Want to Use AI in Your Real Estate Document Workflows?

See how AscendixTech can help you automate your operations with the help of AI document abstraction.

Modern problems call for AI in mortgage lending solutions. With the help of AI, lenders can speed up application approvals, flag signs of potential fraud, and improve risk assessment.

AI in mortgage lending is gaining interest. Fannie Mae projects that 55% of lenders will either start trials or roll out AI more broadly in 2025.

In this article, we’ll explore the emerging role of AI in mortgage lending, mortgage AI use cases, and share digital AI mortgage broker tools that you can incorporate into your loan origination process.

Both borrowers and lenders can discover new ways to implement AI in mortgage lending and stay ahead in an increasingly competitive market.

AI in mortgage lending refers to the use of AI & machine learning (ML) algorithms to ease and automate the lending process. Mortgage AI lending uses data analytics to evaluate risks, creditworthiness, property valuation, fraud detection, and more.

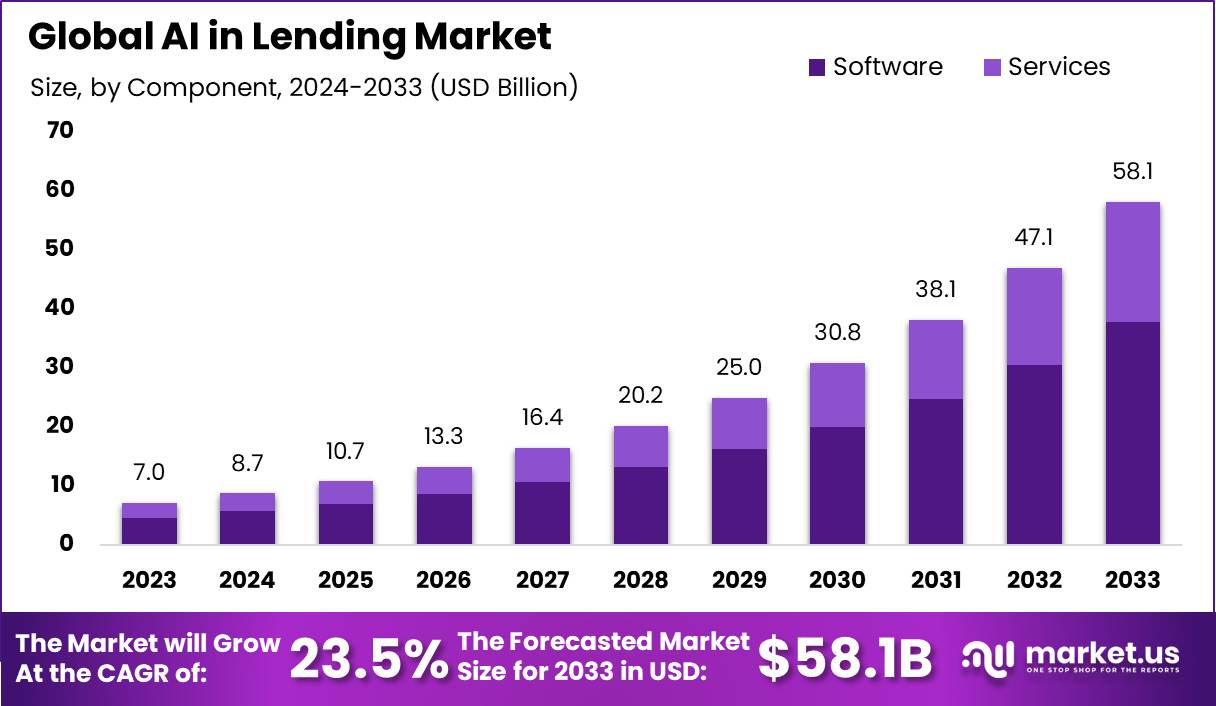

Global AI in Lending Market | Market.us

AI in mortgage lending is expected to reach $10.4 billion by 2027, growing at a remarkable CAGR of 23.5% (source).

Since AI in mortgage lending runs on machine learning (ML) it identifies patterns and trends humans might miss. For example, AI can detect that borrowers who make frequent, small payments are less likely to default. This helps lenders make better decisions and reduce risk.

Some of the significant issues in mortgage lending that complicate the process for both lenders and borrowers are:

AI mortgage lending solutions can speed up the process, make it more efficient and transparent.

See how AscendixTech can help you automate your operations with the help of AI document abstraction.

| Use Case | Key Benefits | Example |

|---|---|---|

| AI Mortgage Document Processing | Faster, more accurate document review, flags inconsistencies. | OCR converts PDFs, scans, or notes into searchable text, AI can extract or summarize details like historical mortgage interest rates. |

| Credit Scoring | Processes large datasets, predicts likelihood of missed payments. | Goes beyond traditional scoring by factoring in overlooked details (e.g., small but consistent savings) and behavioral patterns. |

| Micro-Lending Solutions | Tailors loans to individual borrower needs. | Supports non-traditional income earners like freelancers or first-time buyers with micro-loans that fit unique financial profiles. |

| Automated Underwriting | Accelerates loan approvals and flags issues like income discrepancies. | AI evaluates borrower data allowing lenders to offer customized loan faster. |

| Fraud Detection | Identifies anomalies in applications, monitors suspicious transactions. | Can detect inconsistencies in income/employment history. |

| Risk Assessment | Evaluates environmental, market, and socio-economic risks. | Flags flood-prone areas based on weather and historical data. |

| CRM Data Organization | Centralizes customer data and predicts borrower needs. | Predicts interest in refinancing, sends personalized offers, and alerts brokers. |

| AI Chatbots & Assistants | Provides 24/7 support, answers FAQs and improves customer experience. | Deliver personalized loan advice instantly. |

