Need Help with Building a Proptech Solution?

We’ve got 2 decades of expertise in real estate and SaaS development. Trust your project to Ascendix professionals.

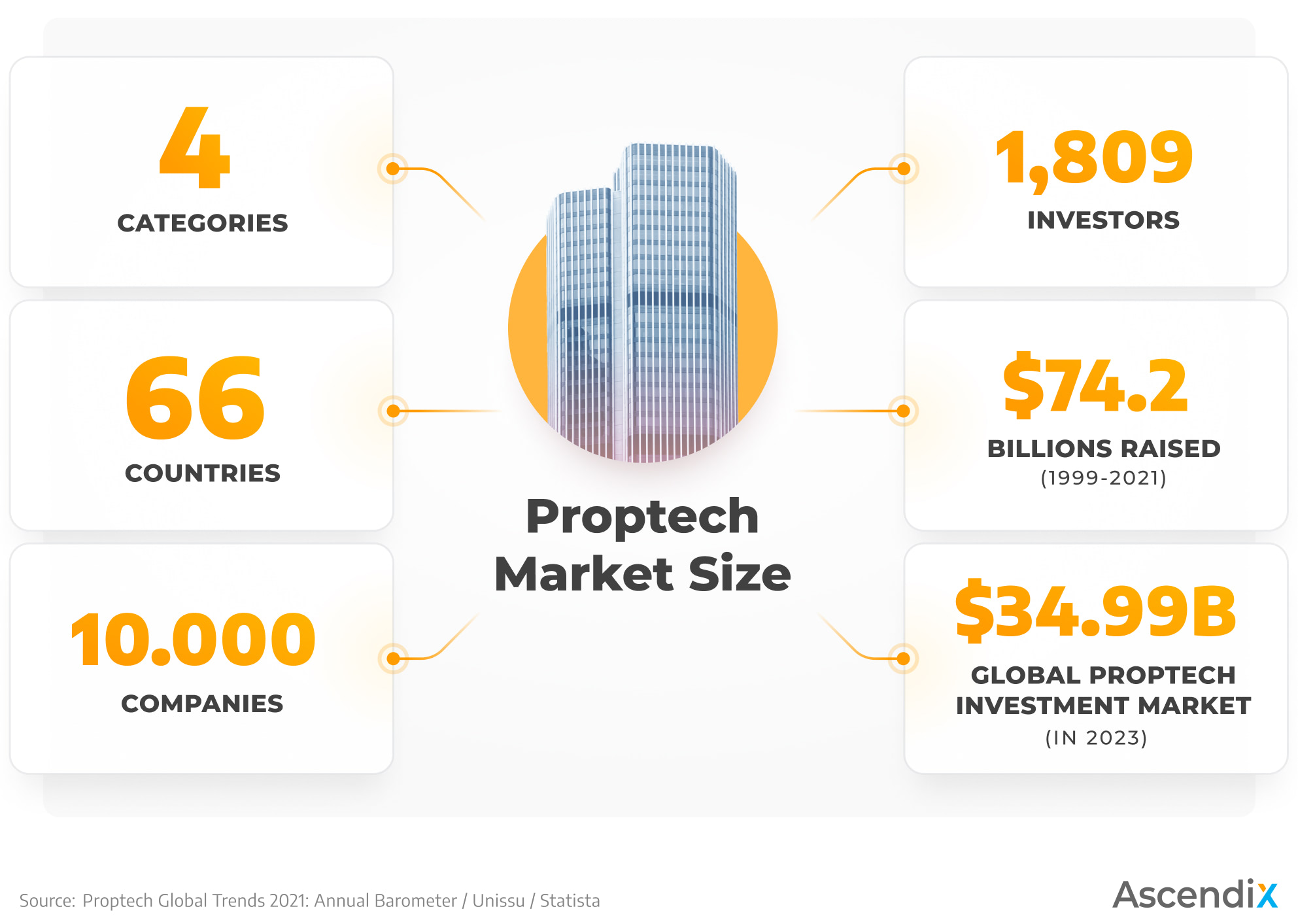

Over the last few years, the proptech market map has turned into a whole universe with a huge number of proptech companies that reportedly equals 10,000. To navigate this complex field with different domains and technological trends of different strategic orientations, now one certainly needs a map.

In this article, we would like to measure the pulse of the current state of the real estate tech market map and define the most successful proptech companies and areas that attract the heaviest investment. Moreover, we will answer the most frequent questions regarding the highest value proptech unicorns and the state of the European proptech market.

The real estate tech market consists of different market players, each focusing on different aspects of proptech. Maybe that’s the reason why at the moment, there is no single view on what the real estate tech market map should look like. However, the first beginnings are starting to crystallize with the help of innovative proptech companies and communities all over the world.

This year, we’ve presented our very own overview of the proptech market in the form of a full-fledged map of the proptech network. Check our proptech market map introducing companies from both commercial and residential real estate markets below.

Proptech Market Map

Proptech companies on the map are classified according to their type of operations: listing, broker tools, financial/capital market, underwriting, leasing and lease management, property management, building automation, and tenant experience. Each category represents the top real estate proptech companies, their solutions, and how they improve real estate operations at each point of the real estate customer journey. Among these names are the most acknowledged and well-funded solutions according to Crunchbase like Airbnb ($6.4B), Zumper ($180.2M.) – one of the largest marketplaces in real estate, Buildout ($8.4M), VTS ($462.4M), Appfolio ($30M), etc.

Detailed characteristics of the companies mentioned above can be found in our list of the most innovative proptech solutions for commercial real estate.

