“ 3 out of 5 of our clients come with the request to optimize document management in real estate, in areas like underwriting, mortgage document processing, or CRE brokerage. So, we've directed our focus on creating professional services like AscendixDA to help you deal with inefficiency of abstracting data. ”

Mortgage lenders and brokers deal with huge numbers of documents daily. The paperwork includes bank statements, tax forms, background check reports, and many more documents that must be considered carefully before the mortgage approval. The risk of error is tremendous, and so is the volume of data. How can it be solved?

This is where AI mortgage document processing technology steps in, offering a cutting-edge solution for mortgage automation of the extensive document analysis required in every loan phase. By automating document management and summarization, AI and ML tools streamline the workflow, improve efficiency, and enhance accuracy.

In this article, we describe:

What is AI Mortgage Document Processing?

AI mortgage document processing refers to the use of artificial intelligence to automate and streamline the handling of mortgage-related documents within the loan processing workflow.

What Tasks Can Be Automated With AI Mortgage Document Processing?

AI mortgage document management can handle tasks like document classification, data extraction, verification, validation, analysis, data entry into the CRM or a database, document compliance check, etc.

What is Mortgage OCR in AI Mortgage Document Processing?

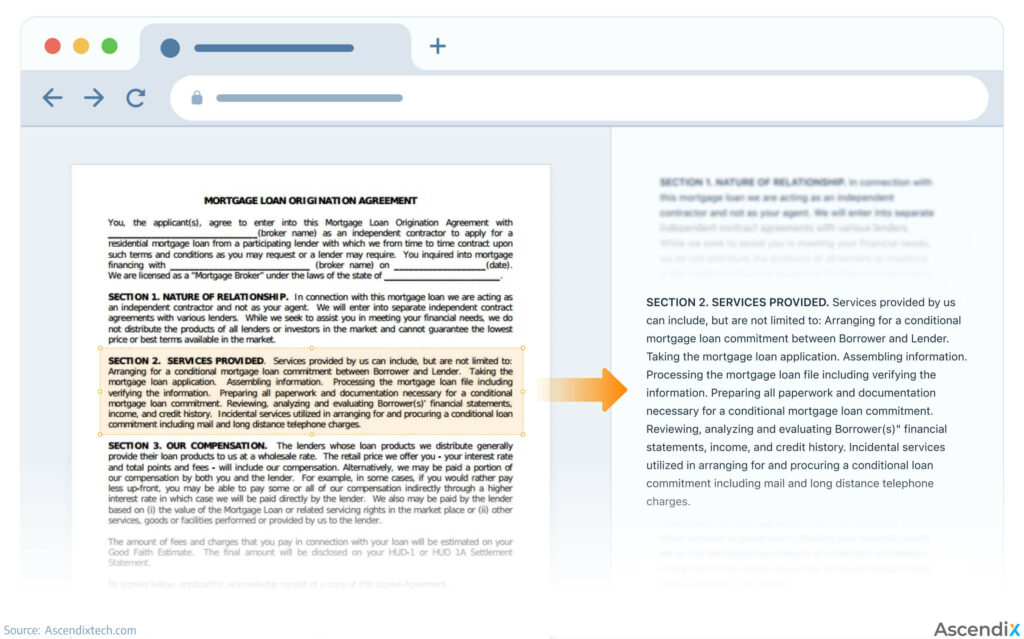

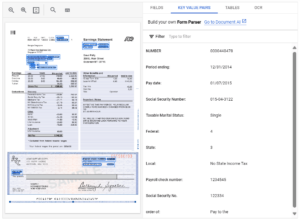

In AI mortgage document processing, the backbone of efficiency lies in mortgage OCR (Optical Character Recognition) technology. OCR is responsible for the key tasks in mortgage document automation – recognizing the data from the document. This plays a pivotal role in enhancing the accuracy and speed of AI mortgage processing.

With the help of mortgage OCR, AI algorithms recognize and interpret mortgage documents, extracting relevant information (such as borrower details, property information, financial data) from text documents, scans, images, and other data formats.