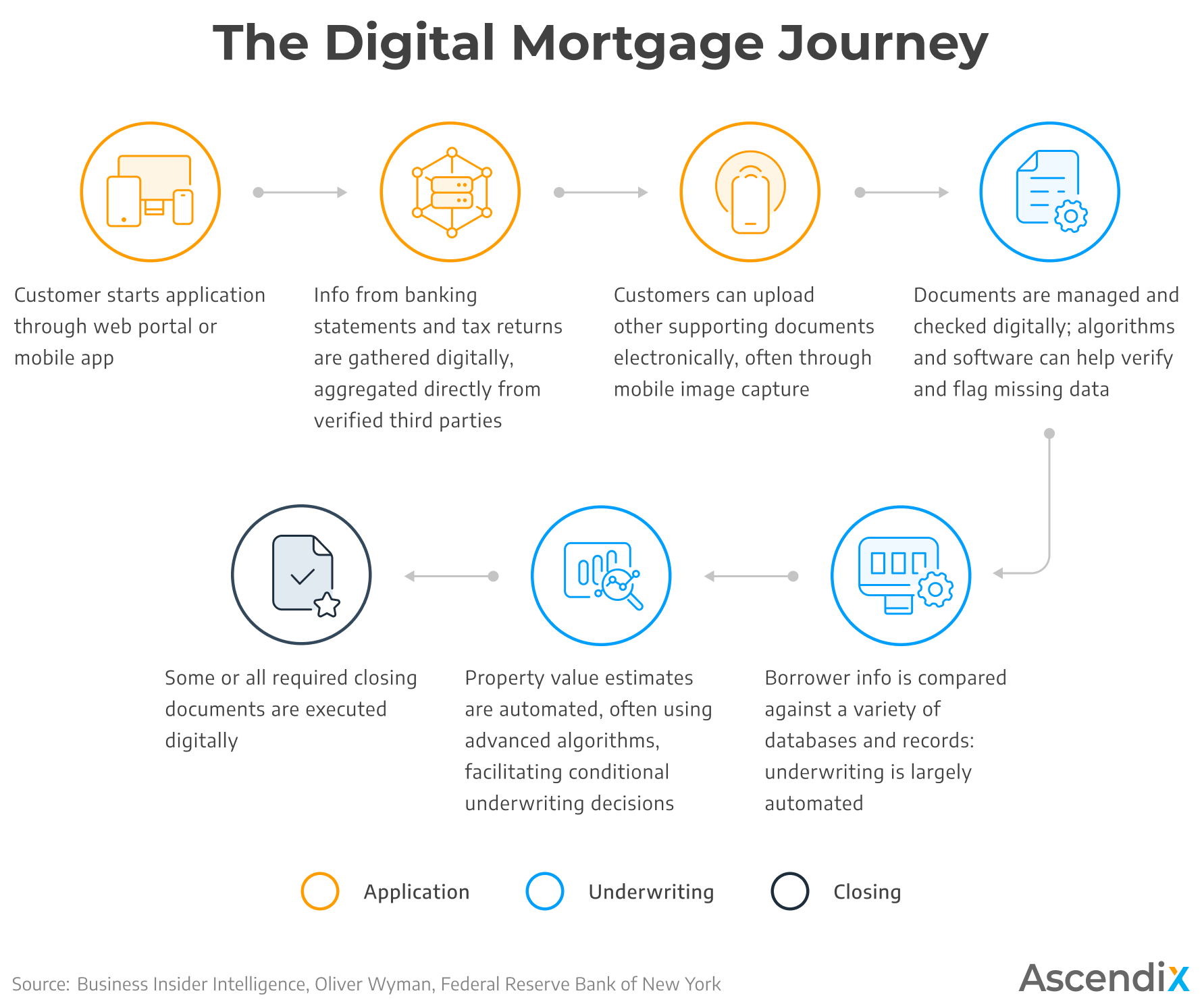

Traditionally, a loan officer would manually review your credit history, financial statements, and other documents to determine if you qualify. This process can be slow and prone to human error or bias. With mortgage AI tools, the experience is much more efficient and accurate.

