Build Innovative Proptech Platform with Us

We are tech experts with 16+ years of experience in the real estate industry. We can execute your vision and give expert advice on your project.

Efficiency has become the watchword in the lending industry, and at the forefront of this transformative shift is loan origination software (LOS), or hard money lending software as it’s called in the private mortgage industry.

Hard money lending software streamlines and optimizes the entire private money loan service cycle, from application submission to fund disbursement, ensuring faster approvals and a more seamless experience for both borrowers and lenders.

In our article, we investigate the possibilities of hard money lending software for loan origination process optimization. Furthermore, we overview different types of loan origination software, spotlighting the best tools and why they work for hard money lenders.

Hard money lending is a form of lending that involves securing the loan with a high-value collateral, usually the property of a borrower. Hard money loans are short-term and are typically used in real estate transactions by investors or house flippers, as they provide a substantial amount of money fast and without credit checks since the property is used as collateral.

This kind of loan is issued by individuals or private organizations rather than banks, therefore, they are also called ‘private money loans.’

Hard money loans are especially popular in the sphere of real estate for a number of reasons:

Therefore, private property loans are more beneficial than a typical mortgage or bank loan.

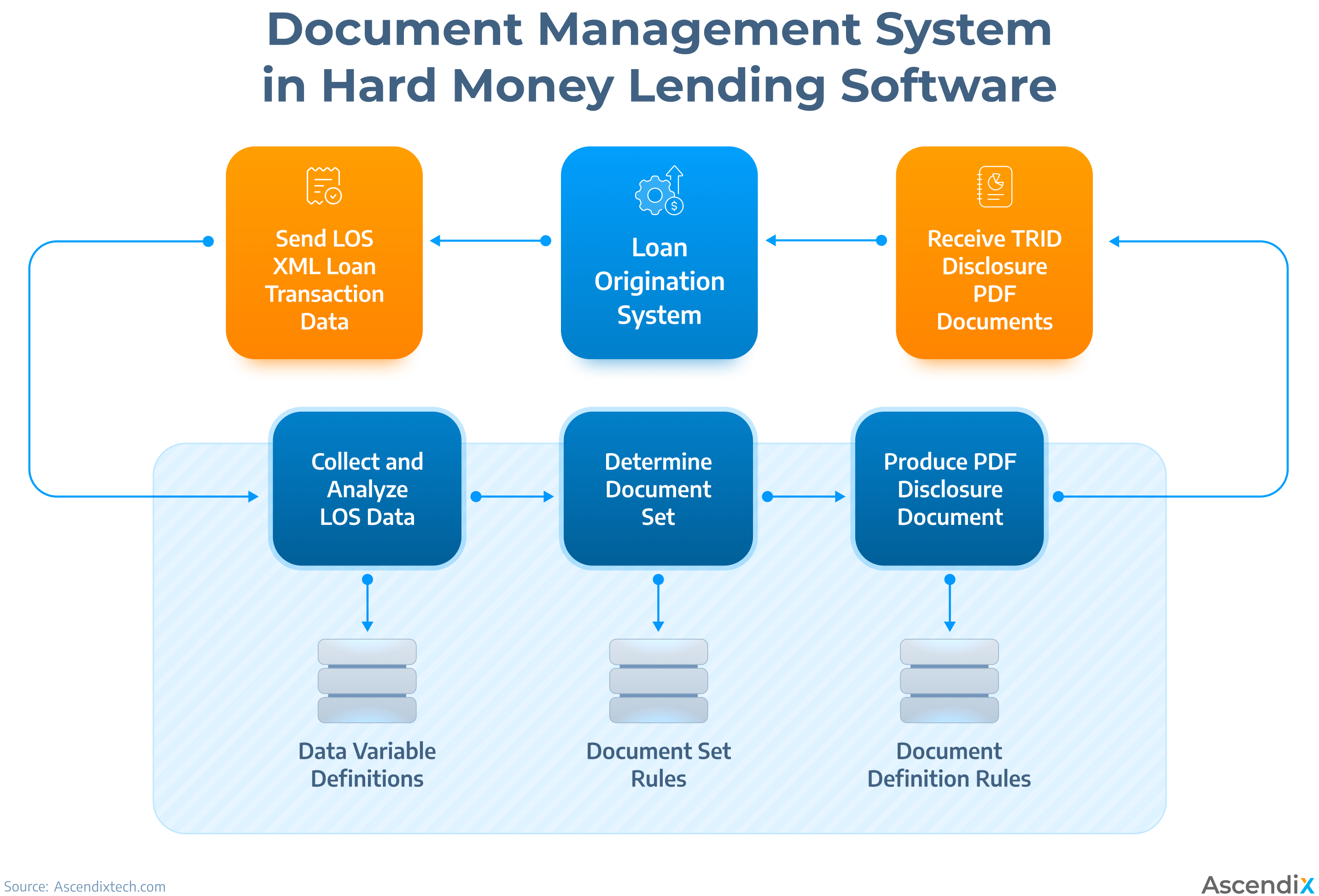

Hard money lending software (aka private money lending software) is a type of loan origination software (LOS) designed to automate and streamline the entire process of originating loans in the private money industry, including document verification, portfolio management, financial statement analysis, loan processing, credit approval, loan sanctioning, and automated underwriting.

Additionally, it can be customized to cater to different types of private money loans, including Fix & Flips, Rental Loans, New Constructions, Multi-family Properties, and Commercial Properties.