In addition to recognizing and extracting the data, AI mortgage document processing tools can validate the accuracy of the extracted data, and facilitate decision-making processes for mortgage underwriting, loan approval, data verification, and compliance checks.

Moreover, some AI mortgage document processing tools also offer the possibility to automate data entry into the existing company’s CRM. By utilizing AI in mortgage lending, financial institutions can significantly reduce manual efforts, improve data accuracy, enhance operational efficiency, and accelerate the overall loan processing timeline.

What Types of Documents Can Mortgage OCR Scan?

AI mortgage document processing tools can handle a variety of documents, required for getting a loan, or providing finances to borrower and checking their credibility. The most common documents include:

- Uniform Residential Loan Application (Form 1003). The document is used for providing personal and financial information from borrowers.

- Income verification documents. They may include W-2 forms, pay slips, tax returns, and IRS Form 4506-C to verify borrowers’ income.

- Assets and debts documentation. Among them are bank statements, retirement accounts, and gift funds verification to assess financial health.

- Credit verification documents. Includes all the documents used to check the borrower’s reliability and background, for example, credit reports, scores, and explanations for any credit issues.

- Additional documents. The lender may ask for extra documentation, such as rental payment history, divorce decree, bankruptcy records, immigration documents, and utility bills for further assessment and verification.

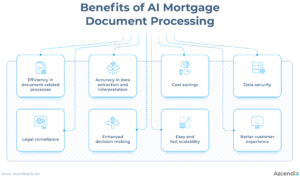

Benefits of AI Mortgage Document Automation

- Efficiency. Mortgage process automation solutions streamline document processing, reducing manual effort and time required for tasks like data extraction, data entry, document classification, and validation.

- Accuracy. AI algorithms ensure accurate extraction and interpretation of data from mortgage documents, minimizing human error probability and verifying data quality.

- Cost Savings. By automating repetitive tasks in mortgage document management, a business can reduce labor costs and improve operational efficiency, while simultaneously saving loads of employees’ time.

- Compliance. AI mortgage process automation solutions can enforce compliance with up-to-date regulations by ensuring legally accurate documentation and adherence to policies.

- Faster decision making. The use of tools powered by AI in mortgage lending speeds up workflows, enabling faster decision-making in mortgage loan approvals, underwriting, and other critical processes in financial businesses.

The AI-powered system extracts approximately 90% of financial details from documents. It saves underwriters about 4.000 hours, so we close deals 2.5 times faster, which has become one of our main competitive advantages.

- Scalability. AI mortgage document automation tools can handle large volumes of documents and scale as the business grows, maintaining efficiency and accuracy regardless of the amount of data inserted.

- Enhanced customer experience. Faster processing times and improved accuracy will ultimately lead to a better experience for mortgage borrowers and stakeholders involved in the mortgage process.