Proptech Market Size

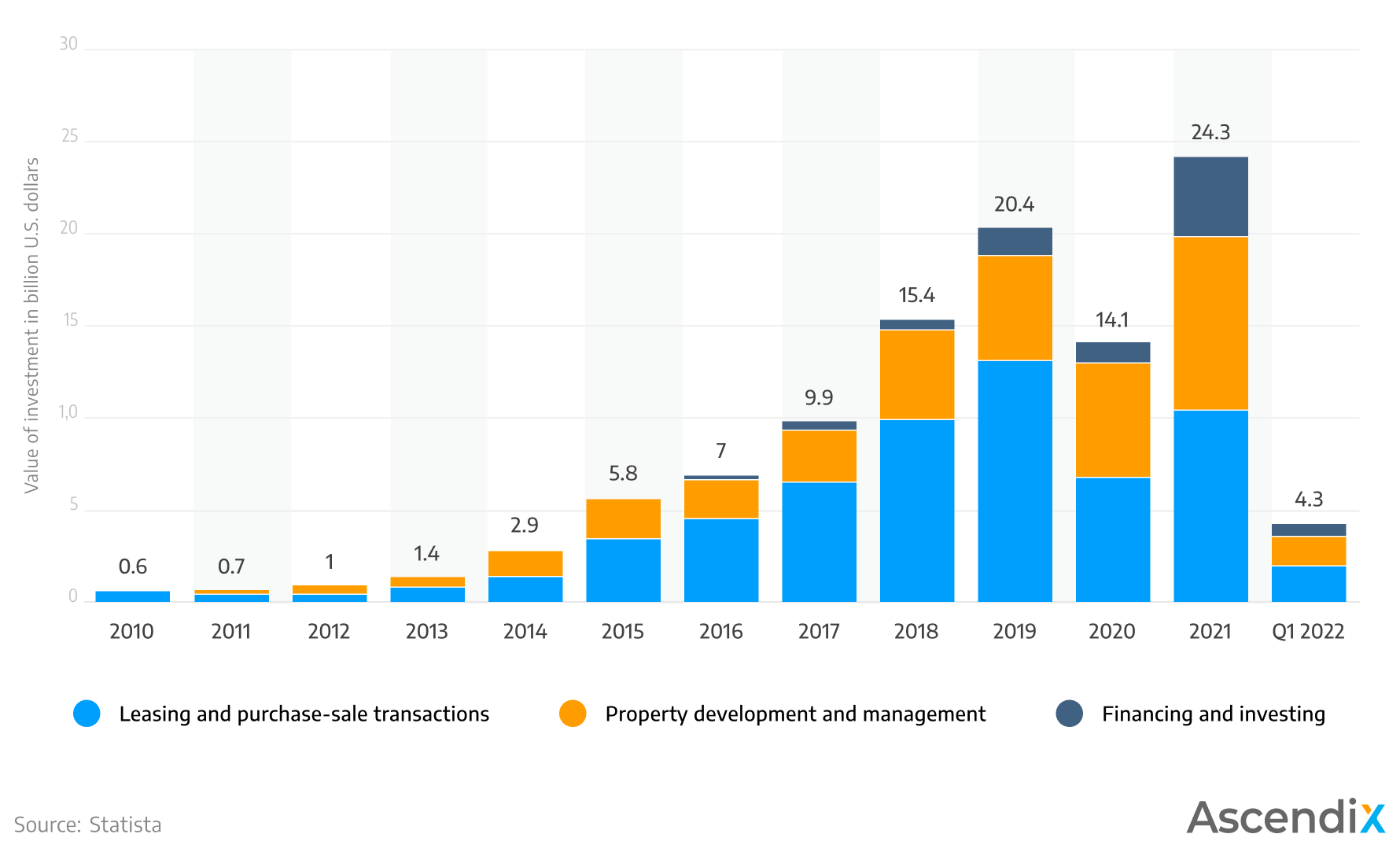

The rapid expansion of the proptech market was surged by COVID that broke through the industry’s centuries-long reluctance to adopt tech and finally put the RE market in the innovation train. The size of the global proptech investment market has grown and in 2021, it peaked at $24.3B. (source).

At the moment, proptech is a huge market that, together with its sub-markets, makes up a large part of the global economy. The proptech market size equals $22.2T. Its submarkets and adjacent markets add another $7T to its market size. (source)

| Energy | Infrastructure | Logistics | Agriculture | Insurance (P&C) | Forestry | Transportation |

|---|---|---|---|---|---|---|

| $1.0T | $992B | $1.6T | $1.0T | $1.2T | $93B | $700B |

Matt Knight | How Big is PropTech?