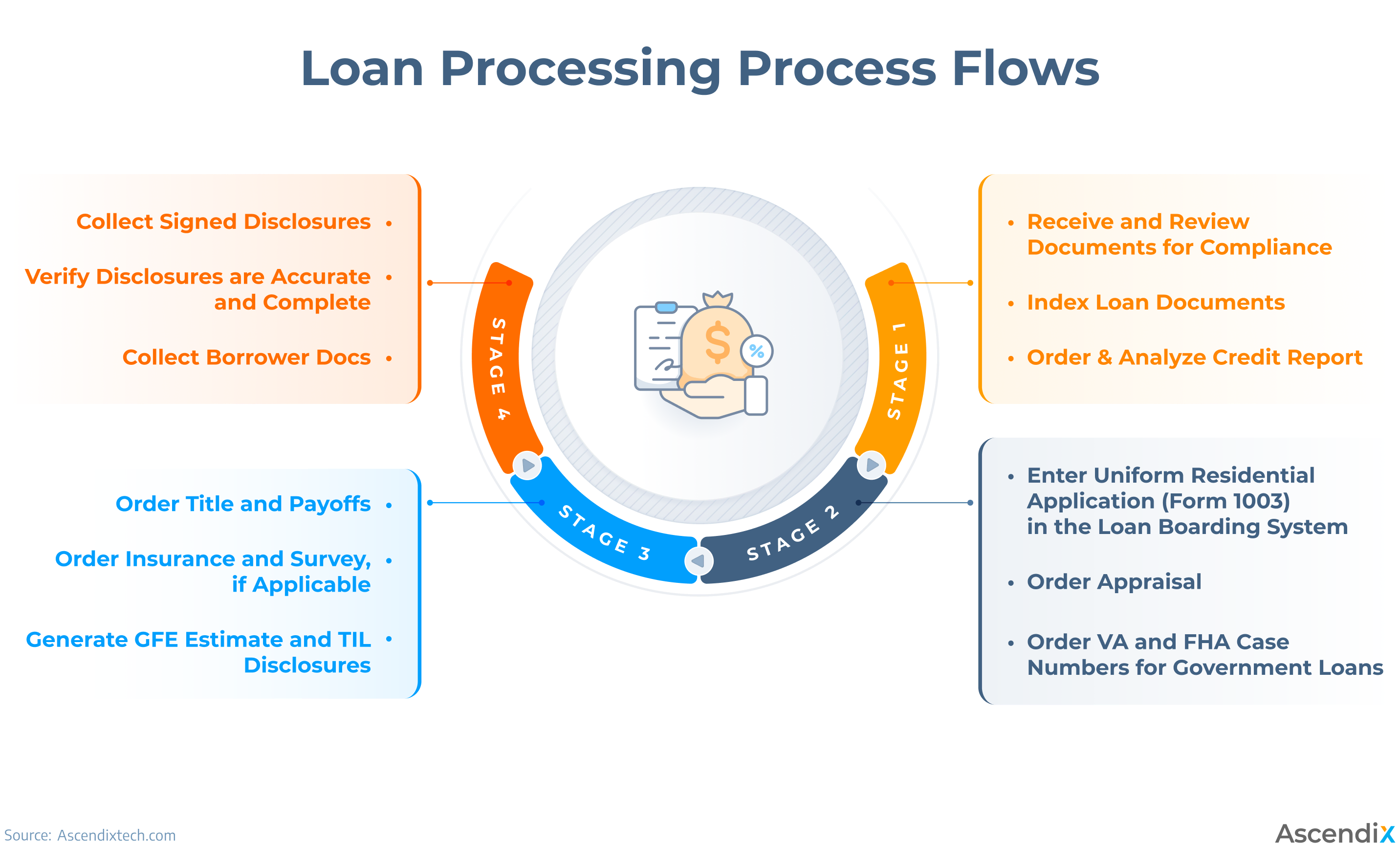

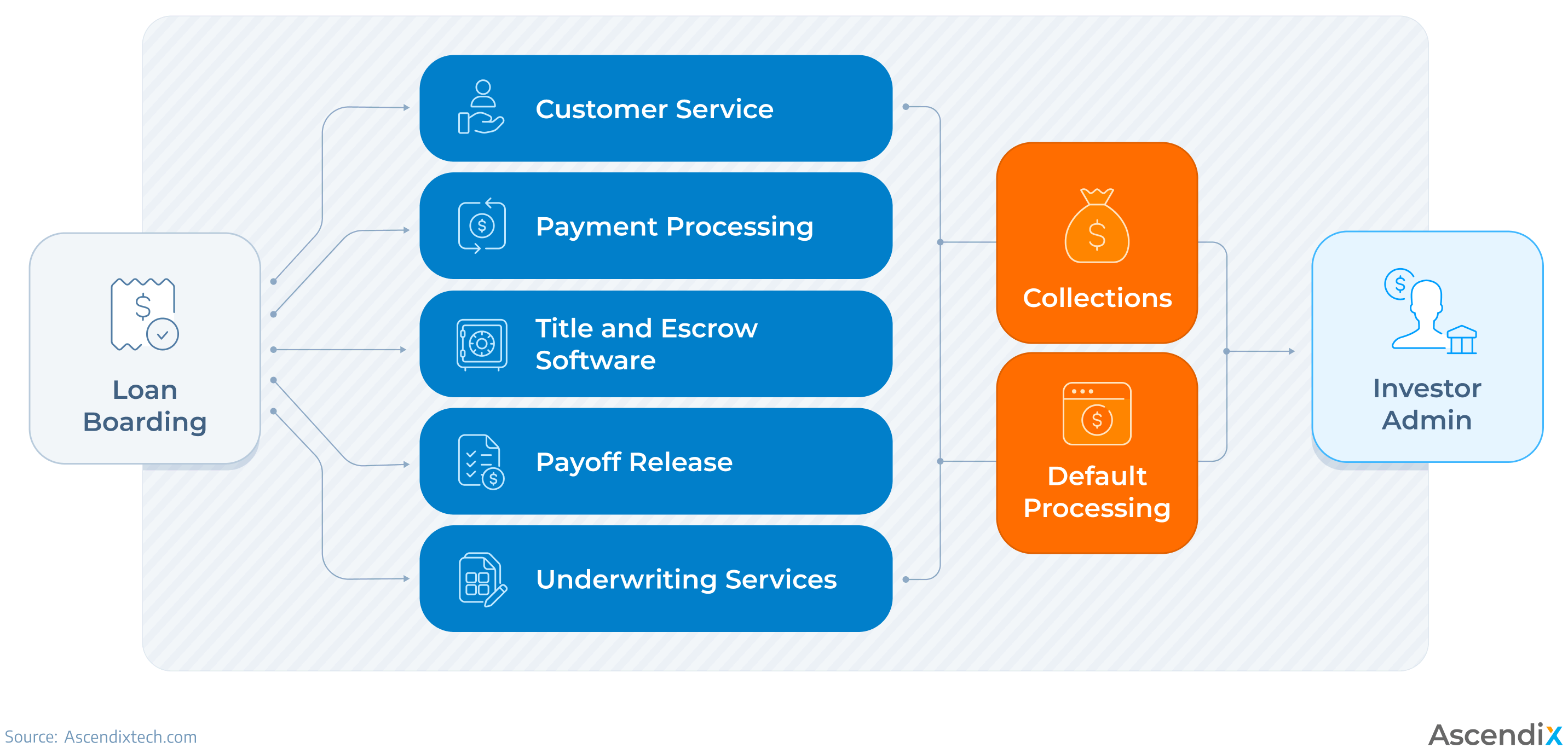

Here are the examples of how private money lending software addresses different stages of the loan cycle:

Stages in Hard Money Lending

By automating these processes, hard money lending software optimizes the loan origination cycle, leaving out a lot of manual work and giving more valuable time for agents to deal with the ongoing tasks.