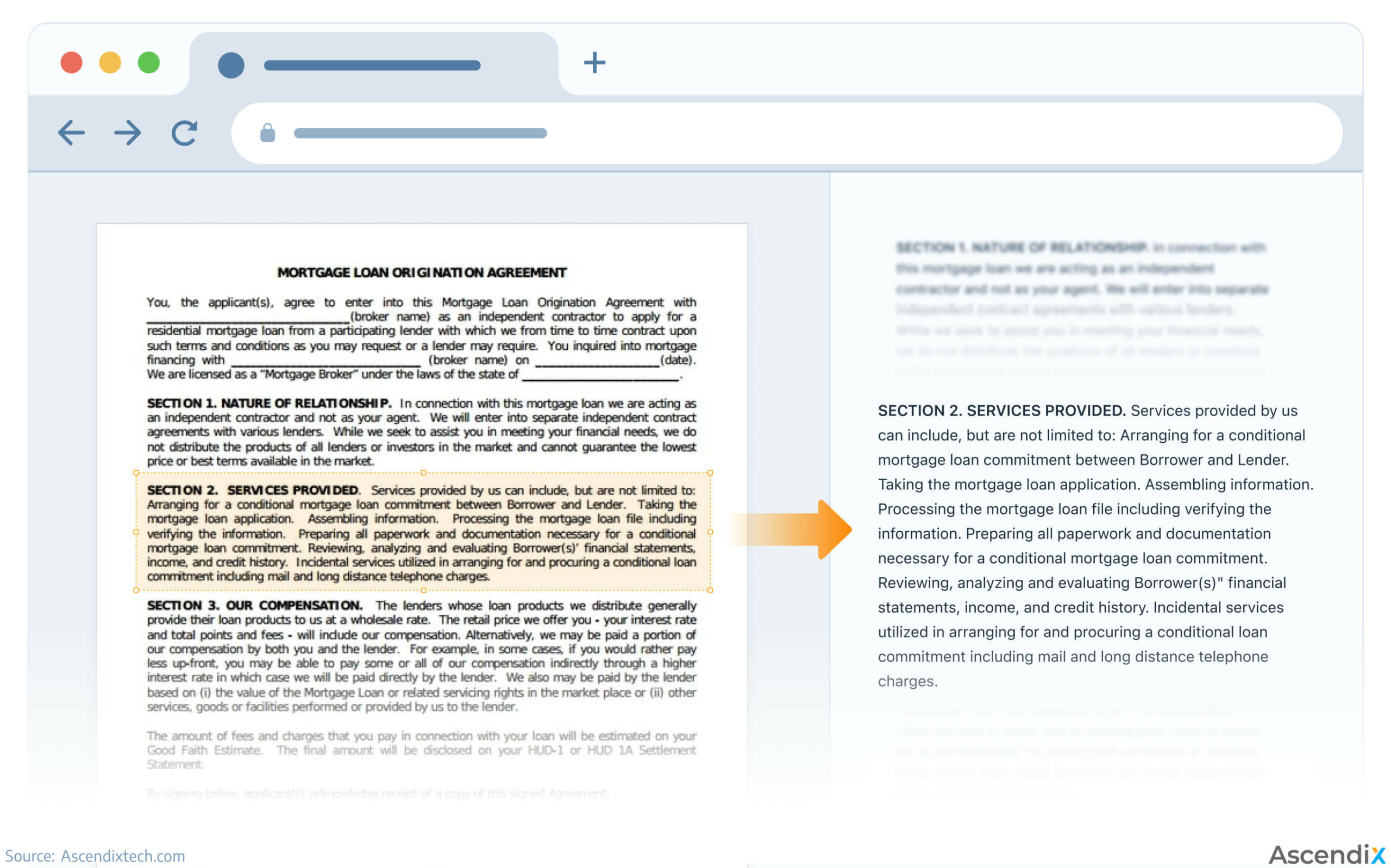

Document automation focuses on processing financial statements, tax returns, pay stubs, and other relevant paperwork. As shown in the picture below, you start by uploading a static document, whether it’s a PDF, Excel sheet, Word file, or a hand-written note. The AI tool with the OCR component then converts it into text that you can easily copy and paste.

The best part is that you can also ask the AI to summarize the document or extract key information. For example, if you want to know the mortgage interest rate for a customer back in 2018, you can simply ask the tool, and it will quickly find and present that information in a concise, easy-to-read format.

Document automation goes beyond just speeding up the process. It allows lenders to handle large volumes of documents and flag inconsistencies or missing information.

The Ascendix team can help you automate your operations with the help of AI.

Credit scoring is a long and meticulous process. One must check the borrowing history, review payment patterns and total income, as well as the client’s financial stability.

AI in credit scoring switches the process to quick and seamless. Machine learning algorithms help you process vast amounts of information, identify patterns, and provide a more comprehensive view of a borrower’s creditworthiness.

Here’s a better overview:

Every borrower has different financial situations and needs. But traditional mortgage products often lack the flexibility to adapt to these individual circumstances.

How can AI help? With AI, lenders can craft lending solutions that fit the specific needs of each borrower. By analyzing extensive data, AI finds patterns in borrower behavior and preferences. So, lenders know how to create personalized micro-loans. It’s beneficial for clients of every walk of life: first-time buyers, freelancers, or those with non-traditional income. Using AI, lenders make the lending process more relevant for the borrower but also boosts the chances of timely repayment.

Automated underwriting leverages AI to assess loan applications more quickly and accurately than traditional methods.

Mortgage AI underwriting systems evaluate borrower data, credit scores, employment history, and other relevant factors to make real-time decisions. This not only speeds up the approval process but also ensures consistency and reduces human bias. Automated underwriting can identify potential red flags, such as discrepancies in income reporting or previous defaults, allowing lenders to make informed decisions and offer suitable loan products.

With AI in mortgage lending, you can detect and prevent fraud in a smart way.