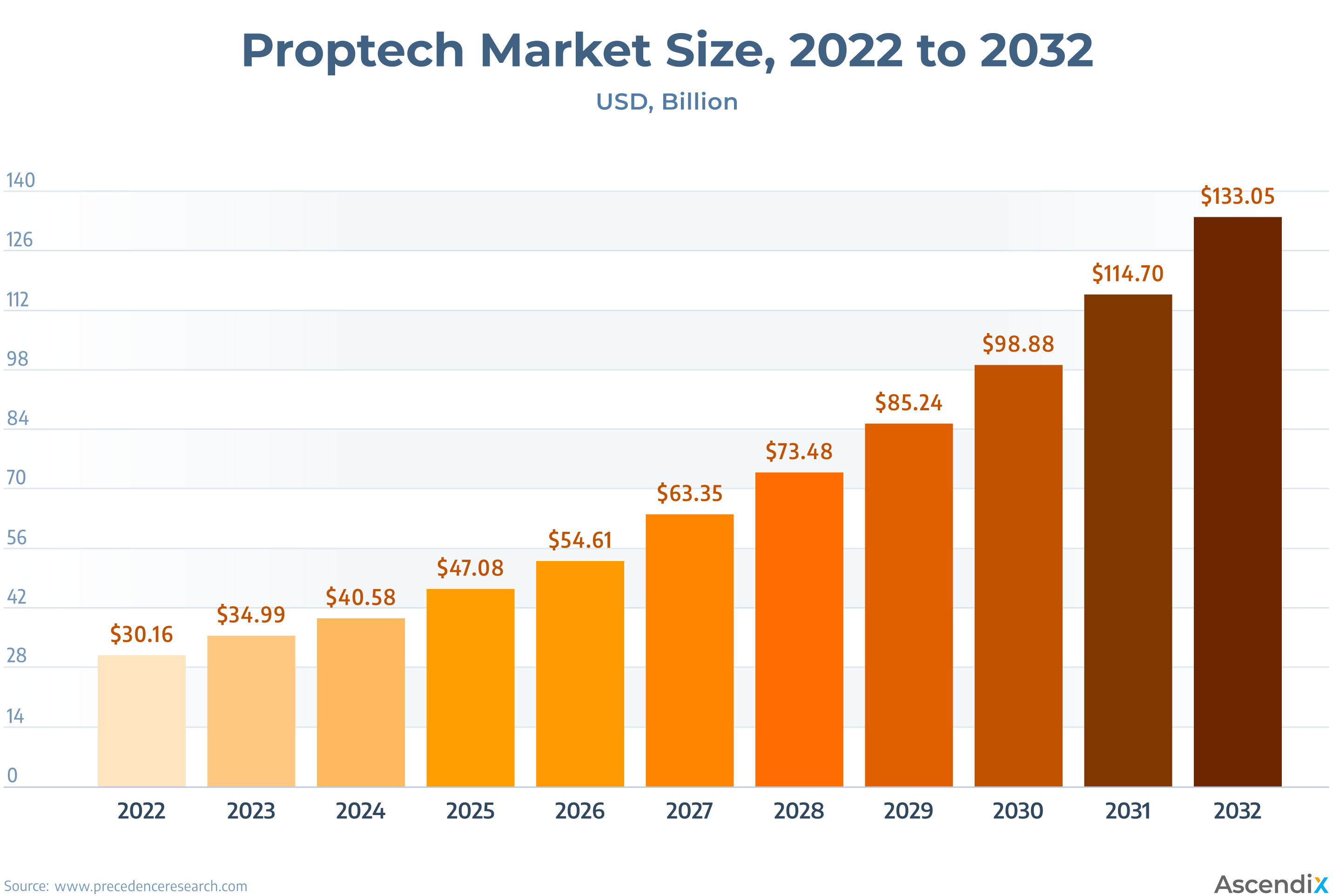

But once we exclude everything related to property, including buying, selling, renting, construction, and management and focus solely on proptech companies and their technologies, we’d get different statistics. And according to these statistics, the global proptech market size reached $34.99 billion in 2023 and is poised to reach an estimated valuation of around $40.5 billion by the year 2024. The exciting news is that by 2032, we anticipate the global proptech market size to soar even higher, reaching its peak at $133.05 billion.

2022-2032 Proptech Market Size

These impressive numbers demonstrate the industry’s readiness to digitize and automate, or at least its awareness of importance to do so.

The total number of proptech companies exceeds 10,000 vendors on the current proptech market map, with half of them being proptech startups, and 70% of these startups are VC-funded.

In 2014, the proptech market map boasted 261 newly founded proptech companies (around 5000 proptech companies in general), while 2022 saw a significant increase, reaching a total of 1,200 proptech startups on the global proptech market.

Globally, the United States holds the largest number of PropTech companies, with 59.7% of the world’s total, followed by Europe (27.2%) and Asia (3.5%). (source)

