Build a Custom Proptech Solution with Ascendix

Hire Ascendix and we’ll execute your vision and create a thriving software product or bootstrap your existing solution.

As we step into 2024, the proptech arena remains dynamic and full of transformative potential, and AI and machine learning aren’t the only trends driving progress. Without further ado, let’s delve into the top proptech trends that professionals and companies should keenly follow to stay at the forefront of the ever-evolving proptech outlook.

Top Proptech Trends in 2024

Call it ‘adult dorms’ or ‘community living,’ the reality is still the same – co-living and co-renting are a proptech trend to watch amidst rising home prices and inflation. Most co-living platforms like Allihoop, Common, and Badi act as real estate marketplaces where users can look for a property, learn more about the community life, and get in touch with the property operator.

For the future of proptech, shared spaces and customized experience mean the increasing need for:

Neighborhood social networking apps will become a part of community living aka co-renting & co-living, helping potential tenants find and connect with the future co-renters based on interests and location and even compare property ratings and reviews like in the ‘real estate Tik-Tok’ app Playhouse.

Commonly, neighborhood social networking platforms like Nextdoor resemble social media where users create profiles, communicate with each other, post news, and engage in discussions.

The core functionality of such apps will be:

The democratization of real estate investment will stay a part of top proptech trends next year due to the lower investment barriers it offers, higher diversification, greater liquidity, and increased flexibility.

The worldwide crowdfunding market, valued at $10.8 billion, is projected to experience a significant surge, reaching an estimated $250 billion by the year 2030. Yeap, according to the proptech forecast, crowdfunding platforms like PeerStreet and RealtyMogul, as well as fractional ownership platforms like Picaso will face growing competition.

For real estate platform development, this particular proptech trend means:

Considering that approximately 40% of global carbon dioxide emissions come from the real estate sector, it’s no wonder that the future of proptech will include solutions promoting greater transparency in ESG practices.

Proptech sustainability solutions poised to achieve the highest popularity in 2024 are:

Hire Ascendix and we’ll execute your vision and create a thriving software product or bootstrap your existing solution.

With the growing focus on energy efficiency & sustainability and personalized living experiences, IoT and smart home automation will be an irreplaceable part of any property that aims to optimize resource utilization, enhance user comfort, and contribute to a sustainable future.

For proptech software outlook, this trend means:

Generally, the digital signature market is expected to experience a Compound Annual Growth Rate (CAGR) of 20.8% in value from 2023 to 2033. Currently, the market is dominated by DocuSign – the company’s share is 67.6% globally.

ESigning will stay a part of any proptech solution that implies real estate deal management. With eSigning, documents can be signed remotely in minutes, expediting the deal closure and eliminating the need for face-to-face meetings.

For real estate software development, eSigning as a proptech trend means:

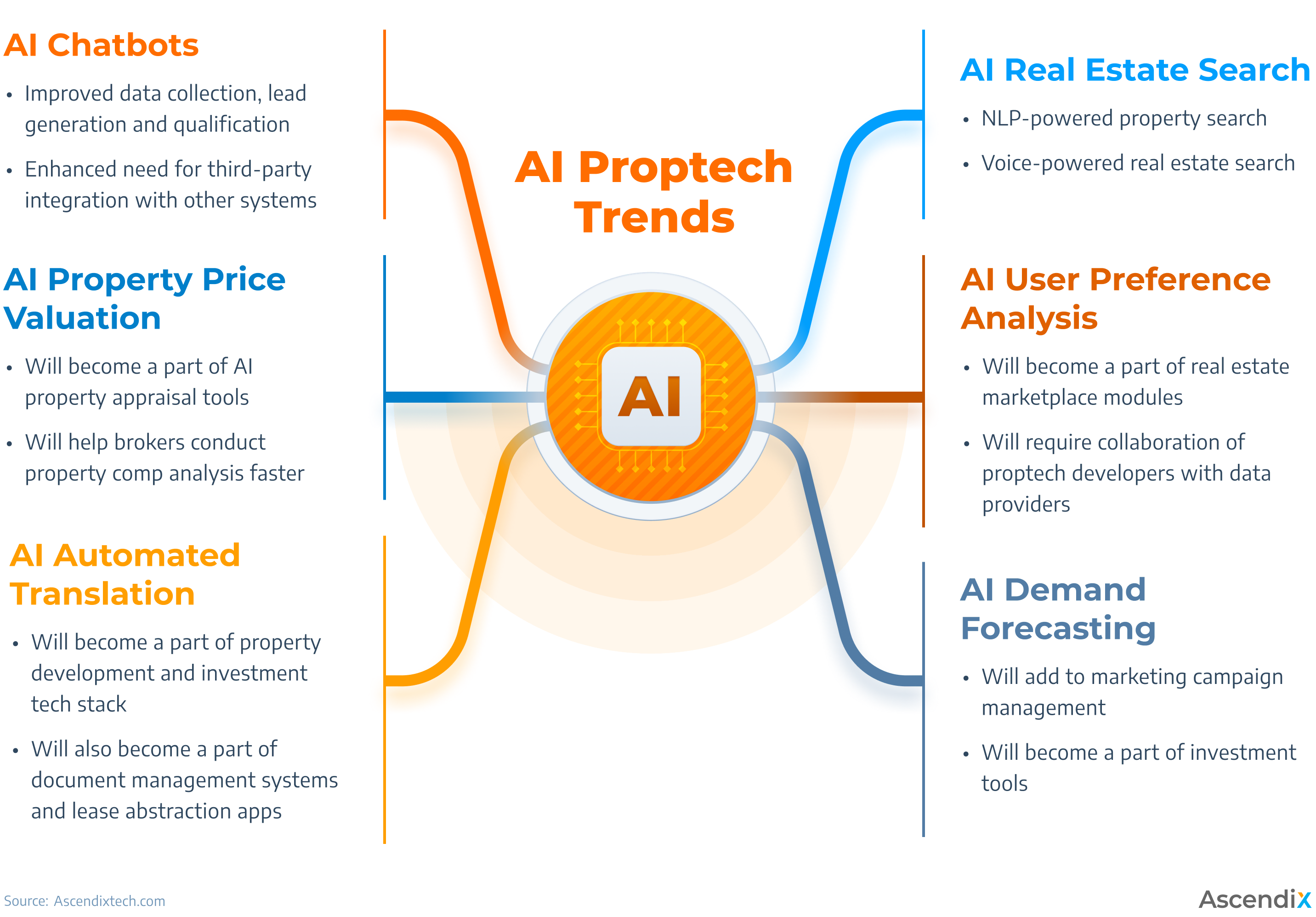

AI Proptech Trends

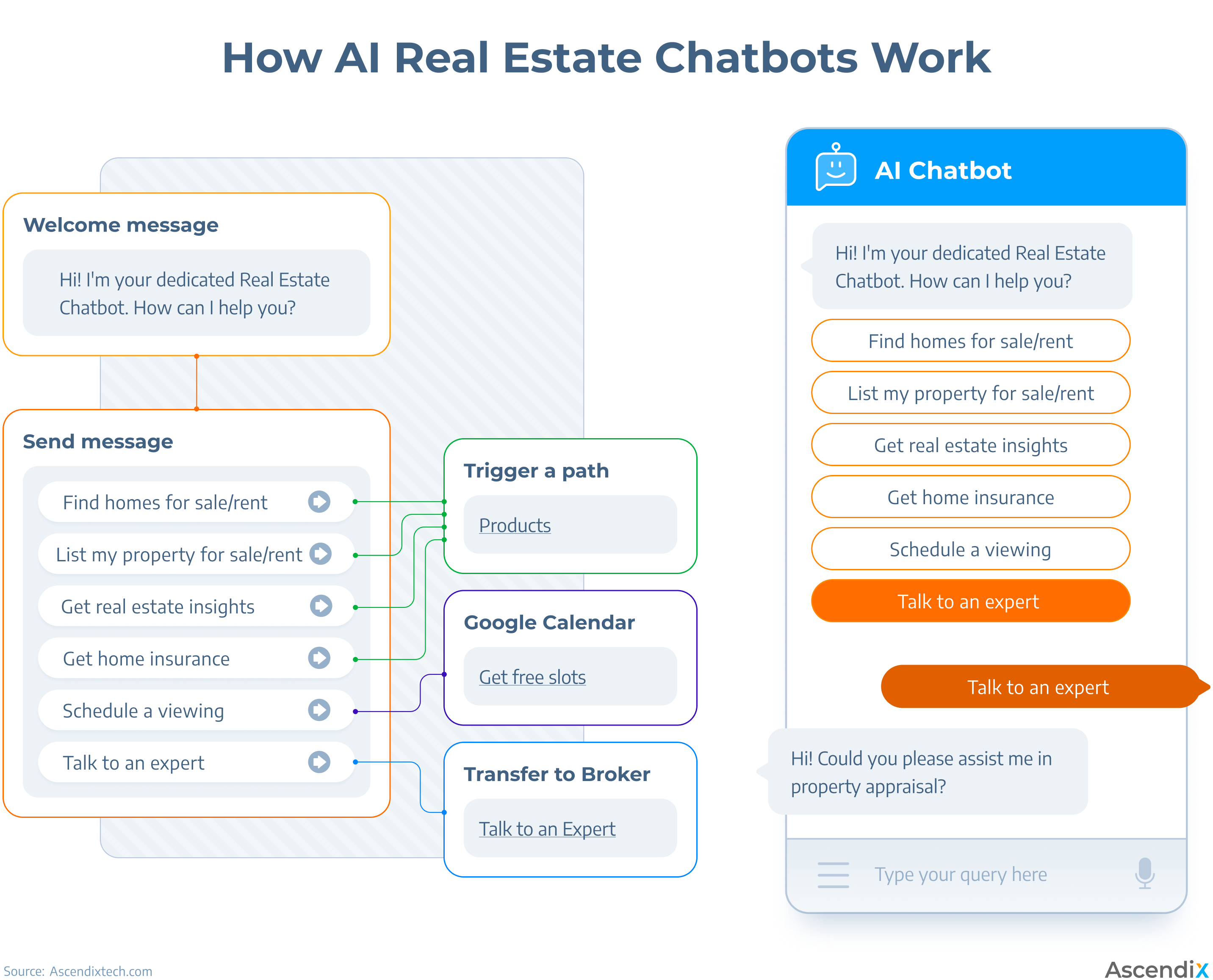

The proptech outlook surely includes conversational AI, and solutions like Hyro, STAN AI, and Roof AI are its examples. Based on NLP or natural language processing models, conversational AI tools (virtual assistants and chatbots) answer tenant questions around the clock, process requests, and help in the property matching process.

How AI Chatbots Work

For proptech software development, AI chatbots mean:

Powered by natural language processing (NLP), AI real estate search allows users to explore interactive maps and get the most accurate results.

For proptech software development, AI real estate search means:

Such a feature is extremely useful for landlords and property owners. It allows users to compare properties, establish precise pricing, and predict the properties and locations that renters or sellers are most likely to prefer.

What does AI Property Price Valuation mean for the proptech forecast?

This proptech trend will highly add to the personalized user experience and enhanced property search. Based on historical data, AI can offer more accurate search results. Let’s say a user looked for a property for non-smokers and a parking lot – next time, the AI system will automatically consider these preferences in subsequent searches without the user having to specify them again.

For proptech software development, the trend means:

Order a complete checkup of your software project involving a deep analysis of its technical architecture, design, processes and procedures.

AI demand forecasting enables landlords and property operators to predict the demand for their properties based on various factors such as seasonality, property market trends, booking history, and more.