How AI for Data Extraction Works

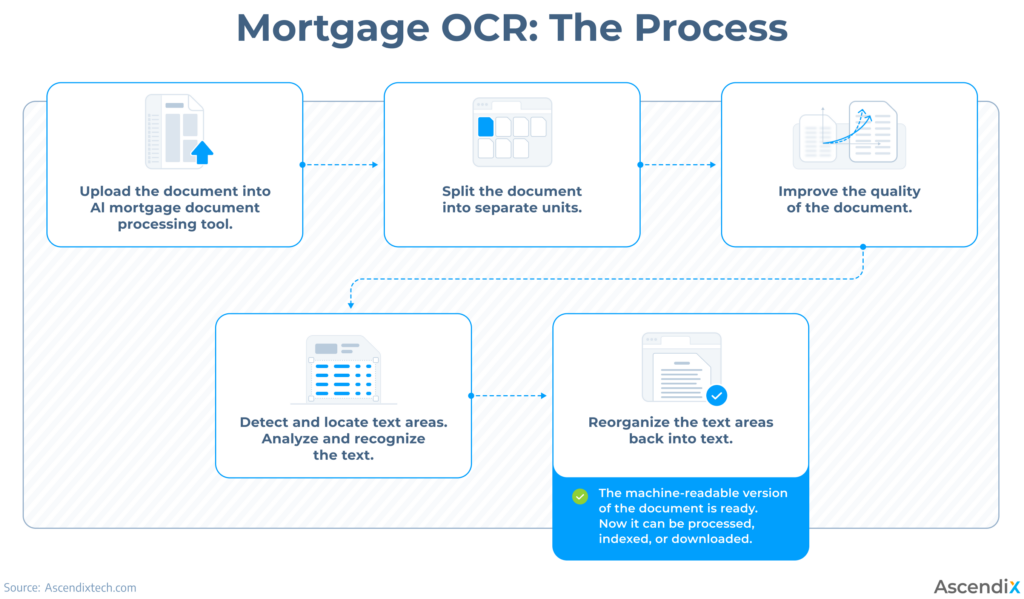

AI mortgage document processing involves several stages – from document upload to processing the result and fine-tuning the data. Let’s discover the process in detail.

1. Document Upload

First of all, the mortgage documents must be uploaded to the mortgage document automation tool. The documentation may also be retrieved from various sources like Loan Origination Systems (LOS), emails, FTP servers, company databases, Dropbox folders, cloud storage solutions, or any other integrated systems for storing data.

2. Data Extraction with Mortgage Document OCR

Mortgage OCR works by using AI algorithms to analyze images of text and convert them into machine-readable text. The OCR text recognition happens after the documents are already in the system, and it also includes several stages.

- Each uploaded document is split into separate entities so that the tool differentiates between the pages. This is done using mortgage OCR and AI models trained for document classification and file splitting.

- The scanned document or image undergoes pre-processing to enhance its quality and prepare it for OCR mortgage document handling. This may involve tasks like image cropping, noise reduction, and contrast adjustment.

- Mortgage OCR data extraction algorithms detect and locate text areas within the pre-processed image. This step involves identifying lines, words, and individual characters within the text.

- Each detected character is analyzed and recognized using pattern recognition techniques. Mortgage document OCR algorithms compare the features of characters against a database of known characters to determine what is in the document.

- The characters are organized back into words, sentences, and paragraphs based on how they are located in the document and context within the text regions (if the NLP technology is used in the mortgage document processing tool).

- The final output needs some post-processing to correct errors, improve accuracy, and format the extracted text according to the original layout. As the OCR data extraction technology does not understand human language per se, the tool might employ natural language processing algorithms to ensure a higher quality of the extracted text.

The final output of the mortgage OCR processing is a structured text that is easily managed, so can be further processed, indexed, searched, or analyzed.

3. Review of Mortgage OCR Data Extraction Results

While AI mortgage document automation tools are quite reliable due to the advanced mortgage OCR technology, AI still may make errors in extracting data, especially from complex or poorly formatted documents.

To ensure accuracy, AI-extracted fields that are questionable or unclear are reviewed by humans for accuracy. For this purpose, AI mortgage document processing tools offer Human-In-The-Loop (HITL) interfaces, where mortgage professionals can access the extracted data, review it against the original document, and correct any inaccuracies.

This approach of combining fully automated mortgage document management with human oversight significantly helps to improve the accuracy and reliability of the data extraction results.

4. Final Data Management

As the process of mortgage OCR data extraction is finished, the data may be downloaded or integrated back into systems like LOS, compliance software, or analytics platforms, for further management, analysis, and usage.

5. AI Data Entry for Mortgage Document Automation

AI mortgage document processing may include an additional step of automated data entry for companies that use CRM systems. After the data has been extracted, reviewed, and approved, AI can integrate it into chosen CRM systems, business databases, or other applications. AI data entry frameworks can be integrated into the existing software for streamlined data input or can be added as a new solution for mortgage businesses. This will lead to streamlined, efficient, and optimized processes in the company.

Extract Data from Your Static Docs in Seconds with AscendixDA

See how AscendixDA can extract key information from contracts and push it directly into your CRM.