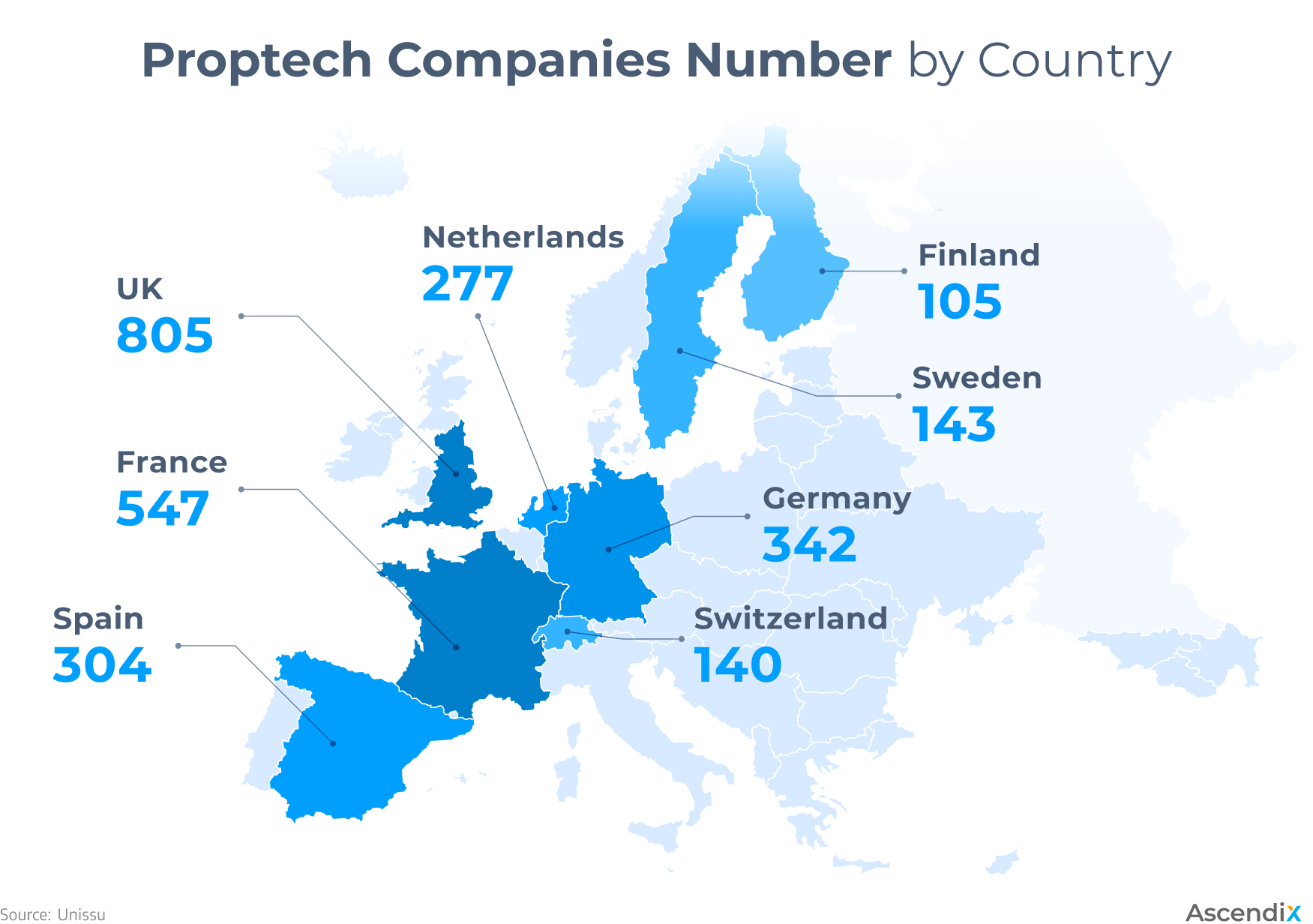

Proptech Software Companies Number by Country

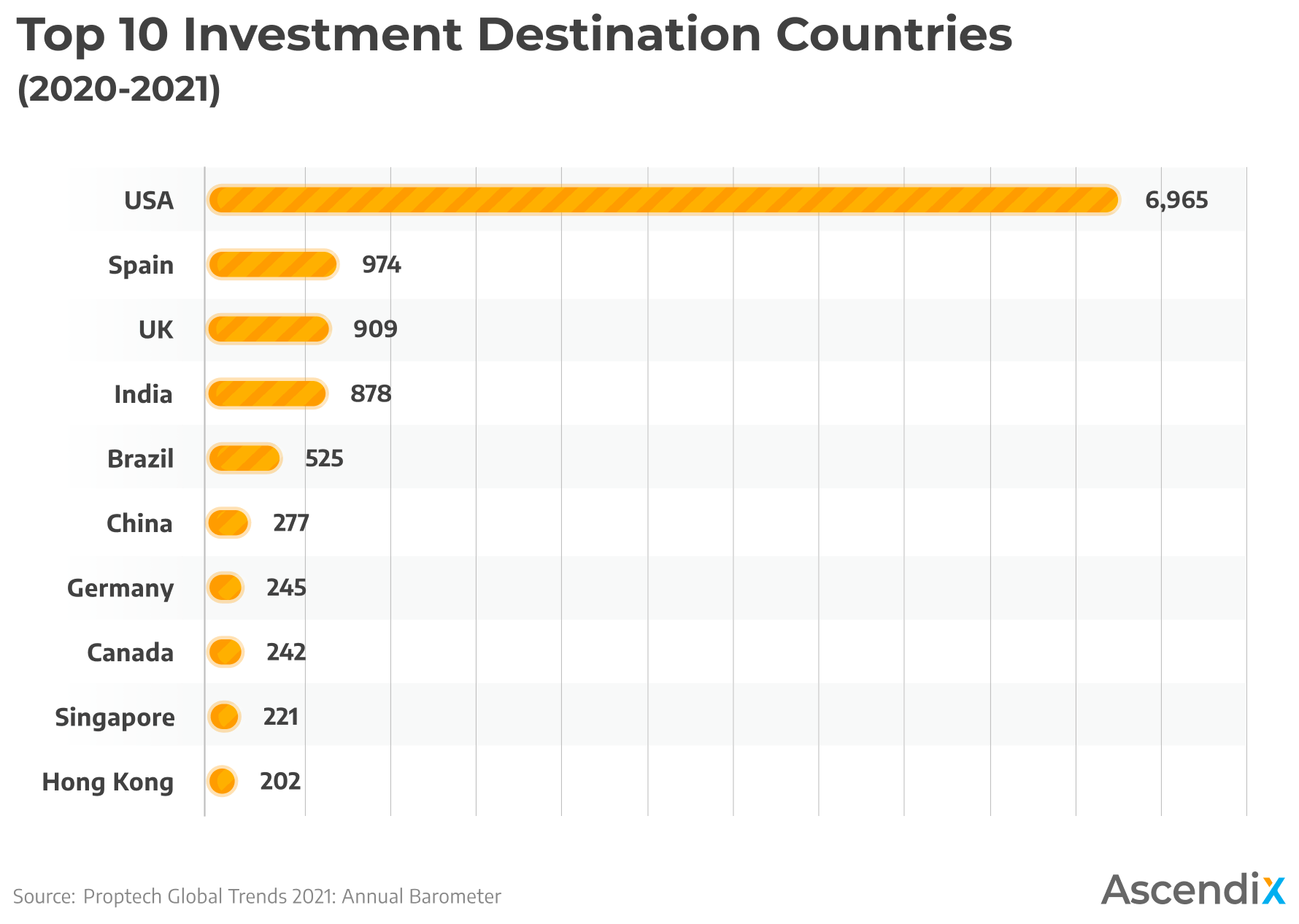

The United States also leads in terms of investments with $1,079B in total. Besides being the global leader in raising investment funds, the USA is also the top destination country on the proptech market map for attracting foreign investment in the PropTech sector.

However, Europe is quickly catching up with the US with businesses scaling just as fast. Europe is also seeing significantly larger funding rounds and increased interest in the market from investors and international venture capitalists. According to Crunchbase, European investors led 77% of seed fundings in Europe, 68% of early-stage fundings, and 49% of late-stage fundings.