AI automated translation doesn’t only help real estate players bridge linguistic gaps but also facilitates seamless communication and collaboration in times of globalization and cultural diversity.

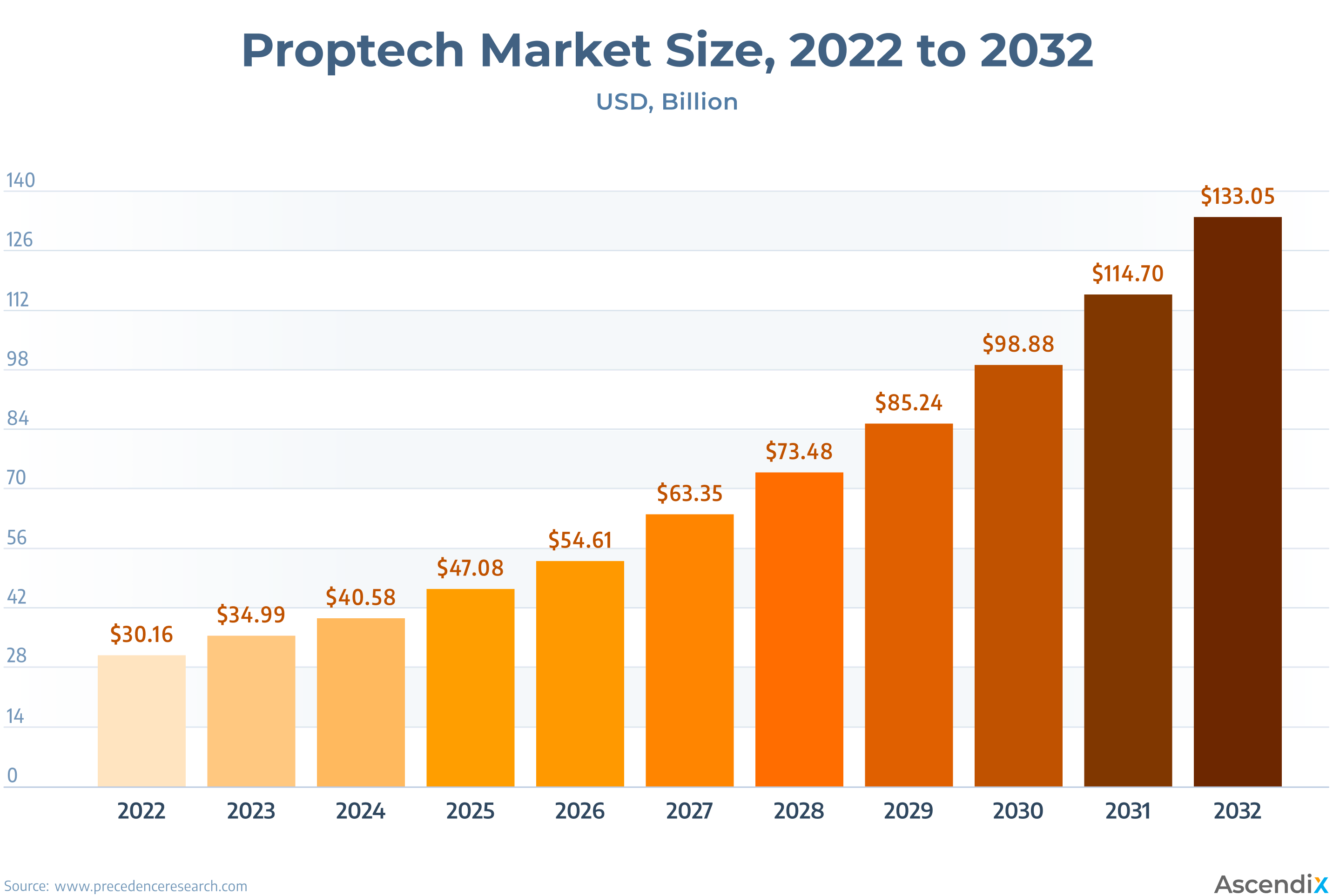

The size of the global proptech market reached $30.16 billion in 2022 and is anticipated to achieve a valuation of approximately $40.5 billion in 2024 – a surge driven by large proptech investments as well.