We are tech experts with 16+ years of experience in the real estate industry. We can execute your vision and give expert advice on your project.

Lender’s Portal Interface | Source: AutoCloud

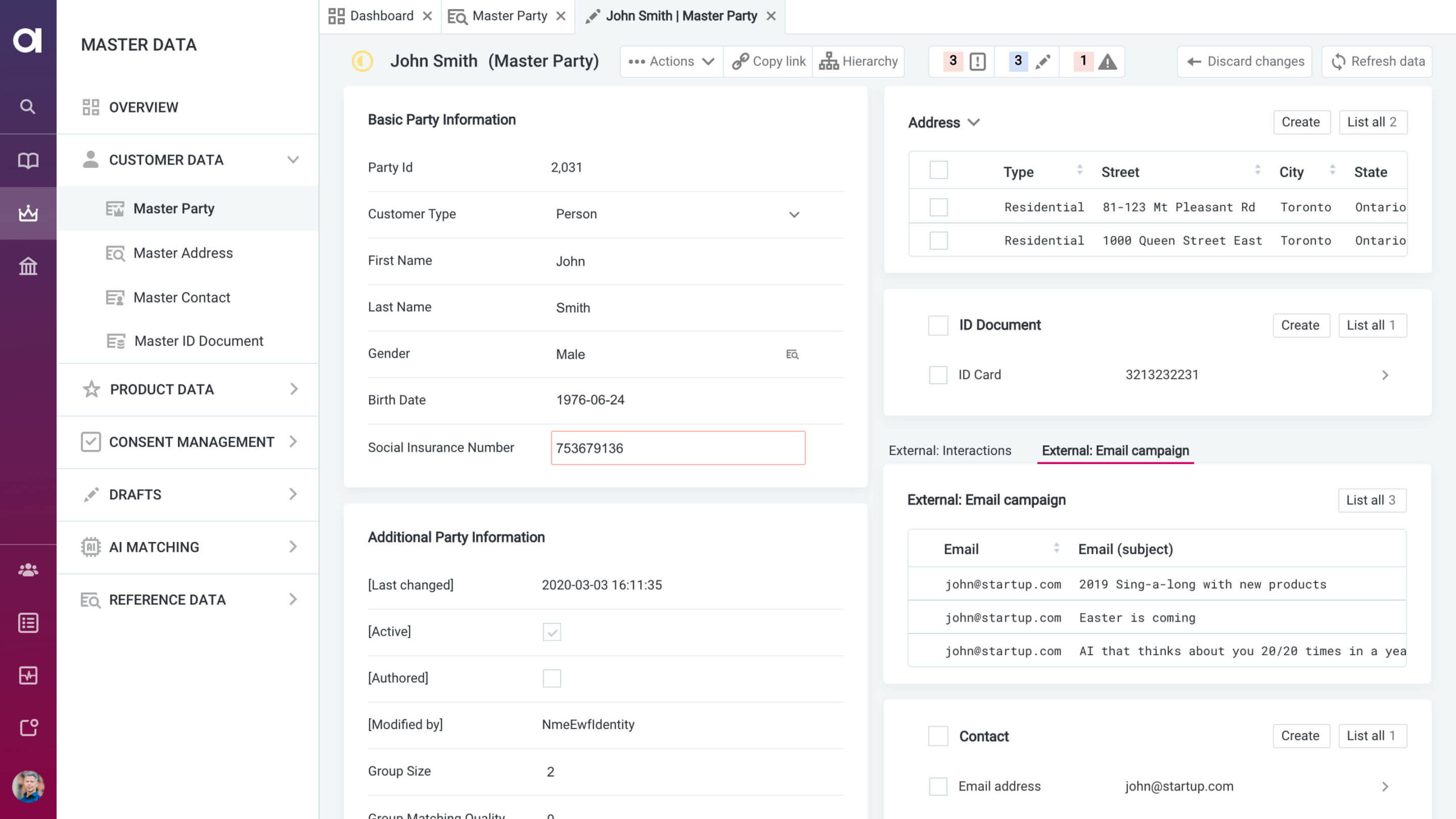

CRM Interface | Source: Ataccama

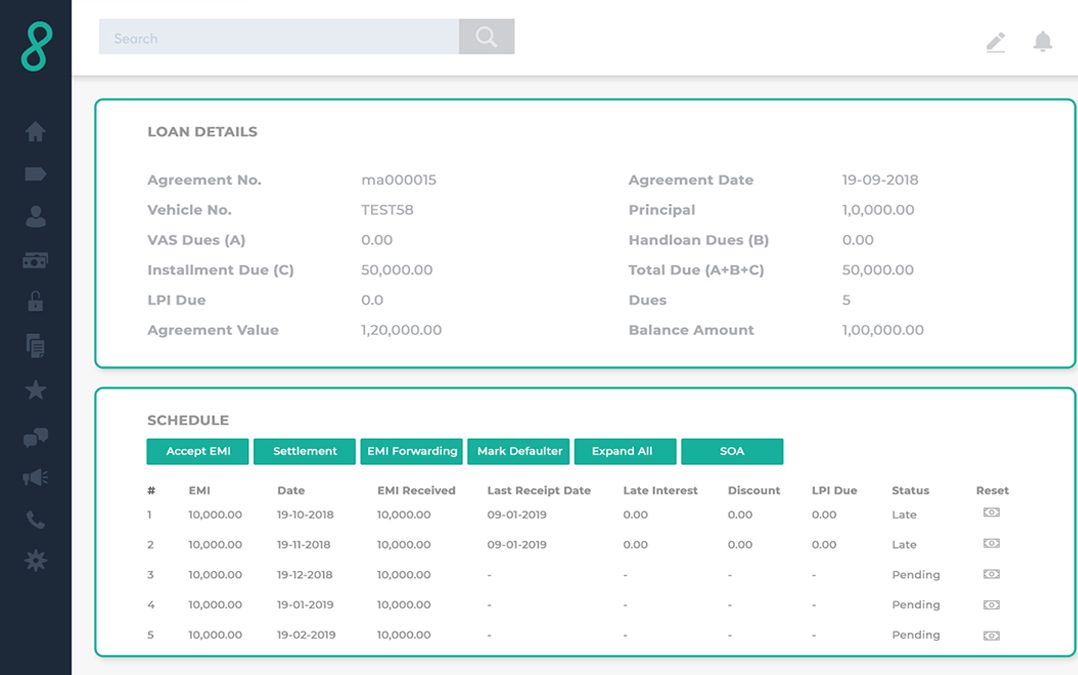

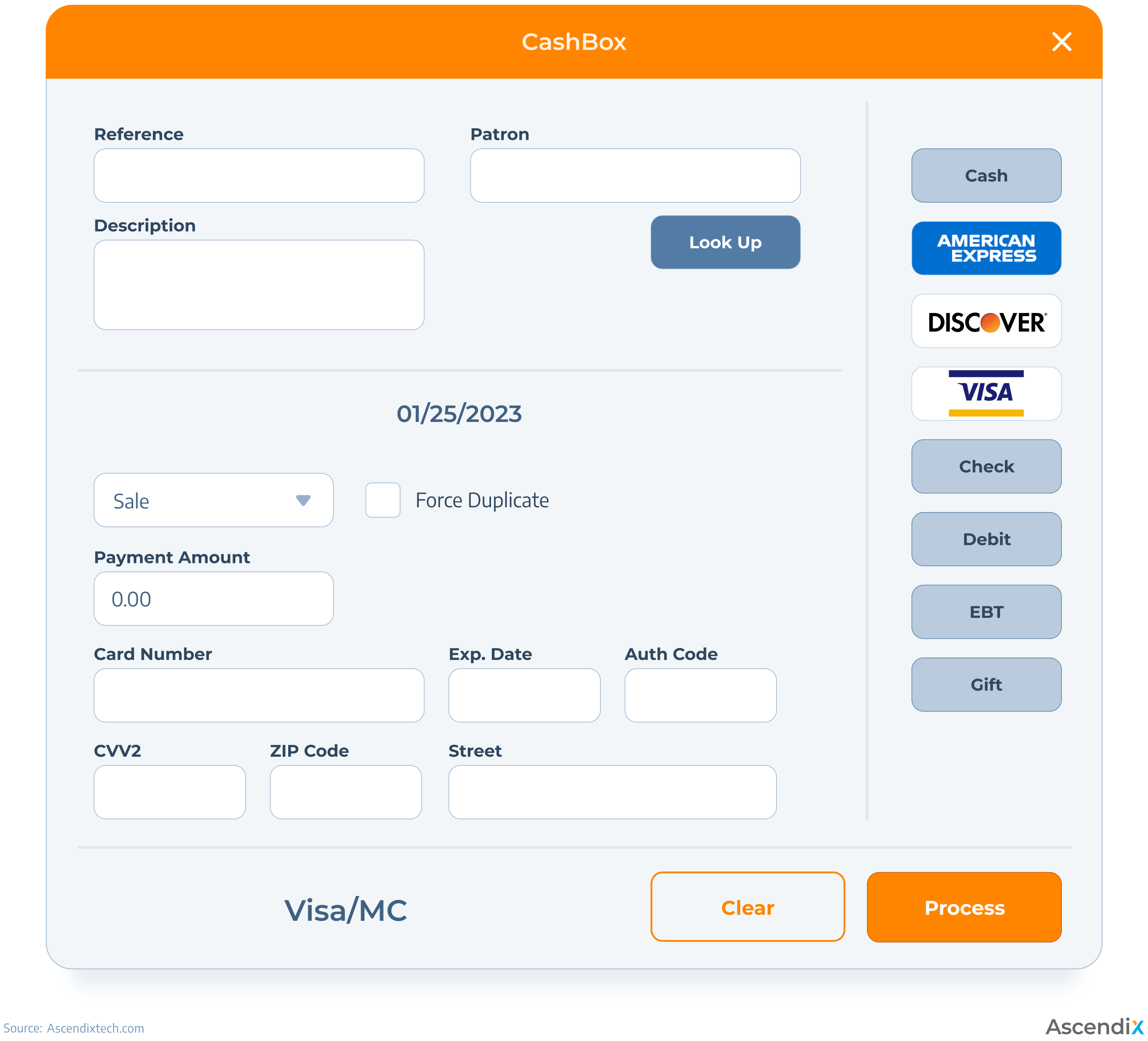

Payment Processing in Hard Money Lending Software

Dashboard | Source: Wemlo

Analytics tools | Source: LexTree

We’ve got 2 decades of expertise in proptech development. Trust your project to AscendixTech professionals.

Hard money lending software is not limited to a single kind of software for lenders and/or borrowers. In reality, there are multiple types of software for these purposes. Most common types are Loan Origination Software and Loan Servicing Software: they facilitate a full cycle of lending, from loan application to payback. Other types of software, mentioned below, like document management or underwriting tools, are often integrated into LOS or servicing software.

Loan Origination and Servicing Software | Features and Services

We have collected the list of hard money lending software providers that may help you in different stages of hard money lending.