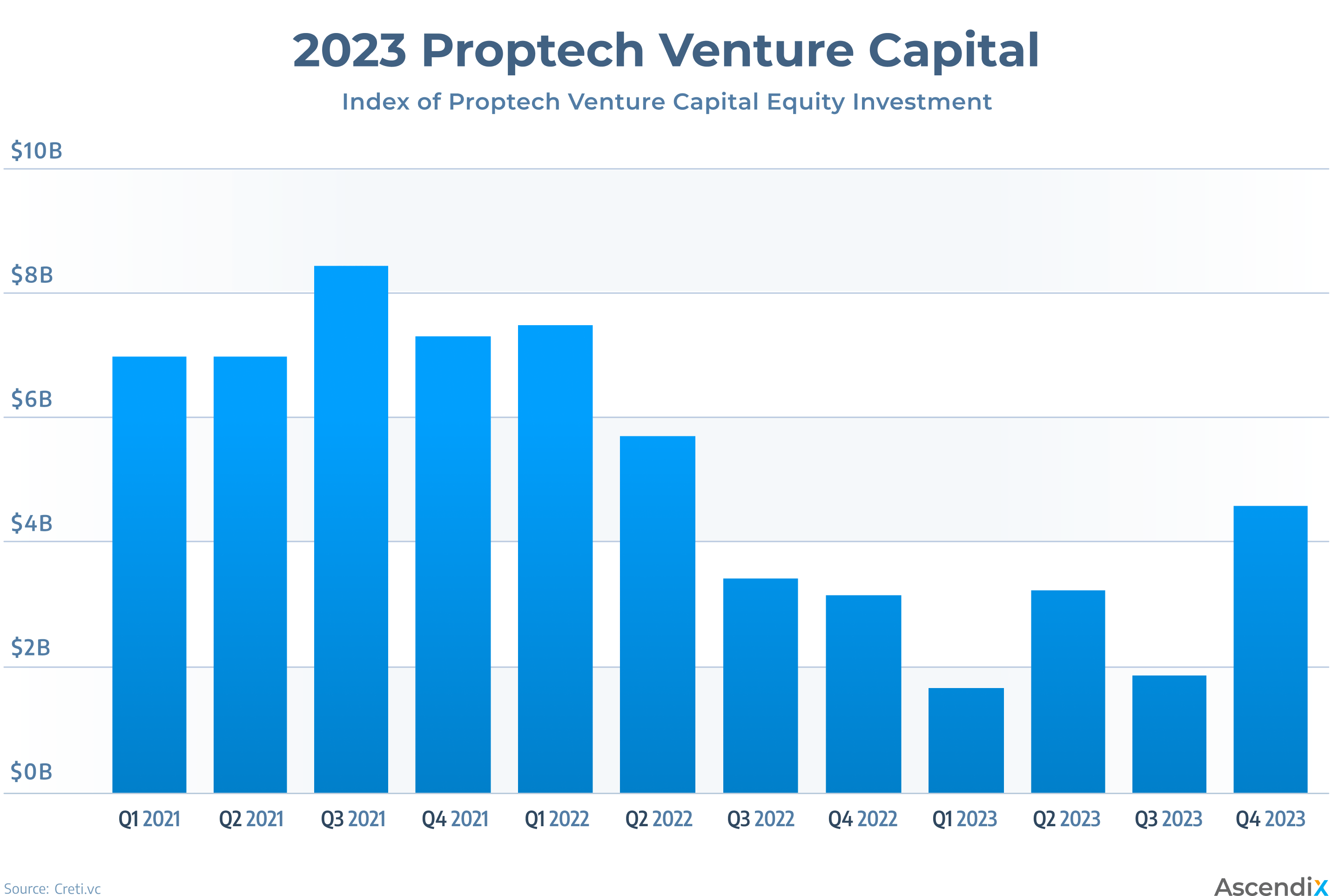

In 2023, investors adopted a cautious stance, as observed by CRETI. There was a significant shift in proptech venture capital investment, totaling $11.38 billion, marking a return to pre-pandemic levels. This amount reflects a 42.42% decrease from the $19.75 billion invested in 2022 and a substantial 64.44% drop from the peak of $32.0 billion in 2021.

2023 Proptech Venture Capital

Regardless of how many proptech companies are there, the key focus remains on fostering innovation and resilience within the rapidly evolving industry. That’s why investors are heavily focused on AI proptech funding. According to JLL, 500 companies worldwide are currently engaged in the development of AI-powered services for real estate.

Speaking of numbers, 70% of all deals were AI-related, and the global funding for AI-powered proptech surged to $4 billion in 2022. Projections indicate an even higher figure in 2024, with 64% of investors planning to invest in AI.

We’ve got 2 decades of expertise in real estate and SaaS development. Trust your project to Ascendix professionals.

According to Annual Barometer, three American proptech companies better.com ($700 M), Service Titan ($500 M), Hippo Insurance ($500 M) were leaders in terms of investment in 2021.

In the United States, the PropTech market is estimated to have a CAGR of 16% through 2032 (source). Thus, despite the slow economic growth expected in the US over the next few years, the US is probably the destination where the term ‘proptech’ is the most sound.

The US market hosts the largest number of proptech companies – 59.7% of the world’s total (source). According to Unissu, in 2021, there were 2234 proptech companies in USA. (source).