AI systems analyze patterns and behaviors to identify suspicious activities. For example, they can detect anomalies in loan applications, such as inconsistencies in reported income or employment history. AI can also monitor transactions for signs of money laundering or identity theft. By flagging these issues early, lenders can take preventive measures, safeguarding their operations and maintaining regulatory compliance.

For 2 decades we’ve been developing bespoke software that automates workflow in real estate companies.

Mortgage AI enhances risk assessment by analyzing vast amounts of data.

AI in mortgage lending can assess risks by identifying potential environmental hazards, local market fluctuations, and neighborhood crime rates. For example, if mortgage AI detects that the property is in a flood-prone area based on historical data and recent weather patterns, it might flag this as a risk. This allows the lender to adjust the loan terms or require additional insurance to mitigate potential losses.

AI-boosted CRM systems, like Salesforce, manage and analyze customer interactions and data throughout the customer lifecycle.

Imagine a mortgage broker using an AI-enhanced CRM system. Here’s how it could work in a real-world scenario:

A client recently inquired about refinancing the mortgage. Mortgage AI in CRM tracks client’s interactions, such as email exchanges and call logs, and notes her specific interest in lower interest rates. Based on this data, the AI predicts that the client is likely to be interested in promotional refinancing offers.

The next time the client logs onto the mortgage broker’s website, they receive a personalized message offering a new refinancing option with competitive rates. Mortgage AI feature also suggests relevant loan products based on their financial profile and previous interactions. Additionally, the CRM system alerts the broker to follow up with the client at an optimal time, based on their past engagement patterns.

The Ascendix team is an expert in Salesforce and Dynamics 365 CRM.

Chatbots and virtual assistants automate customer interactions. They can cover the following tasks: answer frequently asked questions, schedule appointments, and provide initial mortgage advice.

Interested in implementing AI in your business? You can fully trust Ascendix with the technical part. Our certified software professionals are ready to help you build a custom AI real estate chatbot that elevates your operations. Talk to our team to find out how.

AI mortgage brokers offer advanced solutions in the real estate industry. For instance, they can help with risk assessment, property and market valuation, and document automation.

Also referred to as robo-advisors, AI mortgage brokers, run on special algorithms and offer valid financial advice. For instance, an AI mortgage broker can analyze a client’s financial history, credit score, and current market conditions to recommend the best mortgage options.

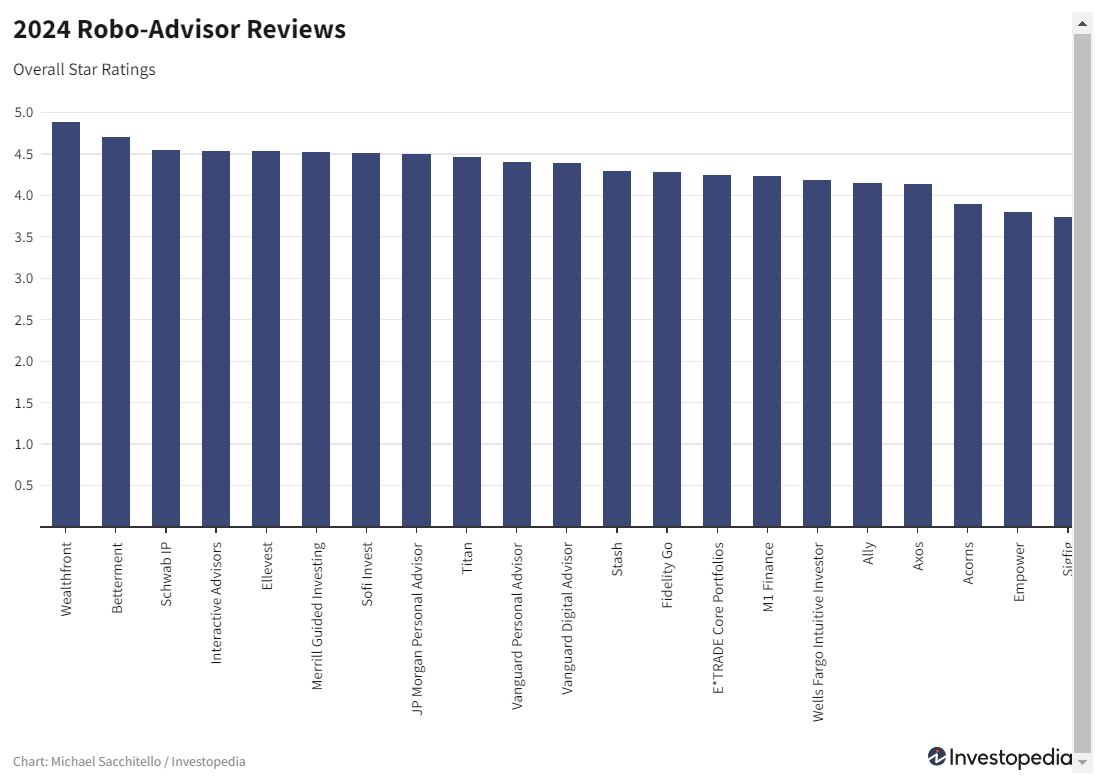

Some robo-advisers come with many nifty mortgage AI features while others offer tools within their investment portfolio which can aid during the home-buying process.