LendingWise is a cloud-based loan origination system providing LOS, servicing, and CRM solutions. It is designed to streamline the lending process for various types of loans, including hard money lending. This hard money lending software has been helping lenders and brokers since 2017 in their efficient loan management, gaining over 2,000 users over the years.

LendingWise specializes in various loan types, including rentals, bridge, flip and fix loans, multi-family loans, and other CRE and SBA loans. The platform offers an all-encompassing solution for individual lenders, organizations, and brokers, integrating a comprehensive loan origination system, CRM, and marketplace platform with private money lending software features like draw management, asset management, and loan application setup. This integration empowers users to oversee the entire loan cycle effectively.

Type: Loan origination & Servicing software, CRM

Features:

Moneylender Professional is a hard money loan software offering a user-friendly loan management system. Its flexibility extends to accommodating various loan structures, including interest, principal, fees, and repayment, making it suitable for any loan type. The software allows users to modify terms at any point, with automatic adjustments to calculations. Whether dealing with traditional amortized loans or more complex, unstructured loans, Moneylender handles them seamlessly.

The hard money lending software acts as a central hub to monitor the performance of all hard money loans, offering a main window to track and run detailed reports on individual loans or the entire portfolio. Users can customize statements and reports, tailoring Moneylender to match their preferred style. MoneyLender Professional is a private money lending software that is perfect for managing loan origination, servicing, and conducting required calculations.

Type: Loan Servicing Software

Features:

LendFoundry is a kind of hard money lending software for loan origination process optimization, ensuring swift loan closings via an adaptable and automated cloud based hard money lending platform. The software best suits the dynamic needs of hard money lenders, borrowers, appraisers, contractors, and investors. This cloud based loan origination system is tailored for a wide range of loan types, including Fix & Flips, Rental Loans, New Constructions, and Commercial Properties.