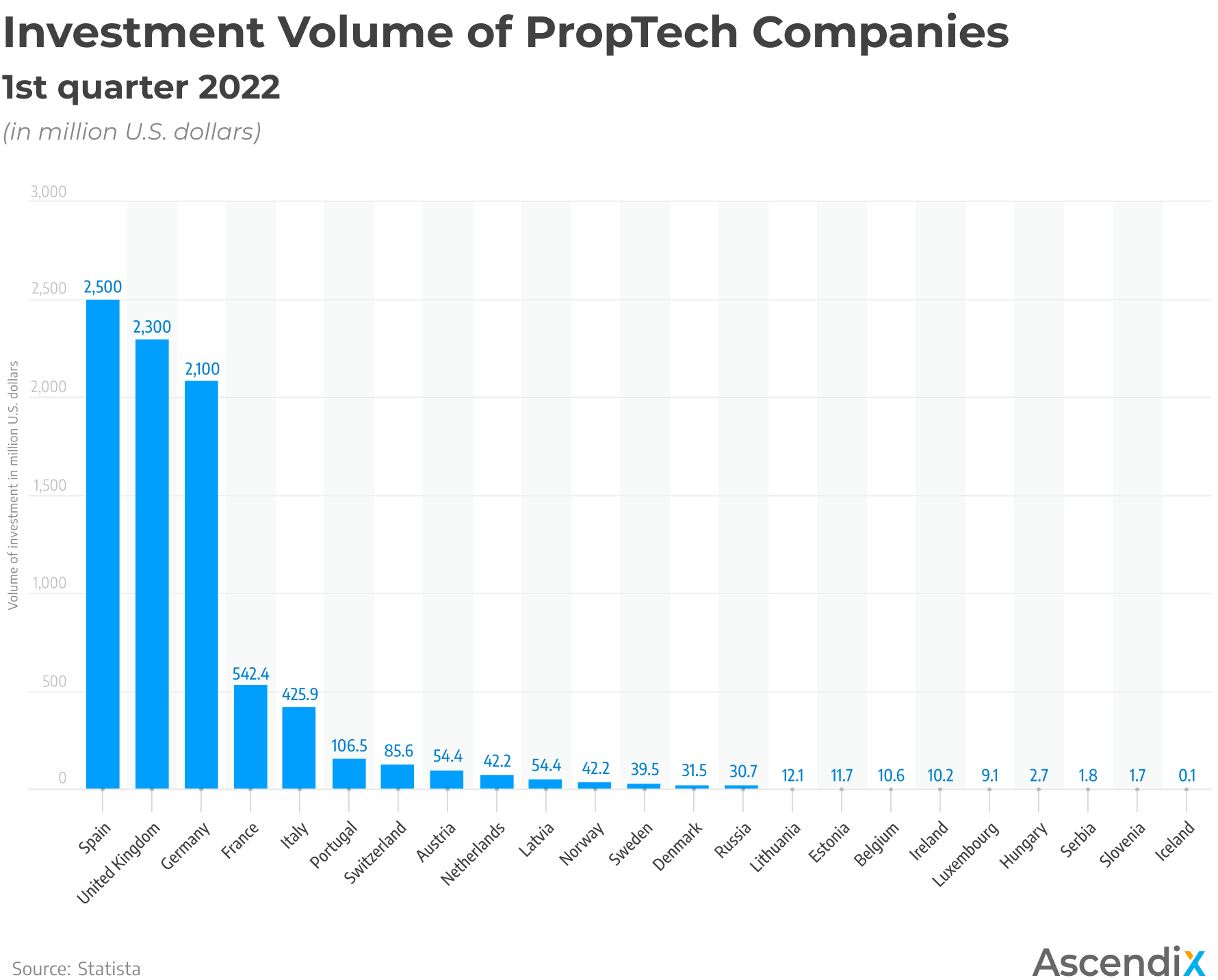

According to Statista, the leading proptech country in Europe in 2022 is Spain with $2,500 million investments. Among the leading Spanish companies is Idealista which successfully attracted $649 million and $304 million of investment funds in 2021 (source). The major focus of Spanish companies is on the housing sector and the technologies that can be used there.

Top PropTech Companies in Europe by Investment Volume

Despite the period of uncertainty caused by Brexit, the UK is still among the leading proptech markets in Europe with the largest number of companies (709) and $2,300 million investments. In 2021, only the UK’s LendInvest got $700 million in investment funds, according to the Annual Barometer. The PropTech market in the UK is expected to have a CAGR of 17.1% through 2032. (source) Germany closes the top three with $ 2,100 millions of investments and the expected size of US$ 444.39 million by 2028. The proptech market in Germany is also estimated to grow at a CAGR of 10.4% from 2021 to 2028. (source)

The introduction of brand-new practices in sustainable asset development and climate control makes the EU proptech market more compliant, predictable, and risk protected.

Europe is becoming the capital of proptech events in the world – standardizing the defragmented EU market together. Also, compared to other markets on the global real estate tech market map, the European market is still largely undigitalized. Meanwhile, industry challenges, from climate change regulation to urban development and population growth, require new technological solutions to ease the pressure on profits and efficiency.

Another point is the investment influx in the EU proptech which according to PWC is expected to reach $69 trillion by 2033, showing a strong indicator for the future. (source)

European proptech leaders in terms of deals in 2021 include: (source)