The interest in the AI robo-advisors is growing in the financial niche. Here’s the 2024 statistics:

Let’s take a detailed look at the well-known robot-advisers that can have AI mortgage broker features.

Looking for a robo-adviser with many sophisticated features? Wealthfront offers all-round financial help with affordable fees. With this robo-advisor you get investment portfolio options, daily tax-loss harvesting, as well as a mortgage AI assistant.

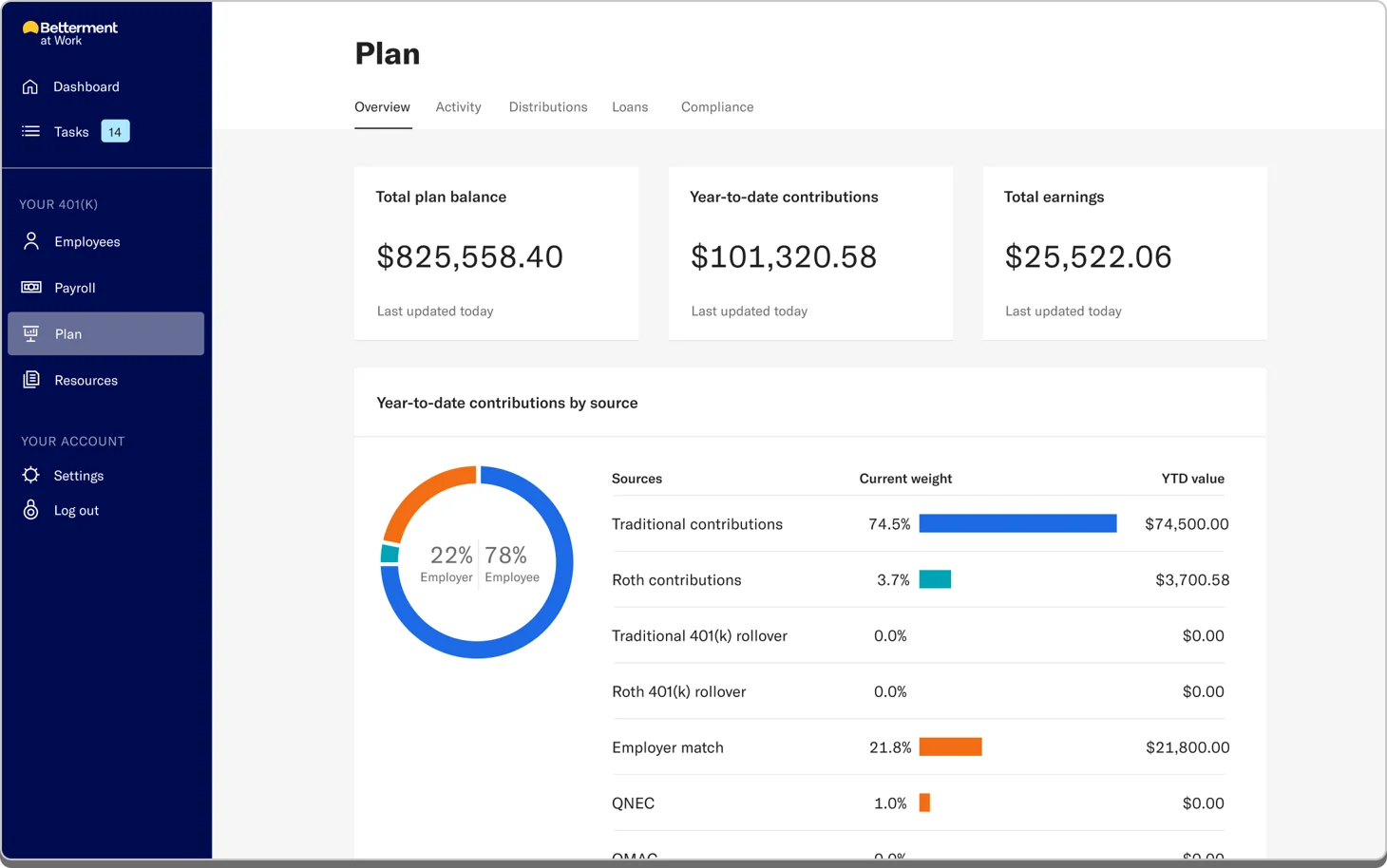

Betterment combines AI technology with a human broker’s touch. For instance, clients get help with tax optimization, rebalancing, portfolio management, and more. Additionally, customers receive mortgage AI-driven tips regarding investments and credit cards from Betterment. On top of everything, this robo-advisor offers seven-day-a-week customer support.

Schwab Intelligent Portfolios is the latest addition to the American financial giant — Charles Schwab Corporation. This robo-advisor provides high-quality insights and various features to its customers.

Schwab Intelligent Portfolios does not directly provide mortgage AI services. But it can help with preparation for a home purchase through its financial planning tools:

See how AscendixTech can help you optimize your operations and improve your workflow with the help of AI.

Interactive Advisors launched its journey as the investment advisory back in 2007. This robo-adviser is perfect for managers and brokers since they can:

The major focus of Interactive Advisors is investing. Hence, this robo-advisor provides strategy-oriented market suggestions, automation features, and adjacent financial services.