LendFoundry facilitates seamless loan approvals, property document verification, application tracking, property reports, underwriting, and final term sheets, all automated to enhance efficiency. LendFoundry’s deployable building blocks can be customized to fit specific workflows, branding, and preferences, with a state-of-the-art micro-services design ensuring high performance and seamless scalability. This hard money loan software facilitates an efficient and tailored solution for different business needs.

Type: Loan Origination and Servicing Software

Features:

Mortgage Automator is an end-to-end loan origination provider offering private mortgage software along with a hard money lending platform. Ideal for various lending scenarios, including residential, commercial, and construction lending such as rehab and fix & flips, the platform’s competitive features are auto-generating personalized documents, compliance reports, ACH/PAD payments, and more. The solutions include loan origination and servicing, giving the lender and the borrower flexibility and operations optimization.

Mortgage Automator is a great variant of hard money lending software, with its quick document generation, compliance capabilities, advanced payment functionalities, and efficient workflow management. The inclusion of borrower and investor portals along with communication channels makes this hard money loan servicing software a great choice for private lenders and also for hard money lending management.

Type: Loan Origination, Investing, and Private Mortgage Servicing Software

Features:

LendFusion stands at the forefront of hard money lending software, providing a streamlined solution for lenders in real estate financing. This cloud based loan origination system uses innovation to automate and optimize the lending process, offering a wide range of tools to match the needs of hard money lenders. LendFusion simplifies the complexities associated with hard money lending, from borrower onboarding to loan origination and management.

This lenders software includes real-time tracking of loans, customizable workflows, and automated underwriting processes. LendFusion also prioritizes security by incorporating encryption and compliance measures to ensure the confidentiality of financial data, involved in the lending process. In essence, LendFusion is a good choice of hard money lending software for both lenders and borrowers, offering an advanced platform that streamlines operations and helps both parties benefit from private money lending.

Type:

Features:

The Mortgage Office is hard money lending software designed to streamline and automate the complex processes associated with private and hard money lending. The software is targeted on lenders in the real estate financing industry. From borrower management to loan origination, servicing, and beyond, The Mortgage Office provides a centralized platform for efficiently handling the complete loan origination lifecycle.

A competitive feature of this private money lending software is its versatility, as the platform combines various loan types and structures within the hard money lending space. The software integrates with accounting systems, automates payment processing, and facilitates borrower communication. Additionally, it includes tools for risk management, compliance tracking, and reporting. The Mortgage Office stands as a reliable and comprehensive hard money loan software for individuals and companies to automate and scale lending business.

Type: Loan Origination and Servicing Software

Features:

LenderLink, a cloud-based loan origination system, is one of the major players in the sphere of private money loans, offering specialized hard money lending software for connecting together borrowers and lenders. LenderLink provides a comprehensive platform that streamlines the lending process, from application to final funding. LenderLink facilitates efficient borrower onboarding, loan origination, and management.

One of the distinguishing features of LenderLink’s hard money lending services is its focus on matching the needs and requirements of lenders and borrowers, helping them find the optimal deal in a short time. This private money lending software incorporates advanced analytics and data-driven insights to aid lenders in making informed choices on loan approvals, optimizing underwriting processes, and managing risks. LenderLink’s focus on using technology to aid lenders in loan origination, approval, and risk assessment positions it as a strategic solution for those seeking a reliable and modern solution in the real estate financing sphere.

Type: Lender Search Platform

Features:

After years of advancements in the real estate industry and proptech, Ascendix has cultivated unique expertise and extensive experience in driving transformative change within the real estate sector.

Why consider Ascendix as your real estate partner?

How Ascendix can enhance your hard money loans in real estate:

With 16+ years of experience in the real estate industry, AscendixTech can seamlessly deliver your vision of the project.

Private money lending is the process of lending money from an individual or a private organization. It is a common practice in real estate investment, where private money lenders finance investors who buy and frequently renovate properties for resale or rental.

Private money lending in real estate occurs when individuals or private entities provide financing to real estate investors. A private money loan is backed by a property mortgage. Private lending is a common practice in real estate investing, as it provides money faster, making it an alternative to traditional lending from banks.

Yana is a proptech enthusiast and a technology fan. In her articles, she explores the world of real estate software, including proptech news, useful resources, and real estate technology insights, assisting everyone involved in the industry to modernize and optimize their business.

Get our fresh posts and news about Ascendix Tech right to your inbox.