She talks about real estate technology, business automation, and industry news.

Get our fresh posts and news about Ascendix Tech right to your inbox.