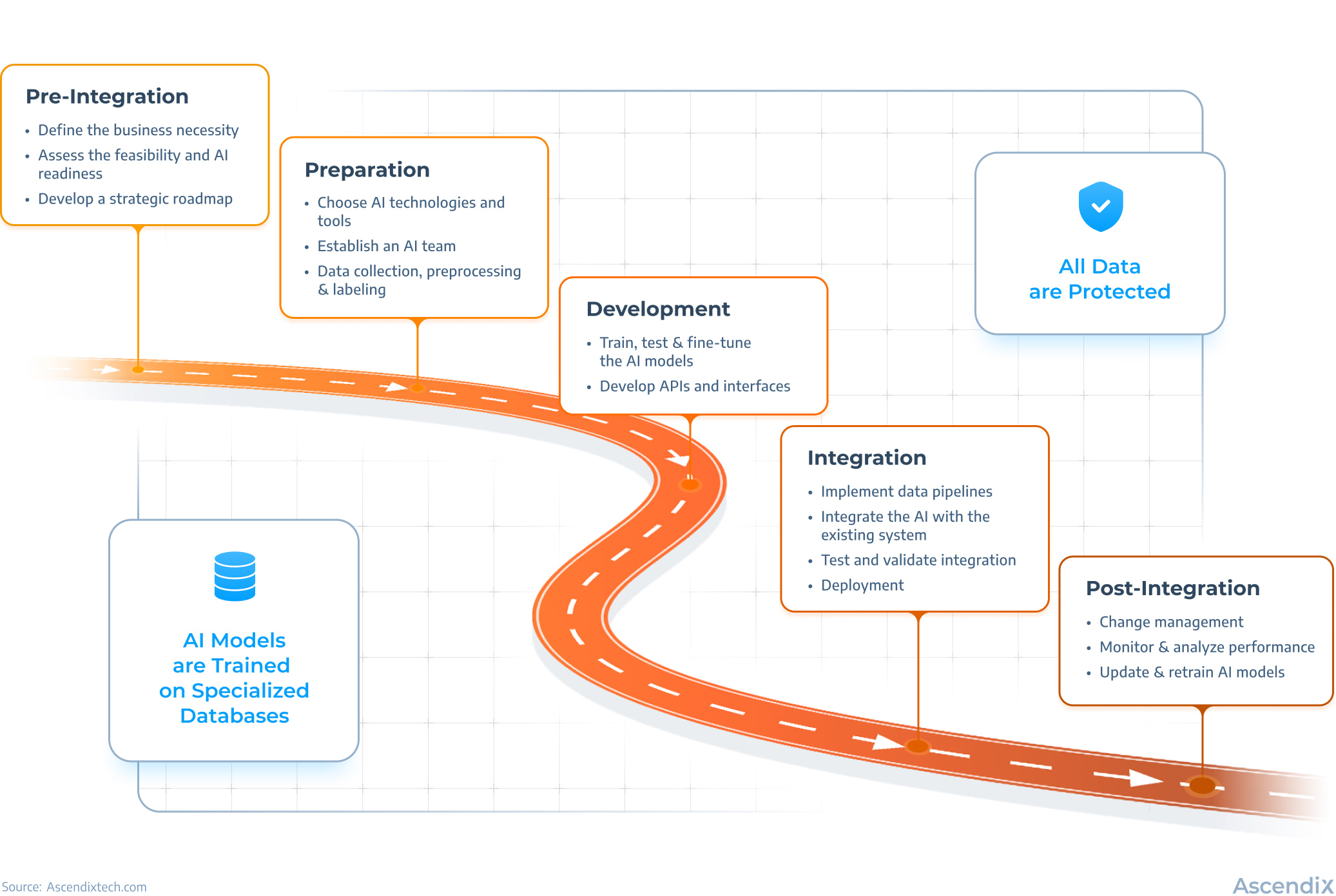

How to Implement AI in Mortgage Document Processing?

Implementing AI in mortgage document processing isn’t just about technology—it’s about transforming your business operations. And transformations are never easy. There is a general roadmap that can help you to understand how AI implementation process typically looks like.