Proptech Market Size

During the first half of 2022, the proptech sector experienced an AI-driven surge, propelling investments in both equity and debt to surpass the $8 billion milestone. Notably, 70% of all transactions were directed towards AI startups.

Currently, investors are increasingly directing their capital towards specific applications of AI and machine learning within proptech, with the biggest spotlight on areas like property valuation, predictive maintenance, and personalized user experience.

With 64% of businesses incorporating AI to boost productivity and shape the proptech outlook, the optimistic forecast for returns is fostering high expectations among proptech venture capitalists.

Did you know that to achieve the net-zero goals by 2050, the global annual investment in energy-efficient buildings must surpass $500 billion between 2026 and 2030?

And while real estate will continue solving the greenhouse dilemma (real estate is responsible for around 40% of global carbon emissions), we should expect higher investment in sustainability solutions like renewable energy sources, smart energy management systems and building automation systems, all powered by AI and IoT.

Meanwhile, sustainability efforts extend to the realm of construction, with investments flowing into proptech solutions like energy intelligence platforms and ESG data analytics platforms.

What we’ll see in 2024 is the rise of investment in affordable housing, hence the advanced development of co-renting and co-living real estate marketplaces as well as fractional ownership investment and crowdfunding platforms with AI-powered functionality.

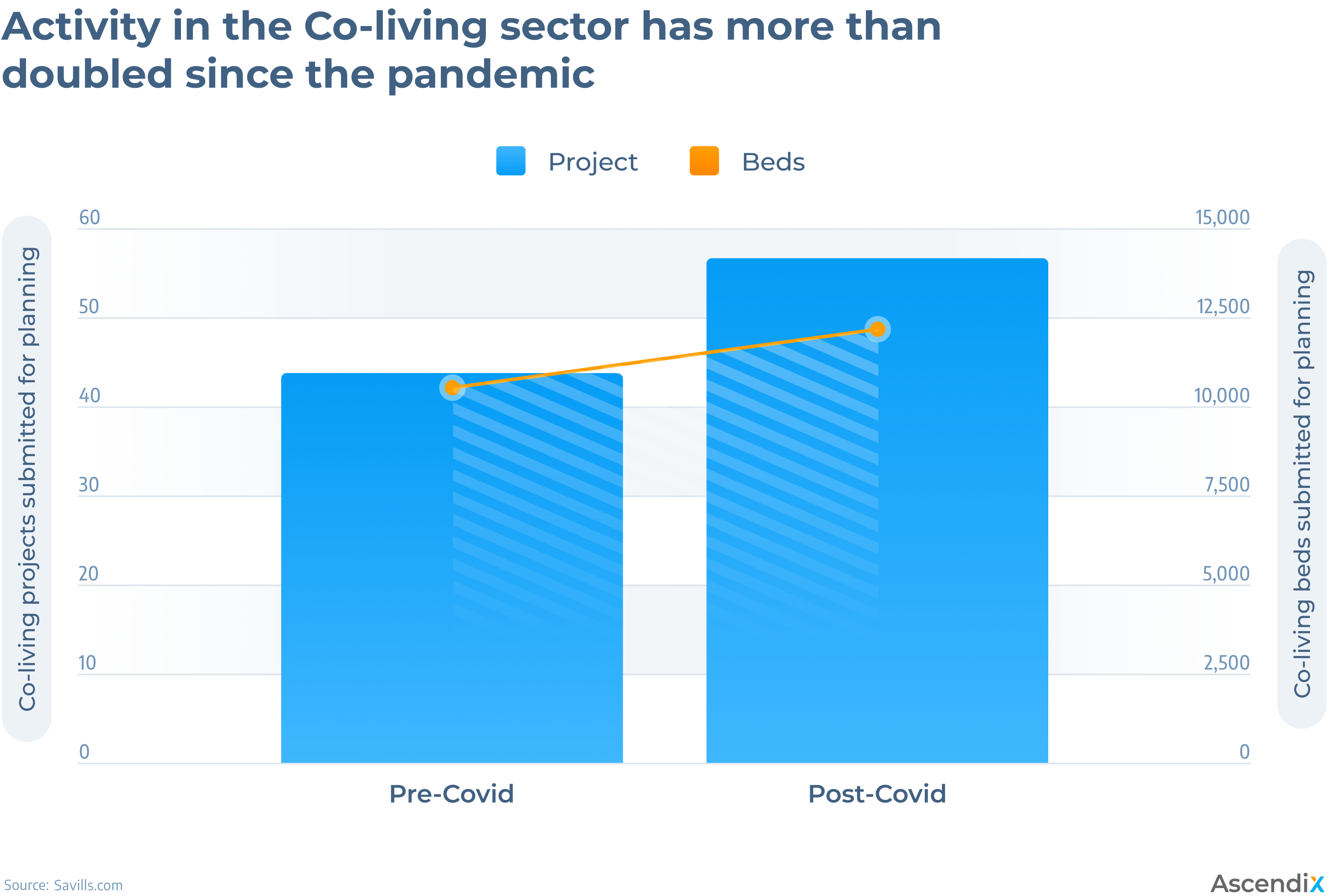

In the first quarter of 2023, Savills and Savills Investment Management conducted a survey among European investors, collectively managing assets worth over €1 trillion. The survey revealed that 38% of these investors are currently involved in Co-living investments. Meanwhile, 51% of European investors intend to venture into co-living investments over the next three years.

If we look at the UK co-living statistics and compare the pre-pandemic number of co-living projects submitted for planning, we’ll see that plans for a further 12,150 beds have been submitted, indicating a more than doubling of activity.