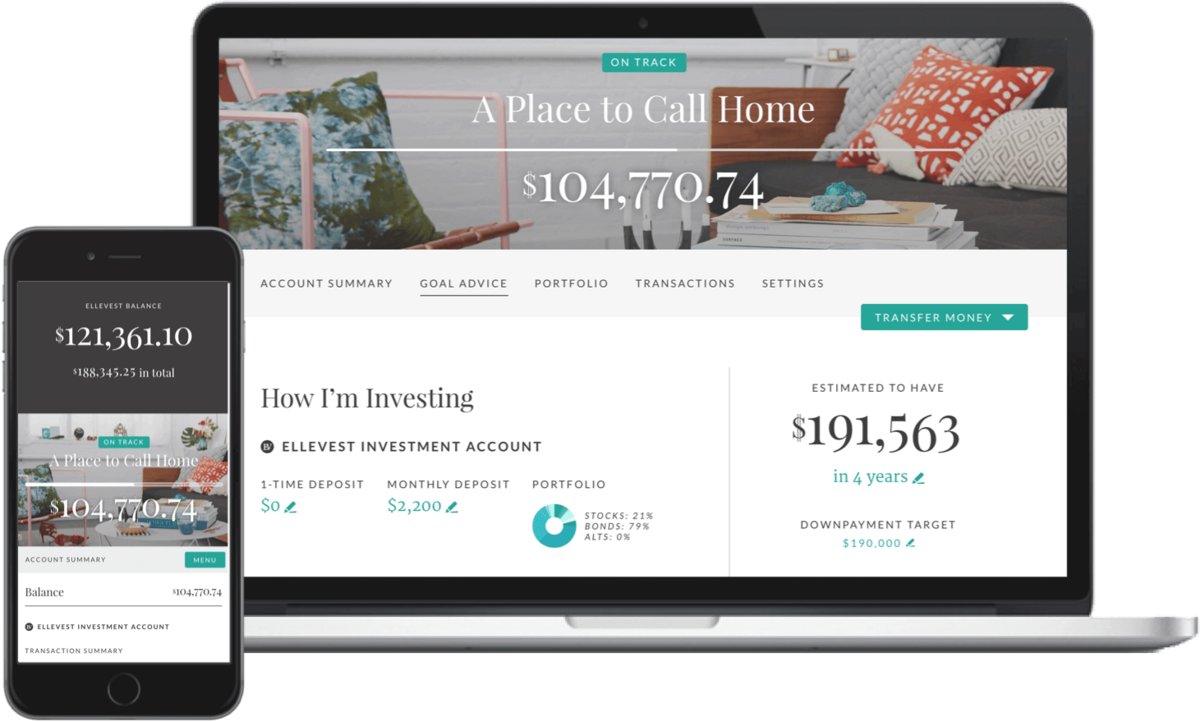

Ellevest is an investment robo-advisor built around and for women needs in the industry. Unrestrictedly people of all genders can become Ellevest users.

Acting as fiduciary, this robo-advisor provides investing options, focusing on the gender-specific issues of salary gaps, career breaks, and longer life expectancy.

While Ellevest does not have a stand-alone mortgage AI feature, it can provide valuable information for home buying and family planning. Through the guide, they promise to cover the following questions: How much home can I afford? Is a full 20% down payment needed? How does one obtain a mortgage?

Merrill Guided Investing is another robo-advisor that integrates automated investment with human professionalism.

With this tool users do not have access to mortgage AI features. However, they can benefit from other investment portfolio tools to make more informed decisions about lending investments:

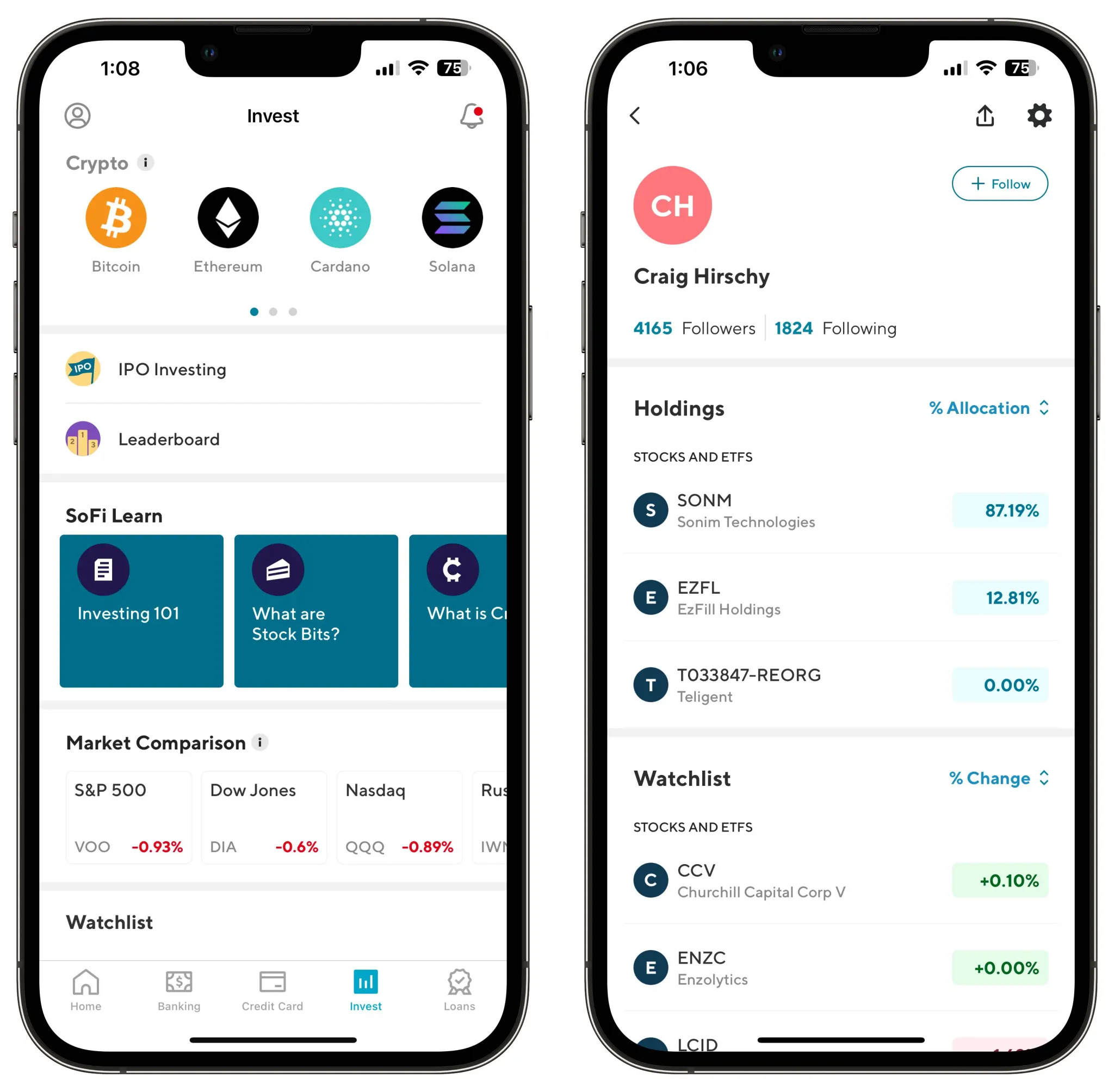

SoFi is known as the best low-cost robo-advisor. If you are just starting out building your investment portfolio, this tool is a great fit. Additionally, SoFi is a is an all-inclusive online brokerage for both passive and active investors.

Just like many investment portfolios, SoFi does not directly have AI mortgage lending tools. However, users have access to:

In case you are not finance-savvy, SoFi can offer you help of financial experts.

Zillow Home Loans is an online mortgage AI tool through which you can get:

Zillow Home Loans uses AI to match borrowers with the most suitable mortgage options. The platform analyzes borrowers’ financial profiles, including credit scores, income, and debt-to-income ratios, to suggest the best loan products. The AI mortgage lending feature helps in optimizing the loan search process and providing accurate recommendations.

Zillow Home Loans benefits:

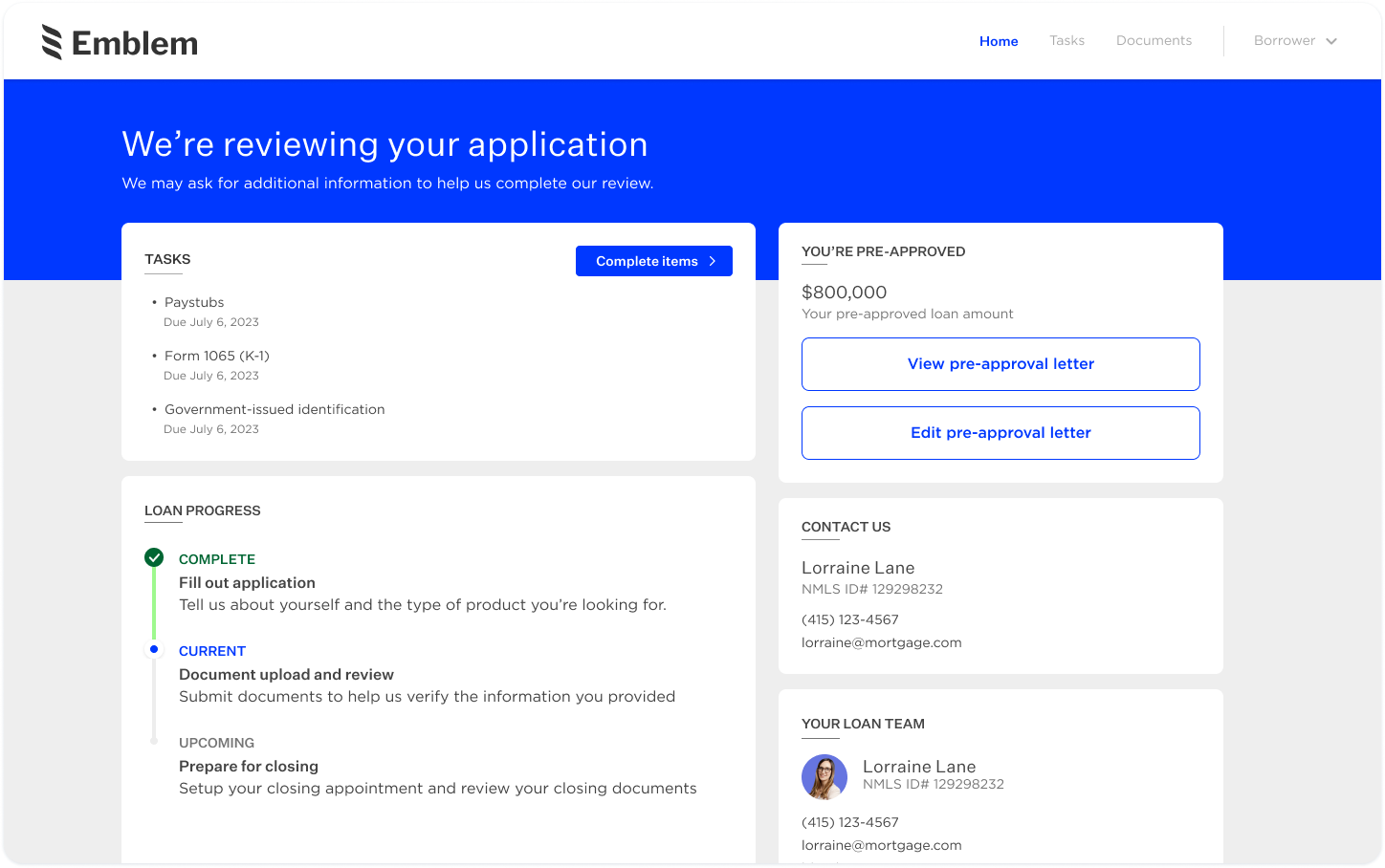

Better Mortgage uses AI to automate and simplify the mortgage application process. The AI mortgage lending platform collects and analyzes borrowers’ financial data to provide instant loan options and quick pre-approvals. The AI evaluates credit scores, income, employment history, and other financial factors to determine the best mortgage products for each borrower.

Key features:

Blend offers users AI in mortgage lending operations. This platform helps lenders streamline the mortgage application process. The mortgage AI feature automates the collection and verification of financial documents, assesses borrower eligibility, and provides real-time loan options. Bonus: lenders can integrate Blend’s platform into their existing systems to enhance efficiency and customer experience.

Blend’s benefits:

Robo-advisors are affordable and beginner-friendly platforms in the investment sector. These online financial services automate portfolio management, mortgage planning, and other financial tasks to help users achieve their financial goals with ease and efficiency.

| Pros | Cons |

|---|---|

| Free or low-cost. Accessible for those on a budget. | Medium flexibility and personalization. |

| Automated processes eliminate biases and emotions in decision-making. | Not all robo-advisors offer in-person support and counseling. |

| AI mortgage broker features help find the best mortgage rates. | May not provide the broader financial situation. |

| Can be used alongside human advisors for a balanced approach. | More suited for simple and long-term investments. |

| Different robo-advisors for various needs. | Can be uncomfortable for tech novices. |

To choose the right AI mortgage lending tool, you must be aware of the benefits and drawbacks of both custom and ready-made tools. Here’s a quick overview to help you:

Custom AI in mortgage lending is often worth the investment when you are searching for:

Off-the-shelf mortgage AI solutions may be adequate for:

If you want to get ahead of the AI adoption game, contact Ascendix professionals. During the intro call, we’ll discuss your AI readiness, identify key areas for implementation, and assess your current technical resources.

For two decades the Ascendix team has been a business automation leader in the real estate industry. Over the years, we’ve closely followed the advancements in AI technology and become experts in integrating it into Proptech software.

One of our recent accomplishments — a custom document abstraction framework — tailored specifically for the real estate industry. Our framework is designed to meet the unique needs of real estate documentation, avoiding the pitfalls of generic, one-size-fits-all solutions.

Why is Ascendix a Trusted Partner in AI Mortgage Lending?

Book a free consultation to learn how we can assist with creating a custom AI Proptech solution.

Contact us and we’ll execute your vision and develop a tailored AI solution for your company.

AI automates underwriting, speeds up approvals, reduces document errors, detects fraud, enhances risk assessment, and personalizes borrower interactions.

Mortgage AI tools can automate day-to-day tasks in broker’s routine. The tools include document processing, AI mortgage lending, data analysis, risk assessment. Additionally, AI chatbots improve customer experience.

Not entirely. While AI is a great help in reviewing documents and spotting any red flags, underwriters are still the ones who take on the really complex cases, using their own judgment to make the final call.

AI in mortgage lending can cover many traditionally manual tasks. For instance, you can extract relevant data from leases, analyze financial data, and predict the risk of loan defaults. Mortgage AI tools are useful in the post-approved stage as well. With the help of predictive analytics, mortgage AI tools can review your borrowers’ credit reports to find warning signs, like changes in how they borrow or pay. By catching these signs early, you can contact your clients and offer a more affordable repayment plan, which can help prevent them from missing payments.

Key concerns include data privacy, regulatory compliance, bias in AI models, and integration complexities with legacy systems.

Darina is an expert in property and AI technology. In her content, she shares insights on how technology can optimize real estate workflows, along with proptech news and handy resources.

Get our fresh posts and news about Ascendix Tech right to your inbox.