AI Integration Process | Source: Ascendix

Assess Your Current Workflow and Define Clear Objectives

Before implementing any mortgage AI solution, thoroughly analyze your existing mortgage document processing workflow. Identify bottlenecks, repetitive manual processes, and error-prone areas that could benefit from automation.

“ That's an important lesson for any enterprise that wants to implement AI. Ask yourself, "What can I do to impact my business the most now? Are there some pain points that I can address?" You have to understand yourself and your business. ”

Think of the result you want to get and establish specific, measurable, and achievable goals. For example, decrease data entry time by 25% (which is feasible, as CBRE’s experience shows).

Research Mortgage AI Technologies

Look into what AI can do. Someone has probably already solved your problem, and you do not need to develop a mortgage OCR solution from scratch.

“ You can't try to do everything at once. Pick one, two, or three pain points that you need to solve, and look to see if AI is ready to solve that pain. It may not be. That will be the recipe for a successful introduction of AI in your organization. ”

Suppose data extraction and entry, as well as mortgage document processing overall, occupy the lion’s share of your resources. In that case, Ascendix’s Intelligent Document Processing framework is probably what you are looking for. It is specifically tailored to real estate documents, including ones involved in mortgage lending. Also, there are a few other promising tools on the market, which we unpacked at the end of this article.

Find the Right Mortgage AI Implementation Partner

As Peter Drucker once said, “Do what you do best and outsource the rest.” Focus on decision-making, communication with clients, profound market analysis, and fostering new strategies instead of implementing mortgage OCR or other AI technology with which you have zero experience.

Things to Look for in AI Service Provider:

- Proven AI expertise. Case studies and whitepapers are good indicators. Also, look up in articles such as, “Top 15 Consulting Firms” and the rating websites.

- Experience in real estate, especially in mortgage lending. Domen knowledge is priceless, and the lack of it will lead to dealing with every pitfall mortgage document management has hidden.

- Flexible team engagement models are huge plus. It’s cost-effective, and transparent invoicing brings you peace of mind. This way, you can easily decrease the number of hours and specialists when AI has been implemented, and you do not have a whole team to maintain it.

A knowledgeable partner will help with every step, from AI readiness assessment and choosing the right mortgage AI tools to staff training and future upgrades.

Need an Experienced AI Implementation Partner?

Ascendix has broad expertise in a few AI technologies and can guide you past pitfalls.

Design the Implementation Roadmap

Work with your selected vendor to create a phased implementation plan. Start with a pilot project focusing on high-volume, standardized documents to see if mortgage OCR can fully recognize and correctly classify them or if additional training is needed. Plan for gradual expansion to more complex document types.

Start small, set clear milestones and realistic timelines, and seek feedback both from your AI service provider and your employees.

Develop, Deploy, Test, and Fine-Tune the Mortgage OCR Solution

During this phase, your AI service provider typically prepares data for the most efficient mortgage document automation, which includes cleansing, sorting, labeling, and pre-processing.

Then comes the mortgage OCR configuration for your specific document types through training and fine-tuning.

The next step is integrating a new AI solution for mortgage document automation with your existing systems (LOS, CRM, etc.).

Experienced vendors always insist on establishing secure data handling protocols and setting up user access controls and audit trails to protect sensitive data. The final step at this stage is testing (accuracy, regulatory compliance, compatibility with your core system, user acceptance, etc.) and fixing errors.

Introduce AI to Your Team

Mortgage document management system is not the easiest solution to pick up, so provide comprehensive training for your team. Highlight that mortgage OCR is here to help, not to replace them—that will mitigate the main concern that can hinder user adoption.

“ “But if we really want our users to adopt the system, we have to think differently. We have to stay tuned to WIFM, "What's In It For Me," and that's what's in it for the broker. “ ”

Improve

Track your progress, gather user feedback, and document inaccuracies or misinterpretations to fix them in the future. Start training the mortgage OCR on more complex mortgage documents and expand functionality. AI moves fast, so you need to be careful not to end up with an inefficient solution.