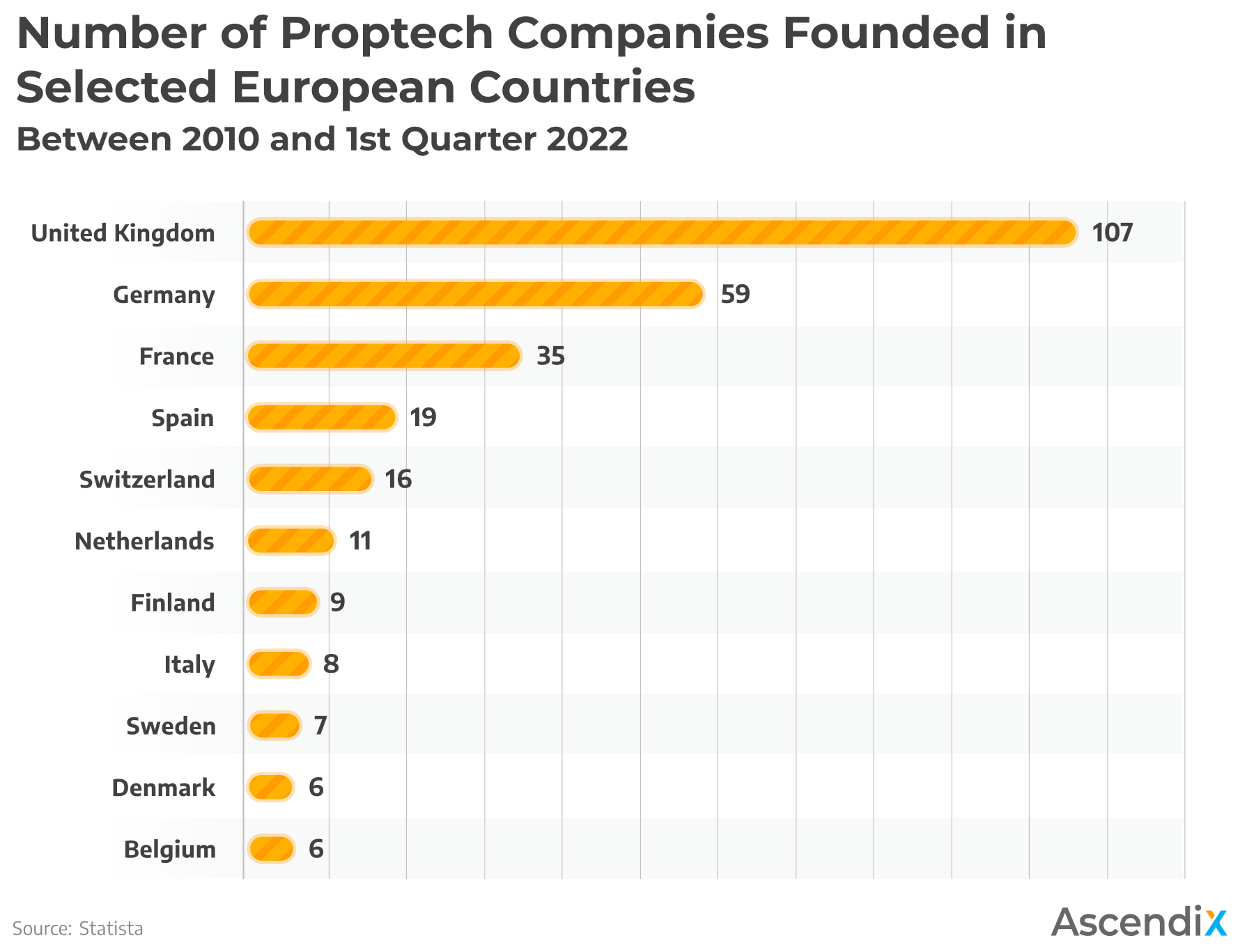

Between 2010 and 2022, more than 330 new proptech companies were founded in Europe, successfully adding to the global market size. The UK, Germany, and France comprise 201 of the totals. (source).

Number of PropTech Companies Founded in Europe

See how AscendixTech can help you close more deals and improve your prospecting.

According to Statista, 31% of commercial real estate investors are planning to invest in proptech companies. This in turn creates a lot of competition among venture investors. On the graph below, Statista demonstrates investment volume in proptech companies worldwide from 2010 to the 1st quarter of 2022, by subsector. Having a glimpse, one can understand they need to be inventive today to thrive in the proptech market tomorrow.

Value of Proptech Investments

In 2021, the European PropTech market registered a record year in 2021, reaching approximately 20% of global investment, including over 200 venture capital investments totaling €3.8 billion (representing a growth of 350% compared to 2020). (source)

The top EU destinations for investments raised between 2020-2021 are Spain ($974B), UK ($909B), Germany ($245B).

Top 10 Proptech Investment Destination Countries

That’s impressive, considering that for a long time the European proptech giants were ‘locked’ in their national market. Due to different industry standards, legislation, and processes. As a result, the very prospective proptech markets in Europe couldn’t cross the borders of their own country. Unlike the American or Asian market, the European proptech market is not standardized. Instead, it is extremely defragmented, consisting of separate ecosystems in different countries.

Despite that, according to PitchBook, now the EU real estate tech market is growing even faster compared to the proptech market in North America.