Meanwhile, in the second quarter of 2023, the American multi-housing sector, which includes both multifamily and single-family rented homes, along with purpose-built student accommodation, witnessed an investment of €8.5 billion, surpassing the €7.8 billion invested in offices during the same period.

This particular proptech investment trend can be explained by the pressing need for affordable housing solutions driven by escalating housing costs. For instance, in 2021, approximately 22 million households in the United States grappled with the financial burden of housing costs, marking an increase from 2019. Meanwhile, a survey conducted in 2022 revealed that over one-third of individuals who were renting did not own a home due to financial constraints.

Generally, smart home and building automation offers stable and lower-risk investment opportunities compared to other proptech investment trends.

As per projections, the smart home market is anticipated to exhibit a compound annual growth rate (CAGR) of 11.43% from 2023 to 2028. This growth trajectory is poised to culminate in a projected market volume of $231.6 billion by the year 2028.

Meanwhile, the most popular software to invest in will be IoT home automation systems that personalize customer experience and AI-powered predictive maintenance systems that help property operators and landlords enhance operational efficiency.

As a trusted ally committed to empowering real estate businesses, both proptech startups and industry leaders like JLL and Colliers, Ascendix stands poised to elevate your journey in proptech innovation.

Why Ascendix?

How can we help?

Don’t miss the latest proptech trends – contact us directly or book a free proptech call to learn which proptech solutions can revolutionize your workflows and keep you ahead.

The outlook for proptech in 2024 is optimistic, fueled by increased investment, groundbreaking AI applications, smart home and building automation along with the growing demand for sustainability and affordable housing solutions.

The proptech investment trends to look for in 2024 are AI-powered solutions, sustainability technologies, co-living, crowdfunding, and fractional ownership platforms, and smart home/building automation systems.

Tania is a fan of technologies and an expert in writing about them. In her content, she shares insights into new trends and proptech solutions in real estate that can help your business thrive while keeping your customers content (pun intended).

Get our fresh posts and news about Ascendix Tech right to your inbox.