Tools for Automated Mortgage Document Processing

- Google Cloud Document AI streamlines mortgage document processing and management by extracting, classifying, and organizing structured and unstructured data. The features include pre-built models for data extraction and a Document AI Workbench for customizing or enhancing existing models, as well as a Document AI Warehouse for document storage and retrieval. With Google Cloud Document AI, it is possible to build document processors from scratch or based on Google’s existing model.

- RAPFlow/RAPBot provides pre-trained AI models that can be customized to automate OCR data extraction and summarize the mortgage documents in your company. The tool claims to be able to customize the whole mortgage workflow, which would transform and automate any business with AI and ML.

- Infrrd has the capability to automate various aspects of the mortgage document management process. The features include enhancing low-quality document scans, extracting the data from documents, classifying, validating, and verifying the data, and the possibility to customize the solution according to your business rules, for instance, to set a specific data format. Ifrrd also does not need human review and states that the tool is 100% automated and reliable.

- ArealAI is a mortgage automation platform with automated mortgage processing features. It can help with mortgage document generation, review, completion, and signing. The inbuilt features also include document classification, data extraction, data analysis, and automated annotation. The platform includes a variety of tax, income, and mortgage documents, which can make the processes in mortgage handling easier and faster.

- DocVu.ai helps mortgage professionals with intelligent document indexing, AI data extraction, invoice processing, loans and mortgage processing, mortgage servicing, quality checks, and records digitization. The tool is tailored not only for mortgage document automation but can also be used in the accounting, finance, and insurance industries.

- Docsumo offers the possibility to extract data from unstructured documents like scans or tables, recognize text with OCR mortgage technology, review, classify, and analyze documents. The validation process involves a human review, which might be an additional step in full AI mortgage automation, however, it adds reliability and accuracy to the extracted data. Except for traditional features of mortgage process automation solutions, Docsumo also includes additional functionality, like the possibility to convert documents into different formats, split, merge, and compress files within the platform.

- DocHorizon can be helpful in AI mortgage document processing. The platform offers a wide range of mortgage document automation features, such as OCR mortgage document recognition, automating data discovery and storing, document verification and validation, document management capabilities like classifying, labeling and sorting, and AI data entry automation. The platform also supports integration with various types of software, including GSuite, Oracle, Microsoft, Zoho, and others.

Build Custom AI Mortgage Tool with AscendixTech

Hire AscendixTech and we’ll create a tailored AI mortgage tool to bootstrap your processes.

Why Implement a Custom AI Mortgage Document Automation Solution?

Custom AI mortgage document processing tool is tailored to business needs and ensures high efficiency in those very processes that may have problems and highly need automation. Implementing a custom AI mortgage document automation solution offers a lot of significant benefits.

- Integration with CRM for automated data entry. Custom mortgage process automation solutions seamlessly integrate with existing company’s CRM systems, enabling automated data entry from the document directly into the correct fields. Ready-made tools often do not have the data entry automation feature or may not perform this integration effectively without prior data mapping, which means more time for adjusting the software.

- Tailored AI models. Custom AI models for automated mortgage processing can be trained on the company’s own datasets and documents. A customized model fully solves the existing problems and bottlenecks and increases efficiency exactly where it is needed. This also leads to higher accuracy and relevance in data extraction and processing, as well as fewer documents that need human involvement for review.

- Enhanced accuracy. By creating an AI mortgage document processing tool specifically for the company’s documents, the system can achieve higher accuracy in data extraction, reducing errors and the need for corrections.

- Improved efficiency. Custom solutions are designed to meet the company’s unique needs, leading to more efficient document processing workflows and faster turnaround times.

- Higher data security and compliance. If the AI model is trained and developed within the company, it can be tailored to meet regulatory requirements for a specific state or sphere. Moreover, it ensures a top-notch level of data security, providing peace of mind for sensitive mortgage document handling.