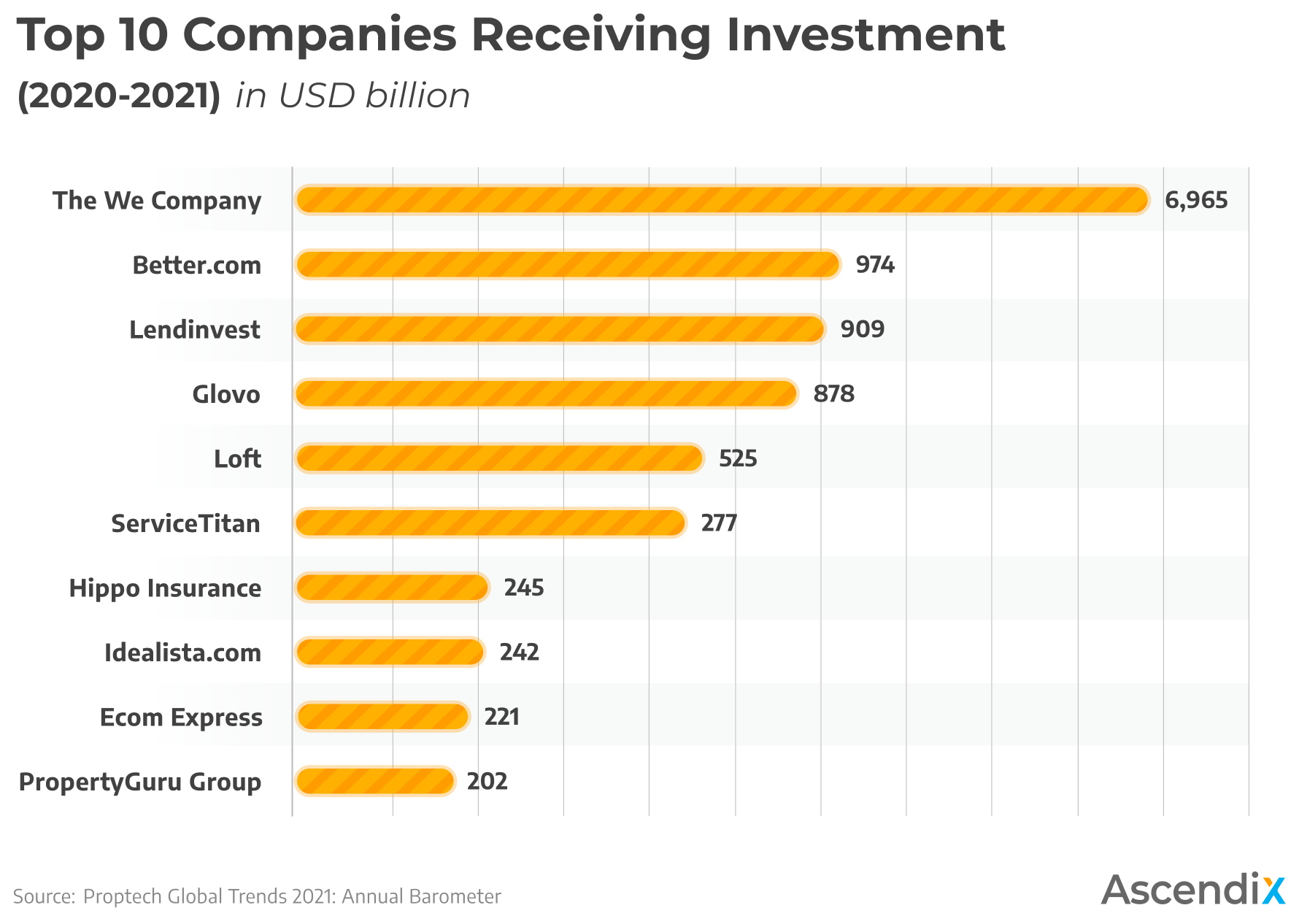

In between 2022 and 2021, the most valuable proptech companies were The We Company ($1,100B), Better.com ($700B), Lendinvest ($682B), Glovo($649B), Loft ($525), etc.

Most Valuable Proptech Companies | 10 Companies Receiving Investments

Speaking of categories, the heavier investment receive property management and construction tech solutions with $17.1B in 1.2K+ companies and $28.1B in 1.4K+ companies accordingly. (source 1, source 2) In terms of the proptech market growth, the most competitive companies focus on production and generation of revenue to increase the proptech market share (source).

Contact our team to start your custom real estate software development.

Companies and real estate users can benefit from the introduction of proptech primarily through automation. The latter is changing the way RE does business with visible results. Reportedly, automation software can increase leads flow by 77% (source). Secondly, technologies behind proptech make a difference making the industry simpler to navigate and ultimately more financially rewarding. Proptech and tech innovation are important, above all, because they change the way people buy and sell a home by:

In the end, proptech market makes real estate a lucrative area for investors, while thousands of tools improve the customer journeys of real estate customers and industry professionals. According to Statista, a total of $12.05 billion was invested in proptech in 2021. All of this in the complex improves tenants’ experience and makes the industry more attractive for profit generation.

Advances in technology in real estate are changing global consumption patterns, transforming our perception of property building, management, selling, and renting. It gives the green light to companies, especially startups, to innovate products and change the real estate tech market map.

The technologies behind proptech include big data, artificial intelligence (AI), machine learning, virtual reality (VR), augmented reality (AR), the internet of things (IoT), 5G, and blockchain. AI (26%), AR, and VR (12%) are the top three technologies making the most significant impact on real estate. Big data and IoT are just a few percent behind them. (source)

Check out the overview of the proptech consulting and software development projects we delivered to our clients.

Airbnb is a vivid example of a proptech online real estate marketplace. Today, the market valuation of this shared economy platform is $30 billion (source). The success of the Airbnb model has inspired many other platforms. As a result, there are now many new real estate marketplace platforms on the global proptech market map, which have their own niche, but essentially work in the same way. Good examples are Spotahome, 9flats and Homaway (now Vrbo) – European rental platforms.

The platform provides users with access to various apartments, rooms, or even houses in 191 countries around the world in a flexible home-sharing format. On Airbnb, people can easily list, search and book accommodation online with the help of their mobile phones.

Implementing innovation shoulder-to-shoulder with major industry players, like JLL, Hanna Commercial Real Estate, Cresa, and others for 26 years, Ascendix invested its best practices and industry expertise in the development of innovative proptech solutions for the real estate market.

Regardless of the niche you want to take on the real estate proptech market map, Ascendix may contribute to your growth by:

Ascendix builds effective digital real estate for different niches, domains, and various real estate players. Once you’re looking to create a prospect app or improve the existing one – contact us – we have a proven tech record to meet your requirements.

The proptech market in the US includes 2234 companies, representing 59.7% of the world’s total.

The value of the proptech market was $34.99 billion in 2023 and is poised to reach around $40.5 billion in 2024.

Compass is the largest proptech company in the world by revenue, with the company’s total revenue reaching $6.42 billion. Meanwhile, Airbnb holds the top position in terms of funding, boasting $4.74 billion in total equity funding and $1.66 billion in total debt funding.

The forecast for proptech is optimistic, with analysts predicting that the global proptech market will reach an estimated valuation of around $40.5 billion in 2024. Additionally, around 70% of investors are expected to invest in proptech AI solutions.

Iryna is a writer and storyteller who translates the inner workings of tech solutions, market trends, and cross-industry influences into the language of business value. Her mission is to drive awareness of innovation by means of engaging, digestible content that combines empathy and human-centricity with deep analysis.