Ascendix AI Expertise for Mortgage Document Automation

Ascendix combines AI technology with deep real estate and mortgage expertise to simplify document management and data processing. Our AI professional service AscendixDA, is designed to extract, validate, and categorize information from contracts, leases, appraisals, and reports. It turns static documents into structured data that can be used directly in your systems, reducing manual work while maintaining oversight.

Our hands-on experience in custom AI software development includes building frameworks for AI property search, AI lease abstraction, AI property valuation, AI data entry, AI recommendations engine, and AI chatbots.

How Ascendix Can Assist with AI Mortgage Document Processing:

- AI Document Abstraction. Our new professional service – AscendixDA – automates the extraction, validation, and categorization of contracts, leases, appraisals, and reports, turning static documents into structured, actionable data.

- Custom AI Software Development. We can create the AI mortgage document management tool from scratch, ensuring it fully aligns with your business requirements, tasks, and existing workflows.

- Custom Mortgage Software Development. If you are looking to extend your tech stack with RPA, more advanced LOS or POS, AI underwriting system or any other mortgage-related software, we can help.

- AI Software Integration. Whether it’s integrating existing solutions or developing custom features, we can help you integrate AI solutions to fit seamlessly into your existing software ecosystem.

- AI Document Abstraction. We can integrate our AI intelligent document management framework into your existing software to simplify paperwork management.

- Consultancy. We can help you choose suitable AI solutions tailored to your needs in mortgage document automation workflow.

- Technical Audit. Our team conducts audits of existing software tools, enhancing them with AI capabilities and other requested features.

Why Choose Ascendix for Mortgage Document Management Automation?

- Extensive Software Development Expertise. With over two decades of experience, we’ve crafted high-quality, tailored software solutions for enterprises and startups across industries like real estate and logistics.

- Trusted by Industry Leaders. Major real estate players like JLL rely on us for in-house software development, along with 300+ clients around the globe.

- Global Reach. With offices in five locations worldwide, we bring diverse skills and international market insights to your project, ensuring 24/7 connectivity and alignment with global trends.

Contact Ascendix and automate your mortgage document management with tailored AI automation tools. Schedule a free consultation today to explore the possibilities of mortgage automation with us.

Enhance Your Mortgage Operations with AI

Contact AscendixTech and we’ll develop AI mortgage software that would ideally match your business needs.

How is AI used in mortgage lending?

AI in mortgage lending is used to streamline processes in document processing, including data extraction data analysis, risk assessment and optimal loan terms calculation. AI chatbots and virtual assistants improve customer service by answering queries, providing information, and guiding borrowers through the application process. AI in mortgage lending significantly accelerates workflows, improves accuracy, and enhances the customer experience.

What is OCR in mortgage?

OCR (Optical Character Recognition) in mortgage is a technology for converting scanned mortgage documents into machine-readable text. It automates textual information extraction from documents like loan applications, income statements, and tax returns. Mortgage OCR plays a crucial role in digitizing and processing large volumes of documents, improving efficiency, accuracy, and speed in document processing workflows.

How does OCR improve accuracy in mortgage document processing?

OCR improves accuracy in mortgage document processing by converting static documents into searchable digital text and mapping data to corresponding fields in your core system, eliminating manual data entry errors. Advanced systems automatically extract critical information like borrower details and loan terms and validate the results against set rules to ensure consistency.

How can AI help mortgage brokers?

Mortgage brokers can highly benefit from AI document processing, data analysis, and customer interaction. AI technology streamlines the mortgage application process by automating document verification, data extraction from documents, data entry, data analysis, credit scoring, and risk assessment. AI algorithms can also identify and analyze market trends, assess borrower risk profiles and optimize loan portfolios, enhancing decision-making for mortgage brokers.

Share:

Yana is a proptech enthusiast and a technology fan. In her articles, she explores the world of real estate software, including proptech news, useful resources, and real estate technology insights, assisting everyone involved in the industry to modernize and optimize their business.

Subscribe to Ascendix Newsletter

Get our fresh posts and news about Ascendix Tech right to your inbox.

(29 votes, average: 4.72 out of 5)

(29 votes, average: 4.72 out of 5)